Hi colleagues,

A bank guarantee is a pledge on the part of a bank to make good someone’s debt in the event that he or she cannot pay it. This type of guarantee is essentially an agreement to stand as a consigner on a transaction. In the event that the original party cannot follow through, the bank can be called upon to provide the payment.

Perquisite

- Organizational Configuration e.g. Company code additional data, Valuating area, Valuations Class, Account code, Position management procedure. (applicable for all Products types) (will explain in separate Blog)

- Business Partner as Counter Party

- Letter of Credit Configuration under Trade Finance. (will explain in separate Blog)

Key focus of this blog is frontend process of Letter of Credit in SAP

A-Create Contract/Order – Issue Letter of Credit

A letter of credit is essentially a financial contract between a bank, a bank’s customer and a beneficiary. Generally issued by an importer’s bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

Letters of credit are used to minimize risk in international trade transactions where the buyer and the seller may not know one another.

If you are an importer, using a letter of credit can ensure that your company only pays for goods after the supplier has provided evidence that they have been shipped. It also allows you to conserve your cash flow, since you don’t have to make any advance payments or deposits to the exporter. Finally, the letter of credit gives you instant credibility with an exporter by demonstrating your creditworthiness.

In this step, create a transaction for issued Latter of Credit.

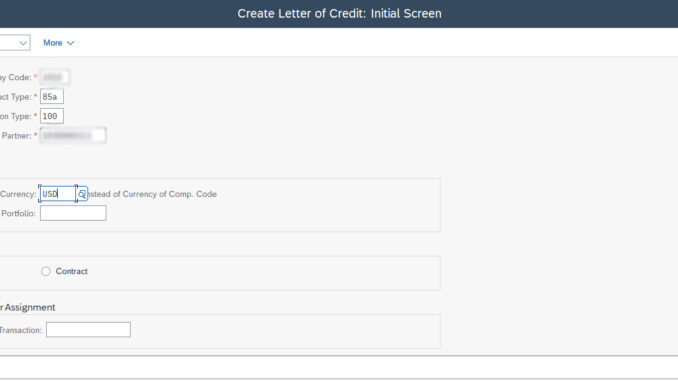

Fiori App: Open Create Letter of Credit (FTRTLC01)

Company Code: Enter Company code

Product Type: 85A (SAP provided or we may create our own)

Transaction Type: 100 (Issue)

Counter Party: Counter Party (Bank/Financial institute)

Currency: USD or any other

Amount: 1M (1M = 1000000.)

Start Date: 01.01.2024

End Date: 31.03.2024

Tolerance: 5%

Confirm Instruction: Confirm

Beneficiary: Vendor/Supplier (First create as Business partner and then assign here. Same as used in Purchase Order)

Advising Bank: Bank (Advising Bank of Vendor/Supplier, First create as business partner with role Bank then assign here)

Purchase Order: PO Number (PO created in MM module, assign here)

Incoterms: Choose

Shipment Period: From and to Date for Shipment as agreed with Vendor/Supplier

Shipment: 04 for Sea

Contract Date: Date when LC opening request initiated

Contact Person: Bank Personal

External Reference: Document number of Bank

Collateral Tab (Optional)

Facility Assignment: Click on create button in front of Facility and add facility transaction number. Before adding here first we need to create facility with product type 56A or 56B. Facility are Revolving credit facility or credit line issues by bank to corporate. Mostly credit facility used in Bank Guarantee and Letter of Credit are Non-funded facilities issues by the bank.

Cash Collateral: Add Cash Collateral details if applicable.

Administration Tab

Portfolio: Add here

Gen Valuation class: Add general Valuation Class here or we may assign in customization and it will be auto pick

Other Flow Tab (Optional)

Here we can add any kind of charges, Taxes, Fee applicable on LC and payable towards Counterparty

Payment Details Tab

Here we assign House Bank and Account ID for inflows and out flows. Normally this information is auto filled from Counter party master data or we may add it manually.

Click on Fee condition Button (Optional)

Here we can add fee condition if applicable

Cash Flow Tab

Here we can review generated cash flows based on added information on previous. We may double click on any line to check their detail or change information like applicable exchange rate

Click on save button. Transaction will be saved and number will be assign to it.

B-Convert Order into Contract – Issue Letter of Credit

If we request a commercial bank to issue a Letter of Credit for our company’s oversea trade, normally the commercial bank will require your company to either provide cash collateral or consume our company’s credit line facility in the bank. The commercial bank will also charge a letter of credit fee for this service.

In this step, we will convert LC Order into Contract for issuing Letter of Credit, and maintain relevant fee in the system.

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Here we have two options Execute Order (click on this button) or Order Expiration (if we will choose this option then no further processing, we use this option when LC is not required further)

This App also work as report, we may get details of BGs and LCs.

LC Number: issued by the bank

Port information: As shared by Vendor/Supplier

Add Documents

There are number of documents related to LC, we can attach document here. Click on add Row button then select and add document. Approve or Reject.

We can attach document any time, open same app click on change button and attach document.

Click on save button.

C-Settle Contract – Issue Letter of Credit

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Click on Settle Button

This App also work as report, we may get details of BGs and LCs.

Transaction is settled (Validated) after settlement there are fewer options to change. Activity number changes for each Process

Order = 1 Activity

Contract = 2 Activity

Settled = 3 Activity

D-Display Position Flows report – Issue Letter of Credit

Fiori App: Open Treasury Position Flows (TPM13).

Enter company code, Payment Period same as Transaction start and end date and Transaction number and then execute report

All the flows related to Transaction are displayed here. Here we can see the column Update type with Values e.g. TF1100+ and TF1206-. Financial document are posted against these update type. How we can assign and which GL need to assign to These Update type are explain in detail in my other Blogs for LC configuration and GL account Assignment.

When we will add presentation, Update type for Presentation will also be added so review this report again after adding Presentation.

E-Post Contingent Liability to Financial Accounting– Issue Letter of Credit

Fiori App: Open Post Flows (TBB1).

Enter company code, Transaction and Payment Date

First execute in Test mode

Update type TF1100+ is configured for Debit Technical clearing Account and Credit Contingent Liability Account. In Balance it show as Liability until it is completed.

Also it depend on Organizational requirements, Which GL account need to be configured for this. After posting if we check again report these two flows are fixed and Financial Document is generated.

F-Generate Payment Request for Collateral and charges – Issue Letter of Credit

Payment steps involved in Letter of Credit, including payment of bank fees and cash collateral. If you exclude the collateral from the payment process in the previous step, then only bank fees will be handled.

If the outgoing payment is initiated by the bank, skip the Generate Payment Request and Process Payment Request procedures because no requests are required.

Each financial transaction contains flows that must be paid. When creating the transaction, the payment request can be selected as required (usually only for outgoing payment in practice). The treasury back office uses the Pay Only functionality in the Post Flows (TBB1) app to create the payment request for outflows that require payment request. It does not create postings in financial accounting.

Fiori App: Open Post Flows (TBB1).

Enter company code, Transaction, Payment Date and choose Pay only

First execute in Test mode

If we will not click on pay only option then Financial Document and Payment request will be generated.

Payment Request will be generated.

After success, run same without Test run check

G-Process Payment Request – Issue Letter of Credit

We use Automatic Payment Transactions for Payment Requests (F111) to start the Payment Program for Payment Requests. The payment program for payment requests app provides another automatic payment option in the SAP system. Unlike the standard payment program, the payments are based on payment requests, not on open items (vendor/customer items).

Fiori App: Open Automatic Payment Transactions for Payment Requests (F111).

Enter run Date and Identification and then click on parameter button

Enter company code, Payment Method, Origin and then click on save button

Click on Proposal button and start proposal run

Once proposal Run is completed, we may display proposal log.

Click on Payment Run to post payment documents and print payments

H-Post to General Ledger – Issue Letter of Credit

With the posting functionalities, the posting related cash flows are transferred to the FI interface that generates the relevant postings in financial accounting. There are two SAP Fiori apps avail-able for posting flows:

Post Flows (TBB1): This SAP Fiori app supports to generate posting for incoming payment and outgoing payment without payment request. You cannot use this app to generate postings for outgoing payments that have been processed in the previous Generate Payment Request step with the Pay Only option.

Process Business Transactions (TPM10): We use this SAP Fiori app to generate postings for outgoing payments that have been processed in the previous Generate Payment Request step with the Pay Only option.

Fiori App: Process Business Transaction (TPM10).

Enter company code, Transaction ID, Date and execute in Test mode

On next Flows will be displayed, choose and click on Execute button

Update Type TF1900- Debit Collateral GL Credit Bank Outgoing

Update Type TF1901- Debt Charges Expense Credit Bank Outgoing

Click on Logs and Message button to view financial document

I-Rollover Contract – Issue Letter of Credit

After the Letter of Credit is issued by the bank, in case the amount or validity term of the Letter of Credit needs to be changed, you can negotiate with the bank to adjust the amount or term of Letter of Credit. Once the bank agrees to do the adjustment, you can roll over the Letter of Credit in the SAP system by changing the Letter of Credit amount or end of term.

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Click on Roll over Button

Here we need to extend end date of Contract.

Further we can increase collateral amount or charges. If these will be added then same payment and GL posting Apps will be used as showed above.

After we roll over a Letter of Credit transaction, we need to settle it again as we did before. We can proceed with further processes. Normally, we need to settle the transaction once you’ve received the updated Letter of Credit from the bank.

After Rollover next step is to settle the rolled-over Letter of Credit transaction.

The updated Letter of Credit normally comes with the new Bank Fees and Collateral. The process of these payments is the same as the process in the Letter of Credit Fees and Cash Collateral Payment step of the previous section. So repeat the process if applicable.

J-Add Presentation – Issue Letter of Credit

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Click on Present Button

Presentation Tab

Click on insert Row button to add Presentation

Add Presentation Details as shared by Vendor/Supplier

We can also attach document related to presentation, Process is same as we did earlier in this blog.

After adding required information click on save button. Flows related on Presentation are added. We post to vendor with Special GL for Presentation update type.

K-Accept Presentation – Issue Letter of Credit

In this process we check the presentation documents, and accept or reject the presentation in the system. If you accept the presentation, you post it to general account. After posting, a financial document and an L/C payable open item are generated.

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Choose Presentation item and click on Accept button

Here we have two options either accept presentation or reject presentation.

We can reject the exporter presentation in case of missing documents required under the letter of credit or any other compliance issues.

Check the Details and click on save button

L-Settle Presentation – Issue Letter of Credit

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Choose Presentation item and click on Settle button

Check the Details and click on save button

M-Import Bill – Issue Letter of Credit

We create an import bill advance loan by creating an interest rate instrument according to relevant steps in the Debt and Investment Management.

Note: Make sure that the Amount is within presentation amount. And for netting purpose, make sure that the start date of import bill advance loan is as the same as Payment Date of issued L/C.

Import bill is Bank loan, which means Bank will pay for LC now and we will pay bank full amount with interest on later date.

Fiori App: Open Process Trade Finance Transactions – Collective Processing (FTRTLC00).

Transaction: 167 (Created before)

Click on Execute Button

Choose Presentation item and click on change button

Under Financial we have two option create import Bill or Link import bill.

Click on Create import Bill Advance Loan button and details of loan

Click on Link import Bill Advance Loan button to attach a previously created loan deal.

Import Bill deal is totally separate deal in TRM module which is loan from bank transaction. Here we link it with Letter of Credit

N-Period End Closing – Issue Letter of Credit

We use the valuation function to value the positions of financial instruments based on historical cost or fair value for a given key date, and transfer the results to financial accounting.

Fiori App: Open Run Valuation (TPM1).

Choose OTC Transaction, Enter company code, Transaction, Month end date and choose Mid-Year Valuation with Reset

First execute in Test run then without it

Based on Position management procedure assigned to Product type valuation will be executed.

The Valuation Log screen is displayed. If a red traffic light is shown, click on it and check the error message. Solve the issue and perform a test run again until you resolve the error.

Note: sometimes there is no simulated posting because your selected transaction may not need valuation.

So remaining Processes are (These will be posted in the same way as described with same application TBB1, TPM10 and F111 in this blog)

- Post Payment obligation and Accept payment. Here we will post to vendor/Supplier account with special GL indicator same as did before. 1 TBB1 generate payment request 2 F111 post payment 3 TPM10 post to Financial Accounting.

- Later clear Vendor/Supplier account with invoice Use Vendor/Supplier clearing application.

- Post bank fee same as we posted bank changes and Collateral. 1 TBB1 generate payment request 2 F111 post payment 3 TPM10 post to Financial Accounting.

- Post flow for reversal of Collateral. Post with TBB1.

- Post flows for reversing the contingent liability and concluding LC. Post with TBB1.

Above 5 Process will be posted in the same way as we posted earlier.

Conclusion

Issue of LC is integrated process with Material Management and Financial Accounting module. Purchase Order, Goods Receipt and Invoice are posted from MM module. Financial document are posted in FI module.

I hope this blog will help to understand the complete process in LC in SAP, all possible scenarios are covered in this blog. Every Organization use different options according to their requirements specially posting to Financial Accounting.

Do like and Share

Cheers.

Be the first to comment