From the Desk of Ian Culley @IanCulley

Price doesn’t move in a straight line.

Just don’t tell the US dollar, which has managed to post positive gains for eleven straight weeks.

But the dollar index $DXY is sporting its deepest drawdown since mid-July – a mere 0.20% – as buyers catch their breath.

Five down days and counting have my attention, though it doesn’t shift my bullish bias for King Dollar. Not yet!

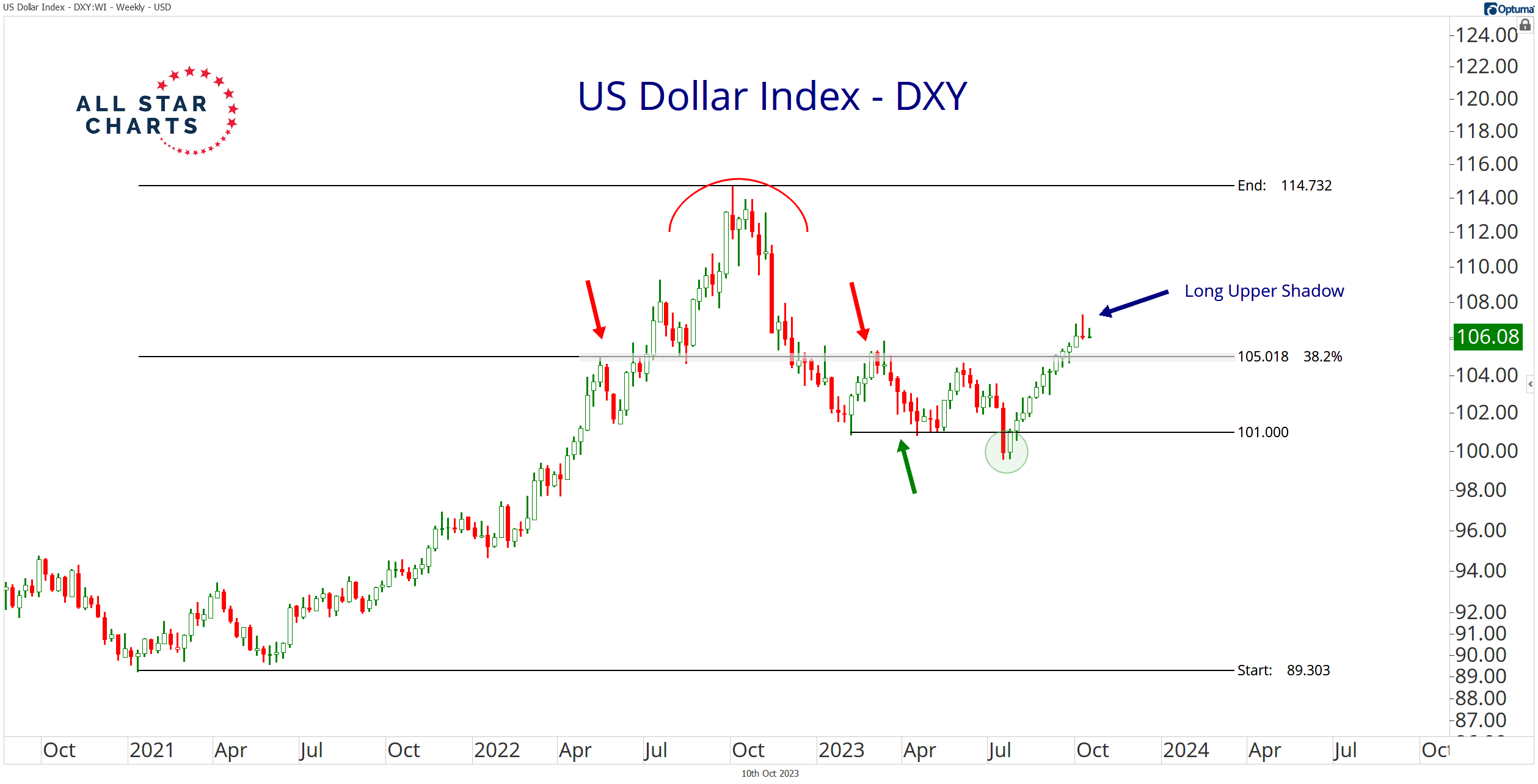

Check out last week’s DXY candle:

Buyers drove prices higher over the course of last week only to succumb to selling pressure by Friday’s close.

The long upper shadow and small real body at the lower end of the range form a “northern doji” candlestick. It indicates the market is exhausted, explaining the continued selling pressure.

But it’s the first lower weekly close in 12 weeks. DXY hasn’t gone on a hot streak like this since 2014.

Let the dollar live!

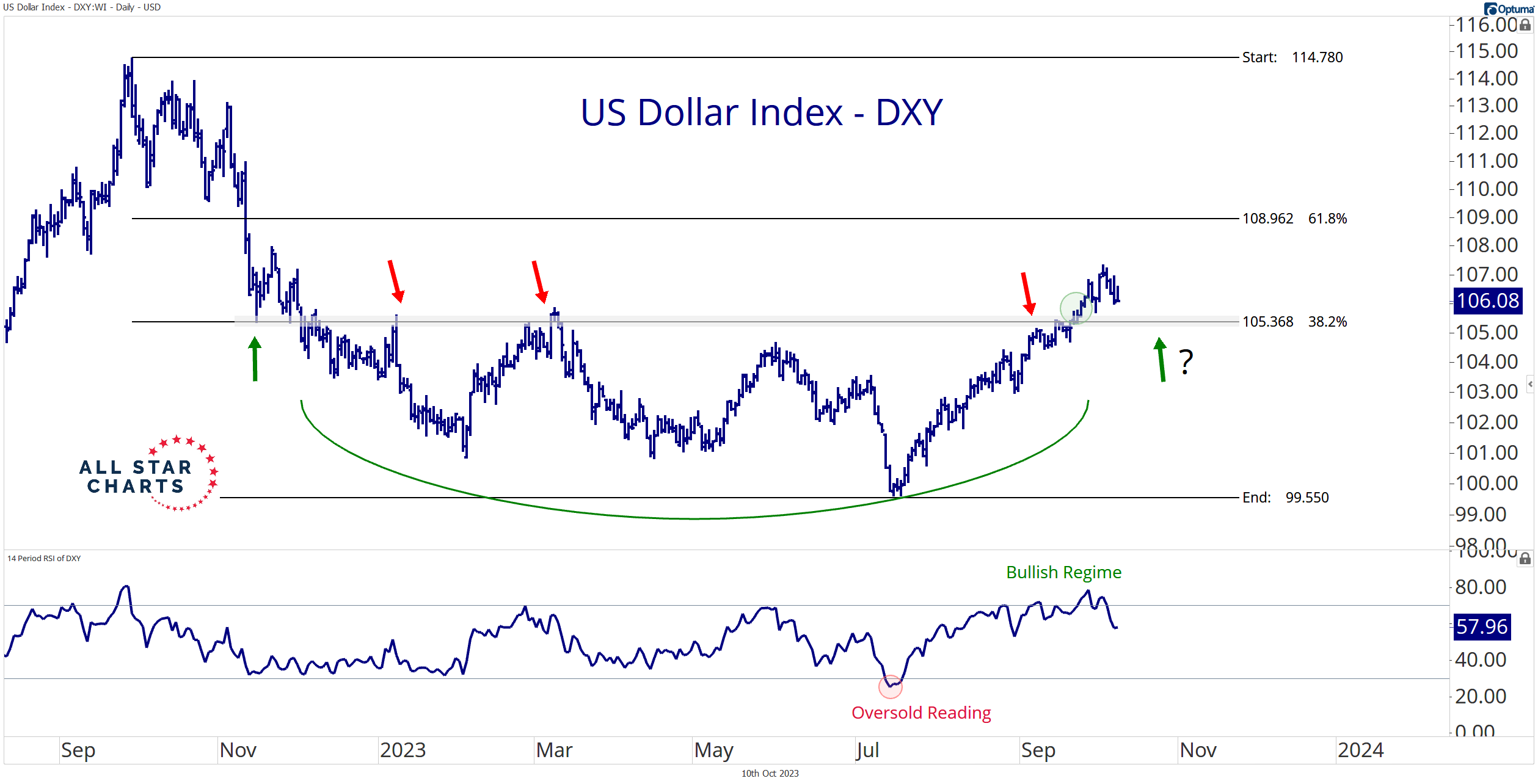

My bias doesn’t flip lower until the dollar index undercuts the 105 level.

105 coincides with a zone marked by a shelf of former highs, a key retracement level from last year’s markup phase, and another retracement level from this year’s correction. (The overlapping retracement levels add to my conviction).

The song remains the same for the market if the dollar index holds above this critical area. Equity indexes will sing the blues, while energy stocks rock out.

That all changes if DXY slips back into the box.

Tech will take center stage as the major averages bounce off local lows if the dollar weakens. In fact, we’re already seeing this happen – and it’s only been a few days!

Markets seldom provide crucial levels with broad intermarket ramifications, such as 105 for DXY. That’s our level. Embrace it!

Energy is your friend as long as it’s above that level…

But you want to own tech on a decisive break lower.

Stay tuned!

Thanks for reading.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment