From the Desk of Ian Culley @IanCulley

The Japanese government isn’t playing games.

Currency crisis or not, Tokyo is willing to defend the yen in the open market. It’s proven this multiple times over the past three years, and today’s FOMC-related volatility will likely test its resolve.

Considering previous yen-buying interventions, the dollar, interest rates, and the dollar-yen pair could be headed lower in the coming months.

Before we dive into the yen, here’s a quick update on the action in the euro and pound.

The euro retested its breakdown level from earlier this month, forming a bear flag:

A close below 1.06 completes the flag pattern and sets a rough downside objective of 1.0450.

The British pound also pulled back this week:

Instead of simply retesting the breakdown level, price closed within its prior range – a hard retest.

The drama was short-lived as the GBP/USD re-completed the multi-month bearish consolidation.

If the pound is trending toward our target of 1.2075 and the euro continues to break down, I imagine the US Dollar Index $DXY will remain buoyant.

Now, let’s take a look at the Japanese yen.

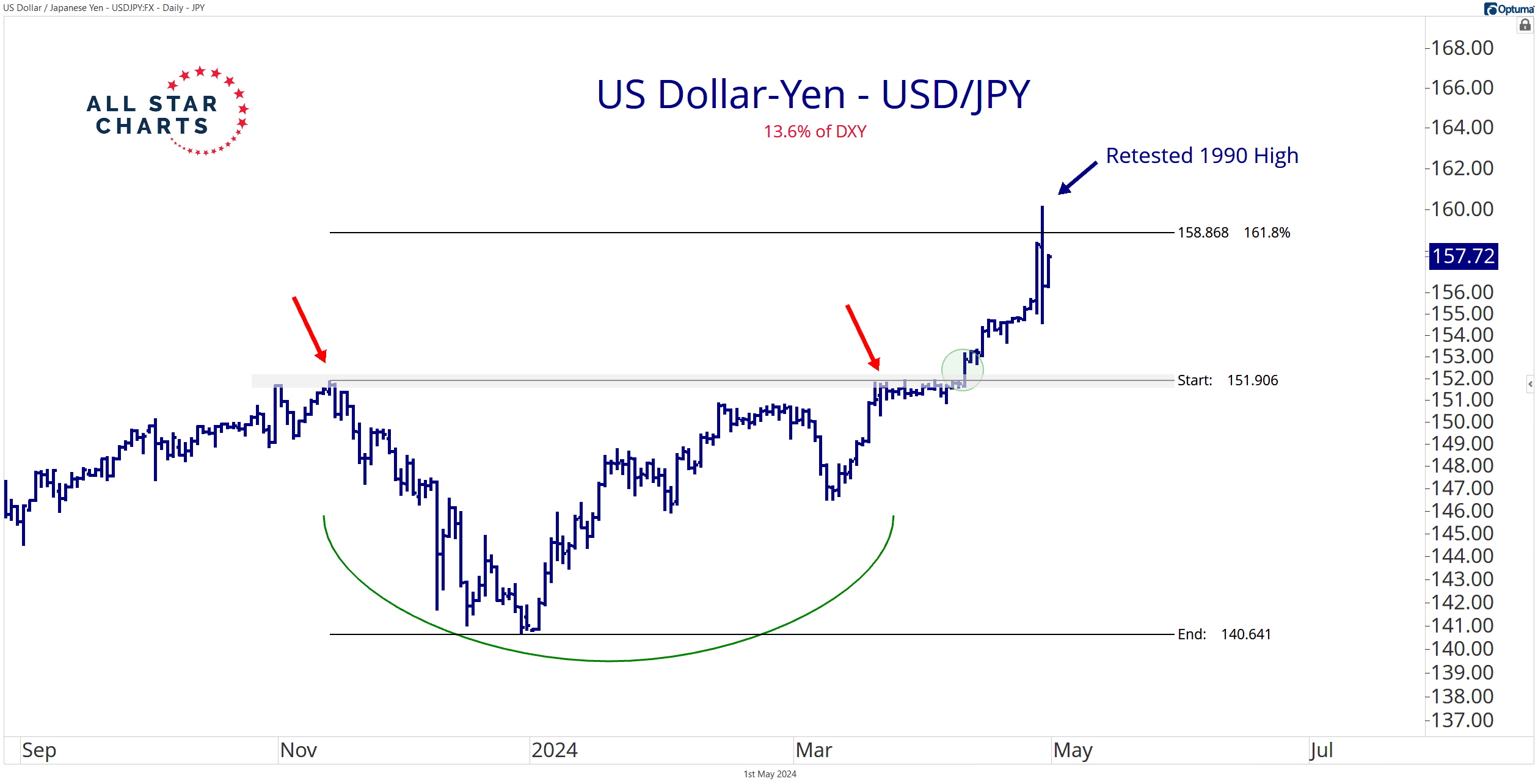

The USD/JPY pair ripped Monday morning, slicing through our initial target on the way to its 1990 peak:

Price did not linger at those former highs.

Japan’s Ministry of Finance (MOF) stopped the carnage, buying $35 billion worth of yen.

It’s not the first time the MOF has defended its crumbling currency …

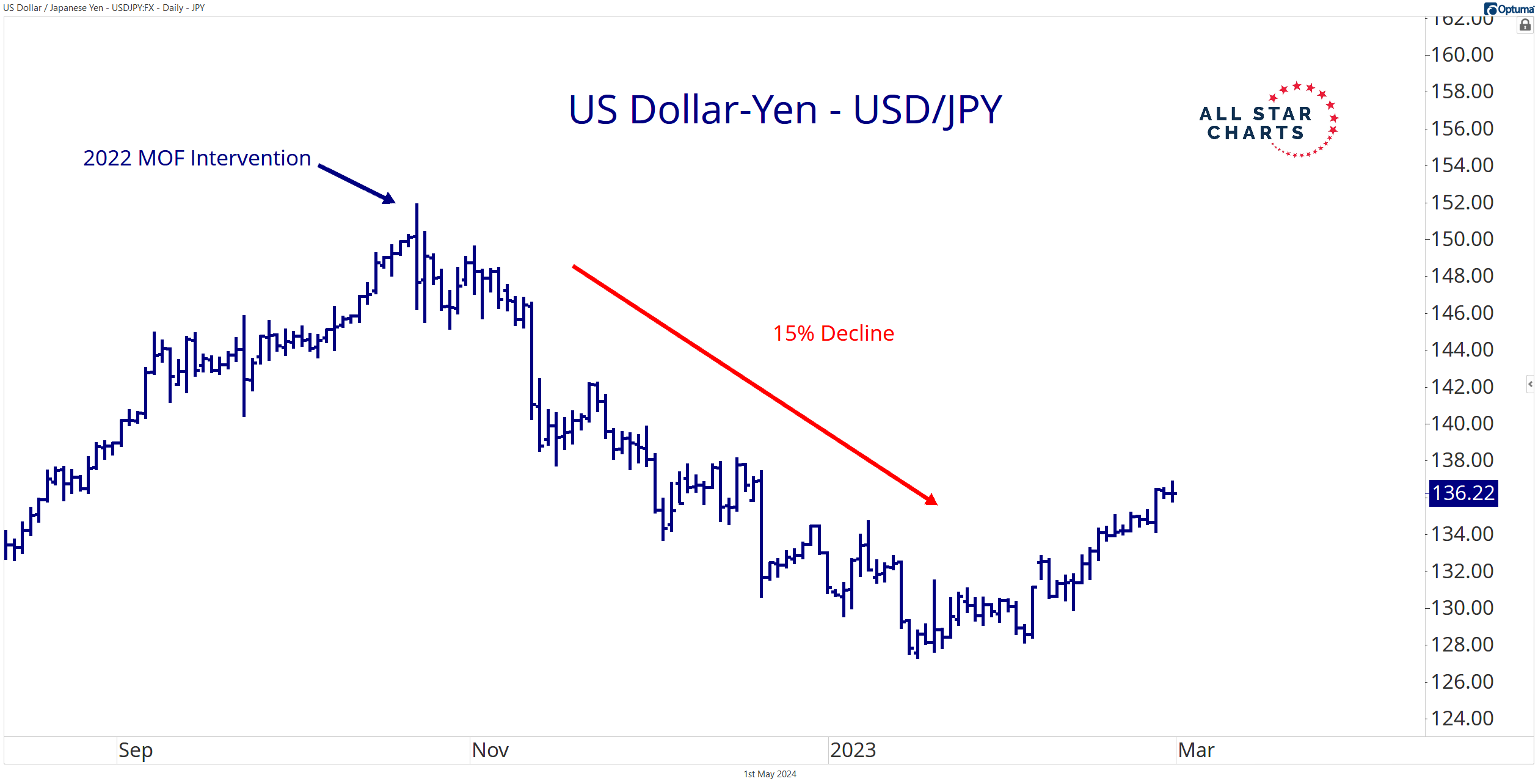

A similar intervention transpired at the 152 level in October 2022, leading to a 15% decline in the USD/JPY pair by mid-January:

Moving forward, the October 2022 highs acted as Tokyo’s line in the sand.

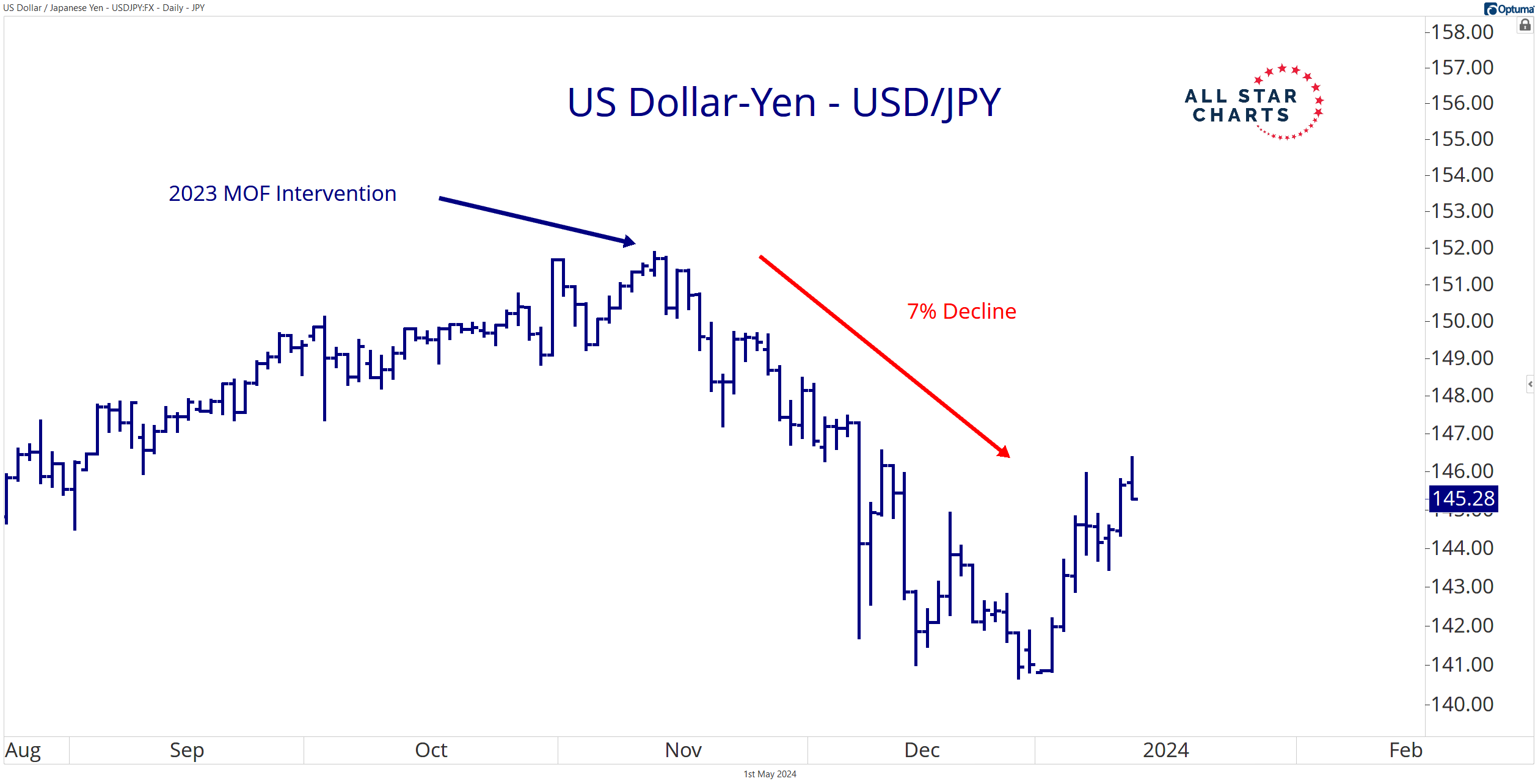

But the open market forced its hand yet again in 2023:

The USD/JPY fell 7% this time in less than three months.

Despite losing its former boundary last month, Vice Minister of Finance for International Affairs Masato Kanda continues to offer jolly threats of looming intervention. A recent comment suggested the MOF is willing to take action around the clock.

Japanese officials don’t care if you’re asleep or if you’re awake.

They know if you’ve been shorting yen… so be good for goodness sake?

Earlier this week, the MOF’s yen-buying operation drove the dollar-yen from 160 to a 154 handle in a flash.

Kanda means business.

If the USD/JPY jumps back toward the 1990 highs following today’s FOMC shenanigans, I might take a small short position with a target of 152.

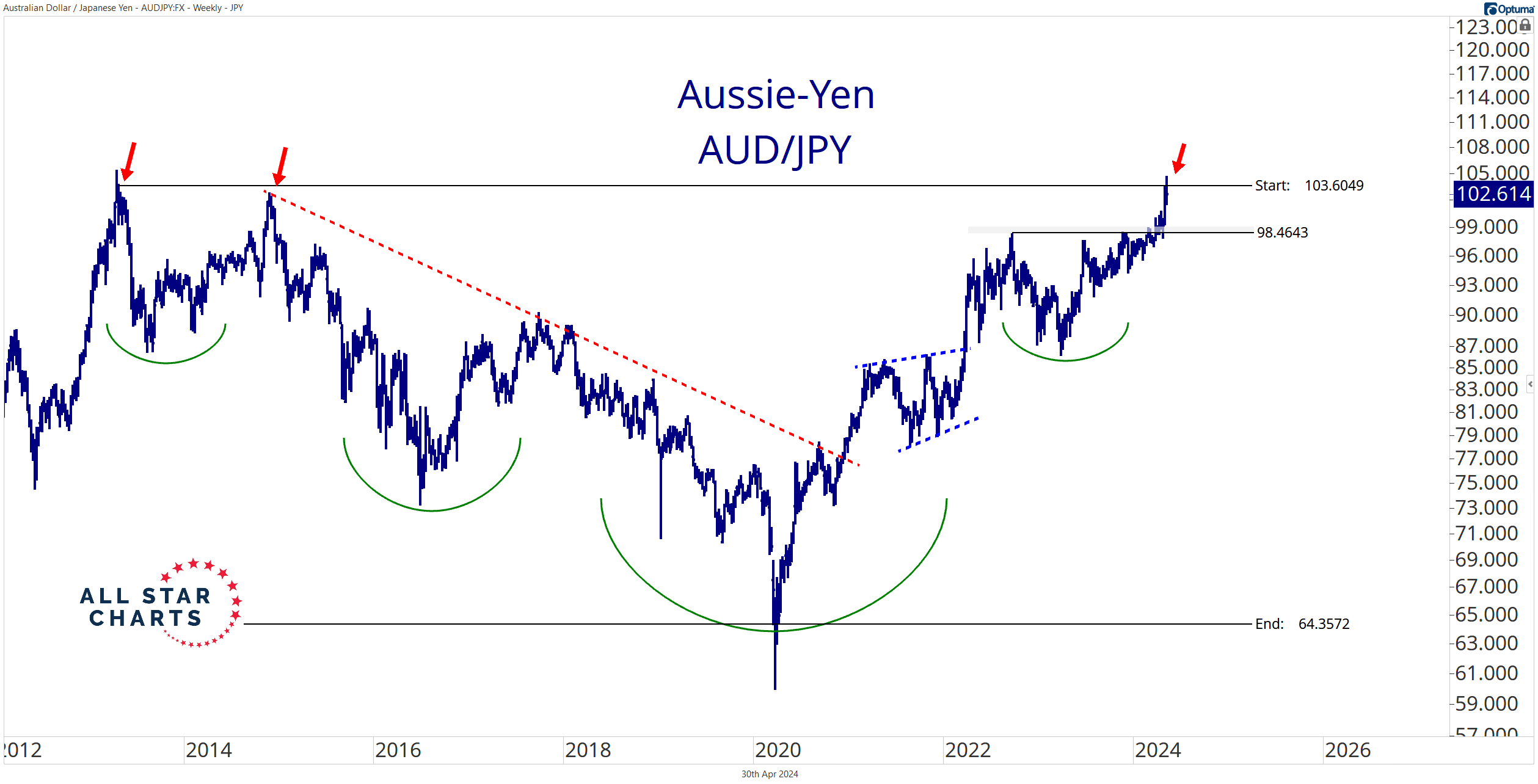

The US dollar isn’t the only currency crushing the Japanese yen…

The aussie-yen cross is posting fresh decade-highs:

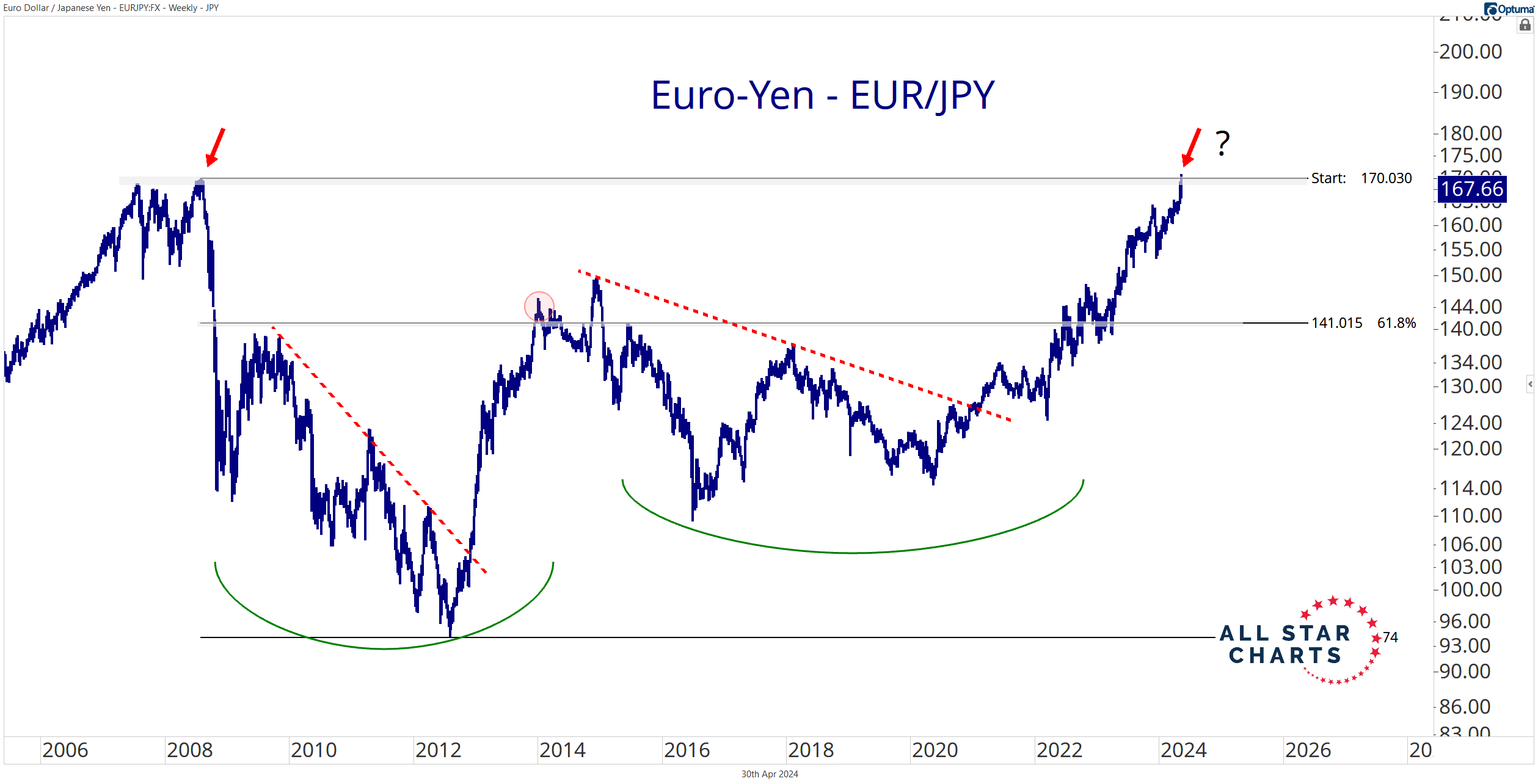

The euro-yen cross is trading back at its pre-Global Financial Crisis highs from early 2008:

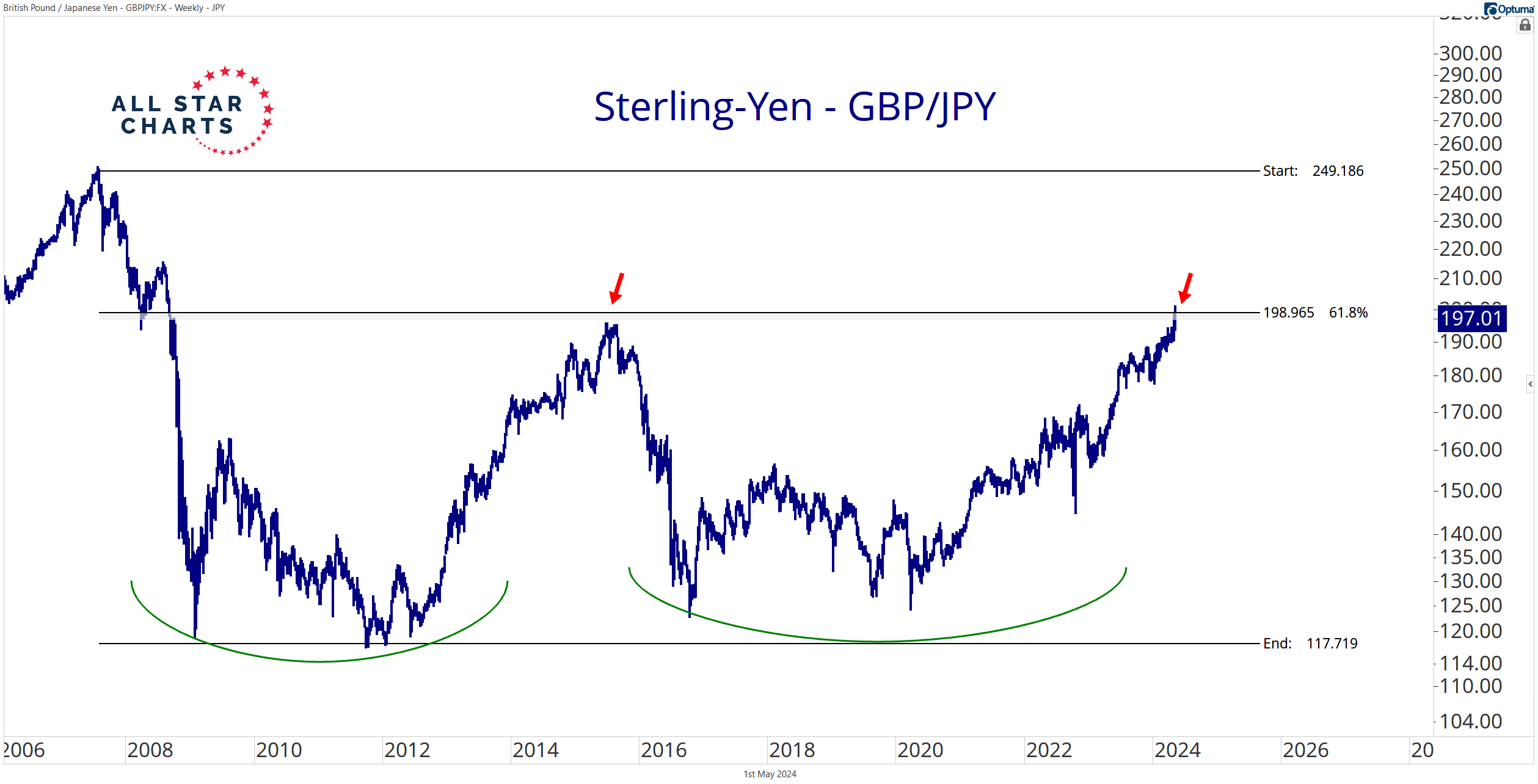

And the British pound is trading at its highest level versus the yen since the summer of 2008:

All three charts reveal significant levels that warrant corrective action or, at least, a digestion period before resolving higher.

Maybe I’m a glutton for punishment, but I like taking a shot at shorting the USD/JPY due to prior interventions and multiple decade-plus resistance levels favoring the yen in the near term.

Of course, the yen knows how to tumble.

If the USD/JPY rips through 160 with authority, I’ll move to the side and set my sights on 167:

Beyond the trades, the two previous MOF interventions led to sustained rallies for the yen and downside corrections for the DXY.

If a similar pattern unfolds in the coming months, perhaps falling interest rates will accompany a weakening US dollar – two items at the top of every stock market bull’s wish list.

My bias is leaning in favor of the stock market bulls: falling dollar, falling rates, and falling dollar-yen.

But I’m prepared to play an unruly yen in either direction.

Am I over simplifying it?

–Ian

Thanks for reading.

Be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment