In today’s Flow Show, Steve Strazza served up the opportunity that is revealing itself in the financials space.

So we looked for some vehicles to express our bullish thesis, while being mindful of upcoming earnings releases that will be kicking of earnings season in less than two weeks.

This is no time to enter trades with undefined risk. But if we can minimize the volatility, it would be best to consider those options.

We think we have just the right idea in Morgan Stanley.

Here’s a one-year chart of $MS:

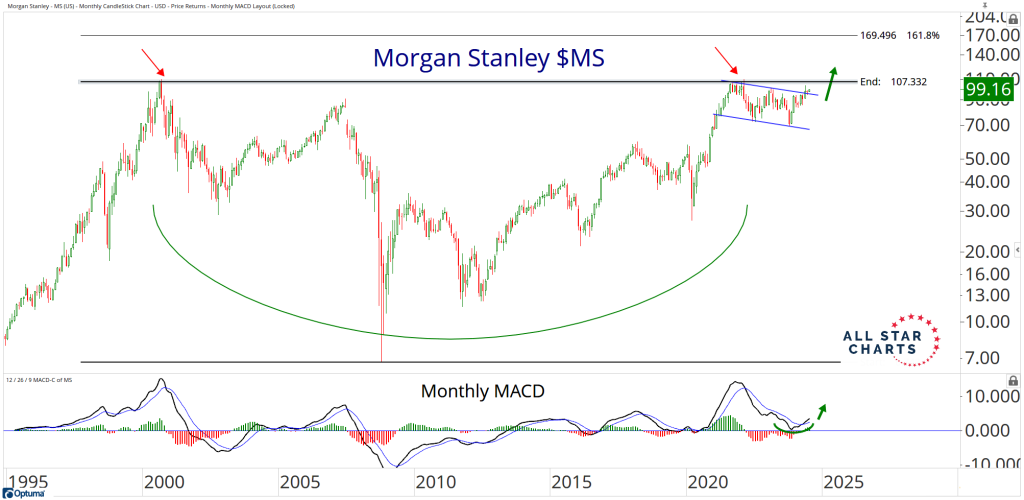

But when you zoom out and look what we’re overcoming, it gets really interesting:

Yes, that’s a 25-year base you’re looking at. Wow!

It looks to us that $MS might be on the cusp of kickstarting a “catch-up” trade to its financials breatheren who are finally clearing similarly monster multi-year bases. And if that’s the case, we want to position ourselves in a way to catch a potentially long ride.

Here’s the Play:

I like buying $MS December 2025 105-strike calls for approximately $10.00 per contract. This is the December options that expire 18-months from now. This gives us a lot of time to catch a ride higher.

As long as $MS can stay above $95 per share, then I will attempt to hold these calls as long as I can. Of course, we have a long time to expiration, so if/when we do begin to trend higher, I’ll very likely move my stop higher, following the trend. But for now, any closing price below $95 means we’re early or wrong and we want out for now.

Additionally, if these calls lose 50% of my purchase price at any time during my hold, I’ll cut my losses there.

No profit target on this play for now. We’re in it to win it. Let’s go!

If you have any questions on this trade, please send them here.

If you missed my most recent ASO video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7910.

Be the first to comment