From the Desk of Ian Culley @IanCulley

Inflation is proving sticky.

So what?

Stocks remain buoyant.

And bonds – the largest market in the world – continue to reveal a risk-on environment.

High-yield bonds relative to Treasuries measure risky junk bonds’ performance versus the safest fixed-income asset, US Treasury bonds.

The key characteristics of these assets create a critical risk gauge for bond and equity markets, as risk-seeking behavior in the bond market also bodes well for risk assets.

Check out the High Yield versus US Treasury Bond ratio ($HYG/$IEI):

Bonds supported a stock market rally last quarter. And the HYG/IEI ratio was one of those charts screaming, “All systems go!”

It’s an easy way to monitor credit spreads and the overall health of the bond market.

Remember, if the bond market is happy, everyone is happy.

Notice HYG coiled relative to IEI for most of 2023. That all changed in early December as the ratio resolved higher.

The relative strength of high-yield bonds cooled during a successful retest of the breakout level last week.

Nevertheless, bonds send a clear risk-on message to the broader market as long as the breakout holds.

On the flip side, if HYG/IEI slips back into last year’s range, stocks are most likely under pressure. Bonds also contend with sellers in that environment.

Stocks are sliding lower following today’s CPI report.

But don’t let the intra-day swings or the latest headlines throw your portfolio off balance.

Focus on what matters: the markets we trade, risk management, and critical intermarket relationships such as HYG/IEI.

Stay tuned!

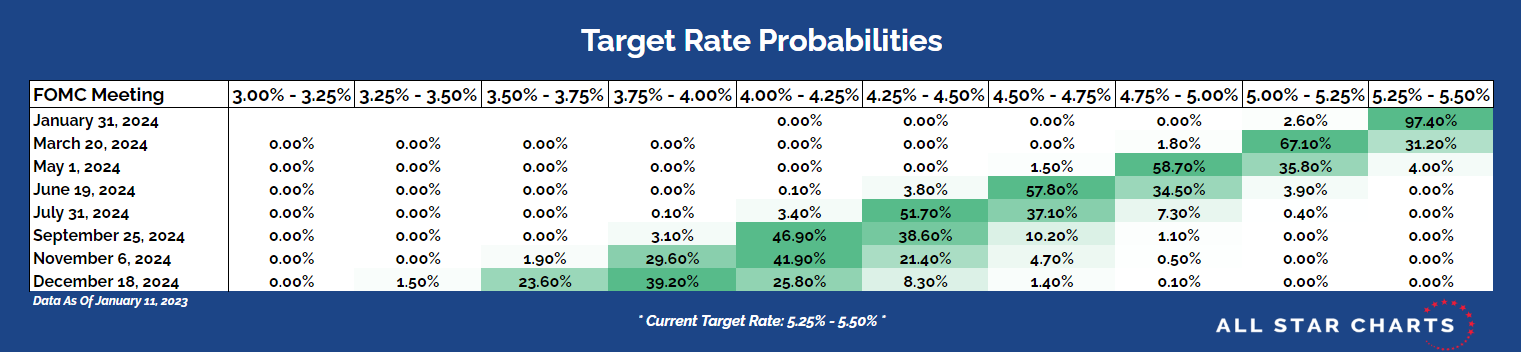

Countdown to FOMC

The market is pricing in a pause in the hiking cycle with a possibility of a 25-basis-point cut in March.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of January 11, 2024.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment