From the Desk of Ian Culley @IanCulley

King Dollar reigns supreme, and its near-term rally shows no sign of slowing.

What can you do about it?

You can profit from it.

Today, I’ll share with you three tactical setups for dollar strength. And they’re all close to triggering.

But, before I outline the trades, let’s look at the relationship between the dollar and stocks…

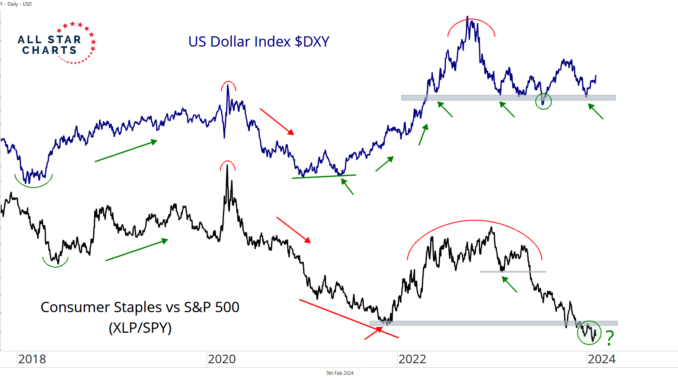

Last night, Alfonso dropped a stellar chart in Slack of the US Dollar Index $DXY overlaid with Consumer Staples $XLP relative to the S&P 500 $SPY:

The chart supports the inverse relationship between stocks and the US dollar that’s been in place for almost a decade.

Money flows out of the major stock indexes and into staples when investors are scared.

The same is true for the US dollar. That’s why these two charts look alike.

Interestingly, staples fell on a relative basis as the US Dollar Index chopped sideways during 2021 and 2023.

The pattern supports the thesis that stocks not only enjoy a falling dollar but also a range-bound one. A similar dynamic is at work with interest rates.

Since the DXY is trading in the middle of a year-long range, I can’t think of a better time to broaden the scope to include other risk ratios that track the dollar.

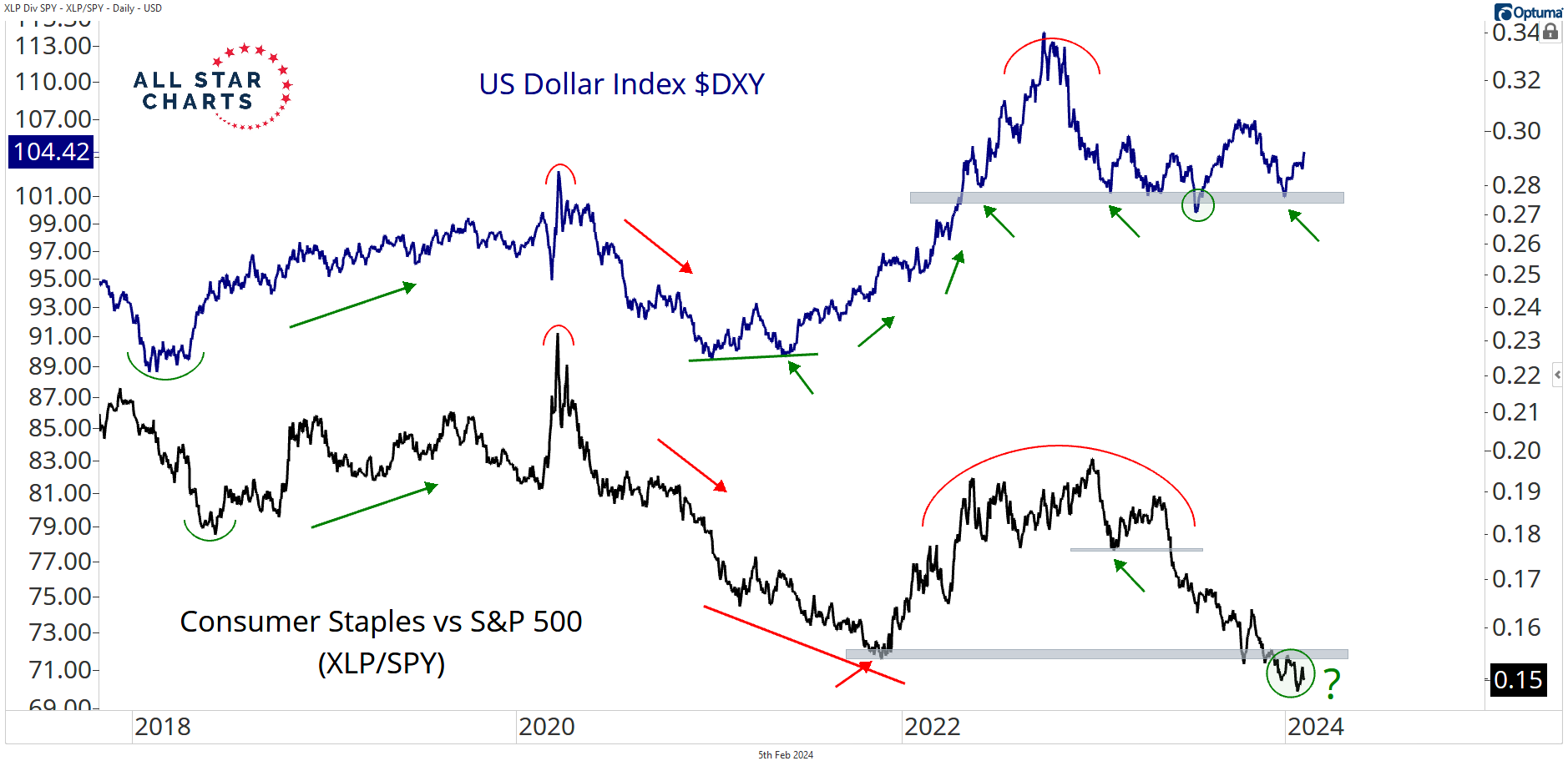

Check out the US Dollar Index with the S&P 500 Low Volatility Index $SPLV versus the S&P 500 High Beta ETF $SPHB and the US Treasuries ETF $IEI versus High Yield Bond ETF $HYG:

If your initial reaction follows something like, “Hey, it’s just another way of looking at the same thing – risk-on versus risk-off,” you’re absolutely correct.

And that’s useful information.

Investors shouldn’t overreact to a strengthening dollar while low volatility names and US Treasuries underperform their riskier alternatives.

I view the flow of money into the US dollar as a simple precautionary reflex until signs of more overt risk aversion surface.

Meanwhile, we have three critical intermarket ratios to track for confirmation: a sector-focused relationship in XLP/SPY, a thematic risk ratio in SPLV/SPHB, and a credit spread proxy in IEI/HYG.

If these ratios reclaim their respective highs from last month and start ripping to the upside, the dollar rally and the broad stock market correction likely have legs.

It’s that simple.

Now for a few trade ideas…

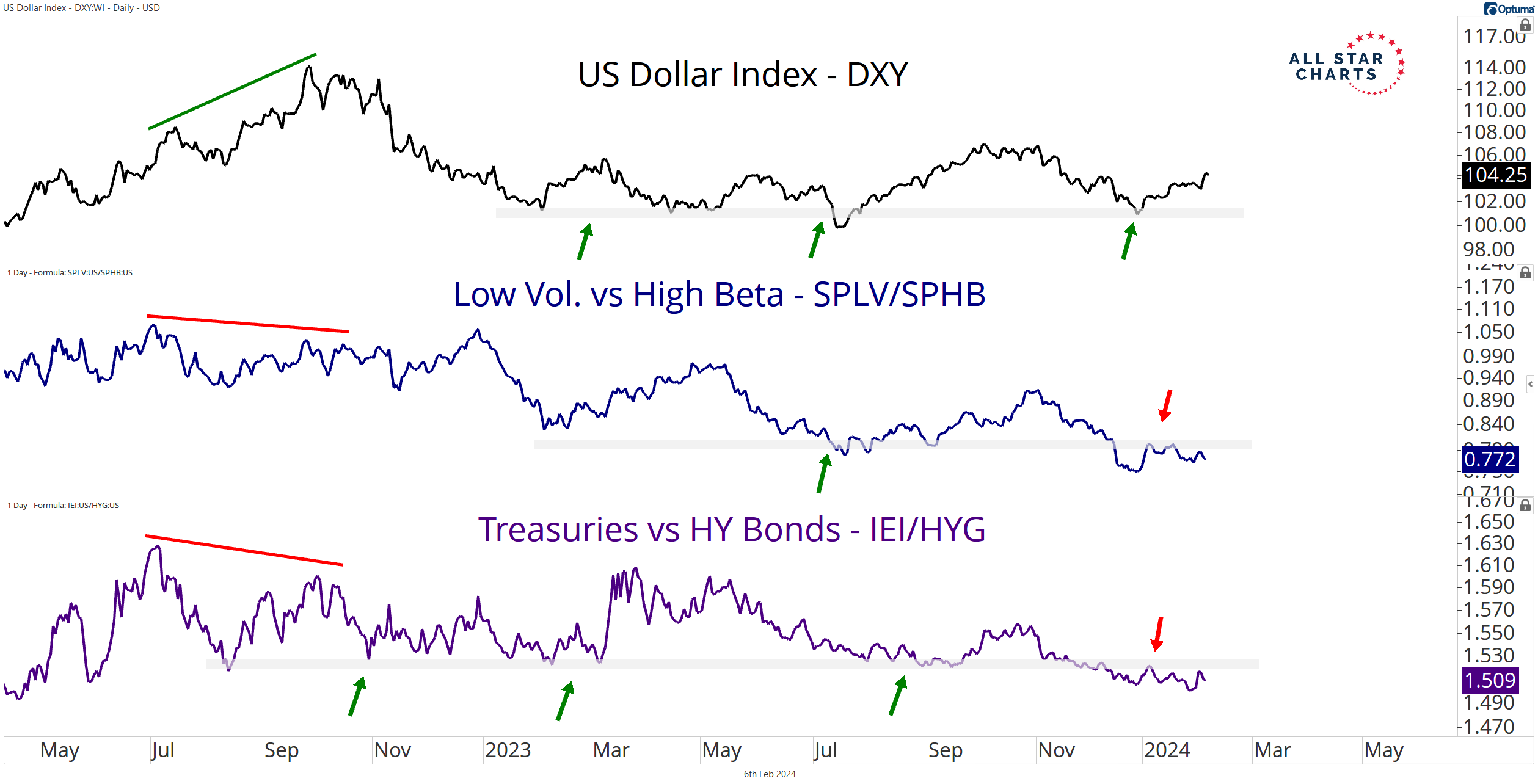

First up is the EUR/USD:

The euro is finding support at its December pivot lows.

I like shorting a break below those former lows, pinpointing the December 8 close of 1.0745 with a target of approximately 1.05.

A brief period of consolidation above our line in the sand makes sense, so I will not hold a short position on a daily close above our risk level.

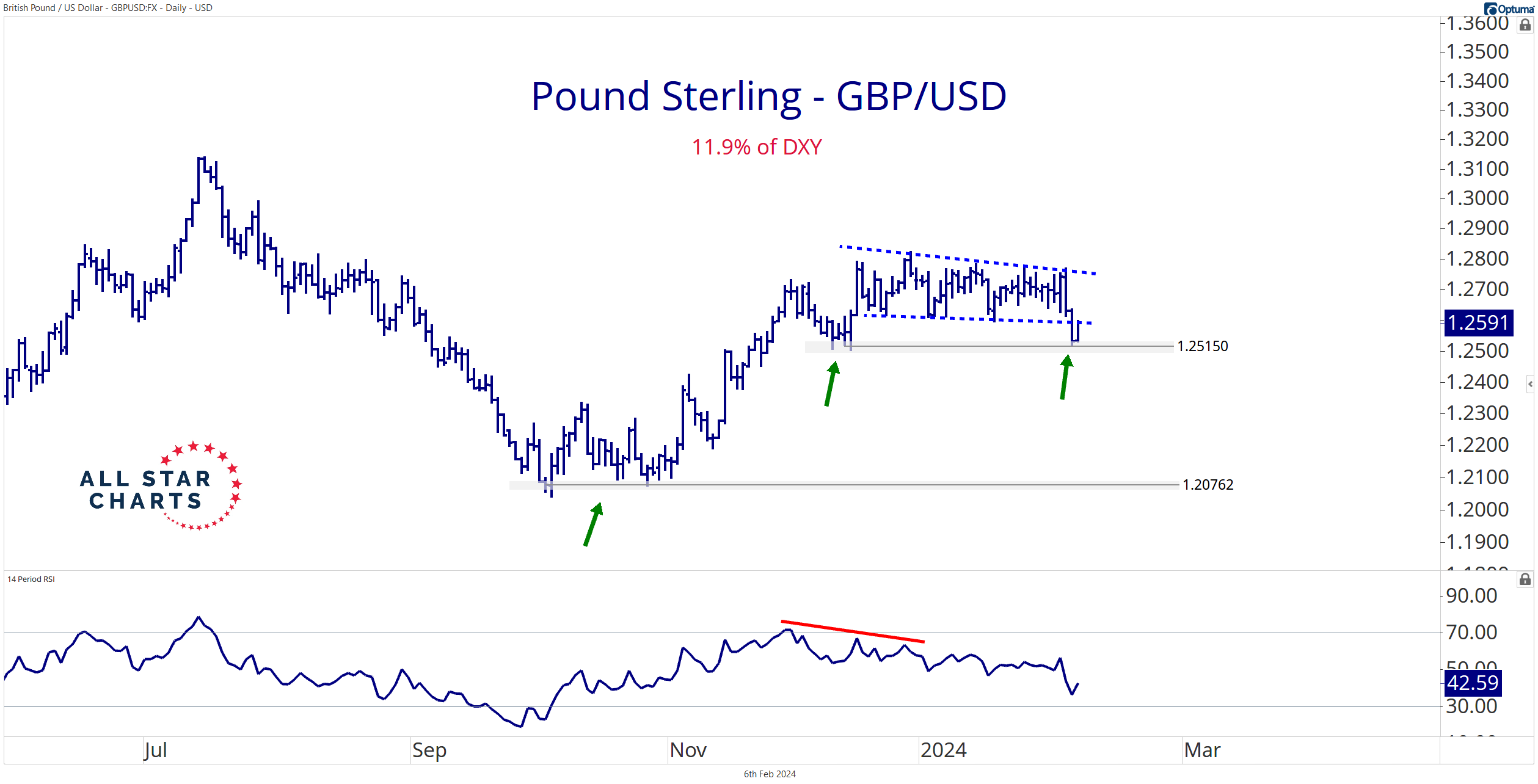

Next is the GBP/USD:

The pound is also testing its lows from late last year. I’m monitoring Monday’s low of 1.2515, coinciding with the December 15 low.

A break below that level flashes a sell signal with a downside objective of roughly 1.21.

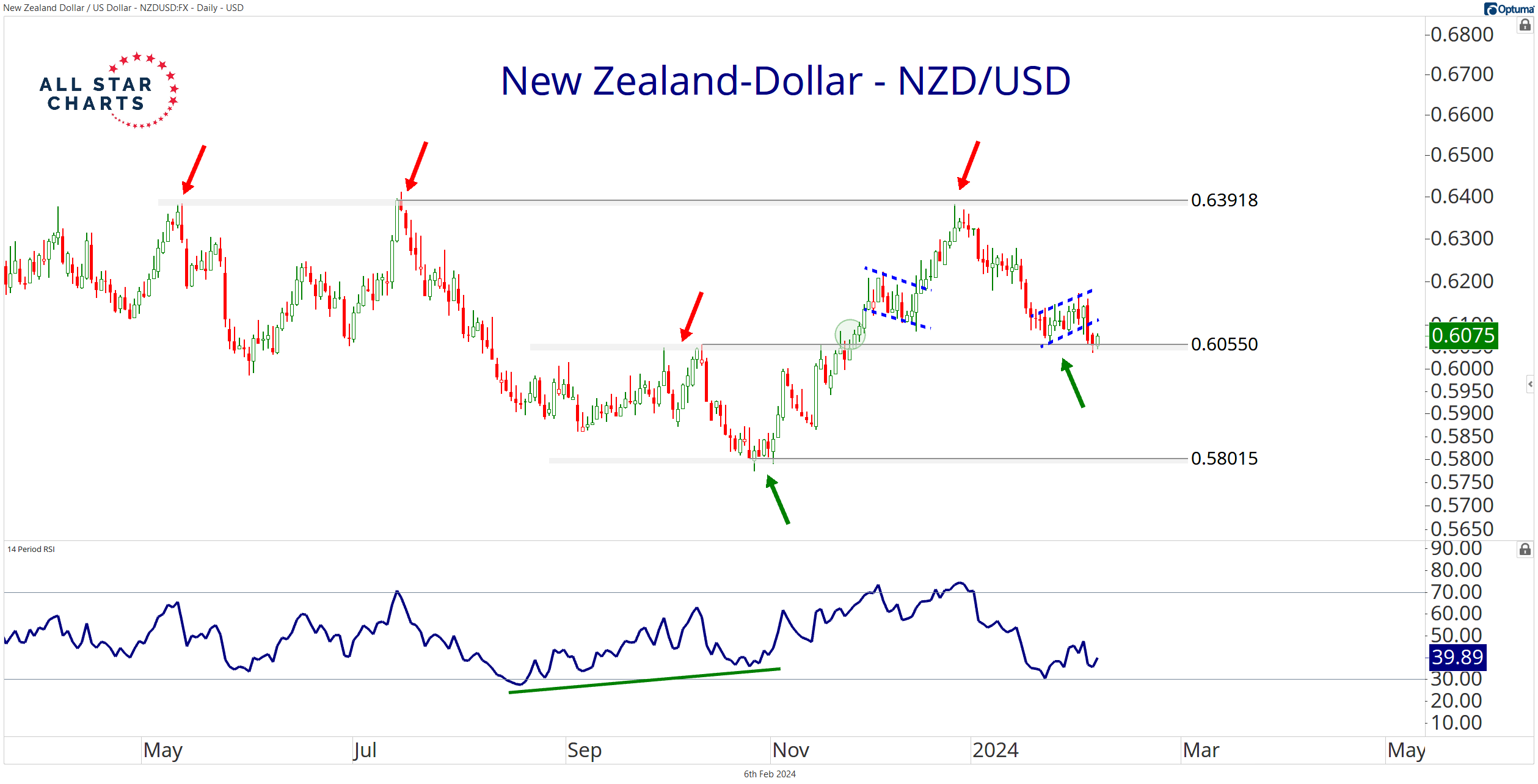

Finally, here’s the NZD/USD:

I thought the New Zealand and Australian dollars were carving out potential inverted head-and-shoulders patterns.

Those bullish reversals may still come to fruition.

Nevertheless, a break below yesterday’s close of 0.6053 triggers a sell signal with a target at approximately 0.5800.

All three are hovering just above their respective breakdown levels as of Tuesday afternoon.

I imagine our alerts will sound and our orders will fill if the US dollar continues to strengthen.

Stay tuned.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment