From the Desk of Ian Culley @IanCulley

Two of our energy trades from July recently hit new all-time highs. Heating oil also broke out Friday following crude’s buy signal that triggered in January.

The market is beginning to reward investors for rotating into oil and gas.

With that in mind, let’s track the next emerging breakout in the energy space.

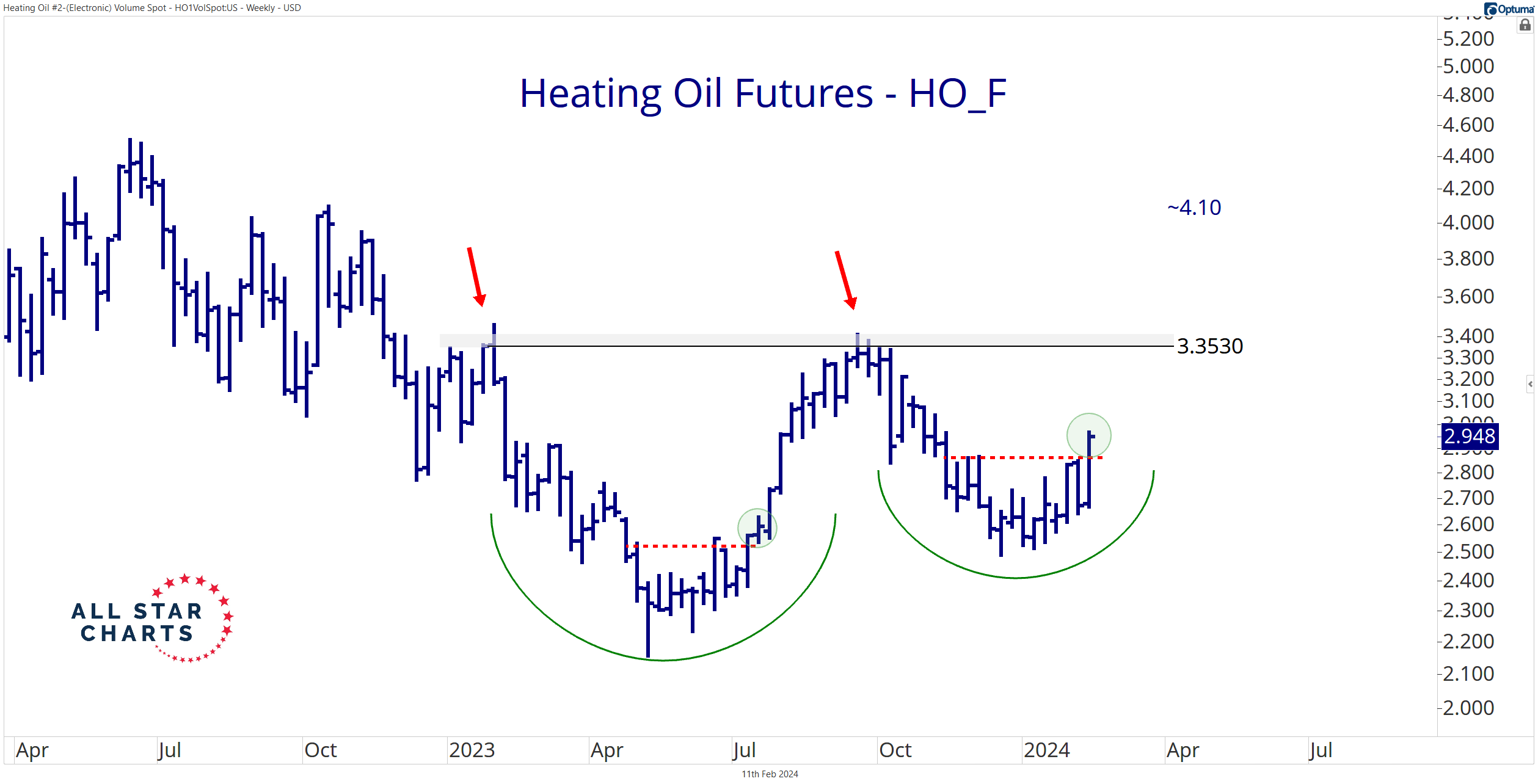

First, heating oil futures are carving out a base just above their former 2018 highs:

Energy markets – including heating oil and gasoline – are likely in the early stages of a significant bullish reversal.

A weekly close above 3.353 (the Jan. ‘23 closing high) sparks a new structural uptrend for heating oil with a target of 4.10.

Despite the distance from last year’s highs, we can start building a long position based on Friday’s strength.

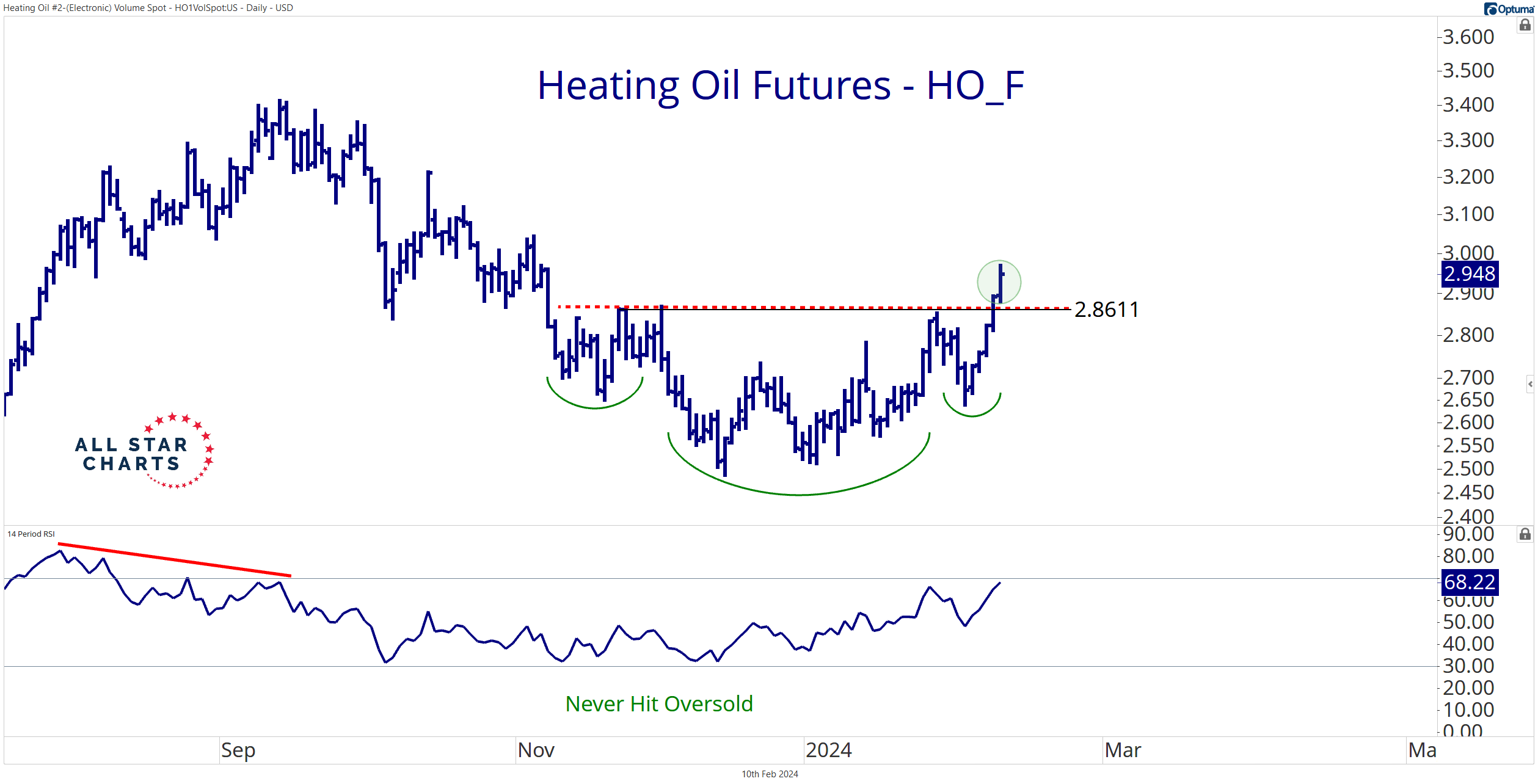

Last week, buyers drove price through the neckline of a four-week inverted head and shoulder pattern:

The Nov. 21st close of 2.861 defines our risk.

It’s not ideal to enter a long position since price is trading well above the breakout level.

Nevertheless, I want to take a small position, anticipating a more significant upside resolution in the coming weeks and months.

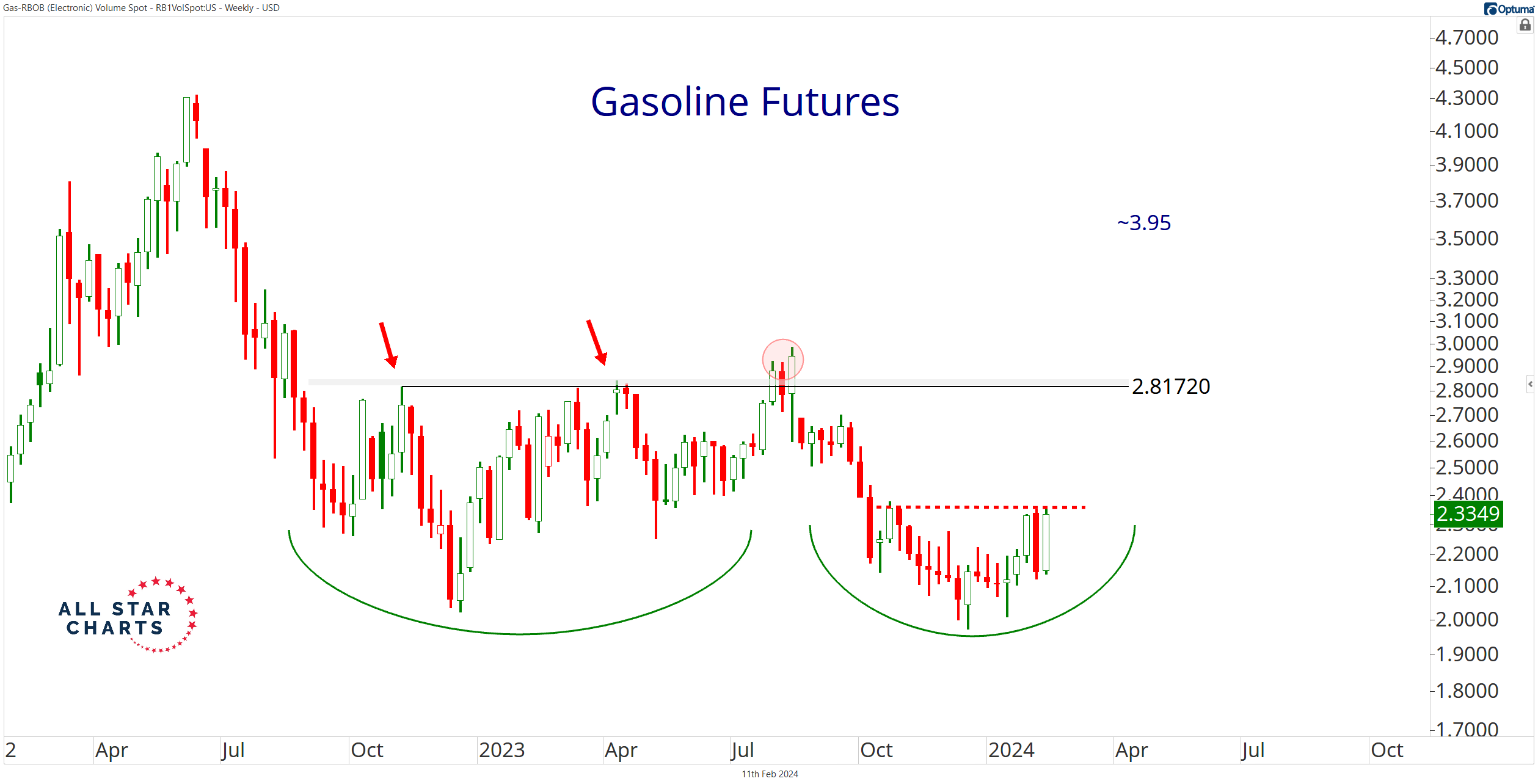

If that’s out of your comfort zone, gasoline offers an alternative.

Gasoline futures are forming a multi-year base (a potential double bottom) below the Nov. ‘22 peak of 2.8172:

That’s our structural breakout level. A decisive weekly close above the Nov. ‘22 high registers a buy signal with a target of 3.95.

But like heating oil, gasoline trades well below its respective highs.

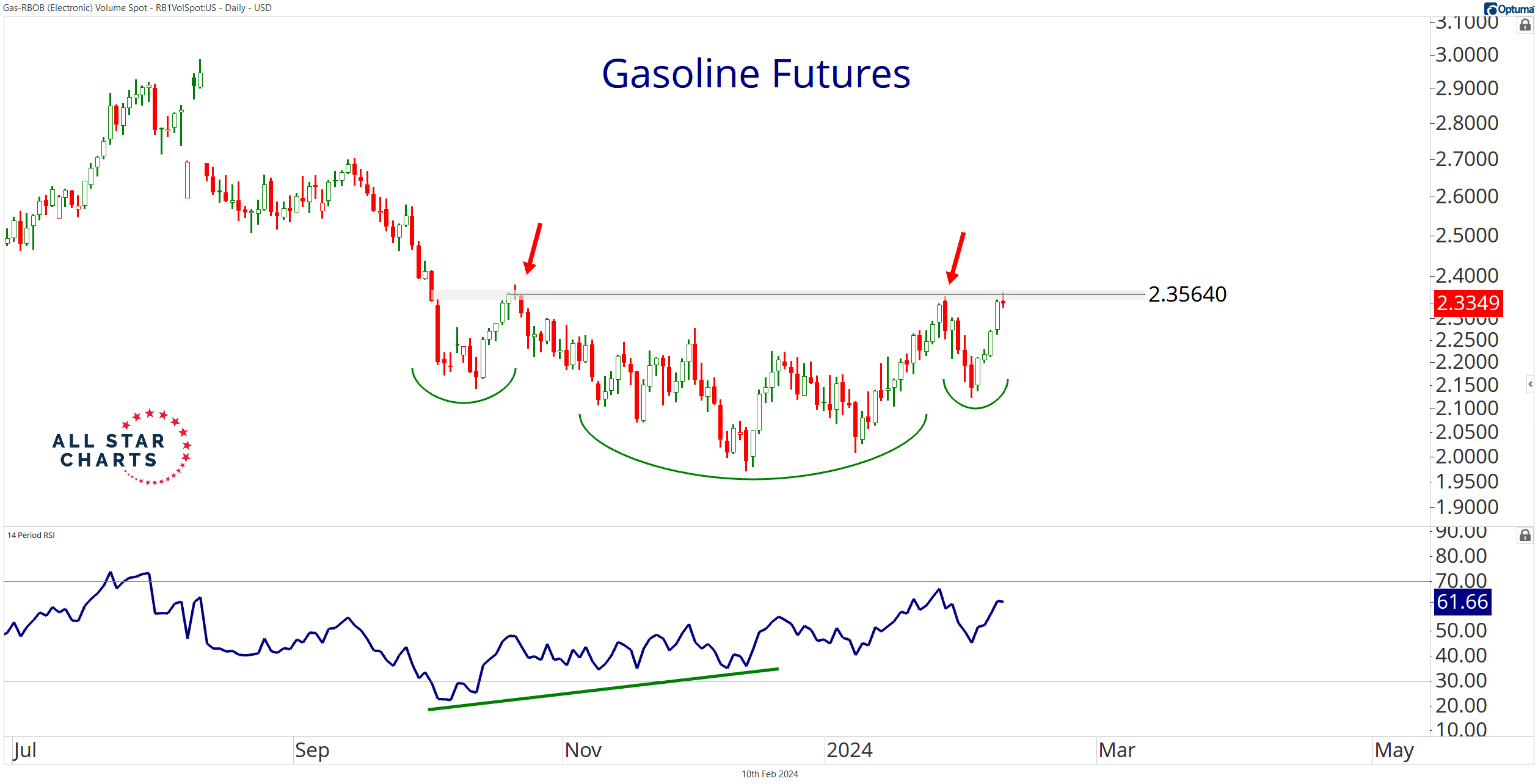

Not to worry, a potential inverted head and shoulder pattern is forming on the daily chart:

The daily gasoline chart looks quite similar to heating oil with one crucial difference: It hasn’t broken out yet.

A shelf of pivot highs marks our breakout level at approximately 2.3564.

I like building an initial position on strength above those former highs – but without setting a tactical target. It’s all about managing risk and letting profits run.

Energy markets are entering a seasonally favorable period. The intermarket landscape (rising yields and a strong dollar) supports a bullish bias. And energy contracts and their related equities are flashing buy signals.

It’s time to rotate into energy.

Are you ready?

-Ian

Be the first to comment