All Star Charts chief options strategist @OptionsSean joins Yahoo Finance to discuss the meme stock craze: pic.twitter.com/OXp18lXl1I

— Yahoo Finance (@YahooFinance) May 14, 2024

It appears that “Meme Stock Mania” is back. Or we’re at least having an echo moment.

Cool. I’m all for it!

Whatever leads more sheep to slaughter, the better for those people who trade with plans and logic. People like you and me.

If we learned anything from the last go-’round, remember that it’s very hard to control our risks in these mania stocks – especially when we have to deal with trading halts that may or may not resolve in the direction we desire.

Fortunately, options traders have a unique and specific advantage over common stock traders – we can PRECISELY define our risks. Of course, this privilege comes with a cost: high options premiums.

Yes, we can express our bullish devotion to @TheRoaringKitty by purchasing call options in his favorite meme stock, which comes with the very important feature of limiting our risk to the premium we pay for those calls. But we’re going to pay through the nose to buy them.

Market makers aren’t stupid. Especially after what happened to them last time.

Might I suggest…

If you’re dead set on trading these crazy meme stocks, it might be more prudent to put the market maker’s risk aversion to your benefit by utilizing simple vertical options debit spreads. If I’m bullish, I’d use a bull call spread that involves purchasing a slightly out-of-the-money call and reducing my cost of participation by selling a richly priced, further out-of-the-money (OTM) call against it.

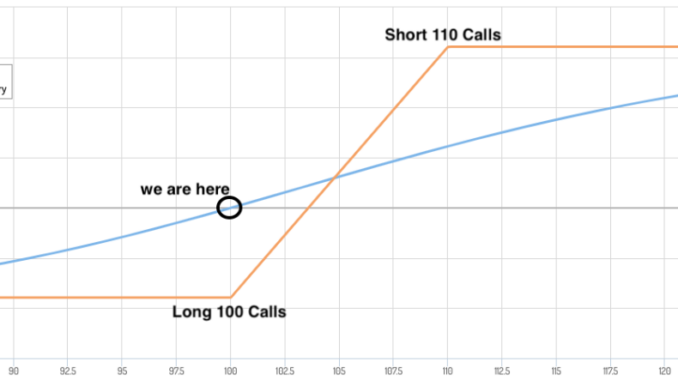

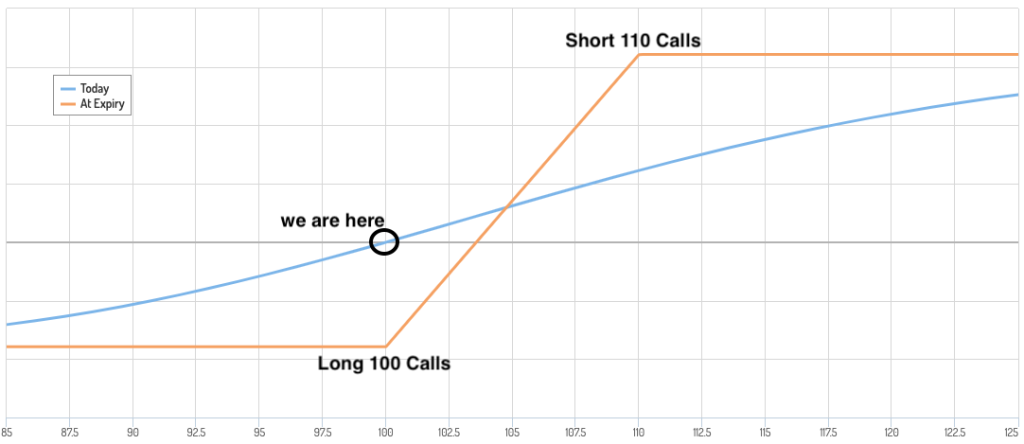

Here’s what a typical PnL graph looks like for a call vertical spread (aka: “bull call spread”):

Yes, selling a further OTM call limits my upside. But are these meme stocks really going to go to the moon – and more importantly — stay there? I don’t think so.

But if it does… the value of a spread like this (when both strikes are in-the-money) will steadily increase as the premiums in the short calls erode approaching options expiration and the spread approaches full value (the distance between our strike values).

Defining our risk and ensuring a less volatile ride for our positional PnL will allow us to keep cool and focused on our plans while everyone else is losing their damn minds.

I don’t want to be a greedy schmuck. I want to be smart. That’s how I win.

Trade ’em Well,

Sean McLaughlin

Chief Options Strategist

All Star Charts, Technical Analysis Research

Be the first to comment