Aren’t we supposed to get a rally into the end of the year?

That’s what the seasonal trends throughout history would suggest.

I mean, we got the seasonal strength earlier this year, as the Nasdaq put up the greatest first half to the year ever.

And then the typical Q3 Pre-election year weakness came, which could not have been more normal.

Now this is about the time where stocks get going into year end.

“Buy in October and get yourself sober”, is how I learned it from the Annual Almanac.

And what’s interesting is how this seasonal weakness has been such a surprise to so many.

It definitely reset a lot of that optimism we saw into the summer. Remember all those permabears throwing in the towel and apologizing for getting it so wrong? That happened right before the market peaked in July.

Classic.

But now the question becomes, when does the year end rally begin? And do we even get one?

As we’ve discussed plenty around here, it’s going to be hard for the S&P500 to make new highs without the most important groups breaking out too.

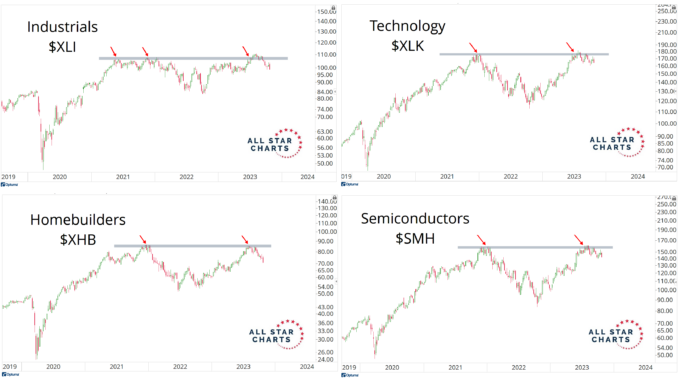

Here’s what they look like all stuck below former resistance from the peak of the last cycle:

Without the majority of these groups getting going to the upside, I think the indexes are going to continue to have a hard time advancing.

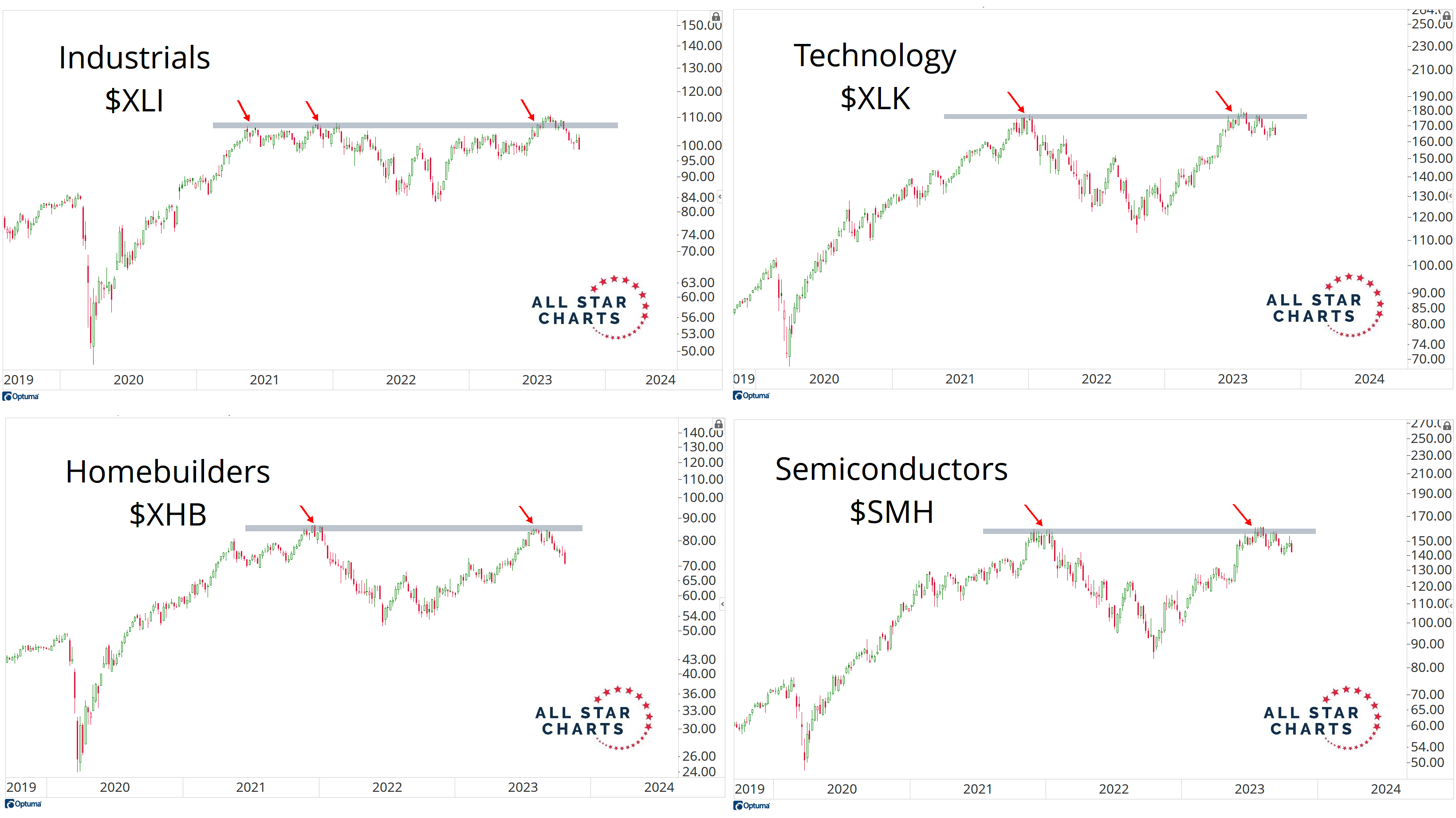

Here’s how each sector performed from the S&P500 bottom last October:

A lot of investors have been very upset that they missed out on those historic returns because they were distracted by headlines that have nothing to do with the prices of these assets.

Things like the Fed, inflation, wars and viruses didn’t matter at all. Or better said, those things didn’t matter any where near as much as what the market was more focused on.

Look at those sector returns. Some people looked at that and called it a bear market.

Odd.

The internals of the market bottomed out in Q2 last year, so by the time I was telling Maria Bartiromo in October last year that we were in a bull market, a majority of stocks were already working their way higher.

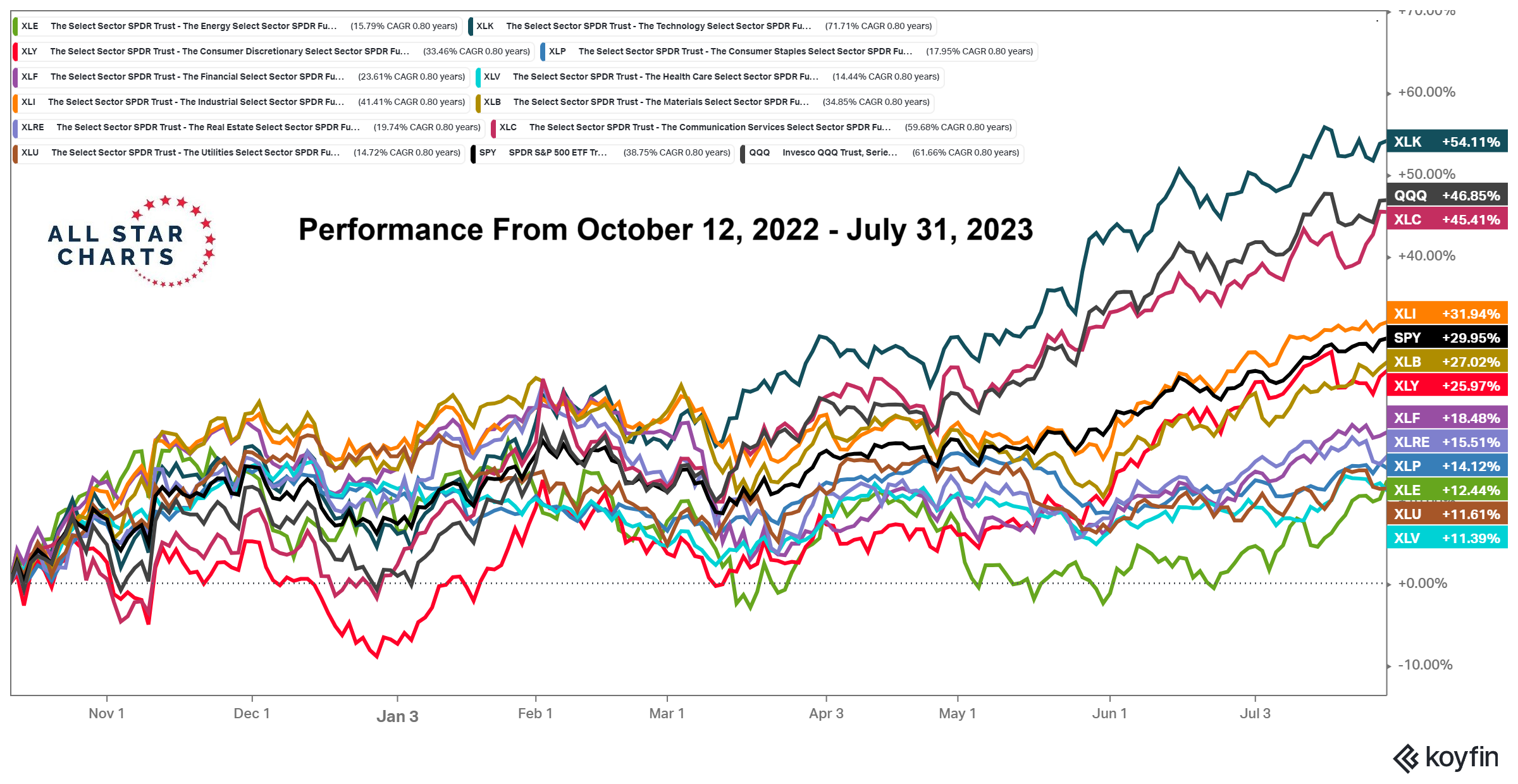

But after a record start to the year, a correction was well deserved. And here’s what we’ve seen since the S&P500 peaked at the end of July:

The S&P500 and Nasdaq are both down over 7% during this seasonally weak period.

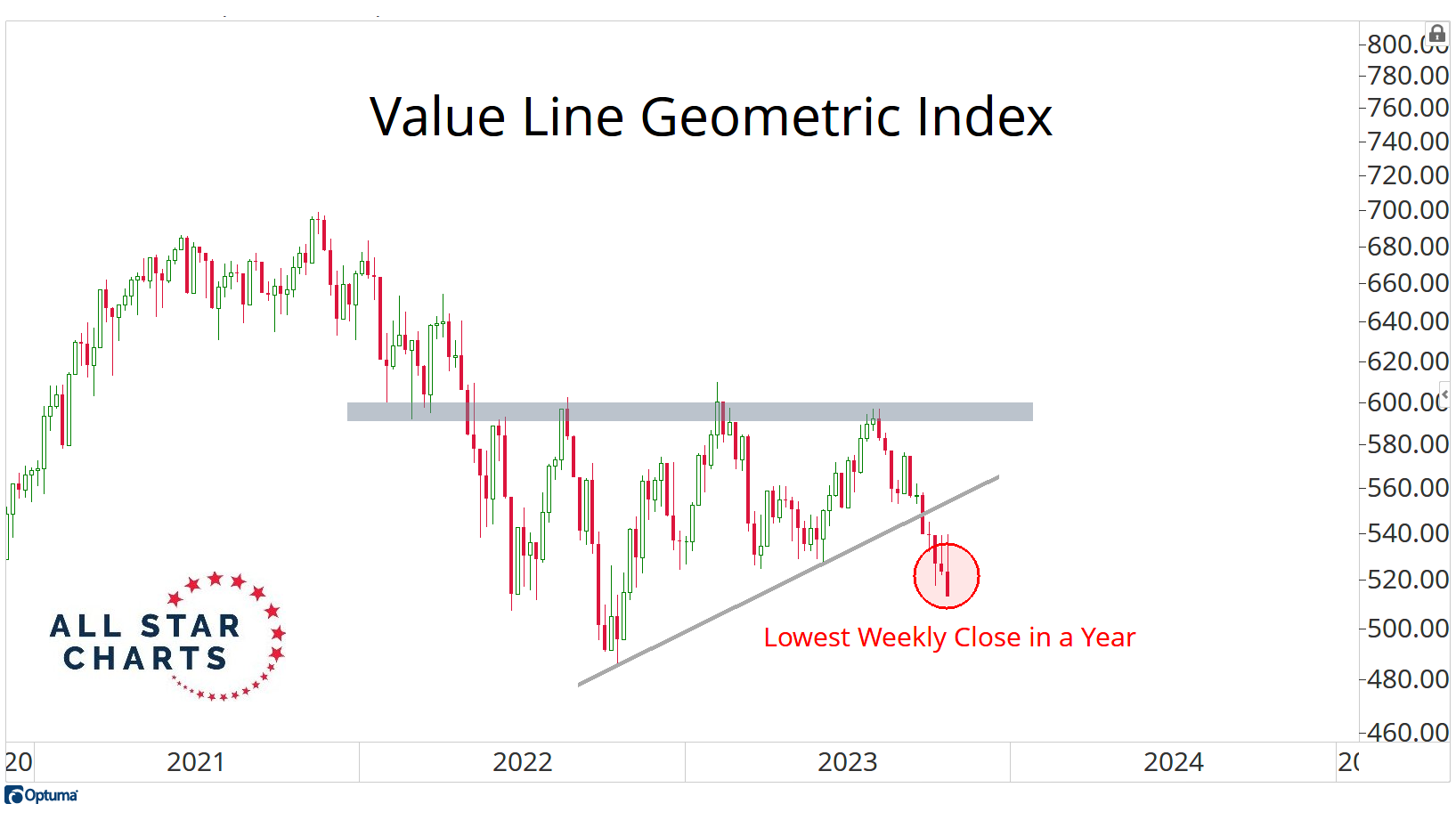

The median stock, using the Value Line Geometric Index, is hitting the lowest levels in a year:

We like buying strength around here, and the median stock is definitely not that.

The only way to make sure you own the strongest stocks is to buy the strongest stocks.

So that’s where my head is at.

We discussed it all on this week’s LIVE Conference Call.

There are plenty of opportunities right now in individual stocks. Remember there are hundreds of them working very well this year, just in the S&P500 alone.

That whole S&P493 stuff is just a cry for help from people who are bad at math, or lazy, or both.

We’re sticking with the winners and looking for some areas ripe for rotation.

Check out the video in full here and download all the slides.

Let me know what you think!

JC

Be the first to comment