The stock market is messy, not trending higher, and frustrating many investors who haven’t studied their market history.

This type of market environment, this time of the year, is EXACTLY what we should expect as investors.

If the market was NOT acting this way, then that would be weird.

Sometimes the market ignores seasonal trends. And that tends to be an important signal.

But, to be clear, this is definitely NOT one of those times.

The market is doing exactly what it should be doing.

Over half the stocks on the NYSE are below their 200 day moving average. Same with the S&P500.

Here’s what the index itself looks like near the lower end of this multi-month range:

This has been a great environment for selling premium, and we’ve been doing a lot of that over the past couple months.

But when you take a step back and look at the structure of the market, the major indexes are still rangebound, at best.

Underneath the surface, here are a few areas worth watching. All 3 of these found support over the past year right at those former highs in 2018 and 2020.

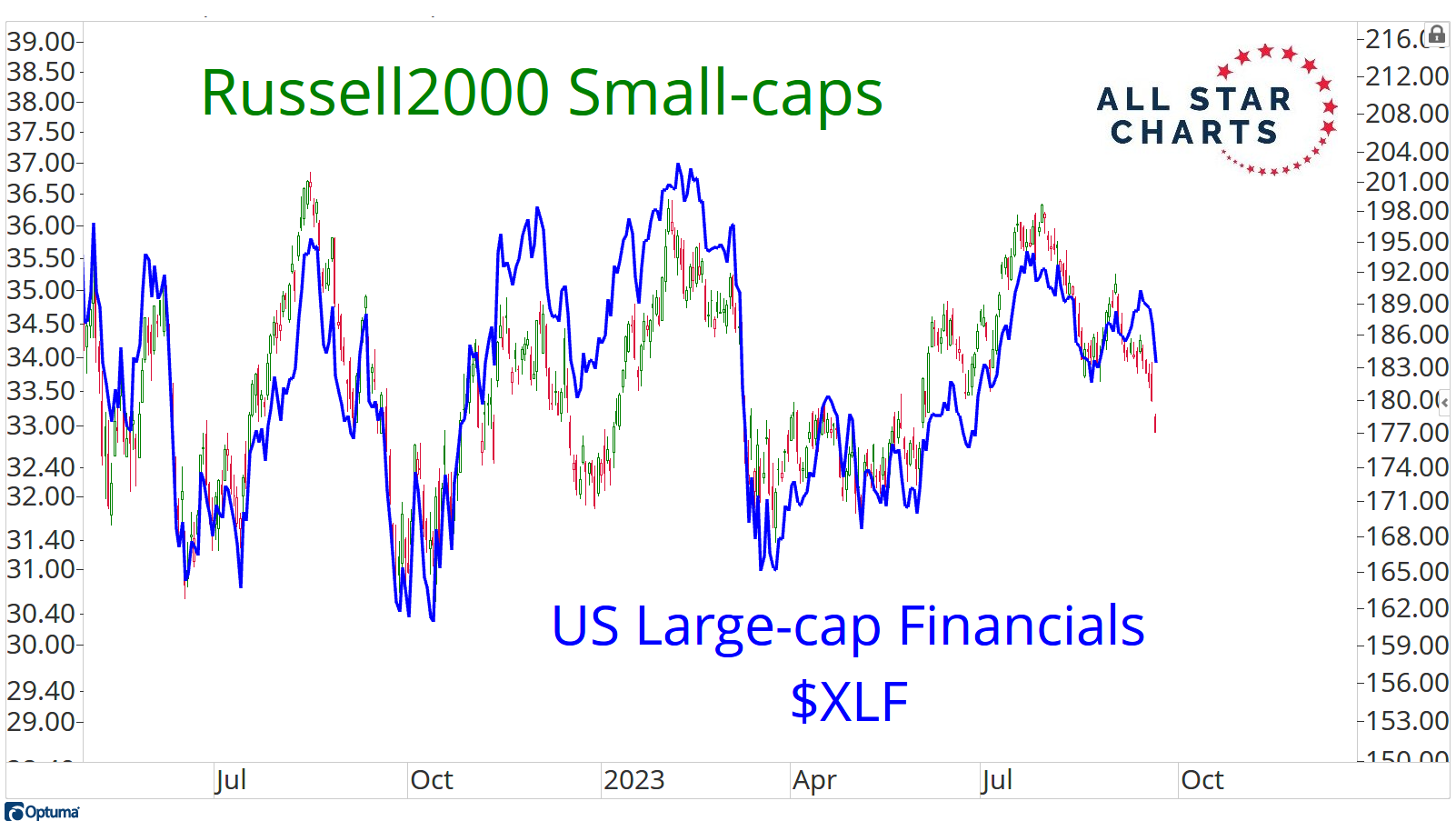

We’re looking at the Russell2000 Small-cap Index up top, Large-cap Financials in the middle, and Industrials at the bottom.

Industrials have held up the best, most definitely.

But it’s the 2 up top that we want to keep a close eye on.

If Financials and Small-caps lose last summer’s lows, that would likely be a major problem for the overall health of the market.

Look how closely these two have been trading together:

For now, the overall market is doing exactly what we should expect it to do.

That could remain the case through the end of this weak period and then we rip into the end of the year.

Or, things get much worse and we do NOT see that year end ripper.

I think any future breakdowns in Small-caps and Financials could be a heads up of further deterioration in the market.

So these two will be front and center.

We went over everything on this week’s LIVE Conference Call.

Premium Members make sure to check out the full replay and download the slides.

Feel free to reach out with any questions.

JC

Be the first to comment