What is electronic invoicing in Malaysia?

Electronic invoicing, also known as e-invoicing, is gradually gaining acceptance worldwide, including Malaysia.

In Malaysia, e-invoicing is part of the Malaysian government’s initiative to promote digital transformation and a paperless environment among businesses. It’s an electronic method of billing your clients for goods sold or services rendered, and it’s achieved through email or any other electronic medium.

One key advantage of e-invoicing is that it supports the country’s move towards digital tax monitoring. The Malaysia Royal Customs Department introduced the Sales and Service Tax (SST) in 2018. E-invoicing makes it easier for businesses to calculate, track, and pay this tax in real time.

Malaysia plans to implement a mandatory e-invoicing system for all taxpayers, regardless of their sales turnover, from January 2027. This will be a gradual implementation, with the first phase beginning in June 2024 for taxpayers with an annual turnover of MYR 100 million or more.

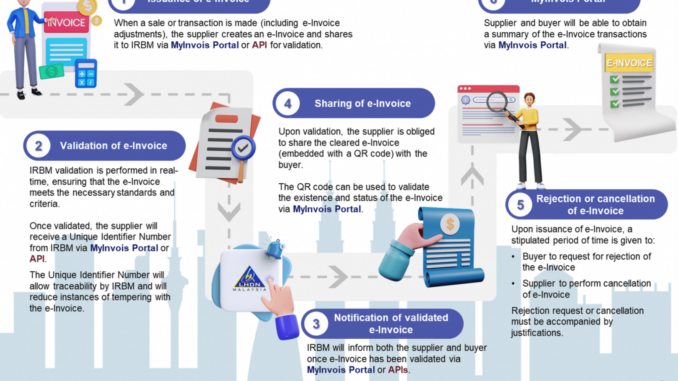

The Malaysian Inland Revenue Board (IRB) has developed two mechanisms for taxpayers to transmit their e-invoices to the IRB:

- MyInvois Portal: A web-based portal that allows taxpayers to create and submit e-invoices manually or in batches

- API integration: This allows taxpayers to integrate their e-invoicing system with the IRB’s system to automate e-invoice transmission.

Taxpayers can choose the mechanism that suits their business requirements better.

Image from the website of LHDN (Lembaga Hasil Dalam Negeri)

The increasing adoption of e-invoicing in Malaysia is expected to help enhance efficiency, reduce costs, speed up payment cycles, improve financial management, and minimize errors and fraud. Businesses also get to contribute to environmental sustainability as e-invoicing reduces paper use.

Malaysian businesses will join a nationwide e-invoicing framework that adheres to international Peppol standards. This framework allows businesses to send and receive invoices over the Peppol network, regardless of their accounting solution.

How to prepare for e-invoicing?

Businesses can start preparing for e-invoicing by carrying out the following activities:

- Assess their current invoicing process to identify the areas where they can improve efficiency and reduce costs.

- Choose an e-invoicing solution that meets their specific needs and budget.

- Integrate their e-invoicing system with their ERP system to automate e-invoice transmission.

- Educate their staff on the new e-invoicing process.

As the Malaysian government continues to promote digitalization, further milestones for e-invoicing can be anticipated in the coming years.

SAP’s go-to solution to support electronic documents and statutory reporting requirements globally is SAP Document and Reporting Compliance. This would be the strategic choice to support electronic invoicing in Malaysia too.

SAP is currently analyzing the electronic invoicing requirements available. In the meantime, we are waiting for the LHDN to release technical details, such as technical specifications of e-invoices.If you’d like to explore the SAP Document and Reporting Compliance solution, please visit SAP Document and Reporting Compliance

Please note that while these milestones provide a timeline of e-invoicing adoption, the exact dates are subject to change by the authorities.

Be the first to comment