From the Desk of Ian Culley @IanCulley

The tide is turning for commodities now that the dollar and rates are falling.

Crude oil is relinquishing its leadership role. Gold and silver are catching a bid. And copper is digging in at former support.

But it’s not only base and precious metals bouncing off critical levels…

Check out our Equal-weight Commodity Index refusing to roll over:

Our commodity index, comprised of an equally weighted basket of 33 commodities, is finding support at a shelf of former highs. This is the principle of polarity at its finest – former resistance turning into support.

While it’s still too early to get behind the next broad-based rally in commodities, copper-related mining stocks are following Dr. Copper’s lead – a bullish data point not to be ignored.

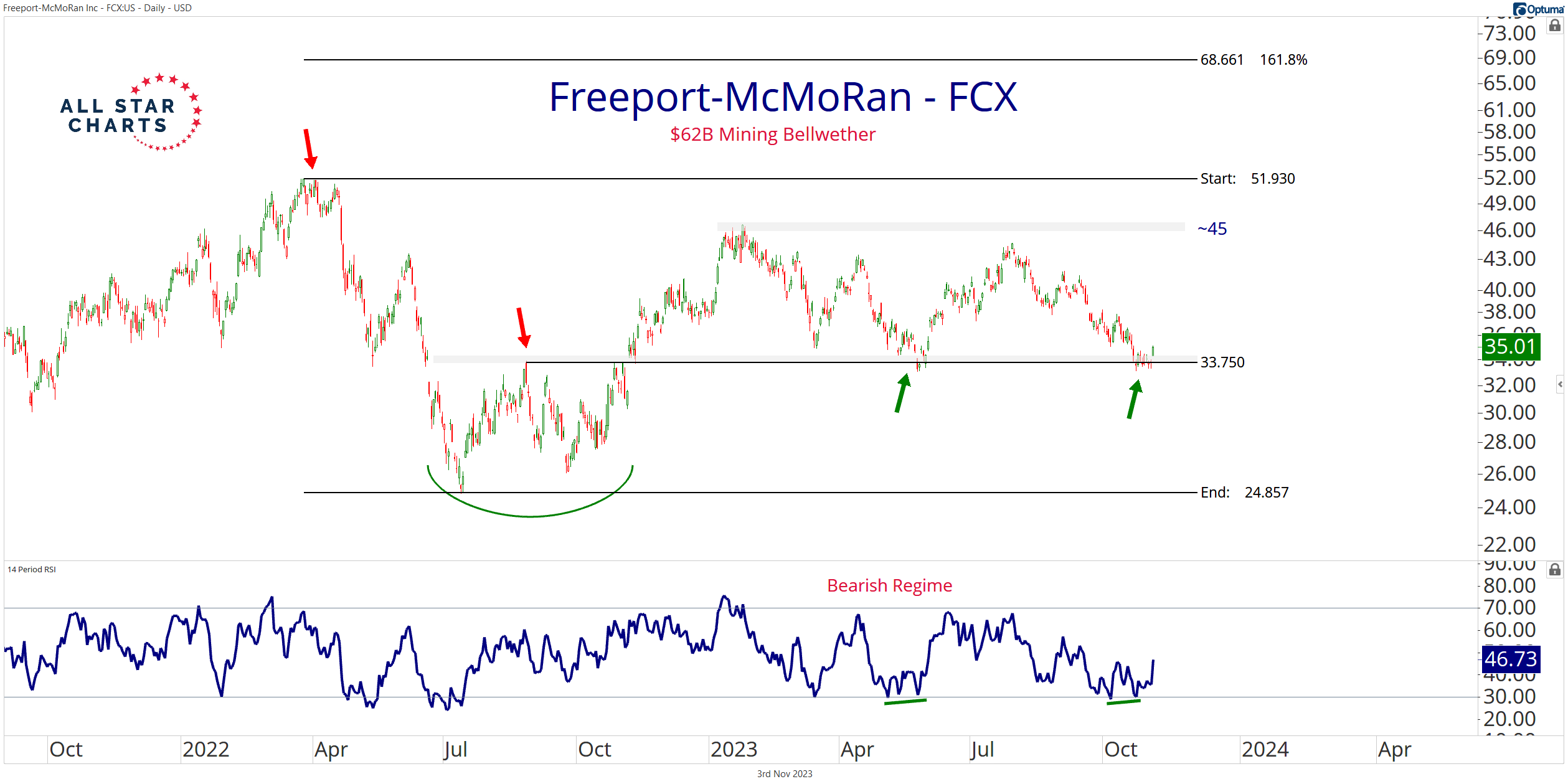

Check out the copper mining bellwether Freeport-McMoRan $FCX bouncing off a critical polarity zone:

Buyers stepped in and defended the May lows at approximately 33. It’s an excellent level to trade against, targeting the year-to-date highs of roughly 45.

Buyers stepped in and defended the May lows at approximately 33. It’s an excellent level to trade against, targeting the year-to-date highs of roughly 45.

From an intermarket perspective, a sustained rally in FCX supports a burgeoning risk-on tone for stocks and commodities.

This newfound risk-seeking behavior for copper miners couldn’t come at a more opportune time, given the stock market entered a seasonally strong period.

Say what you will. But it’s difficult to hold a bearish bias for risk assets – commodities included – as long as DR. Copper and FCX hang tough.

Stay tuned.

COT Heatmap Highlights

- Commercial hedgers post another three-year extreme for their long exposure to KC wheat.

- Commercials are within five percent of their most significant long position for the Canadian dollar in three years.

- And commercials hold a new record-long position for Minneapolis wheat for the second week running.

Click here to download the All Star Charts COT Heatmap.

Premium Members can log in to access our Weekly Commodities Report Chartbook and the Trade of the Week. Please log in or start your risk-free 30-day trial today.

Be the first to comment