From the Desk of Ian Culley @IanCulley

Cattle futures are defying gravity.

Unlike most commodities during this cycle (pick your favorite base metal or grain contract), cattle have yet to correct lower.

Instead, they’re still hanging around new all-time highs.

Something has to give…

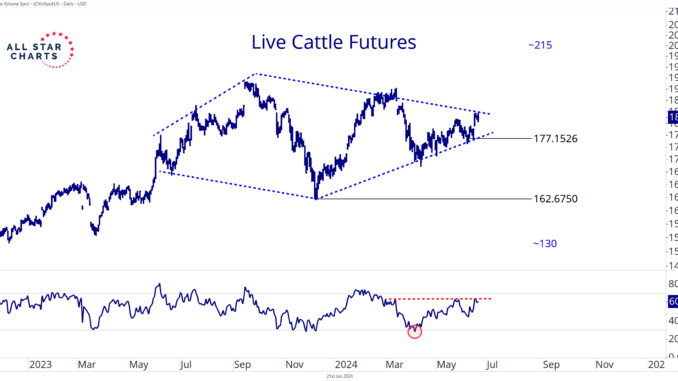

Check out the diamond top taking shape on the live cattle chart:

Diamond tops are a rare bearish reversal pattern. They’re so rare that I’m slow to draw their boundaries.

But I was reassured when referencing Richard W. Schabacker’s Technical Analysis and Stock Market Profits: “The real bible of technical analysis.”

He points out,

It [diamond pattern] is rarely found in perfectly symmetrical and clearly defined form: a certain amount of latitude must be taken and is permissible in drawing its boundaries.

Schabacker’s the authority, so I’ll give myself some wiggle room.

I see a broadening price action that began last June, leading to a contraction or coil.

If the December pivot low fell more in line with the June 2023 and April 2024 pivot lows, we would have a potential double top. But that’s not the case.

Either way, a decisive close below 177 flashes a sell signal with a downside target of 130.

On the flip side, a breakout above the 2023 high of 192 turns our outlook higher toward 215.

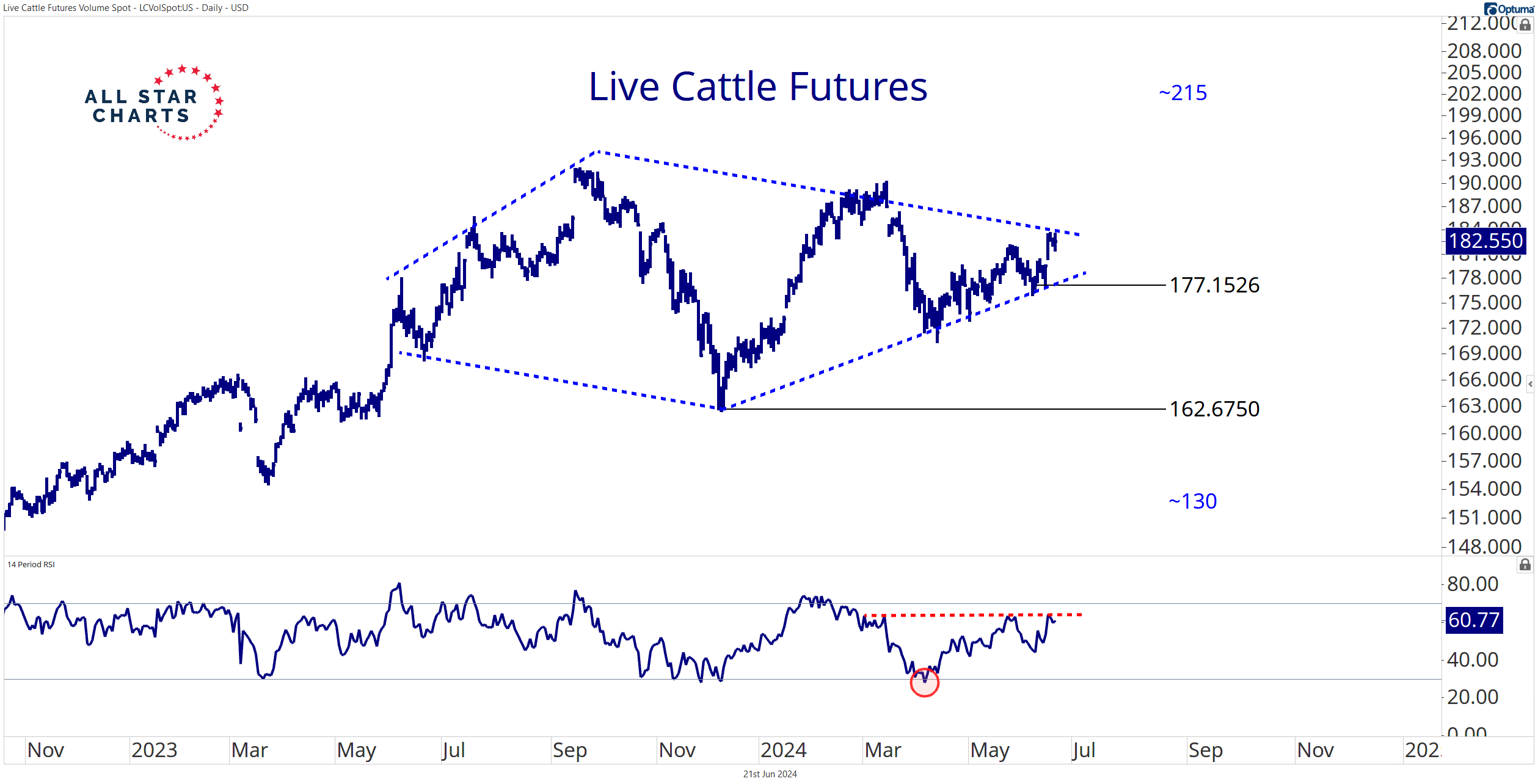

But if I were to take a long position, it would be in feeder cattle:

Feeder cattle is the stronger of the two contracts. Price is challenging the upper bounds of a similar diamond pattern. A breakout above 260 to new all-time highs could lead toward 288.

Regardless, I’m more interested in the short side of this market.

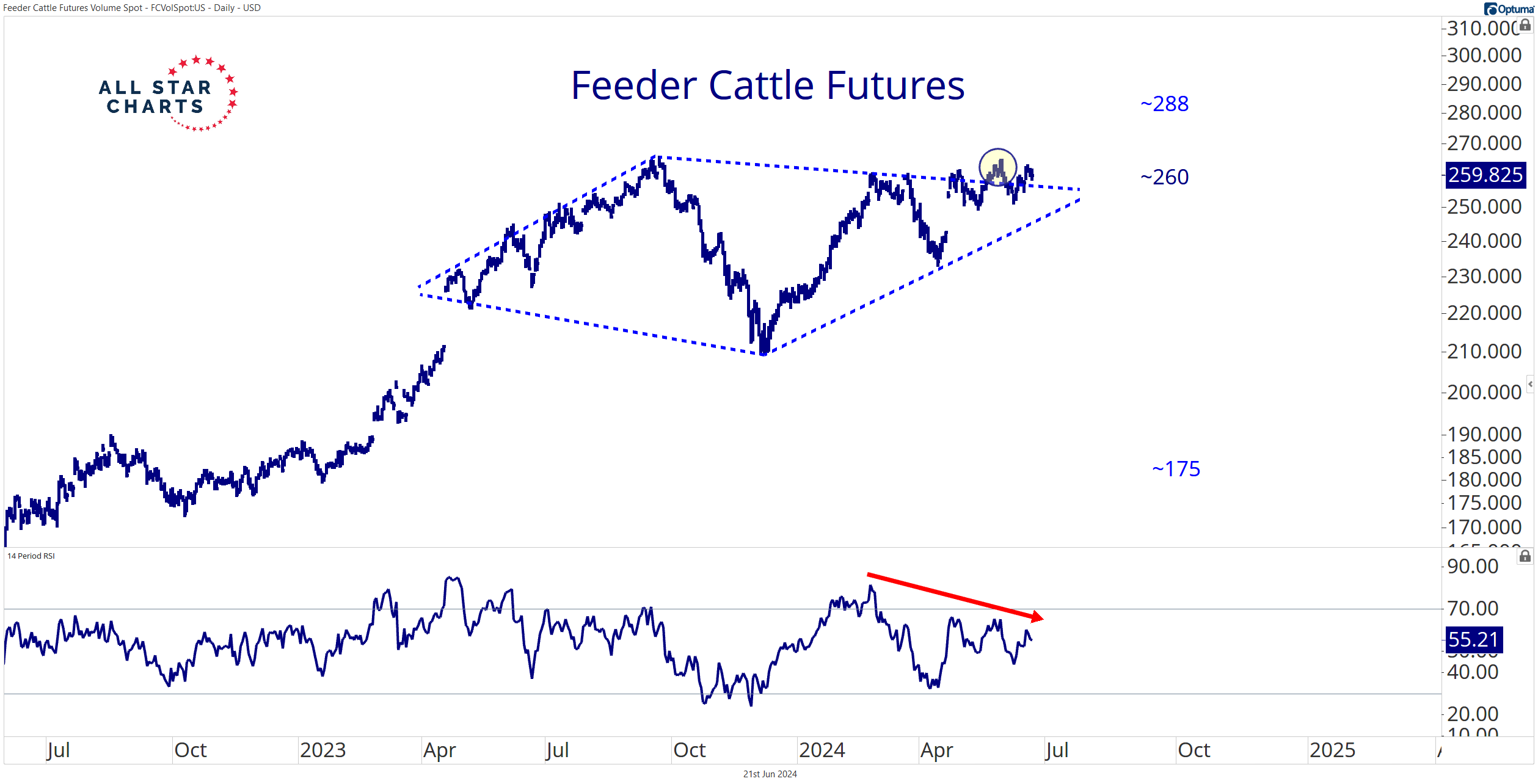

A head and shoulders is forming above last month’s lows as bullish momentum wanes:

I like shorting feeder cattle futures if sellers drive price below 250, setting an initial target of 234. A decisive close below our first downside objective completes the diamond top with a rough target of 175 (though buyers may defend the 210 level).

Both cattle contracts have rallied to new all-time highs but have yet to experience a meaningful downside correction.

Remember, cattle futures are a commodity traded in Chicago. They don’t act like the publicly traded companies on Wall Street.

It’s an escalator up, elevator down for commodities – even during bull markets!

I expect cattle futures to drop a few floors, but only once these diamond tops resolve lower.

–Ian

COT Heatmap Highlights

No report today. The CFTC will update the Commitment of Trader report on Monday.

Premium Members can log in to access our Weekly Commodities Report Chartbook and the Trade of the Week. Please log in or start your risk-free 30-day trial today.

Be the first to comment