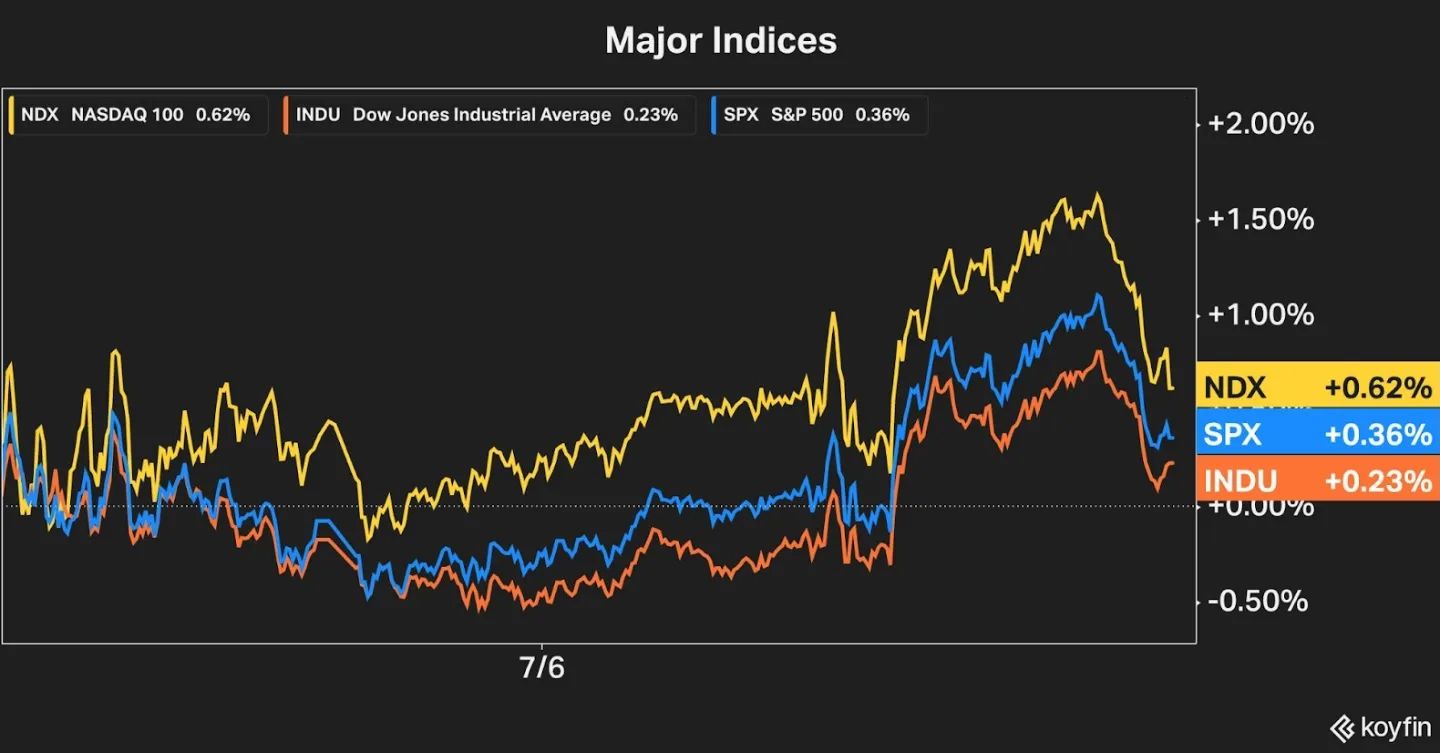

1) In today’s Fed Minutes, officials confirmed their hawkish stance and said they “recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.” Stocks finished up

$INDU: +0.2%

$SPX: +0.4%

$NDX: +0.6%

2) In fx, the EURUSD broke to 20-year lows below a major support level dating back to 1989. This move came as recession risks grow in the European region and the ECB is less hawkish than the Fed.

3) Crude oil has been one of the biggest laggards, trading below $100 and approaching the level seen on February 24th prior to Russia invading Ukraine.

4-6) Within Energy, some of the most bearish charts are in E&P including $FANG, $EOG, and $PXD.

7) JOLTs Job Openings came in at 11.3m in May, down slightly from 11.7 million in April. Meanwhile unemployment rates remain near 10-year lows.The labor market is yet to deteriorate, even though job openings most likely peaked in April.

#koyfin #investment #investing #stocks #etfs #markets #finance #energy #charts #invest

Be the first to comment