From the Desk of Ian Culley @IanCulley

The bull market is back!

The major indexes are hitting new all-time highs, and so is gold.

Small-caps are ripping. Crypto is ripping. And the most heavily shorted names on the street are squeezing higher.

I’d expect the US dollar to break down as stock market bulls rush to put their greenbacks to work.

Instead, the US Dollar Index $DXY is holding steady. Dollar-yen is refusing to roll over.

And risk-on commodity currencies – the Australian, Canadian, and New Zealand dollars – are failing to trigger buy signals.

Stock market bulls don’t seem to care about the lack of risk-on signals from global currencies.

As long as that’s the case, neither should we.

But can you imagine how US equities will respond if the dollar finally takes a dive?

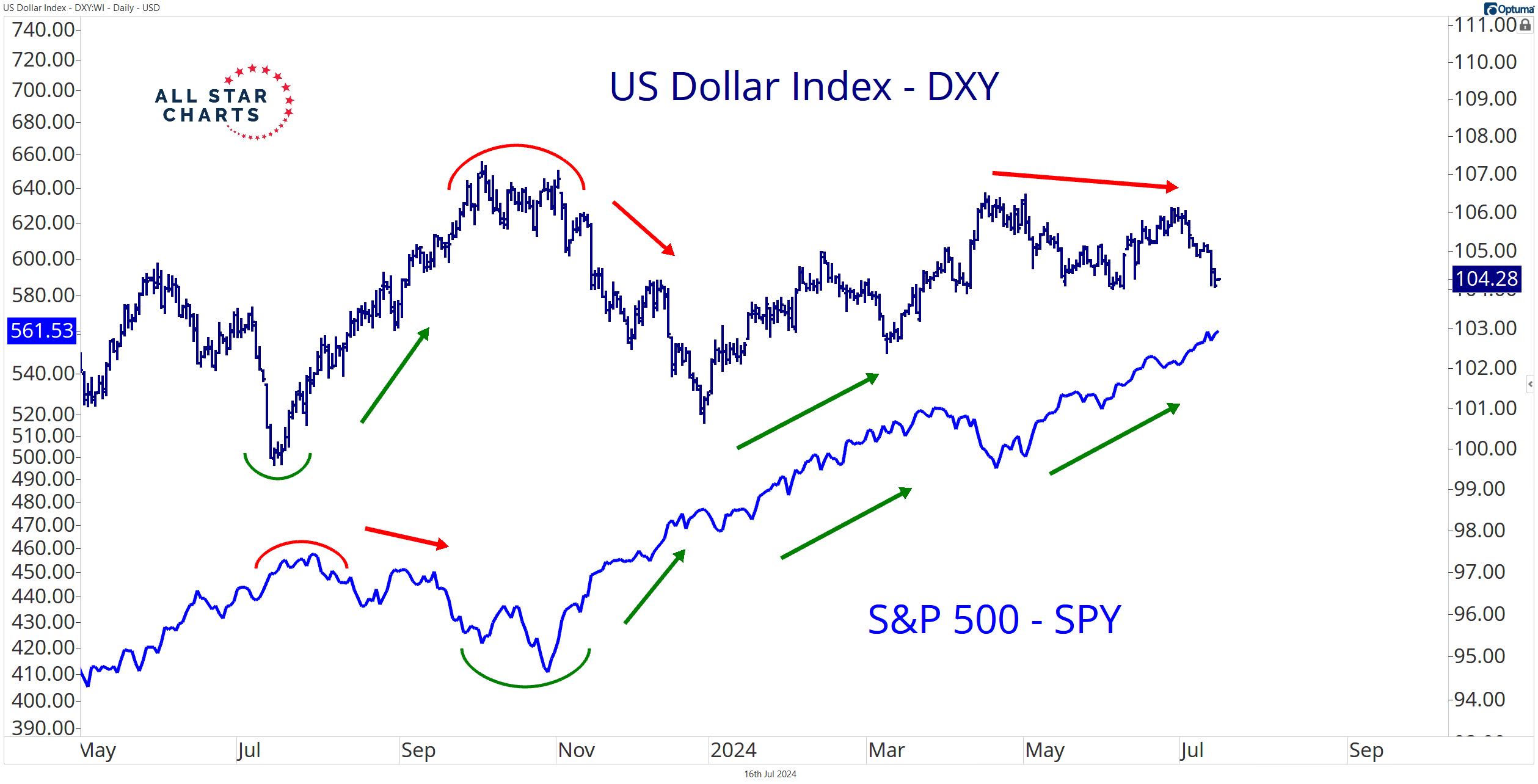

The S&P 500 rose 11.5% during Q4 of last year as the DXY slid to new lows:

Dollar down, stocks up makes sense to me.

However, the dollar and stocks rallied to start the year (the DXY climbed 3% while the SPY gained 10%). Q1 dollar strength failed to deter equity investors.

Granted, the S&P 500 coughed up 5% when the buck retested the 106 level in April. Aside from the modest pullback, this year has seen a steady procession of new all-time highs for the large-cap indexes.

The stock market’s resilience in the face of US dollar headwinds leaves an undeniable impression. Yet a decisive DXY breakdown will turn that bull market grit into pure upside momentum.

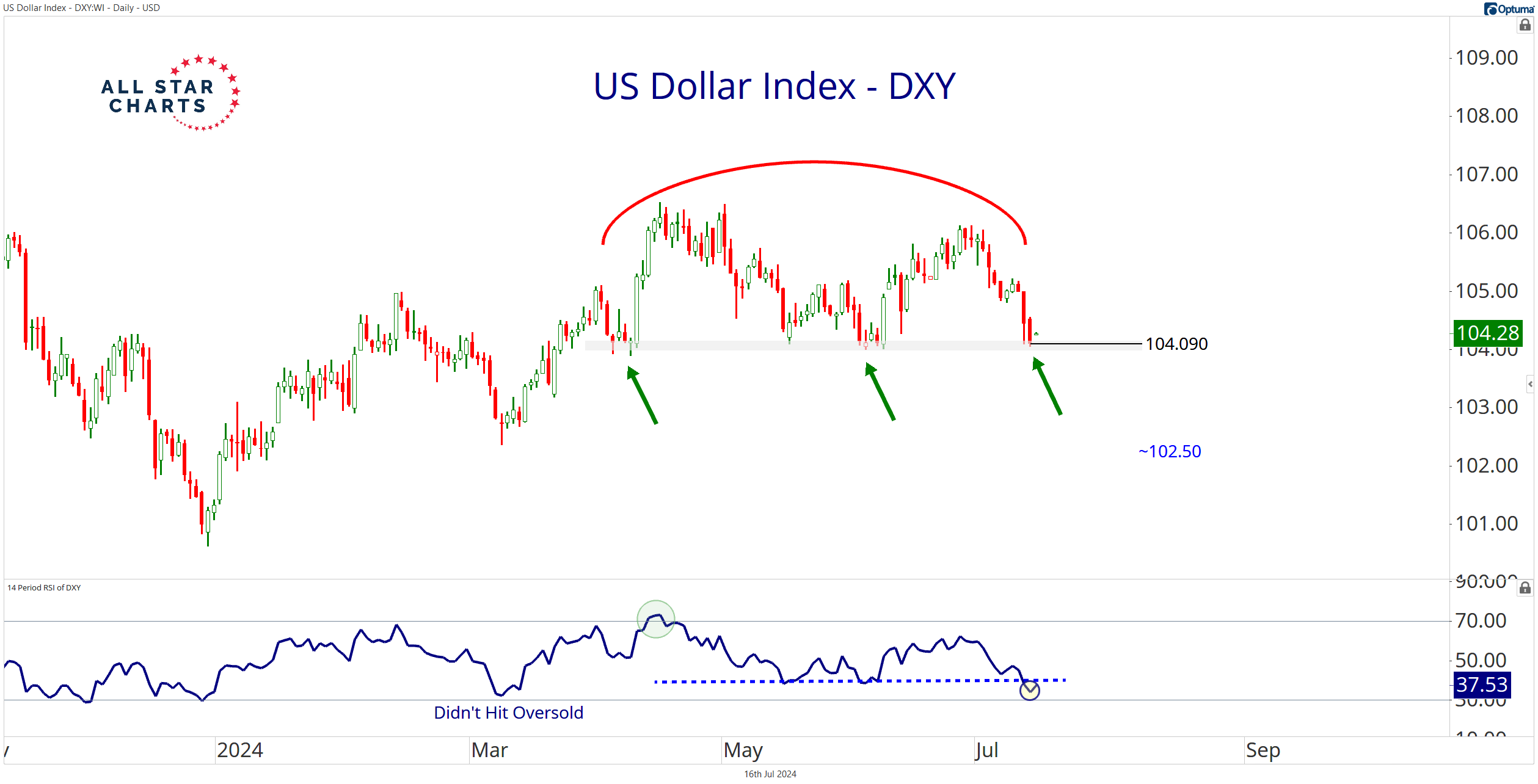

Keep an eye on the 104.10 level for the US Dollar Index:

The path of least resistance leads lower toward 102.50 on a daily close below the springtime pivot lows. A decisive DXY breakdown to fresh multi-month lows flashes a sell signal and gives bull market stragglers the green light.

Perhaps a weaker dollar isn’t necessary for the US stock rally, at least for now.

Nevertheless, today’s equity market headwinds will flip into tomorrow’s tailwinds once the dollar rolls over.

Of course, we need to see it first.

Markets are irrational. Don’t argue with the charts. Embrace the trend and trade what’s in front of you.

Remember, we play this game to make money – not to feed our egos.

Are you fighting the stock market rally?

–Ian

Thanks for reading.

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment