From the Desk of Alfonso Depablos @Alfcharts

The negative correlation between equities and the dollar remains intact, representing a fundamental piece of the current intermarket puzzle.

When the dollar strengthens, stocks tend to fall under selling pressure. On the flip side, stocks often enjoy strong bull runs when the dollar trends lower.

That’s been the case for some time now.

When we zoom in on this relationship, it becomes clear as day why the dollar should be on the mind of every stock market investor right now.

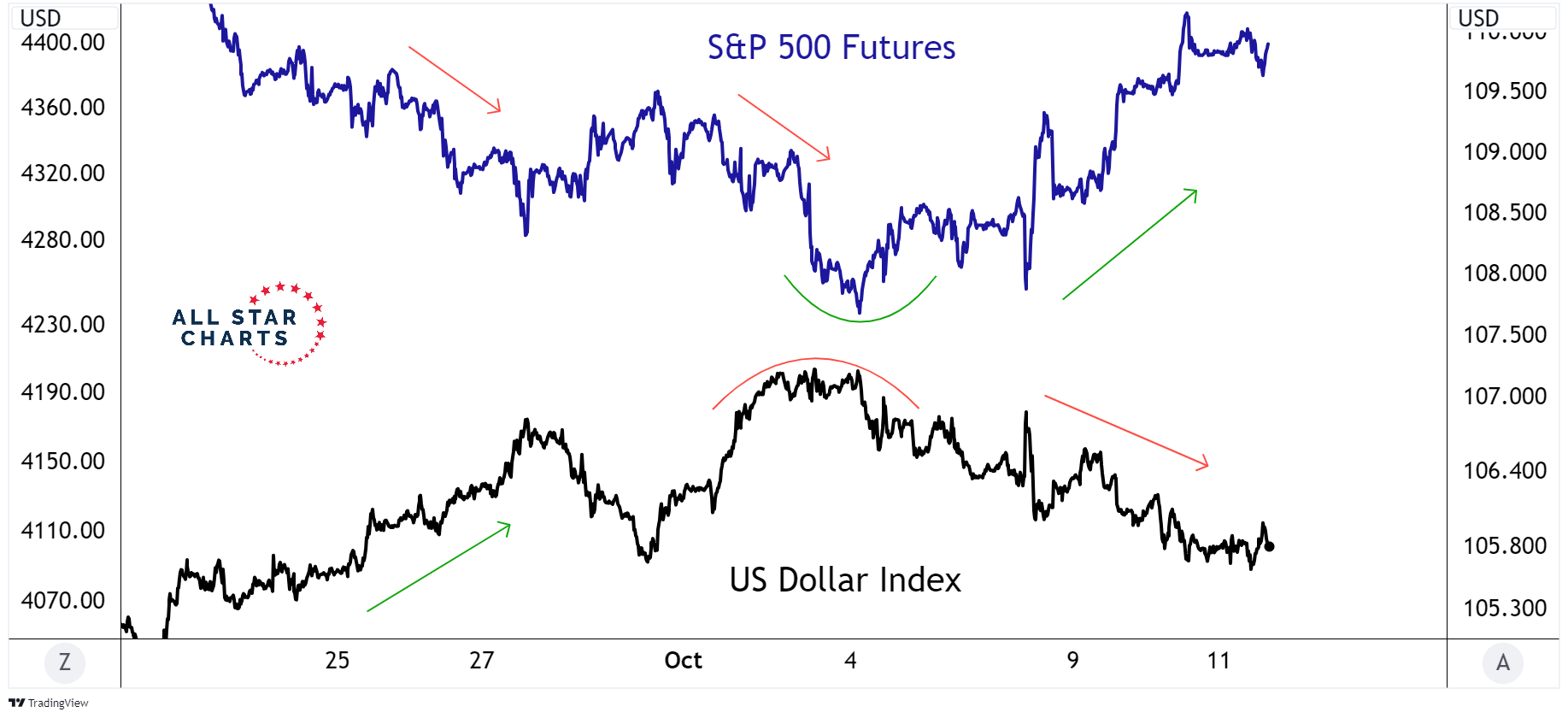

Below is a 15-minute chart of the S&P 500 Futures and the US Dollar Index over the last week.

Last Friday, DXY peaked and started to roll over, buoying stocks and the major averages such as the S&P.

Regardless of the timeframe, the catalyst for stocks to do well is a weaker US dollar. It’s really that simple.

We’re looking at the 105.50 level in DXY. We’re just about there now.

A break below these Q1 highs, and stocks are likely to experience a big leg higher into the end of the year. That’s the dollar playbook these days.

As always, we love to hear from you, so shoot us a note and let us know what you think.

Alfonso

Be the first to comment