With earnings in the biggest bank names mostly out of the way, the time is now for banks to put up or shut up.

And today’s trade is in one of the “junkiest” banks out there we know — Bank of America. Sorry, not sorry.

With a nearby risk management level, we’re gonna make the put buyers pay for our bullish calls.

Here’s a chart of where Bank of America $BAC stands now:

Last week’s lows offer a pretty good level to lean against for risk management. But because we want to minimize the risk of getting stopped out on noise, we’re going to use $26.00 as our line in the sand.

Here’s the Play:

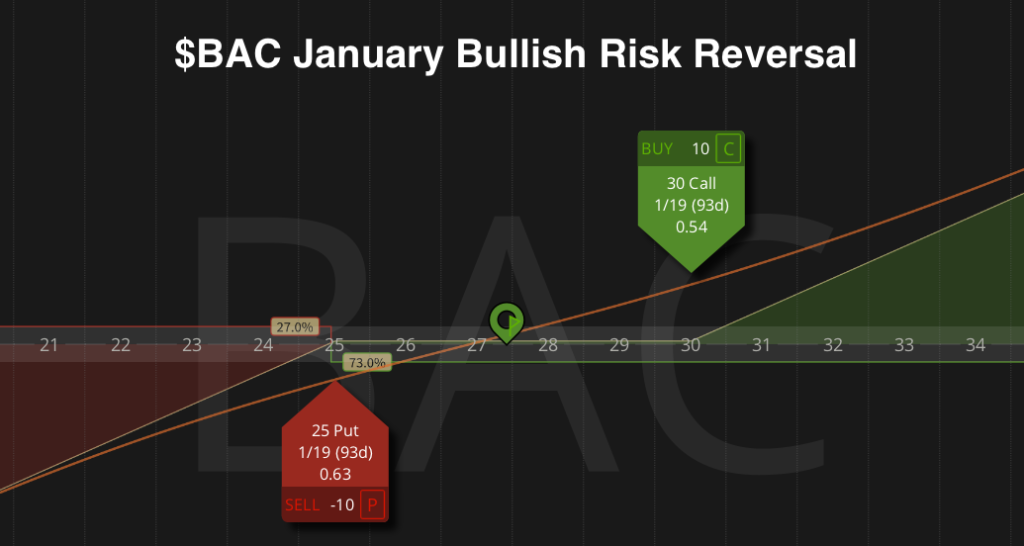

I like entering a $BAC January 25/30 Bullish Risk Reversal for a small net credit. This means I’ll be naked short the Jan 25 puts and long an equal amount of Jan 30 calls. The amount of the net credit is not super important, but I’d like it to be something — even if only 5-10 cents:

Again, it’s either now or never for banks. So we’ve got a nearby stop in $BAC. Any closing price below $26 for $BAC is our signal to cut and run. We’ll step aside as banks attempt to test new lows.

If the lows hold and $BAC rallies from here, we’re going to take profits if/when $BAC trades to/through $32.00. We’ll close all our short puts (for pennies) and sell our calls, booking profits.

If you have any questions on this trade, please send them here.

If you missed last week’s video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7991.

Be the first to comment