From the Desk of Ian Culley @IanCulley

The Bank of Japan is loosening its grip on the Japanese benchmark yield.

And the dollar, the euro, and the pound are ripping to fresh highs versus the yen.

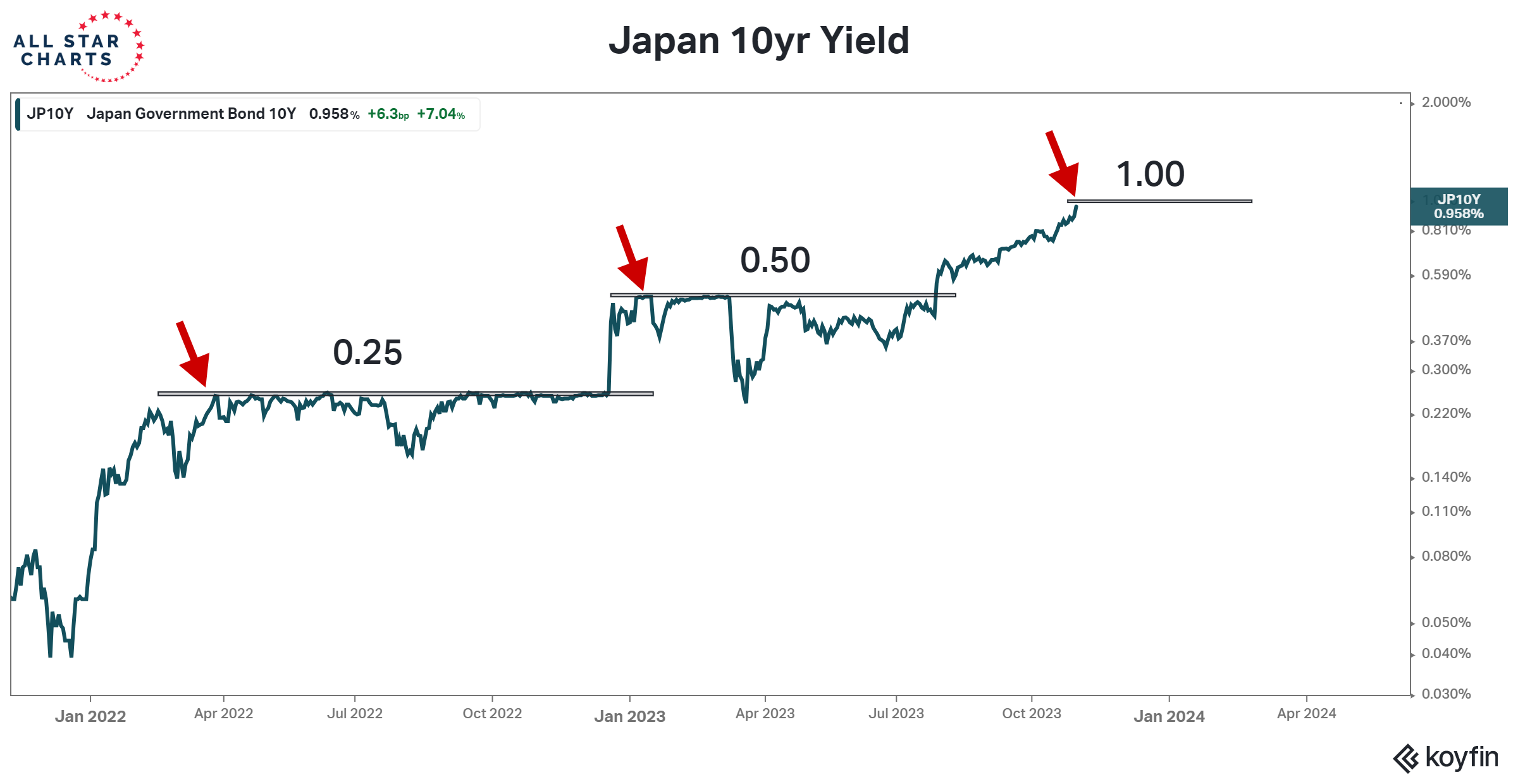

Yes, the USD/JPY is off to the races – again.

But where can we define the next logical upside objectives?

Let’s dive in…

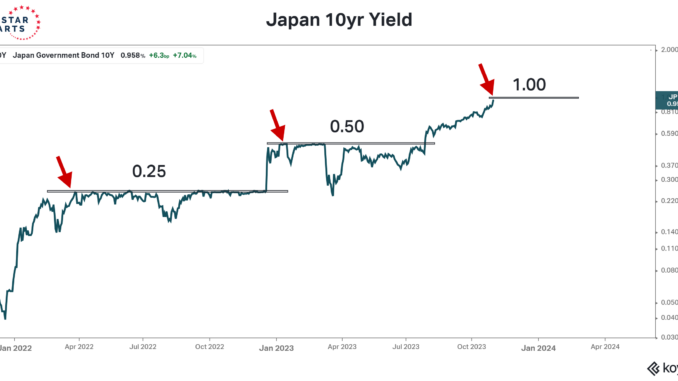

Before tackling our targets for the dollar-yen pair, check out the Japanese 10-year yield:

The BoJ’s yield curve control policy has, in large part, capped the USD/JPY rate as traders and policymakers play a game of chicken. Traders drive the dollar-yen pair higher, challenging the Japanese central bank’s hold on interest rates.

Meanwhile, the BoJ steps in with policy decisions supportive of the yen.

Market participants were expecting the move from the BoJ today – which it did by loosening its grip to 1.00% as an upper bound for the 10-year yield.

But it wasn’t enough in the eyes of the market as the EUR/JPY is hitting its highest level since 2008, and the USD/JPY is posting fresh 52-week highs.

The path of least resistance points lower for the yen and higher for anything denominated in yen. (It sounds like 2022 all over again.)

The former 1990 highs at approximately 159.50 mark the next logical target for the USD/JPY once buyers breach the 2022 high of 151.94. (The dollar-yen pair trades roughly 50 pips away from last year’s high as I type.)

A breakout from a decade-plus inverted head and shoulders pattern has catapulted the US dollar to multi-decade highs.

But where will the crumbling yen end up when buyers reclaim the 1990 highs?

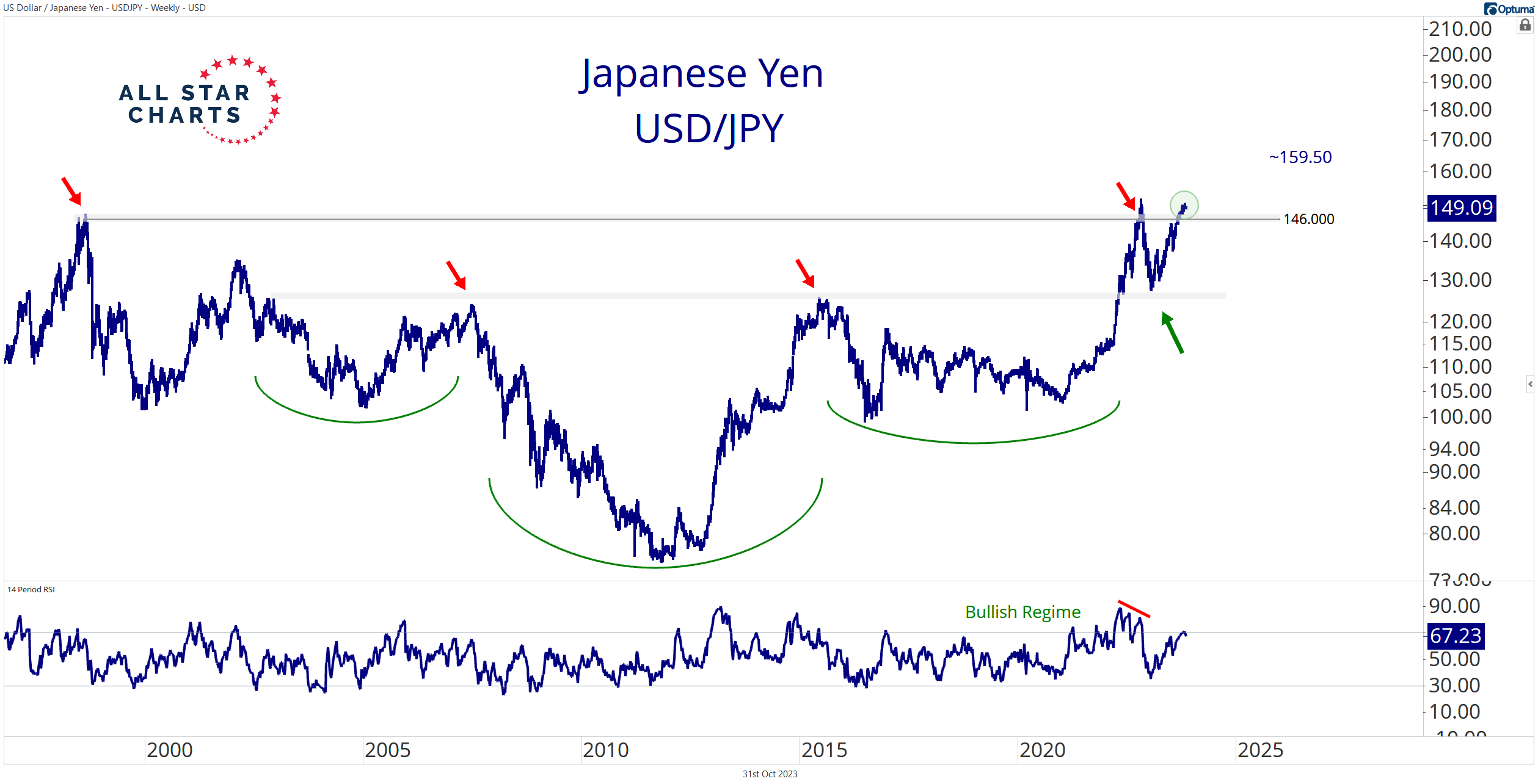

Our next upside objective rests at approximately 175.50 based on Fibonacci analysis:

Notice price has respected the levels extended from the 2016 high to the 2020 low. The repeated action at these levels adds to my conviction.

Rates are rising worldwide. The dollar-yen is marching toward uncharted territory. And the BoJ’s yield curve control policies continue to prove costly – mainly to the yen.

We now have two near-term targets (151.94 and 159.50) and one longer-term objective (175.50) as the USD/JPY sets course for another rip-roaring rally.

Stay tuned.

Thanks for reading.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment