From the desk of Steve Strazza @Sstrazza

Last week, we held our January Monthly Conference Call, which Premium Members can access and rewatch here.

In this post, we’ll do our best to summarize it by highlighting five of the most important charts and/or themes we covered, along with commentary on each.

Let’s get right into it!

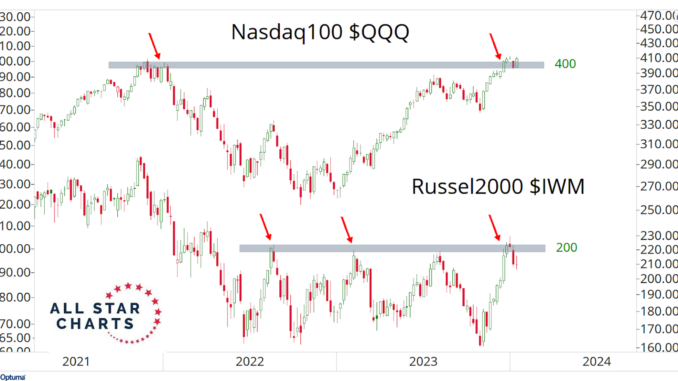

1. Major Indices Mixed At Old Highs

After several years without making any progress, many of the most important indices are running into resistance at the upper range of multi-year consolidations. The Nasdaq 100 $QQQ and Russell 2000 $IWM both illustrate this point:

The lines in the sand for the QQQ and the IWM are 400 and 200, respectively. If these indices are below their respective risk-levels, it will be a more challenging environment in terms of owning stocks.

As it stands right now, the QQQs are comfortably above their risk level, while IWM is still trapped below it. In other words, from an index perspective, things are mixed.

Bulls want to see both these levels get taken out in a decisive manner.

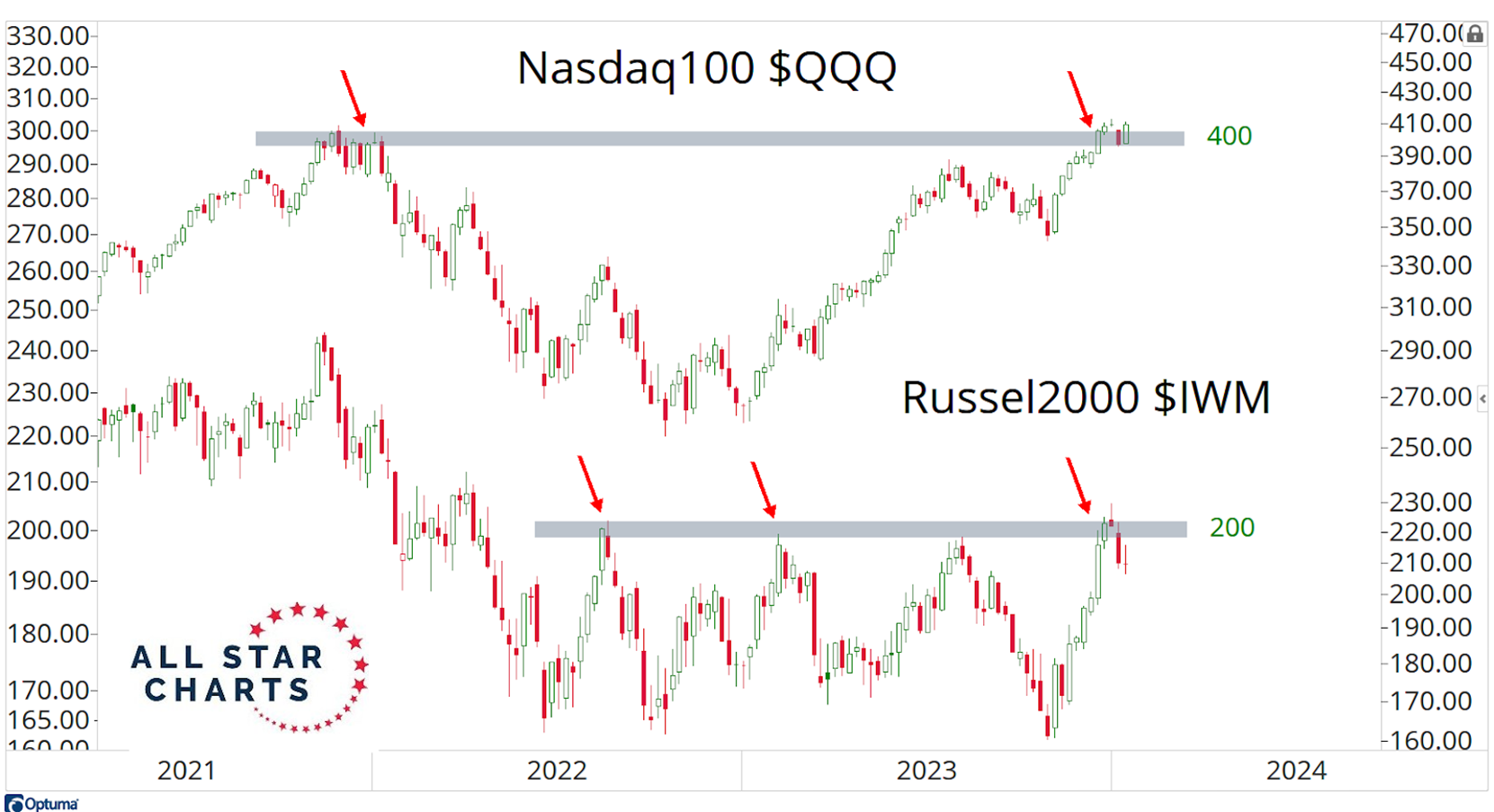

2. Election Markets

Election years tend to be a strong seasonal period for the stock market.

However, the first quarter of this cycle is often volatile.

What we’re doing here is combining every election year to create a composite wave to determine how the S&P did historically in those years.

As you can see, the first three months tend to be sideways, which suggests we exercise patience and be less aggressive in the current environment.

However, once this period ends, the sweet spot for buying stocks starts early in Q2.

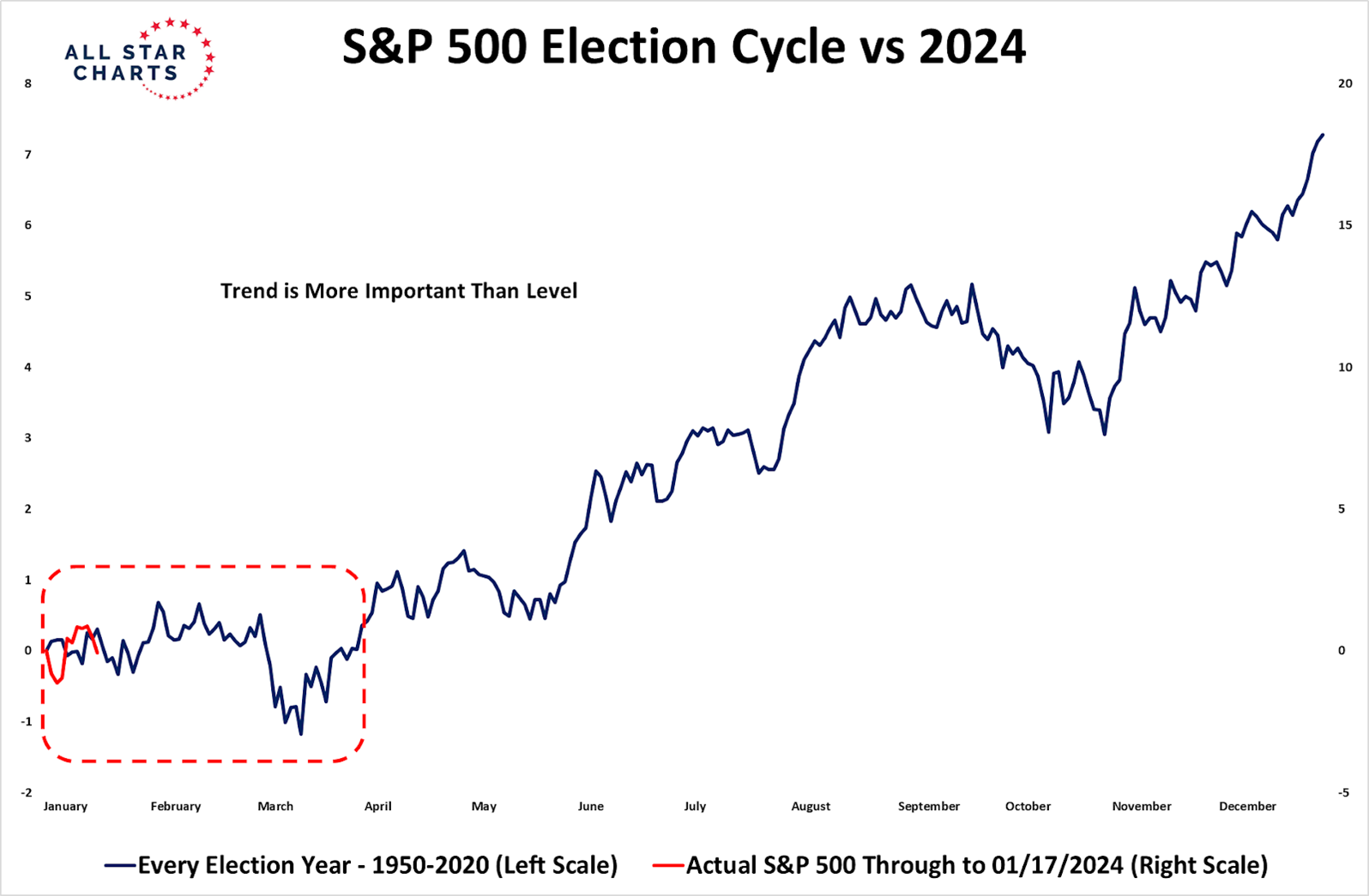

3. Consumer Staples Can’t Catch a Bid

When we look for evidence that market participants are taking defensive positions, the Consumer Staples versus S&P 500 ratio provides tremendous insight.

In bull markets, investors are rewarded for owning riskier stocks and are punished for owning defensive stocks. This is precisely what has taken place with this ratio:

If this ratio digs in down here and reclaims the 2021 low, stocks will likely be under pressure.

However, as long as this ratio is above 0.154, the ball is in the bull’s court, and the bias is higher for risk-assets.

4. Mexico and the VIX?

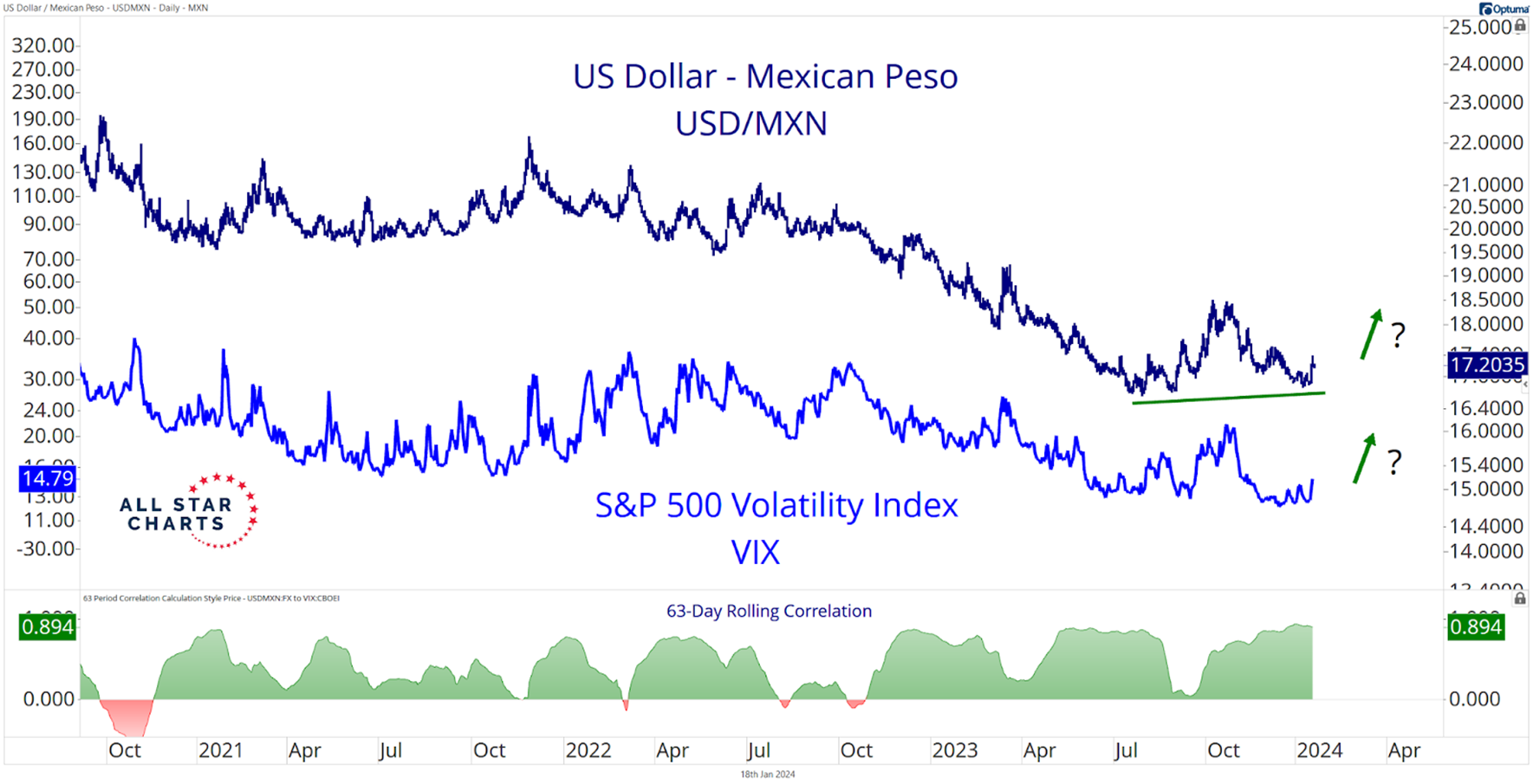

We use intermarket relationships a lot to confirm or contend against the trends we are seeing.

One example is through the Volatility Index and the Mexican peso.

On the one hand, the VIX measures the risk associated with the stock market. Then there is the Mexican peso which is considered a bellwether of emerging market currencies.

When we overlay them, they look almost the same.

When the USD/MXN increases, the dollar strengthens, and therefore, stocks tend to come under pressure, and volatility increases.

The opposite is true when USD/MXN decreases, as it means dollar weakness and volatility decreases, thus being a tailwind for risk assets.

Both are currently moving lower, suggesting a favorable environment for risk assets.

5. Leadership Bubbles Up

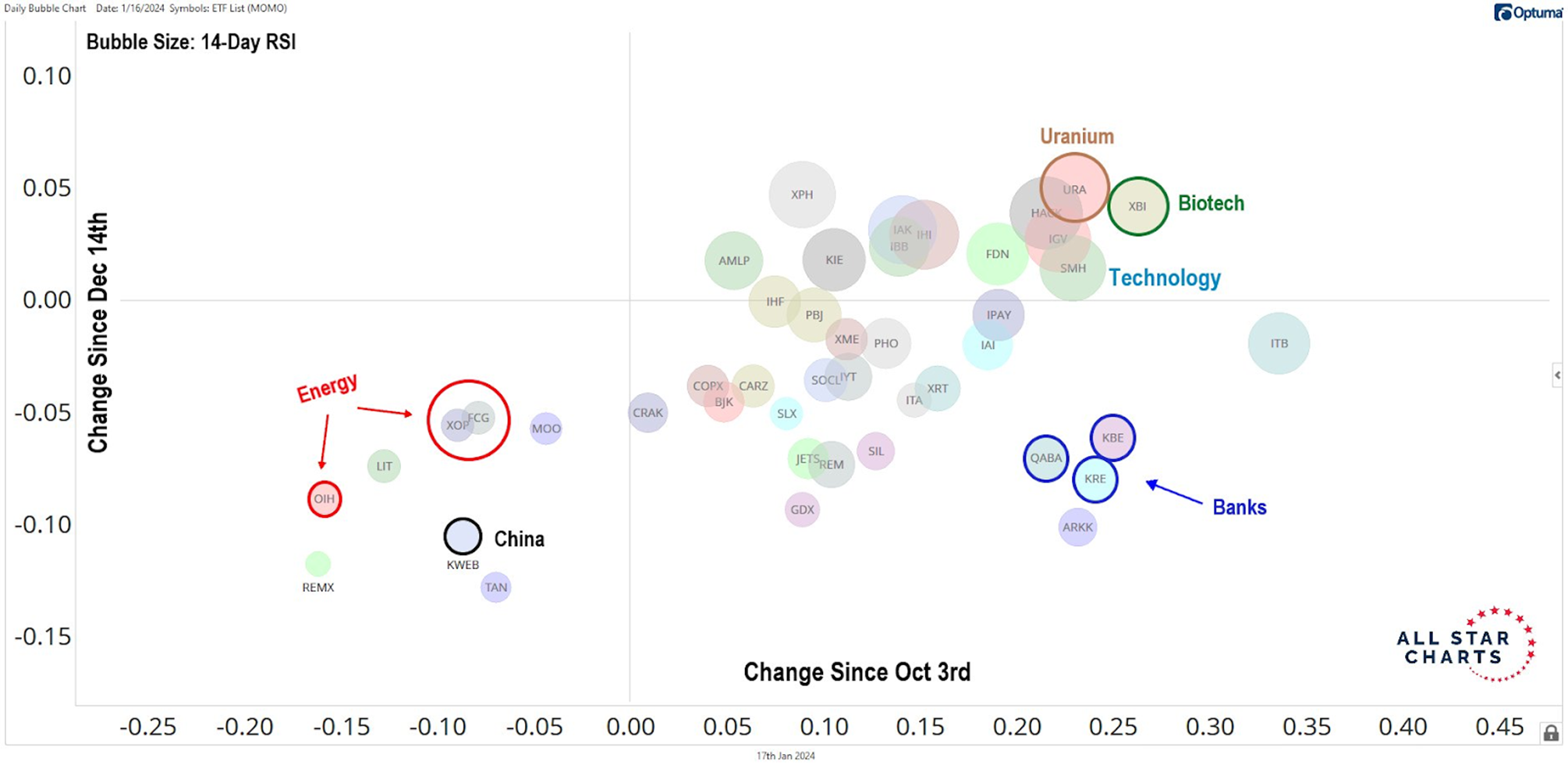

The bubble chart below displays near-term performance with the change since December 14th (when the list of new highs peaked) on the y-axis and the change since October 3rd (when the list of new lows and the US dollar index peaked) on the x-axis.

As you can see, technology, biotech, medical devices, uranium, and insurance have not only booked impressive gains since the dollar peaked in October, but they are also outperforming their counterparts over shorter timeframes.

On the flip side, energy, lithium, rare earth metals, and China lie at the lower left side of the chart, making them the laggard areas of the market so far this year.

Notice how banks led the way up in the last four months, but they have been running out of fuel in the last month? We think they continue to repair this tactical damage. We’re already seeing it.

In short, the higher up and to the right, the stronger.

As always, Premium Members can rewatch the Conference Call and view the slides here!

We hope you enjoyed our recap of this month’s call. Thanks for reading, and please reach out to us with any questions!

Be the first to comment