It has paid to pick our spots wisely in the commodities complex as it’s been a very bifurcated asset class this cycle.

Live and Feeder Cattle are carving out distribution patterns.

Energy has been a rangebound mess.

Meanwhile, the relative strength has been in the soft commodities and precious metals.

Gold recently put the finishing touches on a multi-decade accumulation pattern.

Cocoa has resolved a 12-year base and rallied over 400% to new all-time highs.

Coffee is flirting with new multi-decade highs after completing a tactical reversal pattern.

And we’re betting that Cotton will participate to the upside with the rest of the soft complex soon. The soft and fluffy commodity is on the verge of trapping the bears below a key level of polarity.

We want to continue leaning into the relative strength in soft commodities.

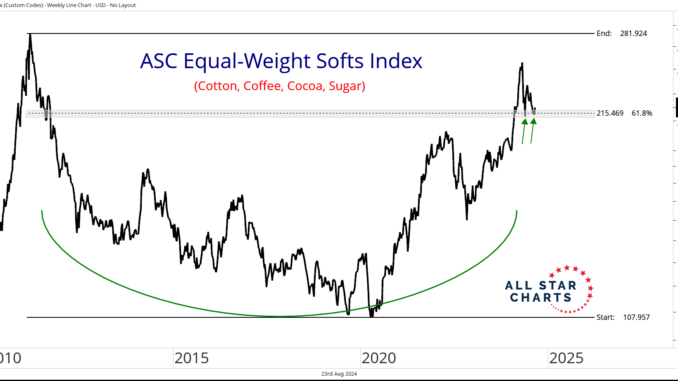

Here’s a look at our Equal-Weight Softs Index consolidating above a key retracement level:

Our Equal-Weight Softs Index holds Cotton, Coffee, Cocoa, and Sugar Futures.

If it’s above 215, the path of least resistance is higher toward the 2011 peak.

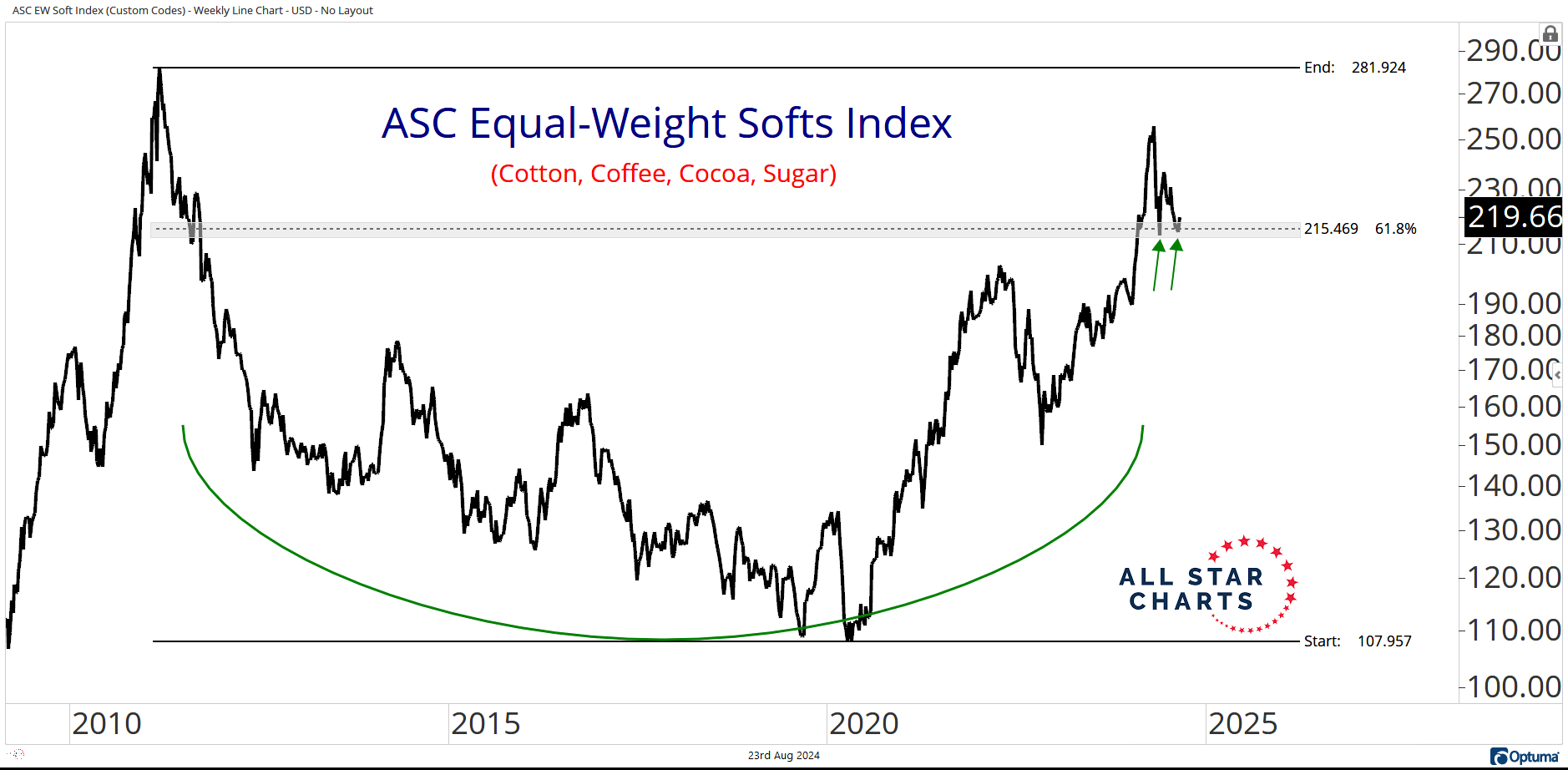

Next, let’s look at how Cotton Futures are shaping up:

After rallying about 200% from 2020-2022, Cotton has given up most of those gains and is back below the old breakout level.

We think this move could prove to be a bear trap and scoop higher. The reaction rally in the opposite direction could be swift… if it comes at all.

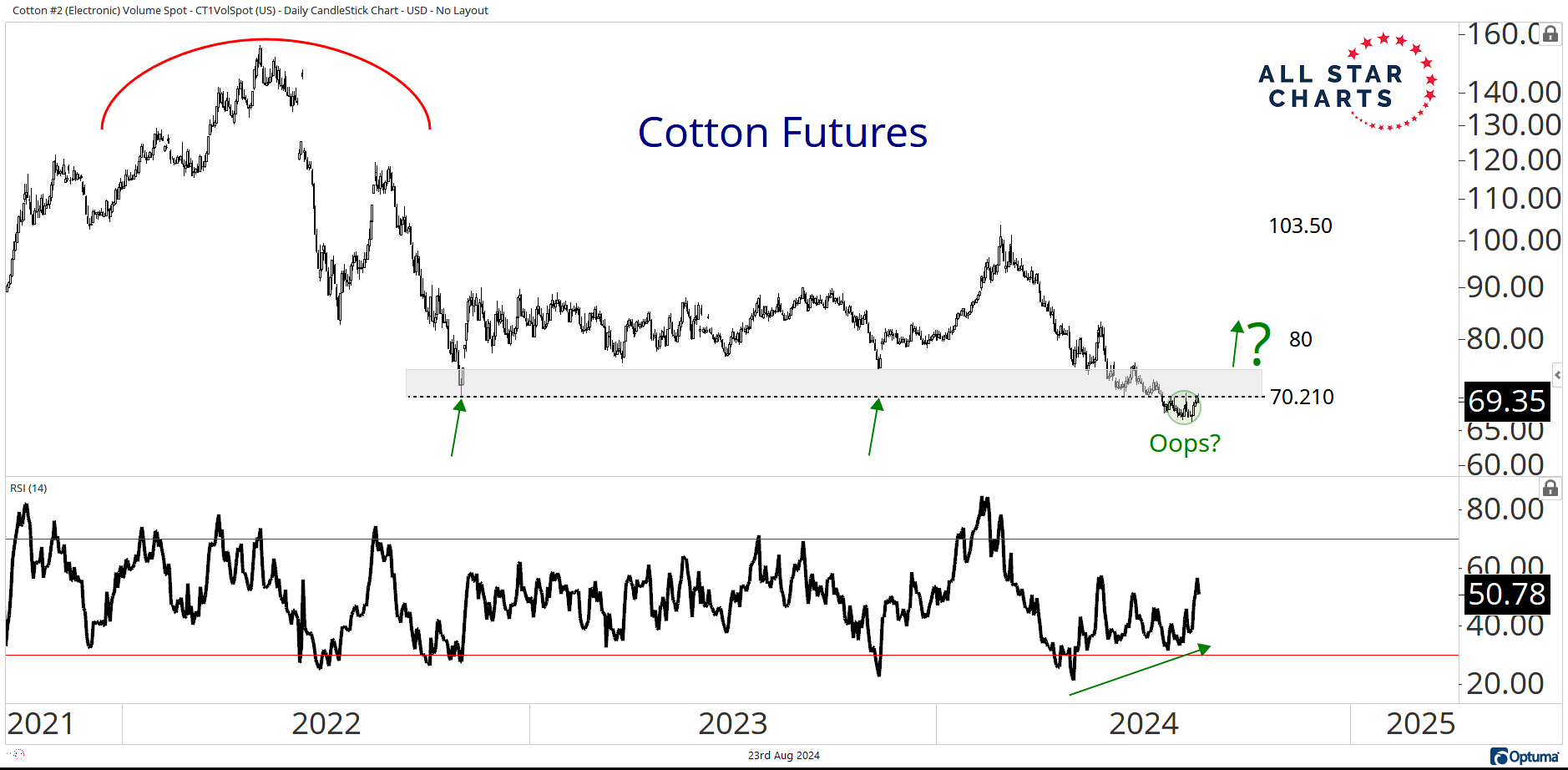

Here’s a more tactical look at the potential failed breakdown in Cotton Futures:

Momentum has diverged from price over the past 3-months, forming a potential bullish divergence. This suggests the selling pressure has been waning as the price has continued to move lower. This is not what the bears want to see!

We’re buying Cotton Futures on strength above 70.20, with a target of 80. Over longer timeframes, we’re looking at a secondary objective of 103.50

On the flip side, we don’t want anything to do with Cotton if it’s below 70.

COT Heatmap Highlights

- Commercial hedgers trimmed their net short position in Heating Oil by over 6,000 contracts.

- Commercials added over 11,500 contacts to their net long Corn position and are approaching a new record-long position.

- Commercials added over 700 contracts and flipped net long Bitcoin.

Click here to download the All Star Charts COT Heatmap.

Premium Members can log in to access our Weekly Commodities Report Chartbook and the Trade of the Week. Please log in or start your risk-free 30-day trial today.

Be the first to comment