From the Desk of Ian Culley @IanCulley

The most important chart in the world is back in action!

A rising US Dollar is producing increased selling pressure for risk assets and global currencies.

US treasury bonds, stock indexes, and even commodities are catching lower.

Yet it’s nothing new for the top components of the US Dollar index $DXY (euro – 57.6%, yen – 13.6%, pound – 11.9%). New lows and broken support have become standard for these currencies.

But King Dollar’s command is spreading to the more resilient pockets of the FX market as fresh breakouts mount.

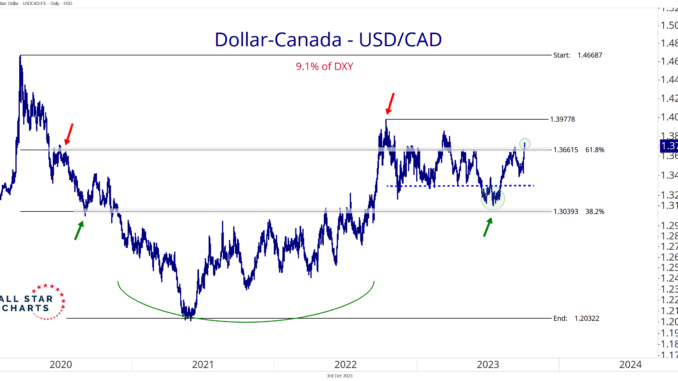

Here’s the US dollar-Canada pair breaking above a key retracement level to six-month highs following a litany of missed attempts:

The failed breakdown during the summer found support at another critical retracement level at approximately 1.3050 (USD/CAD bottomed the same day as DXY in mid-July).

I prefer when price respects multiple retracement levels rather than just a single point. It adds to my conviction in the analysis and the levels I want to trade against.

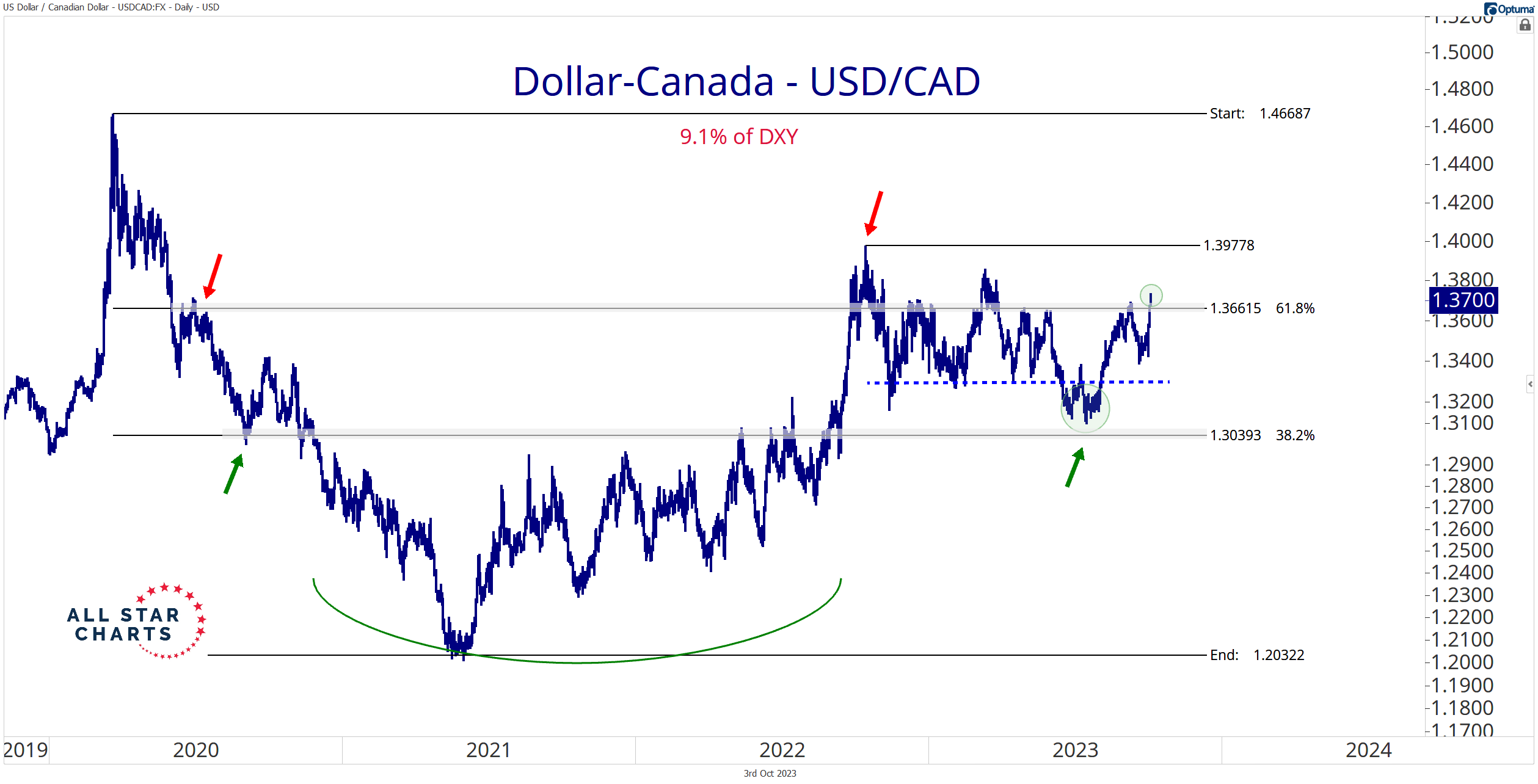

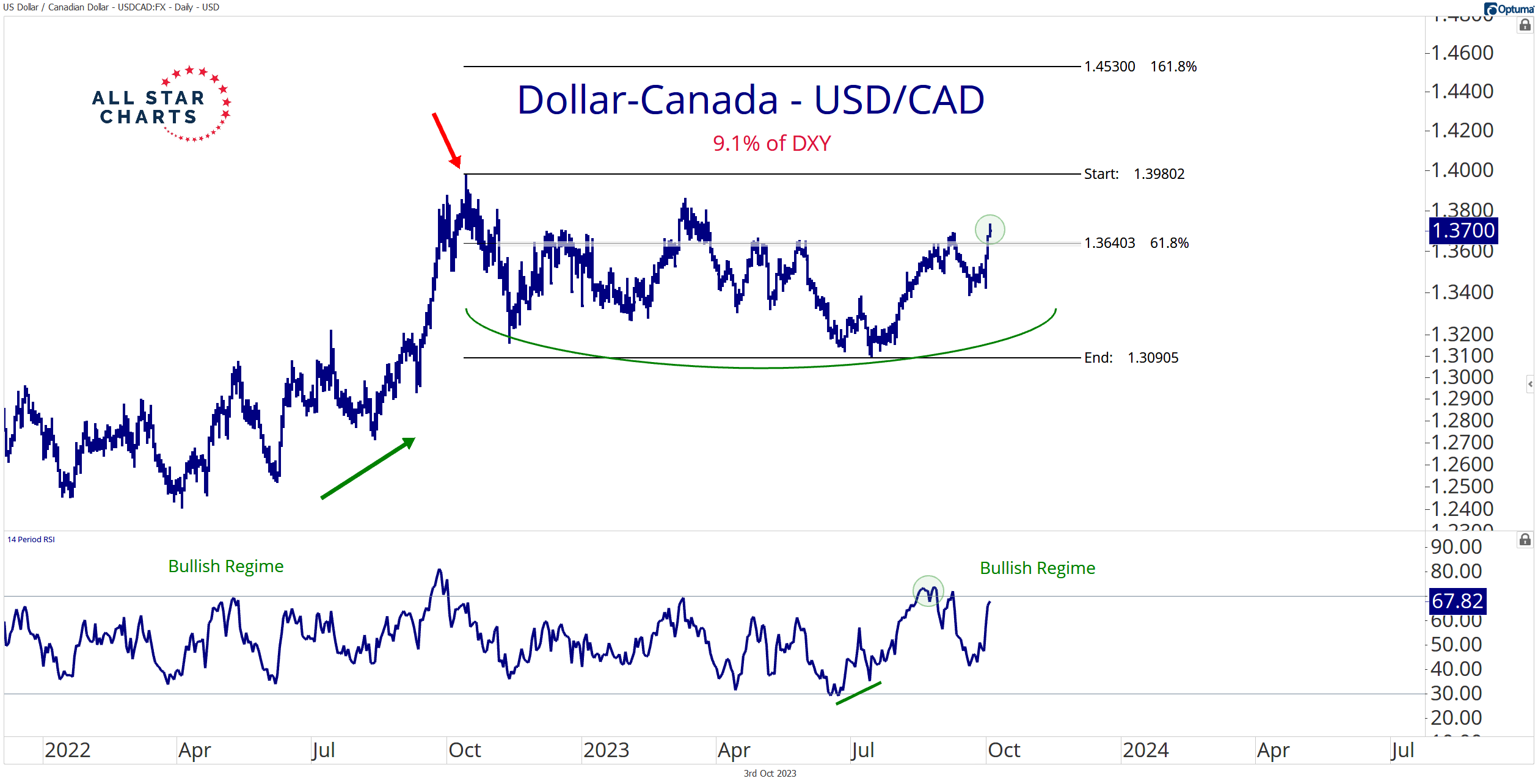

The 1.3640 level marks the spot:

If the USD/CAD is above that crucial level, the path of least resistance leads toward last October’s high at approximately 1.3975.

That’s all the information we need for a simple trade idea…

I like buying the USD/CAD as long as it trades above our risk level, targeting the 2022 high.

King Dollar has made his move. And now markets are reacting.

One more thing…

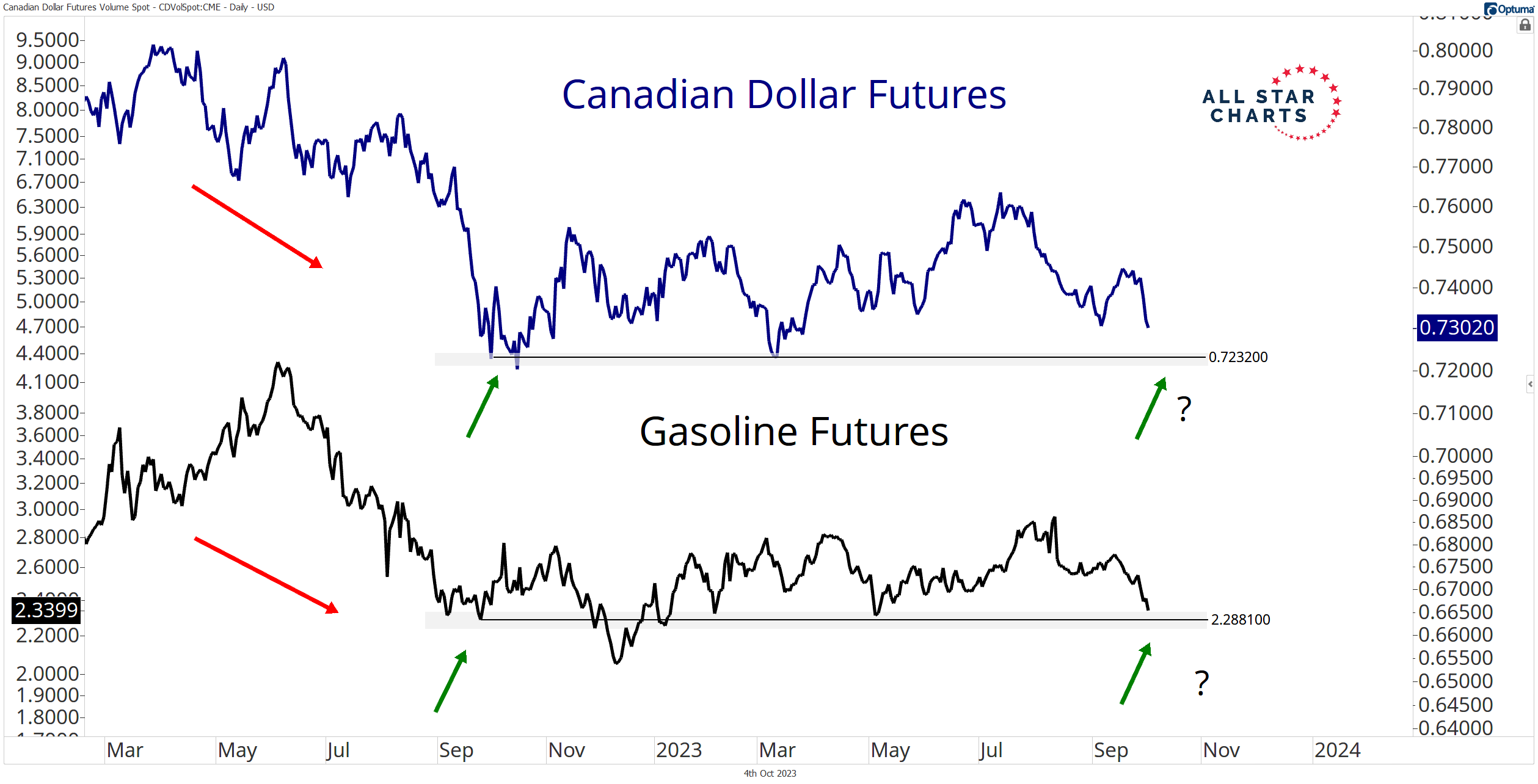

Check out this chart Steve dropped on my desk this afternoon.

The Canadian dollar overlaid with gasoline futures:

They look incredibly similar. And it makes sense, given the Canadian economy’s reliance on crude oil and other natural resources.

If gasoline futures are breaking down, I imagine the Canadian dollar is also falling (and vice versa). These charts will likely resolve in the same direction.

I highlighted gasoline and a contracting crack spread, explaining what it means for crude oil and energy more broadly in today’s What the FICC? episode.

Spoiler: It’s not bullish.

But energy has been on a tear. Much of the space warrants a corrective period.

The dollar is picking off other currencies – one by one – as the Canadian dollar represents the most recent casualty.

Plus, it’s an excellent trading opportunity!

Stay tuned.

Thanks for reading.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Click here for our Weekly Currency Report.

Allstarcharts Team

[/show_to

Be the first to comment