From the Desk of Alfonso Depablos @Alfcharts

One of the relative trends we must regularly evaluate is the relationship between large-caps and small-caps.

Sometimes large-caps outperform. Other times, it’s the little guys leading the way.

This ratio tells us which ones we should be focusing on.

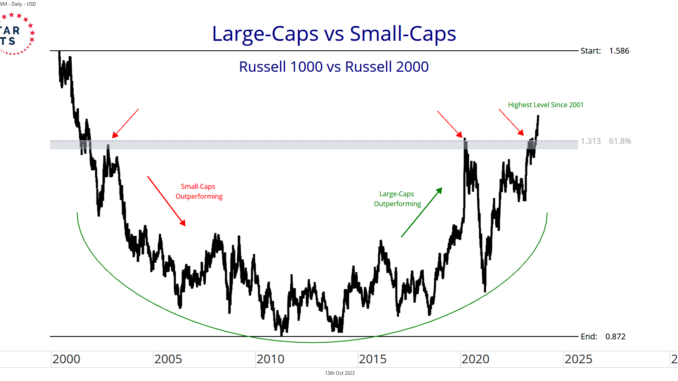

The chart below shows the Russell 1000 Large-Cap ETF (IWB) relative to the Russell 2000 Small-Cap ETF (IWM) breaking out of a monster-basing formation.

After a prolonged consolidation that took much of the last two decades, the relationship is accelerating in favor of large-cap stocks.

This year’s stunning surge from the largest growth stocks has vaulted the ratio to its highest level since 2001.

As long as this breakout sticks, we expect further outperformance from large-cap stocks over their small-cap counterparts for the foreseeable future.

Under this scenario, we want to look for relative strength and get behind upside resolutions in some of the largest stocks in the market.

We’re talking about the Googles, Facebooks, and Nvidias of the world.

If a new large-cap leadership regime is just coming underway, it means these stocks have more to run from current levels.

The bigger the better is the playbook for now.

As always, we love to hear from you, so shoot us a note and let us know what you think.

Alfonso

Be the first to comment