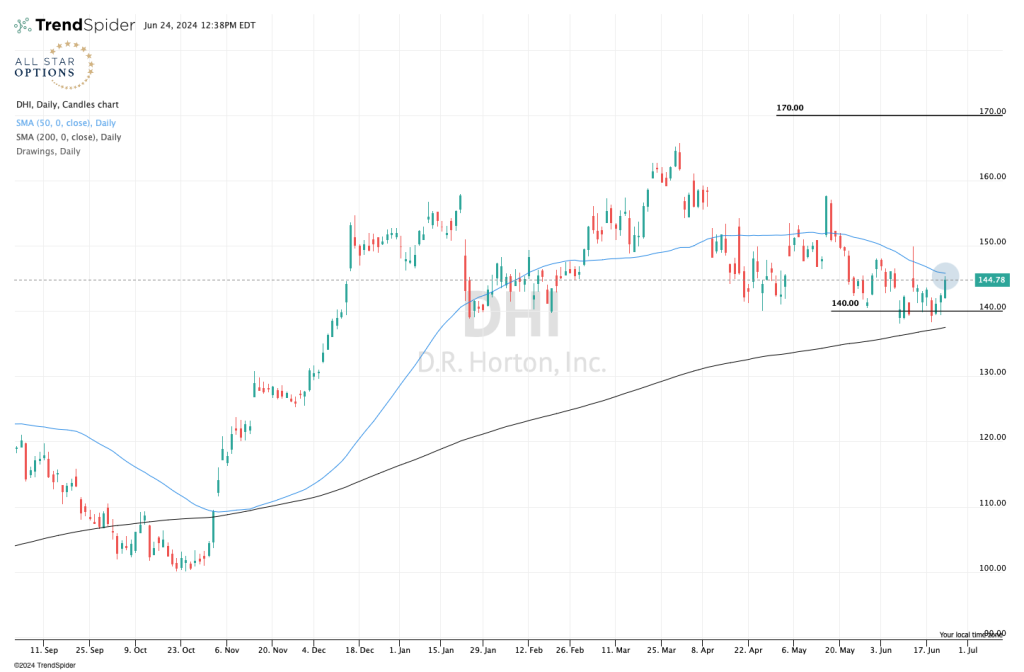

In today’s Flow Show, Steve Strazza highlighted the strength we’re seeing in the homebuilders sector. I immediately liked it because I don’t have any homebuilding stocks in my portfolio, which needs to be corrected.

Last week, Lennar Corp $LEN released earnings, and the market pretty much yawned. I like that. Because the other name that we liked better — D.R. Horton $DHI — hasn’t yet released earnings (scheduled for July 18th) and unless they come out with something truly shocking, my bet is the market will be similarly unfazed. This tells me there’s an opportunity to take advantage of some overpriced options premiums currently being bid into $DHI options.

We like $DHI to make a run back to all-time highs, and we want to be long the November 170 calls. But we will sell some overpriced options to help us finance the trade.

Here’s the Play:

I like buying the $DHI November 170 calls for approximately $3.50 per contract. I could stop here. But I’d like to finance the trade.

To help reduce our net initial cost of this trade, I’m also going to add two more legs:

- I’m going to sell an equal amount of August 170 calls for approximately 60 cents. (This creates an Aug/Nov 170 call calendar spread). And,

- I’m going to sell an equal amount of July 140 puts naked for an approximately $2.80 credit. (Requires margin. I could skip this part if the margin requirement is too high, or I can buy a further out-of-the-money put to reduce the margin requirement and define my risk)

All in all, these three trades will work out to result in a net debit of around 10 cents.

For risk management purposes, we’ll close this entire position down if $DHI sees a closing price below $140 (the strike of our short put). That would be a clear indication to us that we’re either early or wrong in this trade.

As long as $DHI stays above $140, then the short puts will expire worthless in July.

Next, we’ll hope our August 170 calls also expire worthless. If that happens, then we’ll own the November 170 calls free and clear, basically for free! But if $DHI trades to/through $170 while we still have the short August calls on, then I’ll close that calendar spread for whatever I can get for it. That credit we get for closing the spread will be all profit.

If you have any questions on this trade, please send them here.

If you missed my most recent ASO video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7910.

Be the first to comment