From the desk of Steve Strazza @Sstrazza

We held our November Monthly Strategy Session Wednesday night. Premium Members can access and rewatch it here.

Non-members can get a quick recap of the call simply by reading this post each month.

By focusing on long-term, monthly charts, the idea is to take a step back and put things into the context of their structural trends. This is easily one of our most valuable exercises as it forces us to put aside the day-to-day noise and simply examine markets from a “big-picture” point of view.

With that as our backdrop, let’s dive right in and discuss three of the most important charts and/or themes from this month’s call.

1. Sideways Mess

At the beginning of each month, we like to step back and understand where we are.

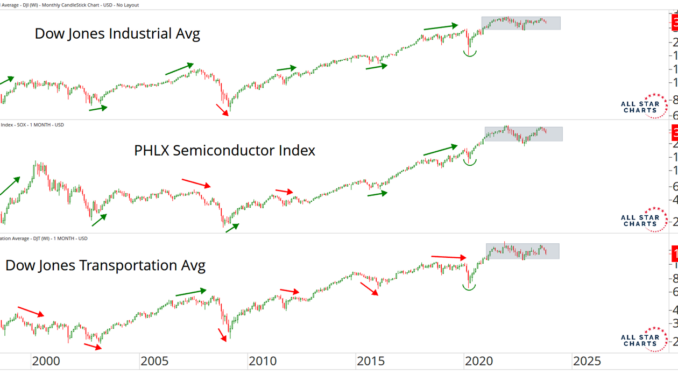

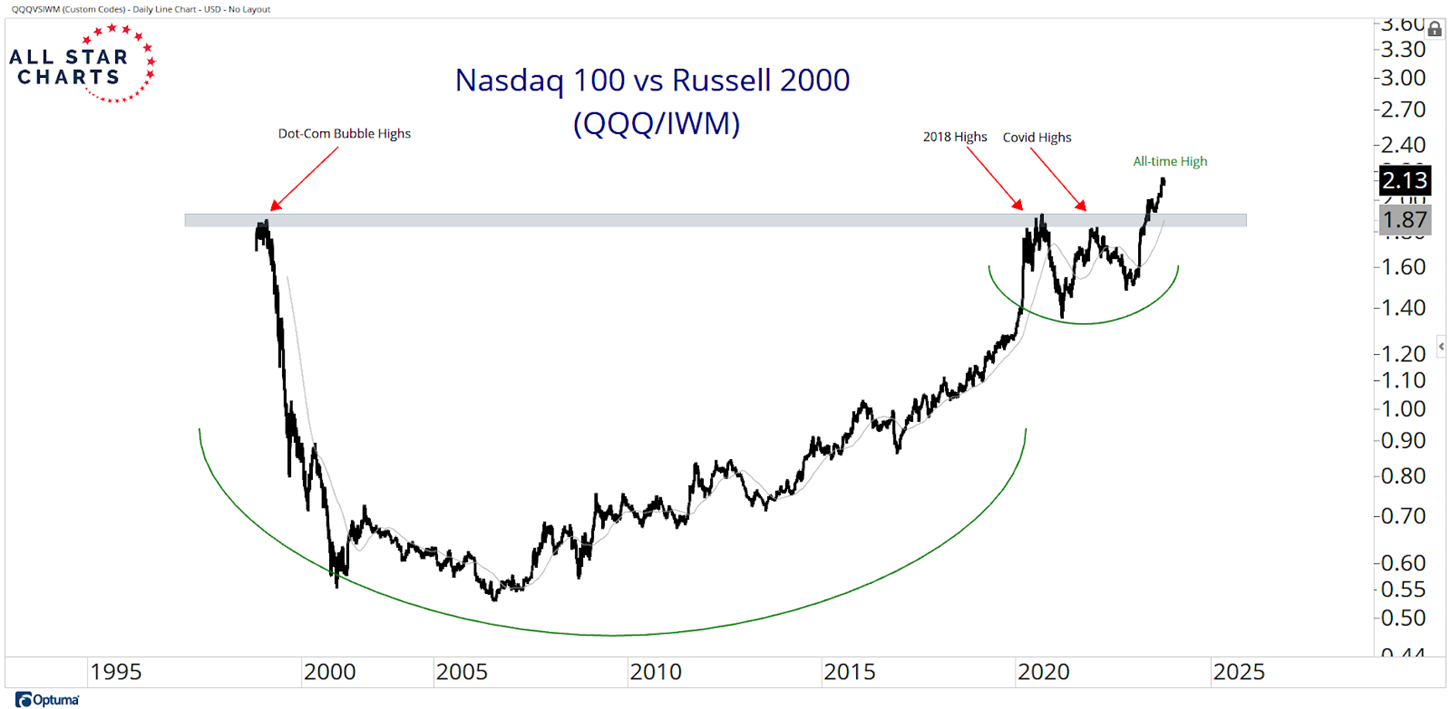

One of our favorite ways to do this is by identifying the primary trends in key indexes like the Dow Jones Industrial Average $DJI, the Dow Jones Transportation Average $DJT, and the PHLX Semiconductor Index.

We call this the “New Dow Theory.”

As you can see, these major indexes have been stuck in a sideways range for over two years.

That means we’re in a range-bound market from a long-term perspective. However, these ranges are playing out within the context of a structural uptrend.

Although we need to remain flexible and wait for a decisive resolution, naturally, we expect these consolidations to resolve higher, in the direction of the underlying trend.

Therefore, we continue to think it makes sense to spend more time looking for stocks to buy in this environment.

2. Remember To Buy in November

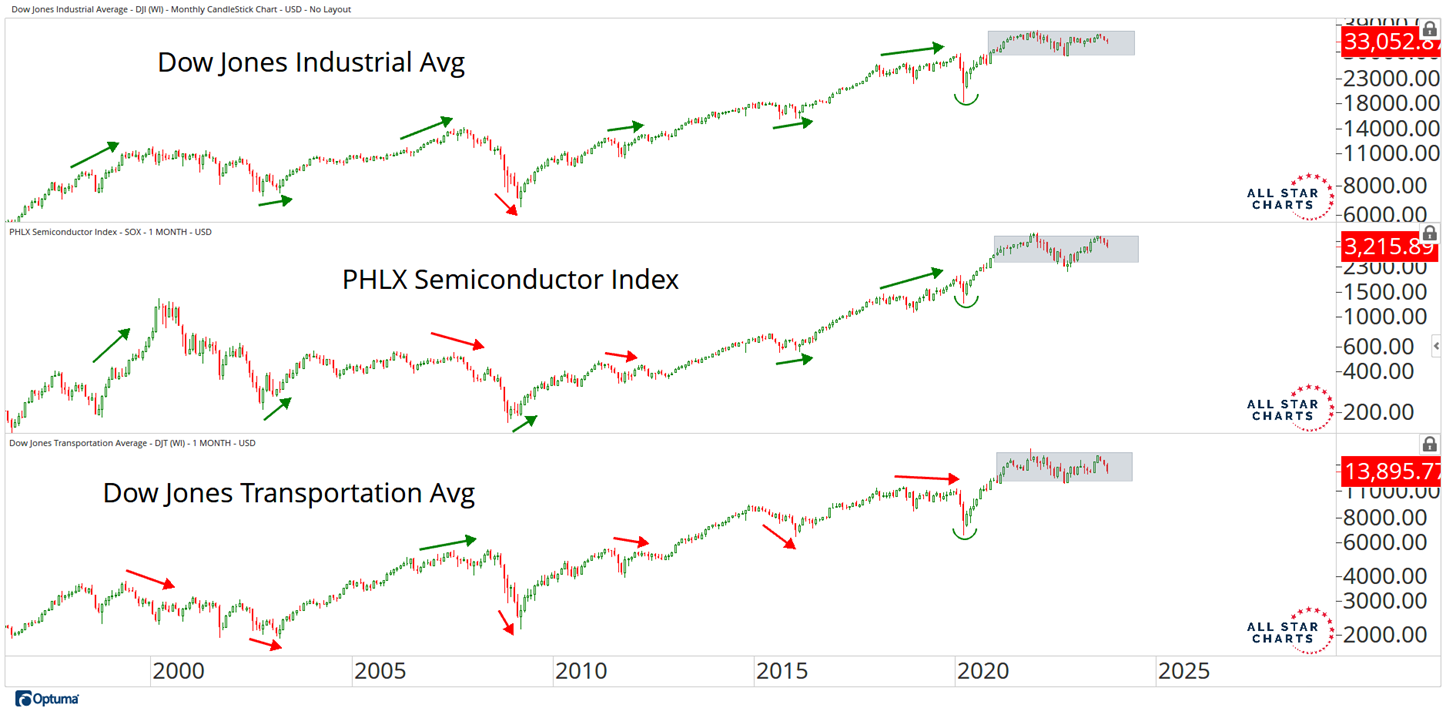

After enduring a well-deserved period of seasonal weakness between July and October, we are entering the best month of the year for the stock market.

As you will see, November represents the strongest month for the S&P 500, with an average gain of 1.73% since 1950.

This means seasonality now represents a tailwind for equities. Under this scenario, there’s no better time for the broader market to experience a rally into the year-end.

This is the micro, annual seasonal trend. And it is definitely bullish. However, when we zoom out and analyze the four-year presidential cycle, we are also in a seasonal sweet spot. Everything seems to be coming together for a Santa Claus rally. We just need confirmation from prices.

3. Tech Over Small Caps

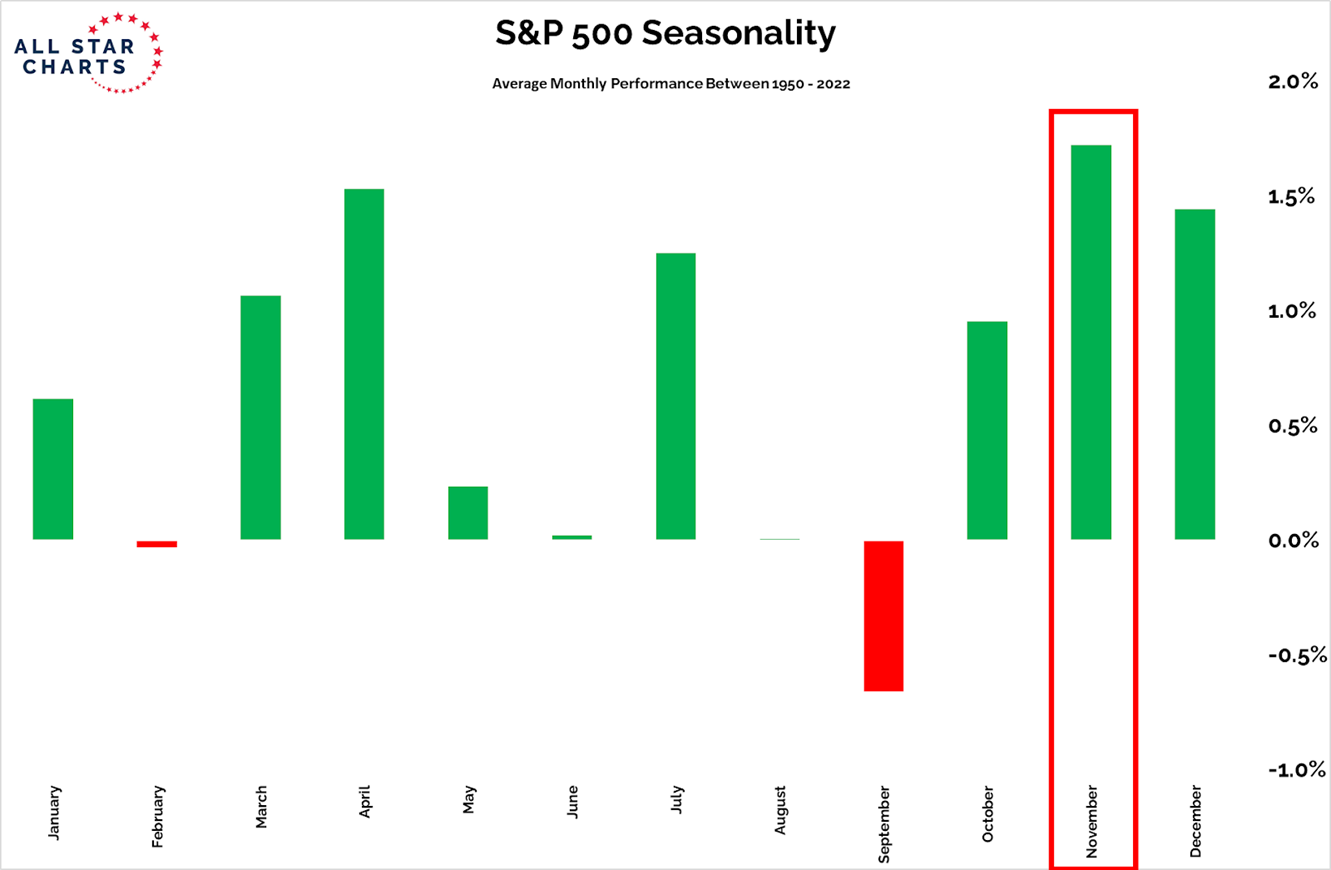

One of the most critical relative trends we like to evaluate is the relationship between the Nasdaq 100 $QQQ and the Russell 2000 $IWM.

The Nasdaq 100 represents large-cap growth, whereas the Russell 2000 represents small-cap stocks (and arguably, most stocks, or the broader market).

Long story short, this relationship tells us how we should position ourselves in the stock market.

Below is the QQQ/IWM ratio dating back to the early 2000s, showing fresh all-time highs:

After a prolonged sideways period for the past three years, the ratio is emerging above its dot-com bubble peak and 2020 highs.

As long as these new highs stick, growth and technology should experience an acceleration in their current leadership role. That’s where we want to be for the foreseeable future.

Those are some of the main takeaways from this month’s strategy session.

Thanks for reading, and please let us know if you have any questions!

Allstarcharts Team

Be the first to comment