From the Desk of Ian Culley @IanCulley

Naming a newborn is tough.

Who is this tiny person? And who will they aspire to be?

These are impossible questions to answer.

As you can imagine, the wifey and I were stumped upon meeting our baby girl earlier this week.

Every time I looked into her eyes, I could hear her plead, “Give me a name, boy!” A situation ten-year-old Ian never fathomed – even while watching The NeverEnding Story.

After a few days of deliberation, hours of snuggles, and the casual piercing gaze, I could only discern one thing: she smelled good.

So I offered up “Coco.”

It was on our shortlist. Plus, will we ever forget this year’s epic rally in cocoa futures? I certainly won’t.

Well, we ultimately landed on Cora, which suits her in some indescribable way.

But if I hadn’t cut technology this week so I could focus on my girls, I might have thrown “Cotton” into the ring.

I mean – it’s the “fabric of our lives!”

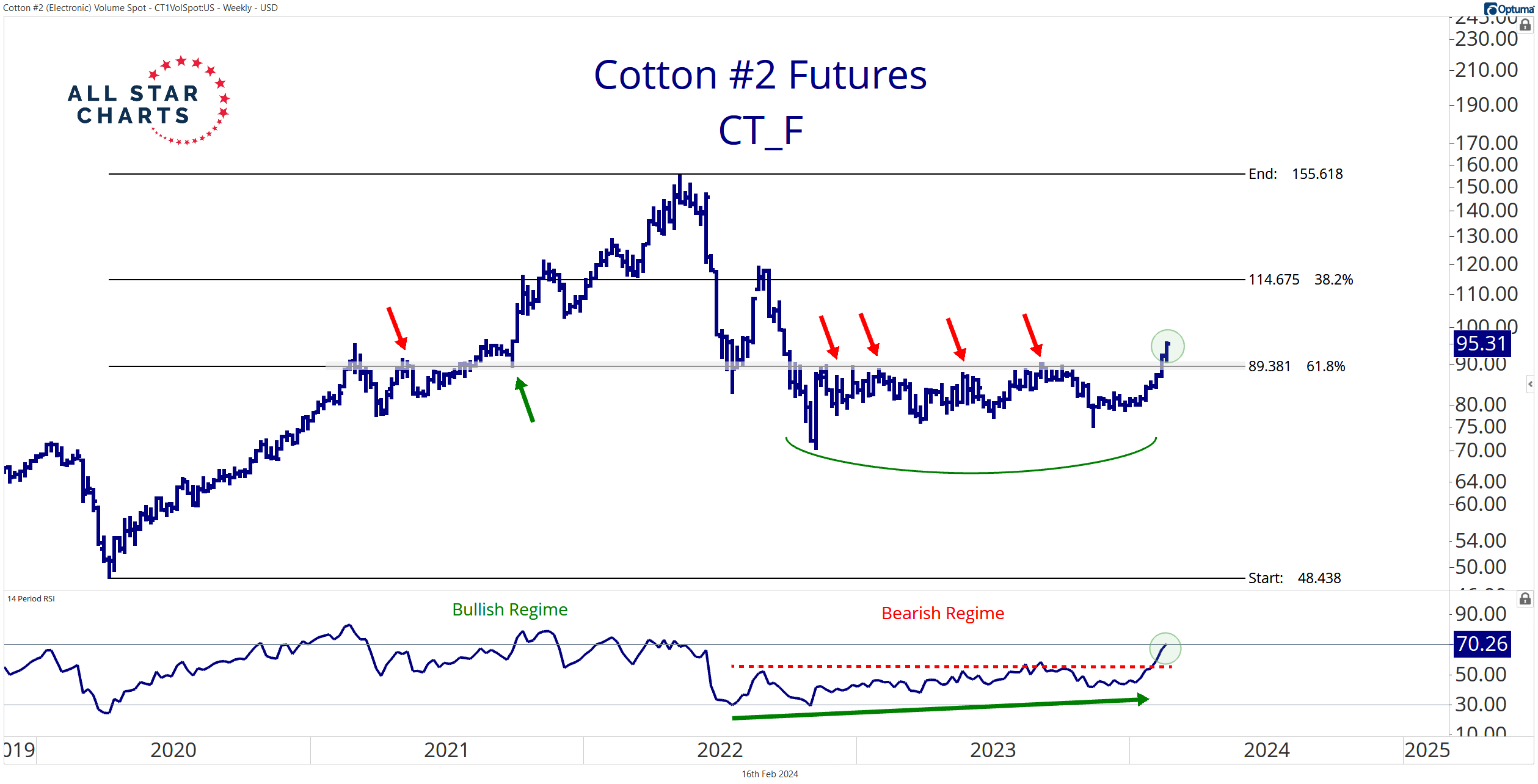

Check out cotton futures completing a sixteen-month bottoming formation:

Cotton was at the top of my list of “must-watch” markets to start the year. I anticipated a breakout. But I never imagined it would come as early as mid-February.

It turns out the breakout above the Dec. pivot high was our entry point last month.

Price has ripped over a thousand ticks since (not too shabby), increasing the difficulty of entering a position at current levels.

If you missed the last month’s buy signal, have no fear, or better yet – FOMO!

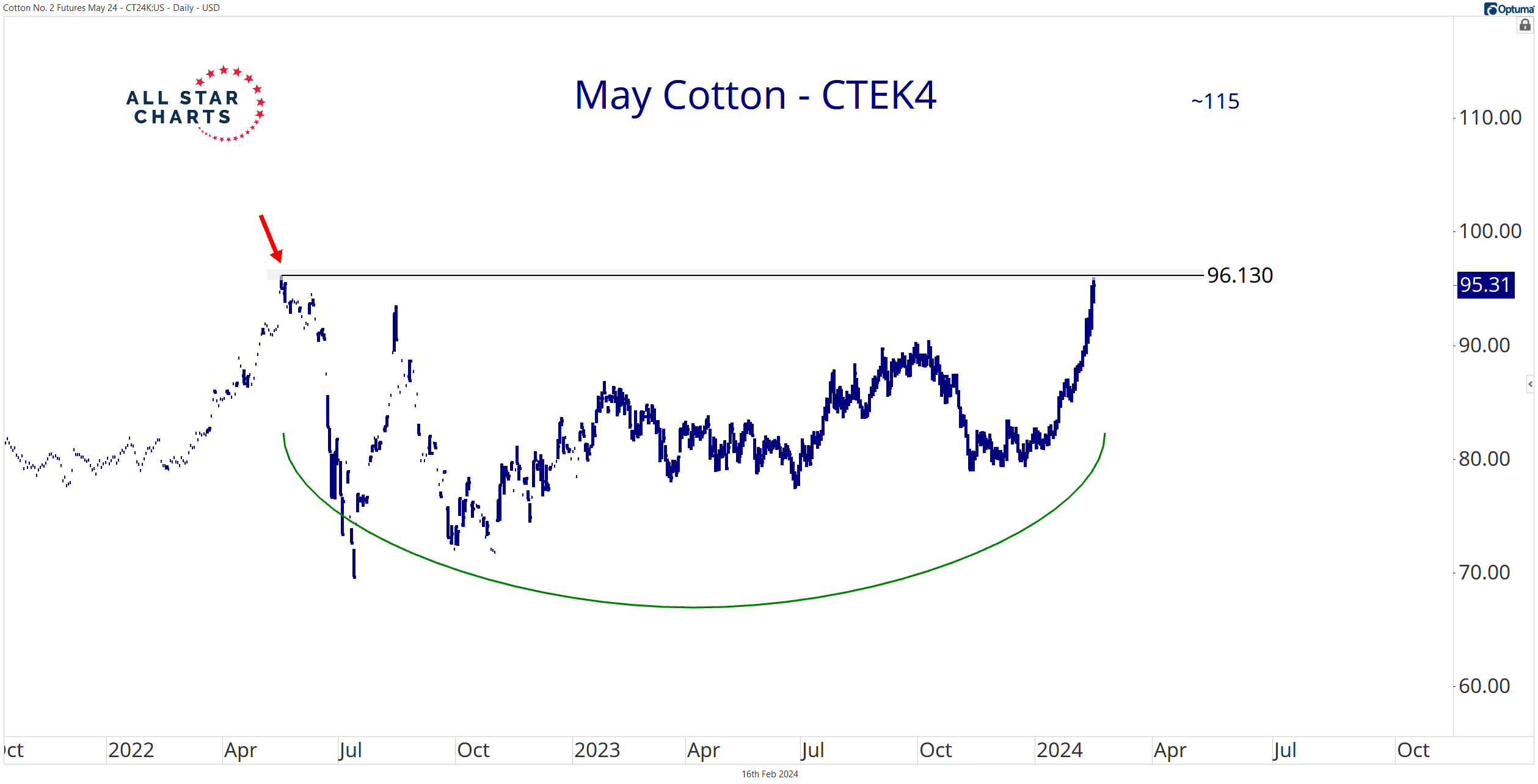

Volume has rolled into the May contract as price runs smack dab into resistance at the former contract highs of 96.13.

That’s the level you want to trade against.

Ideally, price will form a short continuation pattern like a flag or pennant. They tend to form in the middle of explosive trends. But more importantly, flags and pennants provide a defined entry based on risk.

There’s no sense in chasing a runaway market – only pain. (Take my word for it.)

But a one-, two-, or even three-week bullish consolidation just might punch our ticket to 115.

And it will place Cotton at the top of my list of potential dog names.

Stay tuned.

COT Heatmap Highlights

- Commercial hedgers post another record-long position in corn.

- Commercials’ long exposure to soybean meal reaches a three-year extreme after adding more than 33,000 contracts over the trailing four weeks.

- Commercial hedgers notch yet another record-long position for palladium.

Click here to download the All Star Charts COT Heatmap.

Premium Members can log in to access our Weekly Commodities Report Chartbook and the Trade of the Week. Please log in or start your risk-free 30-day trial today.

Be the first to comment