From the Desk of Ian Culley @IanCulley

The entire marketplace is fixated on tomorrow’s FOMC meeting.

Will the Fed make its first rate cut in March, or will it be in June?

Who knows.

I enjoy speculating as much as the next guy, but I’m not into guessing on next moves by central bankers.

I prefer to track another market participant with a Ph.D. in economics, Dr. Copper.

And we can’t discuss copper without including the Australian dollar!

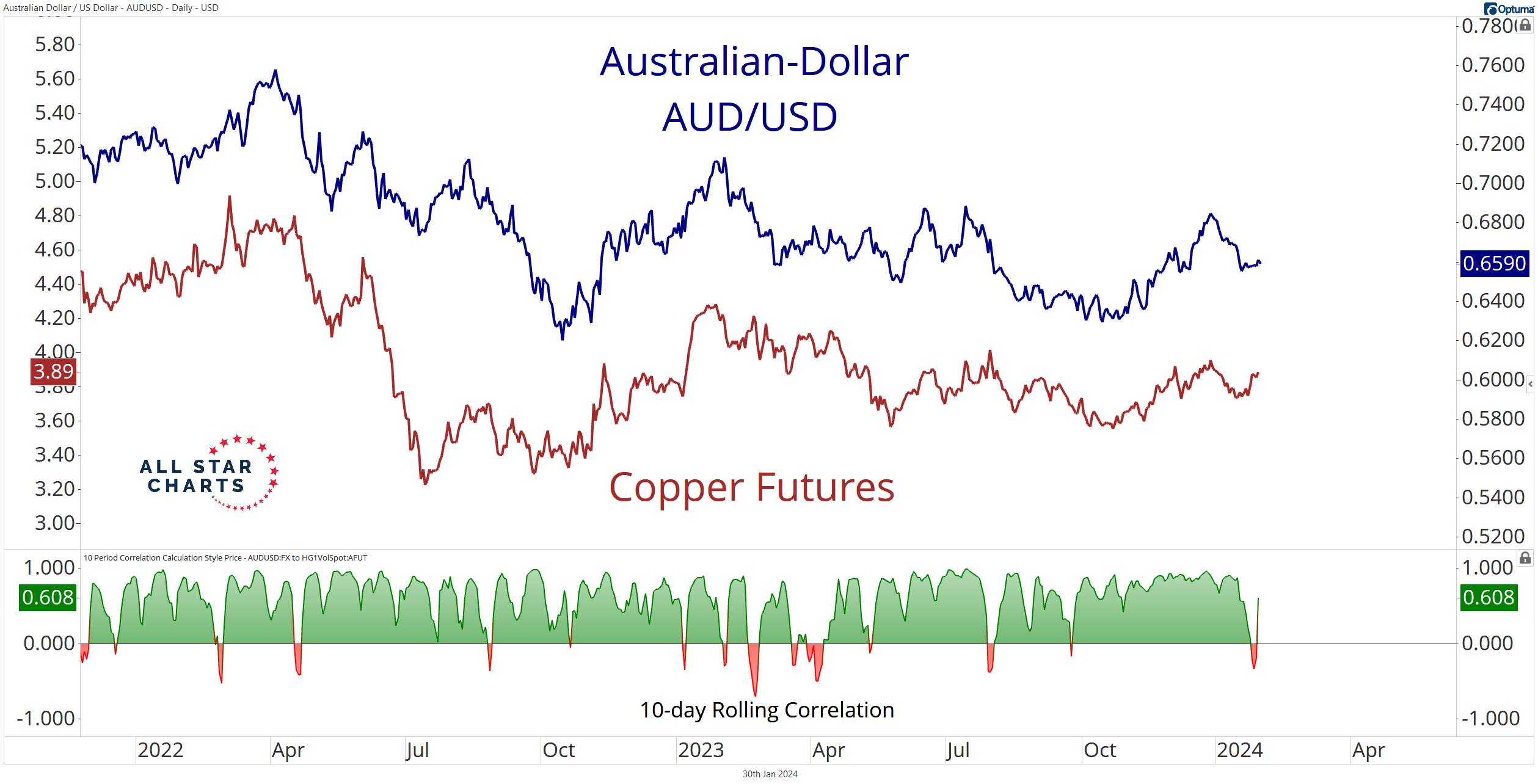

Check out the Australian dollar overlaid with copper futures:

They look almost identical.

I added a 10-day rolling correlation study in the lower pane, highlighting the tight relationship over shorter time frames.

An increased bid for copper would support the current stock market rally, giving the global economy a clean bill of health.

Dr. Copper will likely resolve in the same direction as the aussie heading into Friday’s close.

If it doesn’t, the above chart suggests the positive correlation will reassert itself in the following weeks.

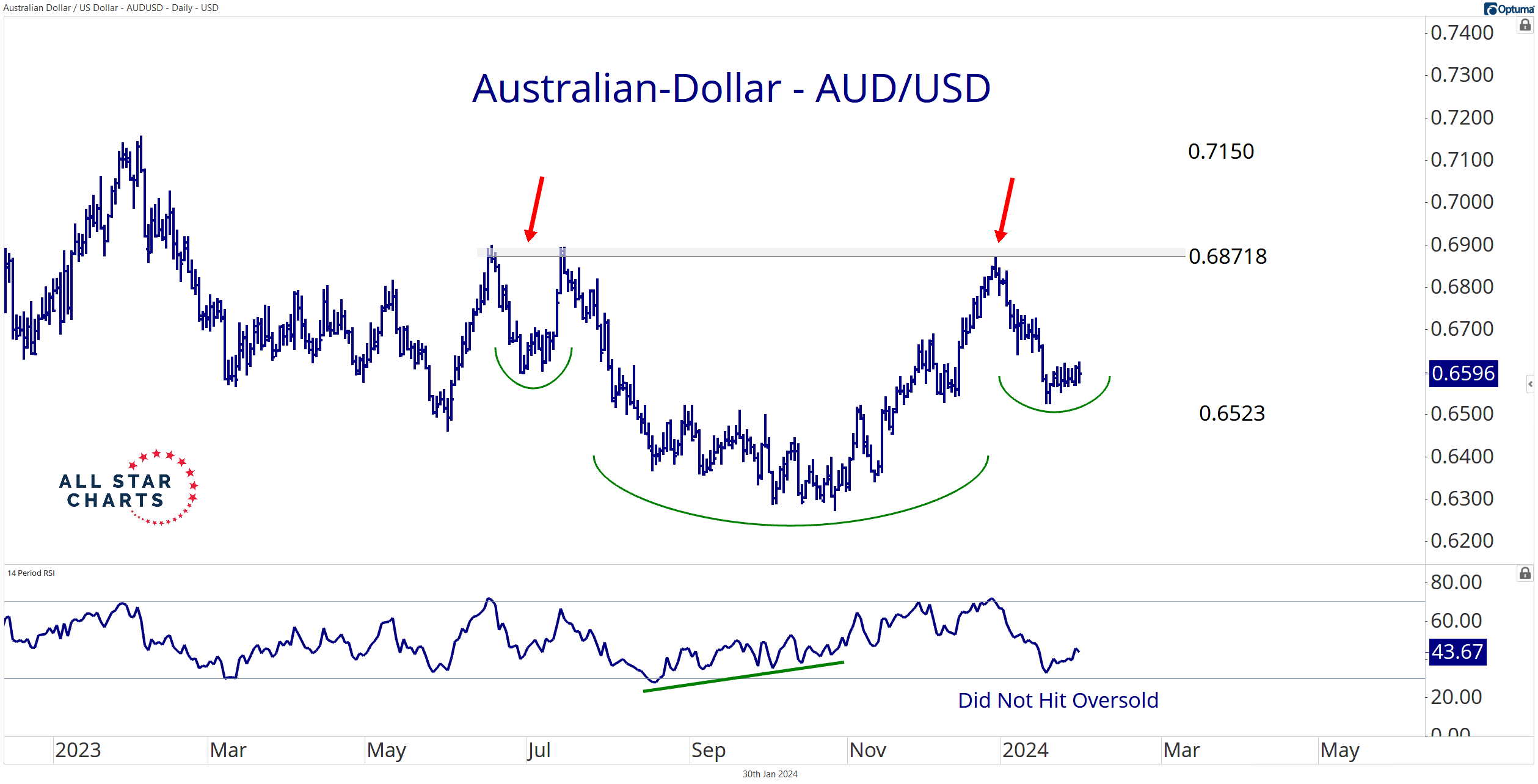

The daily chart of the Australian dollar is carving out a potential right shoulder of an inverted head-and-shoulders pattern:

I like trading the AUD/USD pair against the January low as the 14-day RSI favors an upside resolution.

A bullish momentum divergence coincided with last fall’s lows. The retest of last summer’s high registered an overbought reading – a point for the bulls.

And we failed to witness an oversold reading on the recent leg lower.

But we don’t trade RSI. We trade price.

I can’t hold a long AUD/USD position if it trades below 0.6523. That’s our risk level – the January low.

I’m long targeting 0.6875 and 0.7150 as long as it holds above that level. It doesn’t matter if you take the trade.

More importantly, copper futures are completing a similar bullish reversal, trending higher with an AUD/USD rally toward last year’s highs.

I can’t imagine a more bullish data point for global equities (besides new all-time highs).

Best of all, you can track these associated price levels instead of Jerome Powell’s word choices.

Stay tuned!

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment