From the Desk of Ian Culley @IanCulley

Last month’s bond rally has legs.

Long-duration bonds have gone from printing multi-month highs to reclaiming their March pivot lows in just a few weeks.

So, let’s revisit our recent swing trades as they continue to run…

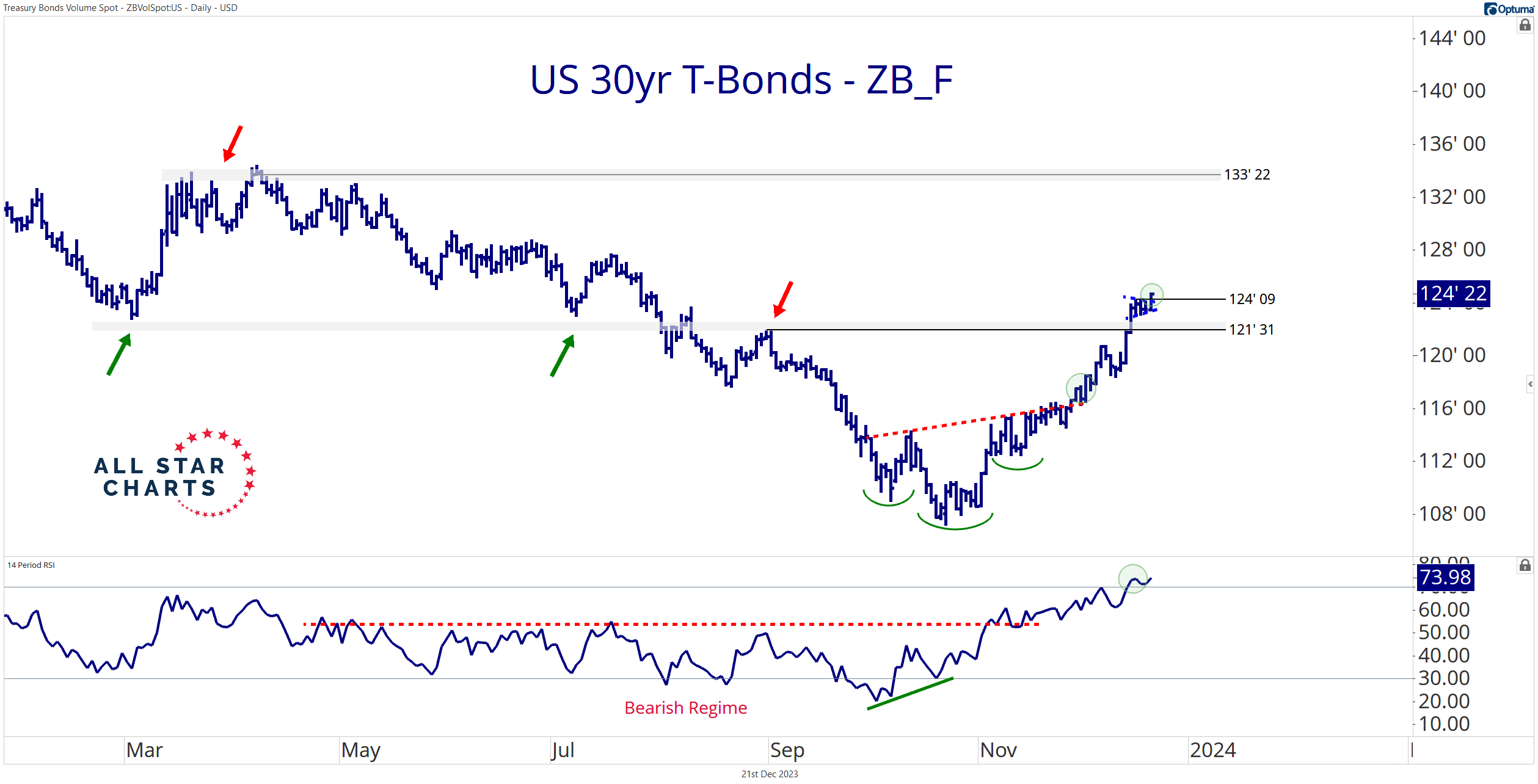

Thirty-year T-bond futures sliced through our initial target of 122:

Luckily, a completed bull flag provides a precise level to define our risk.

We can take another long position in T-bond futures, targeting 134, but only if it holds above 124’09.

Here’s a look through the equities market…

The long-duration bond ETF $TLT is on the verge of reclaiming a critical shelf of former lows:

Let’s call our line in the sand 100.

A decisive break above that psychological level likely sends price to that hundred-dollar roll of 110. That’s our target.

If trading the futures markets isn’t for you, or catching a 10 percent gain in TLT doesn’t make sense, I get it.

There are better trades on the sheet.

But don’t take your eyes off the bond market.

Those “better trades” will continue to work if TLT is trending above 100 as the positive correlation between stocks and bonds remains in place.

Stay tuned.

Countdown to FOMC

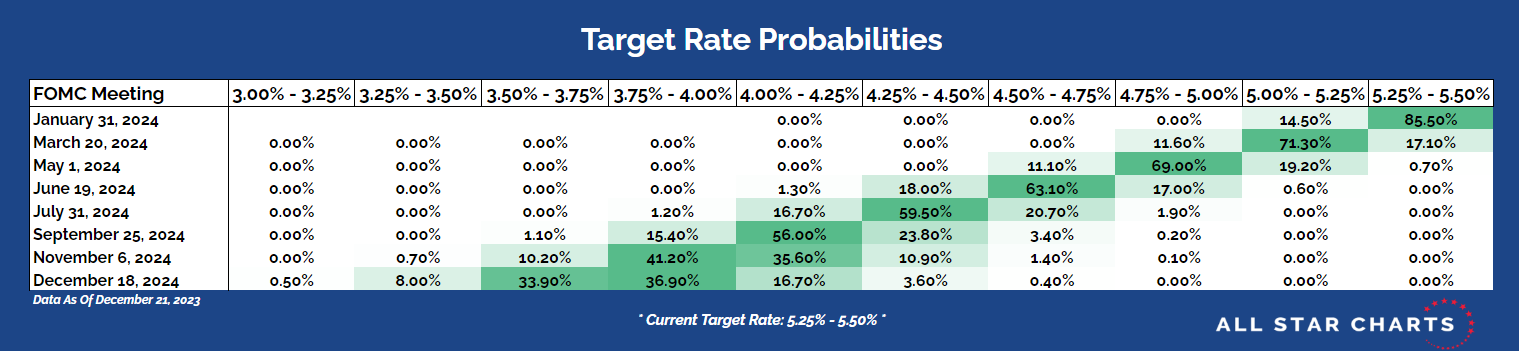

The market is pricing in a pause in the hiking cycle until March 2024 and two cuts before next summer.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of December 13, 2023.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment