From the desk of Louis Sykes @haumicharts

For the longest time, investors in the United States have been rewarded for their home country bias and their overexposure to large-caps and growth stocks.

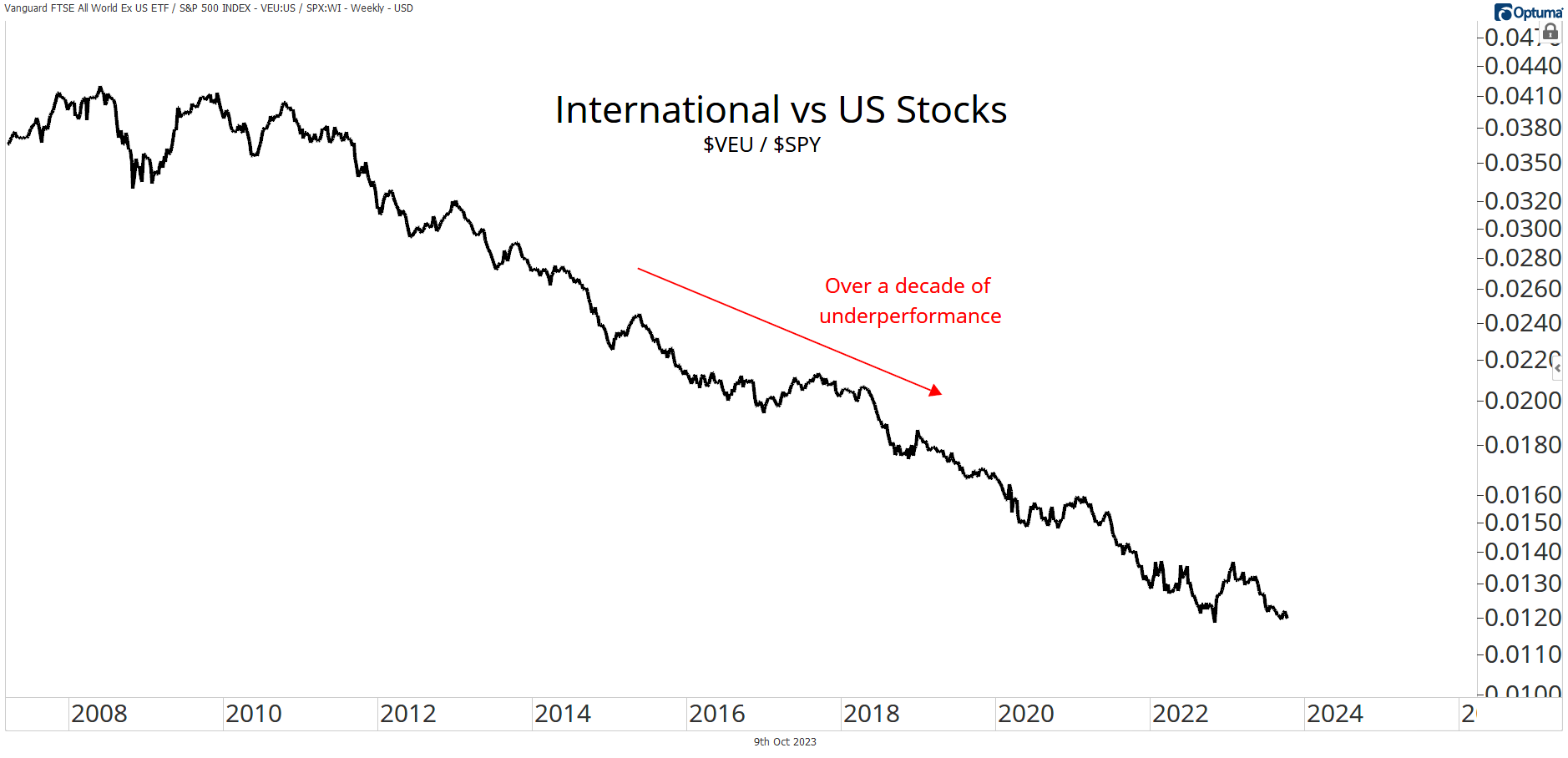

The secular trend of underperformance from international equities relative to the United States commenced over 15 years ago. Many investors have simply never seen stocks outside the US outperform over any material timeframe.

It’s not a matter of impossibility; rather, our recency bias tends to mistake unfamiliarity for the extraordinary.

A regime of sustained value outperformance isn’t isolated to the realm of fantasy. It was only last year that holding growth over value was nothing short of opportunity cost, while international equities outpaced their US counterparts through Q4 and into the new year.

Recently, Meb Faber joined us on the morning show, where he discussed the topic of international investing. He argued that this is the best time in history to make the value trade, both domestically and internationally.

While there is still plenty of work to be done before we want to favor international equities, it’s a scenario we’d be foolish not to prepare for.

So in today’s post, we’ll outline how many of these relative trends are faring in this market environment. This discussion will act as an update to an earlier post we published on this topic 18 months ago, where we outlined our observations of international equities within the context of the growth and value factors. You can read that full report here.

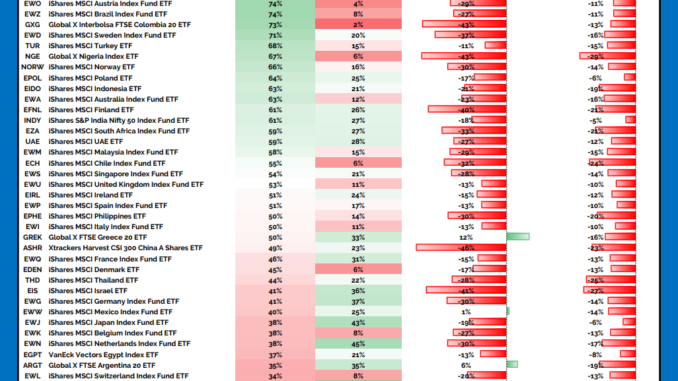

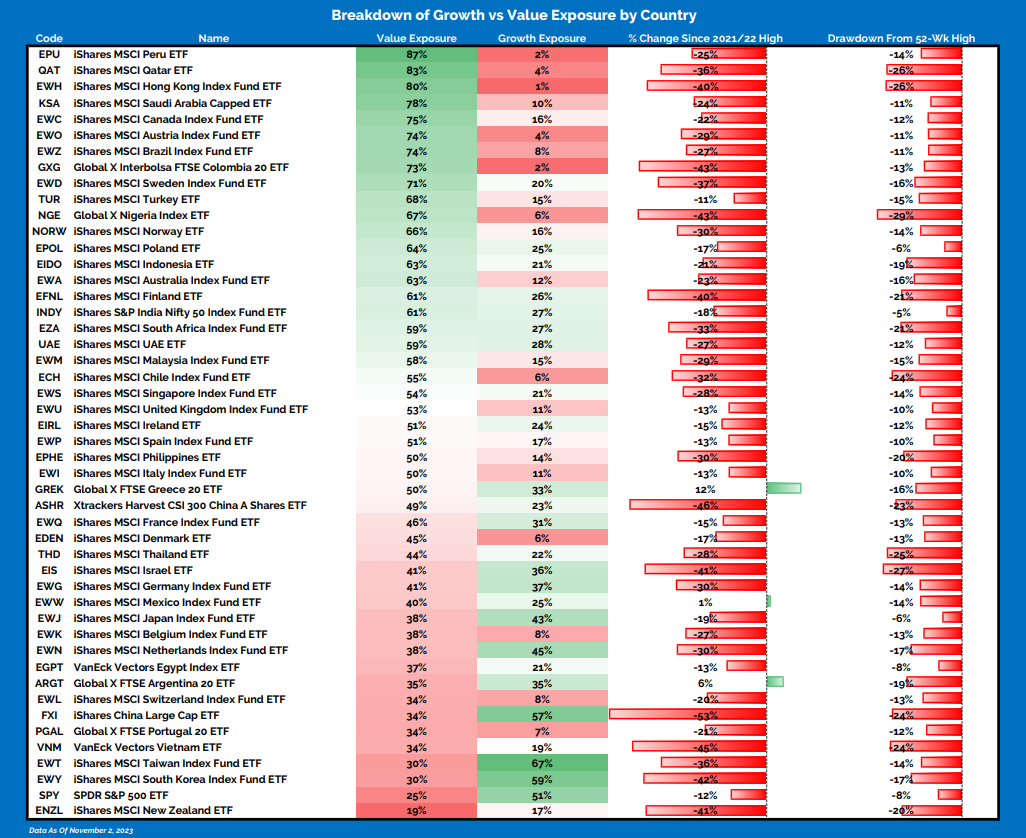

In that post, we provided a table that documented the growth and value exposure of all the individual country ETFs within our international universe.

Our basic assumption here is that we can reduce growth and value down to various GICS sectors: the former being a collection of technology, consumer discretionary, and communications (ex-telecommunications); while the latter can be assumed to be financials, industrials, materials, and energy.

While this is never a perfect measure, it does provide a good estimate of how much each country is exposed to growth versus value at the index level.

Our findings are summarised in the table below.

Click on table to enlarge view.

The major takeaway in our initial report was how, apart from a small number of exceptions, the S&P 500 was exposed to the least amount of value at the index level. And 18 months later, the same story can be told, with New Zealand being the only country ETF with less value exposure than the S&P 500.

The bottom line is this has been the root cause for US leadership. The heavy tilt toward growth has benefited US investors in a ZIRP environment where growth-oriented areas have steadily outperformed value. Should we begin to see this trend reverse, we’d anticipate a shift in the dynamic toward international and away from domestic equities.

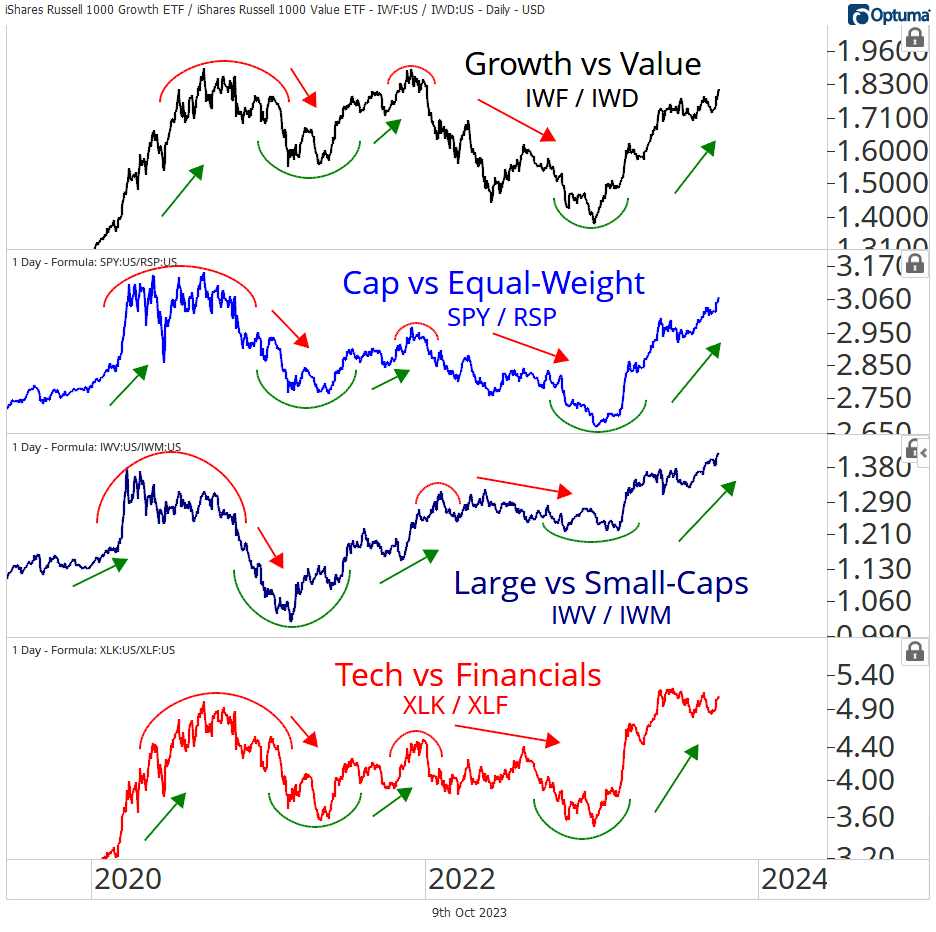

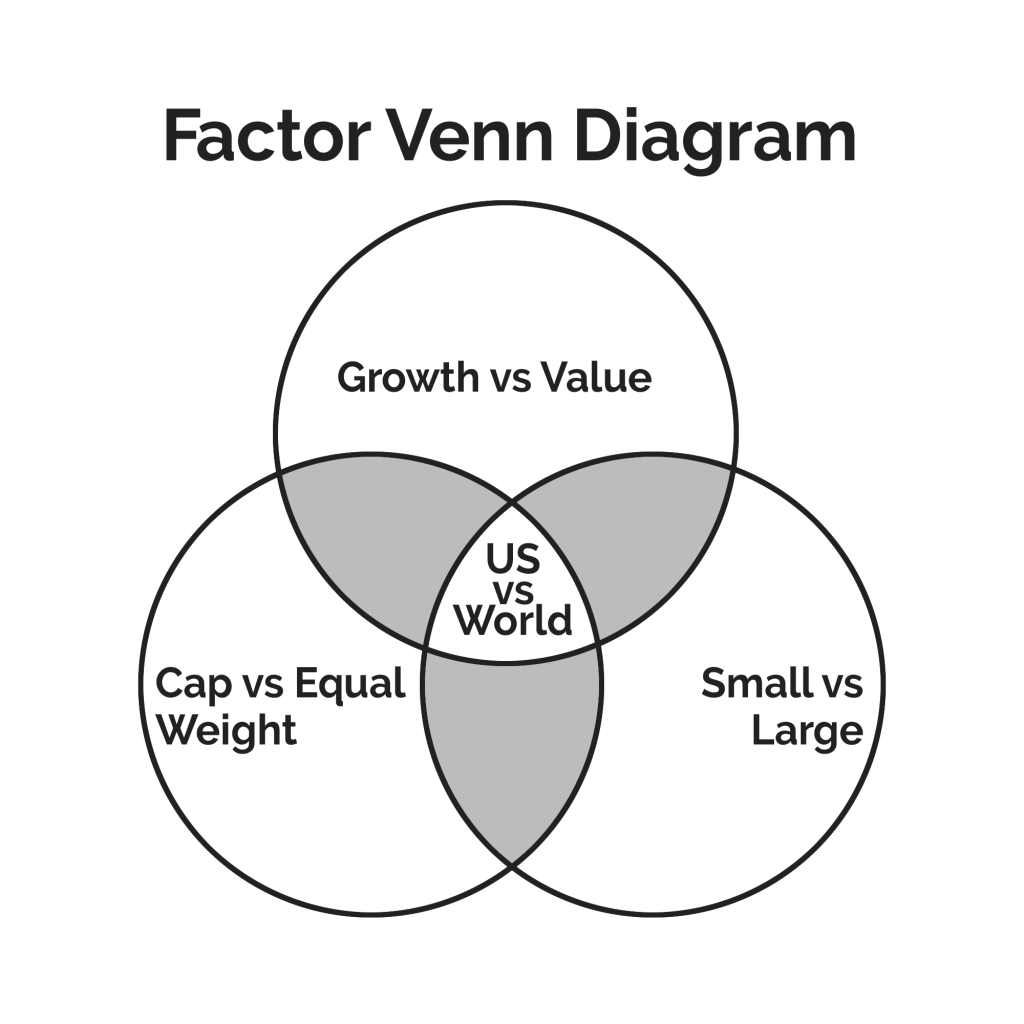

We make this argument because there is a great deal of overlap between these relative trends that underpin the market. When we analyze the performance of various factors like small vs large-caps, cap vs equal-weight, technology vs financials, or US vs world, it all really comes down to growth vs value.

So many of these factors are merely derivatives of growth vs value, and the relationship between US and international equities is no different.

Just look at how close all these relationships trade with one another.

You can see just how tightly the underperformance of international equities is linked to the outperformance of growth stocks over value.

You can see just how tightly the underperformance of international equities is linked to the outperformance of growth stocks over value.

With almost every other market on the planet having materially more value exposure than the United States, it would make sense to see this secular regime of US outperformance come under pressure if we were to see a shift in the trend of growth outperformance we’ve all become accustomed to. One of the primary reasons why international equities have been left for dead over the last 15 years is that investors’ appetite for growth has been satiated in the United States, leaving no reason to venture elsewhere.

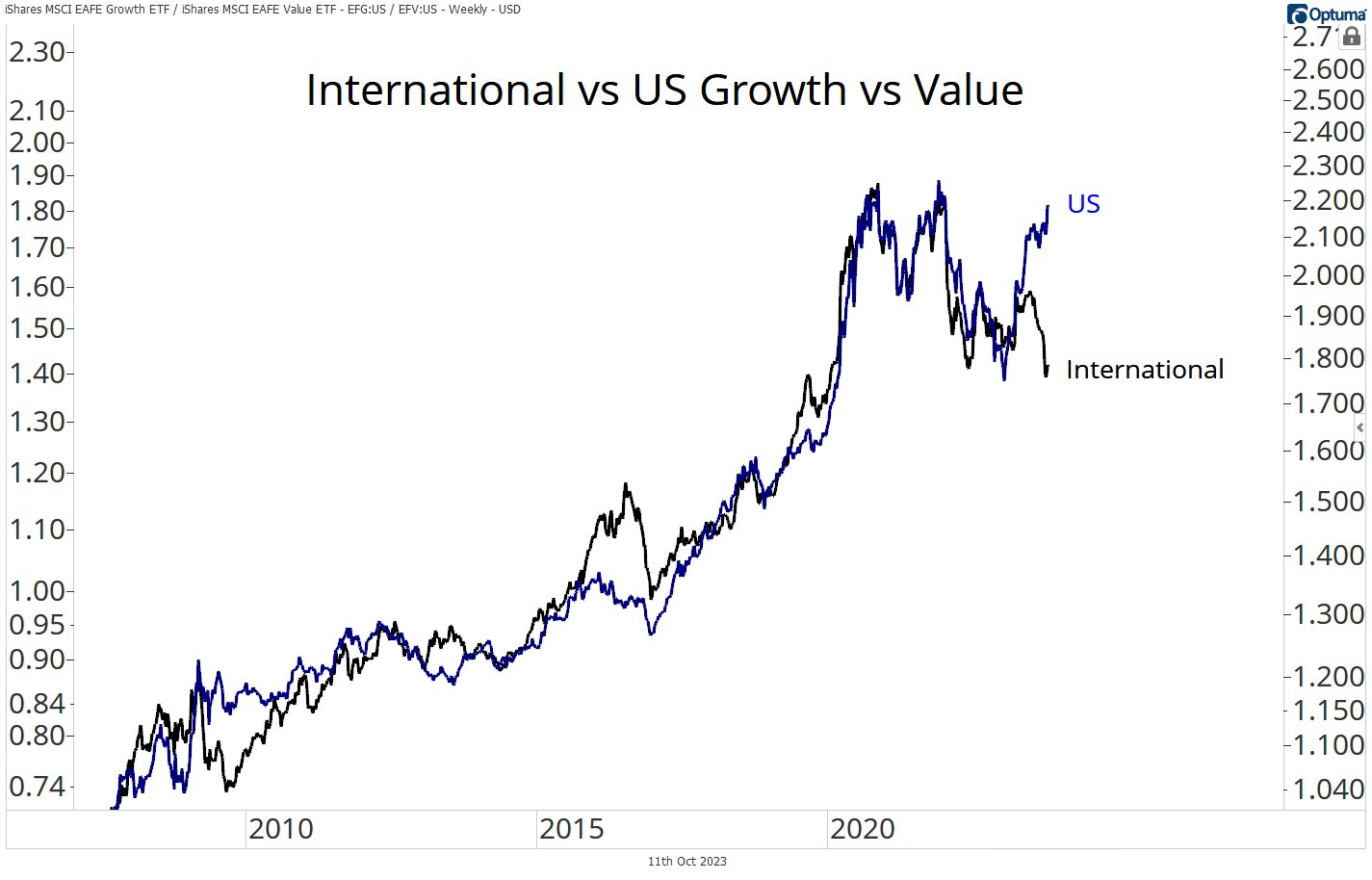

It’s also worth noting that the recent recovery we’ve seen out of growth relative to value has largely been isolated to the United States. When we venture beyond our borders, EAFE growth is trading at 52-week lows relative to EAFE value making this the most significant historical divergence between US and EAFE growth vs value.

With foreign markets sporting high exposure to value, this seems like a sizeable tailwind if this recent trend is to persist.

But this all comes with a caveat.

But this all comes with a caveat.

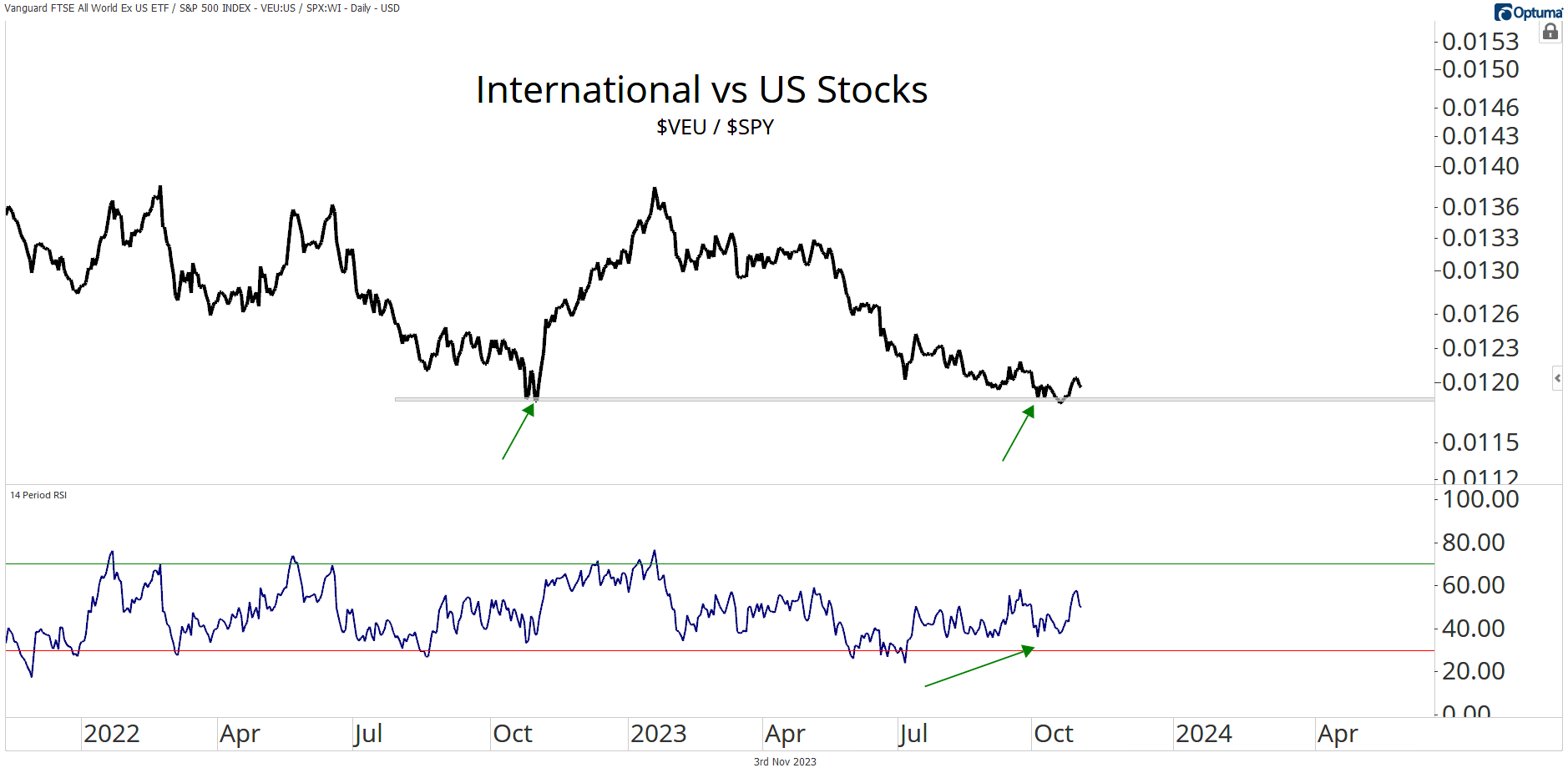

There is still plenty of work cut out for international markets. As it stands, the relative trend is still lower.

Here’s the All-Country World Ex-US $VEU relative to the S&P 500.

The ratio is trading at 52-week lows within the context of a higher timeframe downtrend. As to be expected in a downtrend, this ratio has been continually putting in lower lows and lower highs within a bearish momentum regime.

On a positive note, if this relative ratio can hold this potential level of support, we could see a brief rotation back into international equities relative to the United States. Especially considering the bullish momentum divergence, this would be a logical place to see some mean reversion of this downtrend.

But looking longer-term, we certainly need to see this shape up more before we’d have much conviction favoring international stocks.

Bottoms are processes, and when these trends get going, they can last over a decade. Considering the level of underperformance that international equities have endured over the last decade, it wouldn’t be illogical to pose that this ratio carves out a bottom for a few years before ushering in a new secular uptrend.

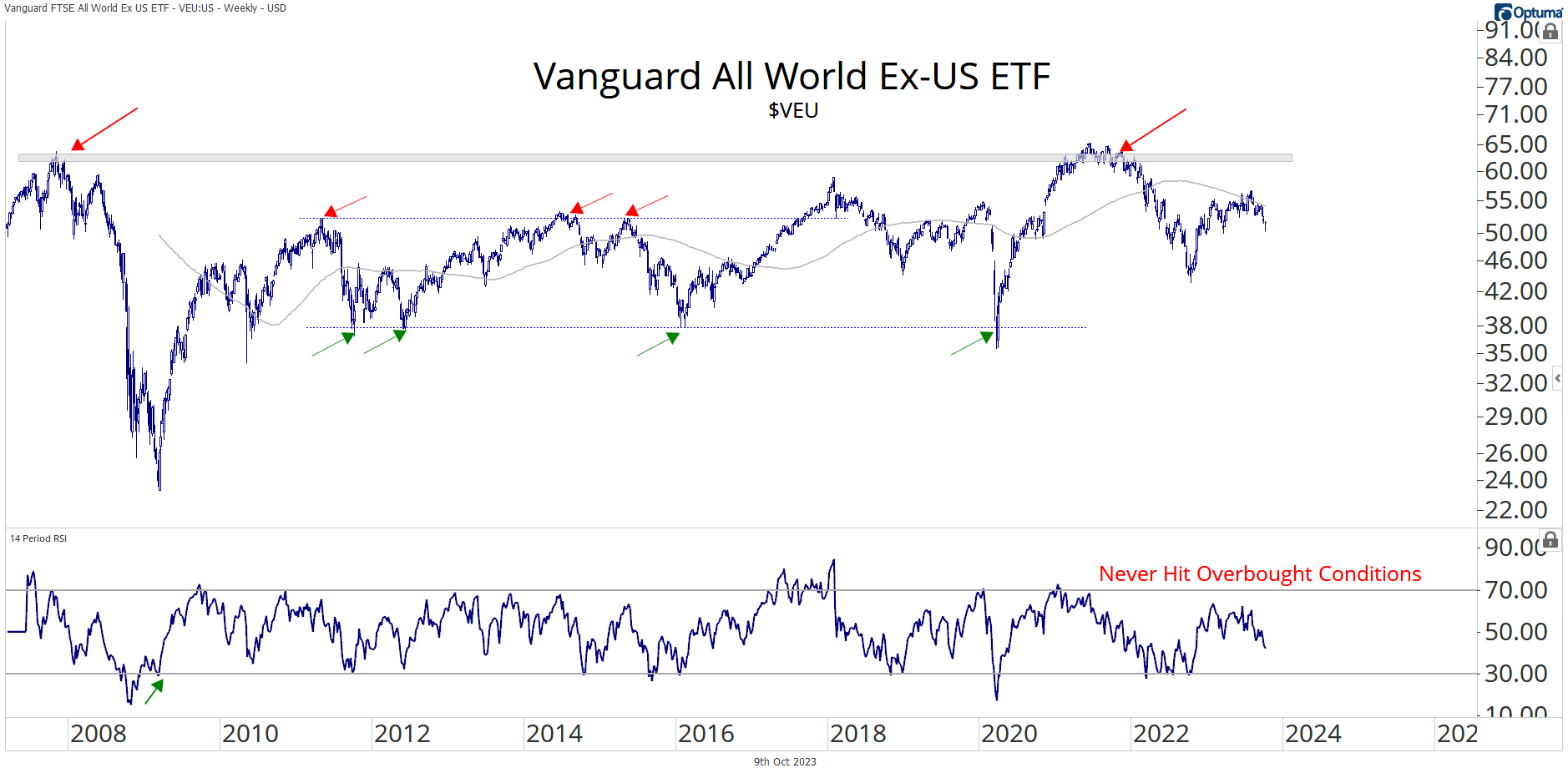

And when we look at the index fund on an absolute basis, the longer-term trend is rather lackadaisical. This is especially the case when we consider that while the GFC highs are a distant memory for the US large-cap indices, a great deal of international indexes are still below their 2007 highs.

Just think about that; most countries have made zero progress in over 15 years…

In the case of Vanguard’s All-Country World Ex-US fund, prices have yet to eclipse their GFC highs. When these markets eventually resolve higher from these bases, it’d be foolish not to have some level of exposure.

But until they do, there is a material opportunity cost in being overweight these international markets.

Looking shorter-term, VEU holding this retest of the 50 support level is a significant development. This coincides with the current tape, where a lot of important indices are in the process of defending key levels. This theme extends to the Dow, the S&P, emerging markets, and EAFE.

Above 50, and the bias is higher for VEU.

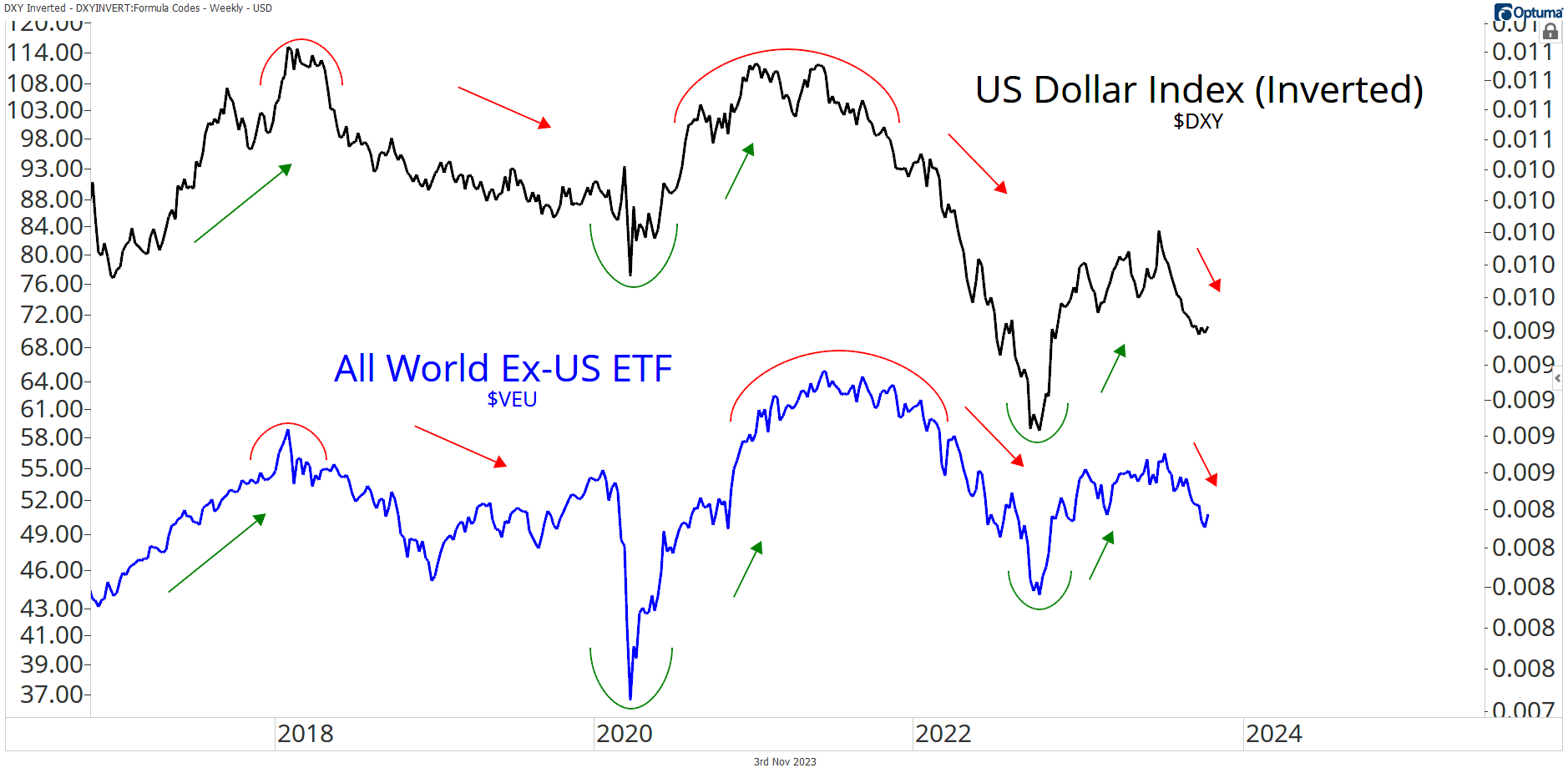

An important element of this discussion is the impact of foreign exchange trends.

An important element of this discussion is the impact of foreign exchange trends.

Global diversified ETFs own stocks all around the world in their local currencies. As most of these funds are unhedged, changes in the relevant exchange rates play an important role in their performance. Long story short, when investing in these vehicles, we don’t just want to make sure that their underlying stocks are performing well in local currency, but also that the currency itself is strong as both will impact the return profile of the ETF.

As such, when we invest in these vehicles we want to be mindful of not just how the equity markets in these foreign countries are doing, but also how their currency is faring against the US Dollar.

There’s no better visualization of this dynamic than simply comparing Vanguard’s All-Country World Ex-US to an inverted US dollar index. As you can see, the two are rather negatively correlated.

A strong dollar is a drawback for international equities held by US investors who denominate these funds in US dollars. It makes sense to see international stocks struggle within the context of this recent dollar strength.

A strong dollar is a drawback for international equities held by US investors who denominate these funds in US dollars. It makes sense to see international stocks struggle within the context of this recent dollar strength.

In assessing the broad relative trends, there is still plenty of work to be done before we’d want to favor international equities. But, there is fertile ground by which to anticipate a shift in the factor dynamics investors have grown accustomed to over the last decade.

We just need to see this manifest before making a bet with some level of conviction.

The question looms large; will the status quo persist, leaving investors to profit from their overexposure to large-caps and growth stocks?

Or will this be the moment when international markets rise from their decade-long slumber, breaking the mold of home-country bias?

If you enjoyed this post and want access to our premium research, start your

30-day risk-free trial or sign up for our “Free Chart of the Week” to receive more free research like this.

Thanks for reading and please let us know if you have any questions!

Allstarcharts Team

Be the first to comment