From the Desk of Steve Strazza @sstrazza

Have you heard about the breakout in America’s online marketplace?

Amazon is up 5% this week as it follows other mega-cap growth stocks to new record highs. Everyone is talking about it.

But there’s more to this story.

Online retail is a burgeoning industry, offering investment opportunities in a variety of companies around the world.

These growth stocks provide some of the highest beta vehicles as they are direct plays on the consumer economy.

And Amazon doesn’t dominate around the globe the way they do in America. There are other regional plays that offer investors exposure to higher growth markets outside the US.

With Amazon $AMZN making a decisive resolution to fresh all-time highs today, it is an opportune time to talk about the broader online retail space.

Let’s dive in!

Following the path of other Magnificent Seven names, here’s Amazon.com $AMZN surging to new all-time highs:

After spending much of this year absorbing overhead supply at its old highs, AMZN is making a decisive resolution out of this mult-year consolidation.

The path of least resistance is higher for this stock and we want to own it above 188, with a target of 255 over the coming 3-6 months.

But this post isn’t about Amazon.

While the whole world is talking about this textbook pattern breakout, we are finding better opportunities elsewhere.

The entire online retail space is waking up.

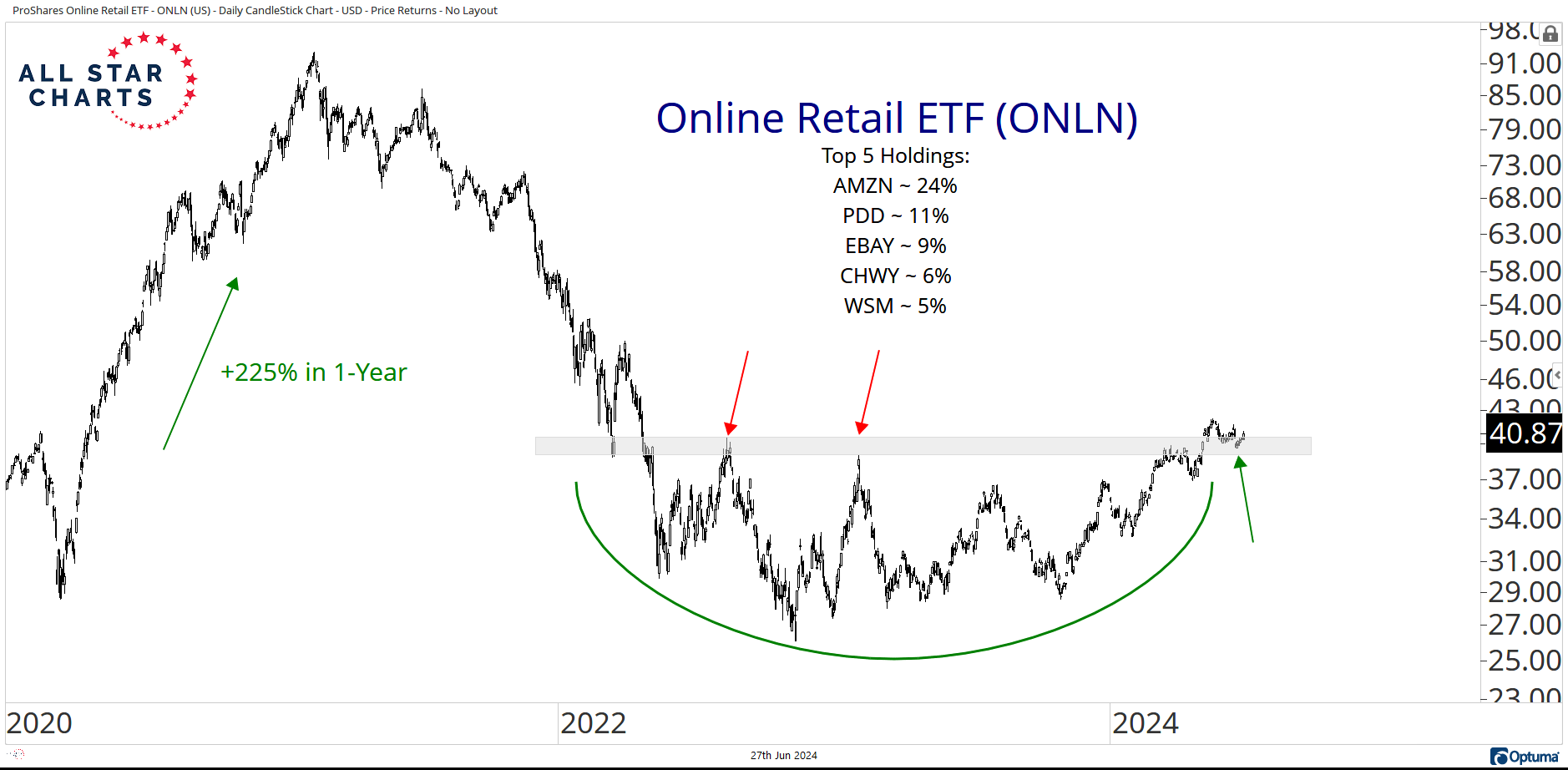

Just look at the ProShares Online Retail ETF $ONLN:

As long as this base breakout remains intact, the primary trend is pointing higher for Amazon and friends.

In the prior cycle, ONLN rallied over 230% in 12 months and produced some of the best returns of the 2020-21 bull market.

However, the Online Retail ETF is made up of nearly 25% AMZN. Is this big cap leader doing most of the heavy lifting?

The answer is no.

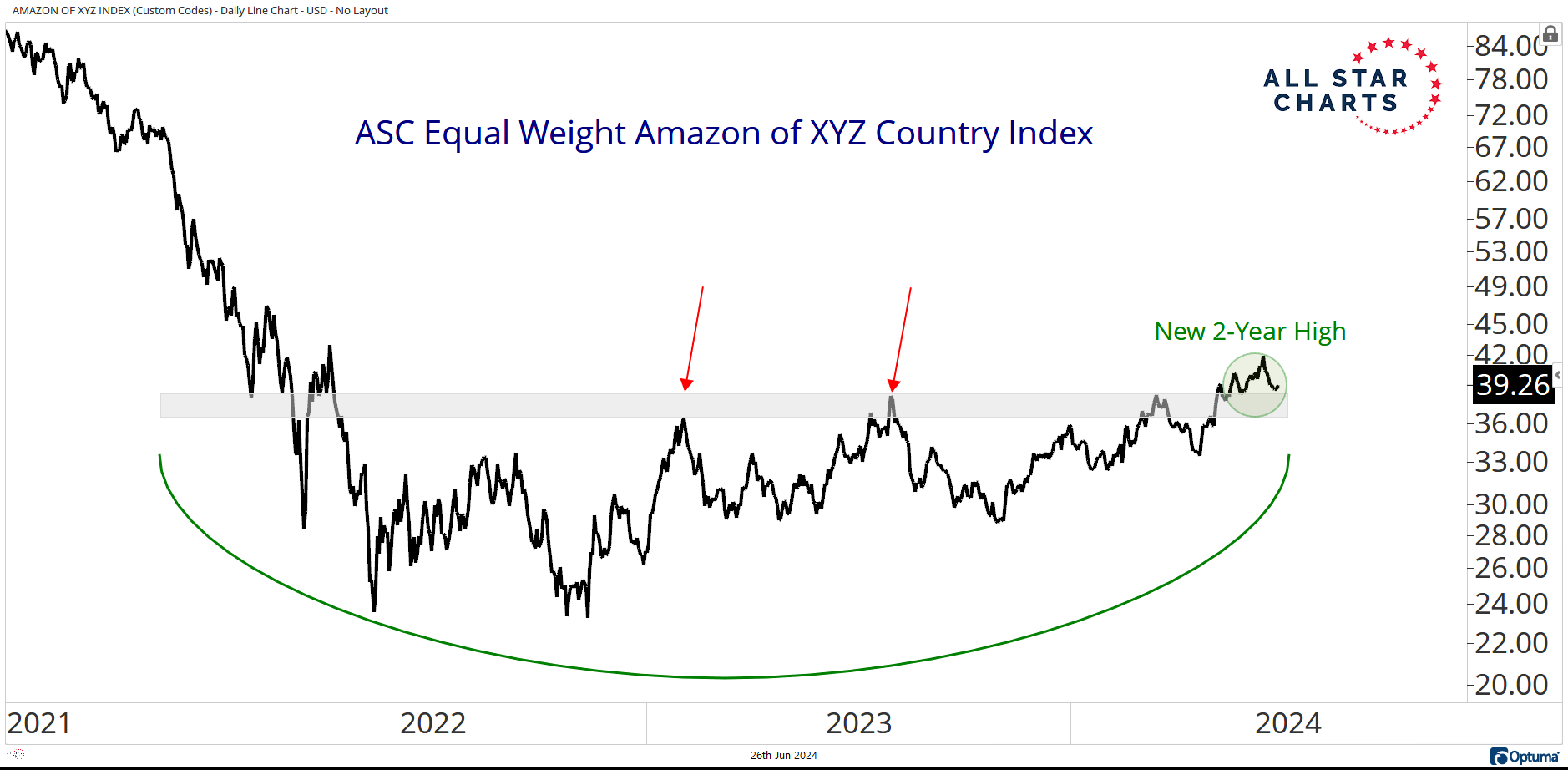

We like to look at this industry group on an equal weight basis, using our Amazon of XYZ Country Index:

We hand-selected 13 of the largest and most-dominant online retail platforms from all over the world.

The idea here isn’t to have representation from all the largest online retailers in the US, but to give a balanced representation of the global digital consumer economy.

For this reason, we equal-weighted the index and only included one USA-based stock… Amazon, of course.

Just like ONLN, our custom index suggests a new bull market for this basket of stocks.

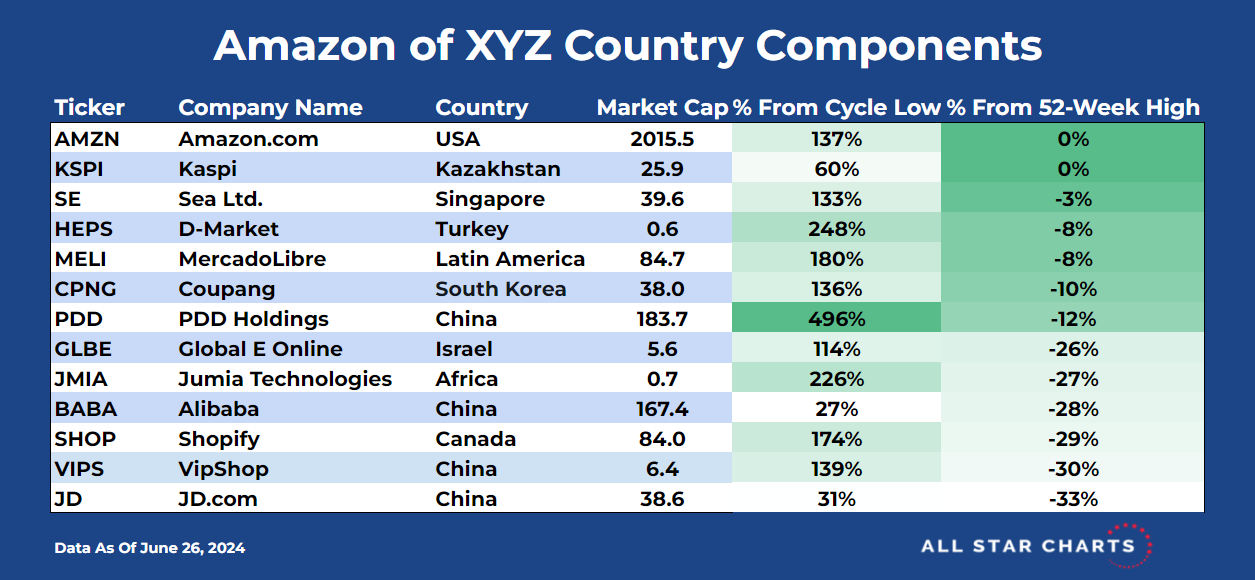

Here are all of the index components sorted by distance to new highs:

*Click to enlarge view

As you can see, these stocks have already experienced some monster gains off their bear market lows.

China’s PDD Holdings $PDD, owner of Temu.com, has rallied nearly 500%, and the Turkish HEPS has rallied nearly 250%.

With many of these stocks recently completing bearish-to-bullish trend reversals, we think this party is just getting started.

Let’s talk about how we’re going to make money off this new leadership theme.

Premium Members can log in to access the Trade Ideas for our favorite internet retail names. Please log in or start your risk-free 30-day trial today.

Be the first to comment