I just want to take a moment to thank everyone for all the kind words throughout the year.

Your support and this community you helped build is inspiring to us all.

I’m incredibly grateful.

Thank you.

Now let’s get into it.

Prediction #1: Stocks will Fluctuate.

At the turn of the 20th century, John Pierpont Morgan was asked how the stock market would perform.

He said, “It will fluctuate”.

And that’s the best answer any experienced investor could possibly give.

End of year targets?

lol

Did you see Wall Street Analysts come into the year with a consensus target of negative returns for the S&P500 in 2023?

It turned out to be one of the greatest years on record.

Are you paying attention to how this works?

We’ll take each day, each week and each month at a time.

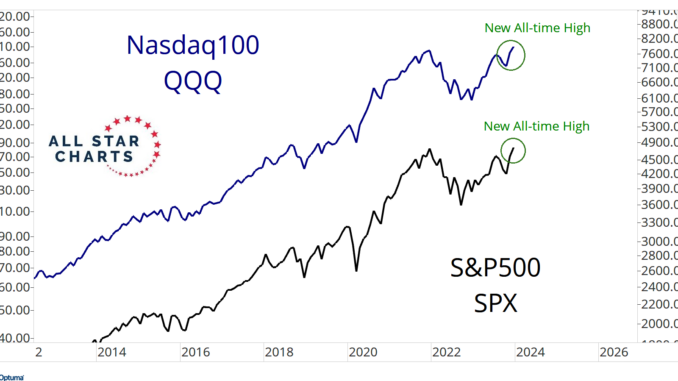

We know the trend for stocks is not down as both the S&P500 and Nasdaq100 just went out this month at their highest levels in history:

If you go back and study bear markets, you’re not going to find too many new all-time highs in those environments.

I encourage you to go back and see for yourself.

We’ll see rallies. And we’ll see selloffs.

Stock prices don’t go up OR down, they go up AND down.

Prediction #2: Humans Will Make Poor Choices

If there’s one thing we can count on is that investors will make bad decisions.

Instead of actually taking the time to look and count the stocks themselves, they will most likely rely on misinformation coming from criminally misleading outlets such as basic cable television, newspapers, social media and even their own financial advisors.

Humans just don’t want to look for themselves.

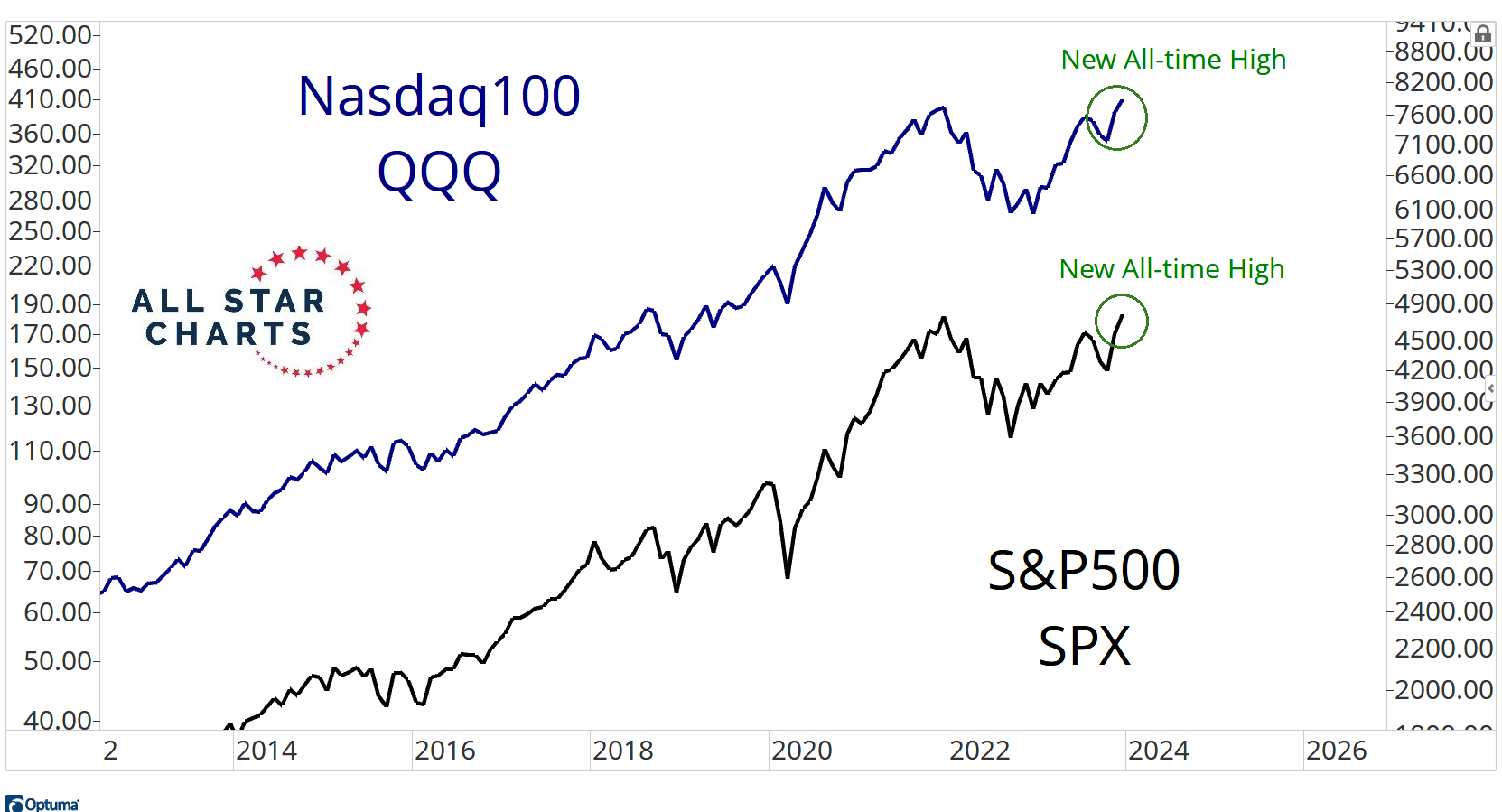

A great example this year was the false narrative of Small-cap stocks not performing while the large-cap indexes were grinding higher.

And of course, had investors just taken the time to go look, they would have noticed that while the Russell2000 Index may have had a tough time rising, until recently, the most important groups within Small-caps had already been ripping since 2022.

When you go back and study bull markets, you’ll notice how in the early stages of these new uptrends, the early leaders tend to be Industrials, Technology and Consumer Discretionary.

This time was no different, particularly in Small-caps:

Humans are bound to make poor choices.

As investors, it’s our job to exploit those bad decisions for our own personal gain.

Prediction #3: Cash Will Prove To Be Even Dumber

It’s amazing to me how many investors are running around bragging about their 5% yield in money markets.

I mean, just do the math. Sitting in cash could not have been a worse decision.

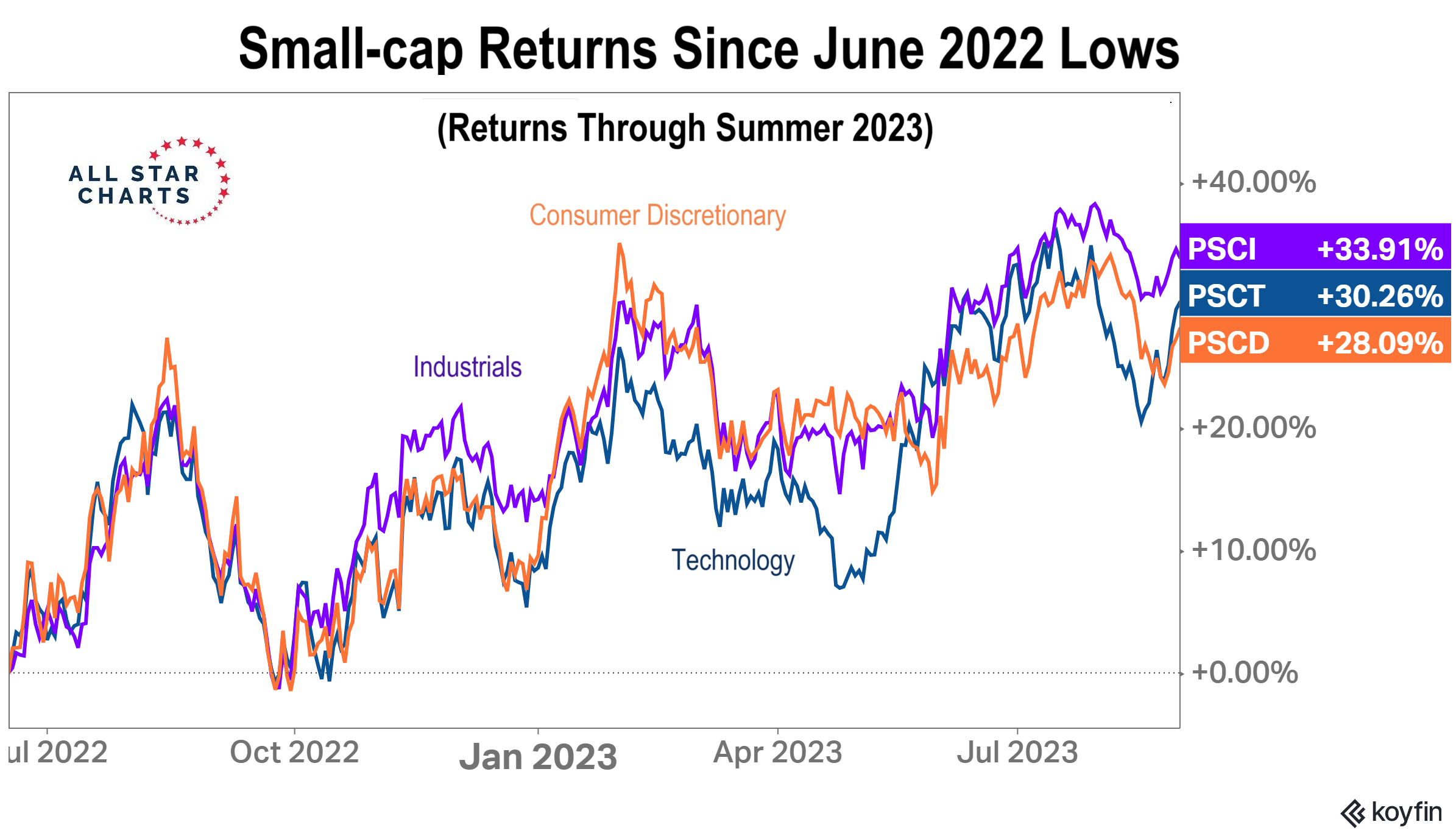

The S&P500 is up over 35%. The Nasdaq is up almost 60%.

Consumer Discretionary is up 30%. Industrials are up almost 40%.

Technology stocks are up almost 70%

Heck, even Financials are up almost 30%. So are Materials.

Notice how the worst performing sectors are the most defensive.

In fact, the worst performing sectors this cycle are historically the worst performers during bull markets.

Do you think that’s a coincidence?

The narrative is that you’re getting 5% risk free in your cash.

But the risk that they don’t tell you about is a little something called opportunity cost.

Imagine sitting in cash this whole time?

Ouch.

And a nominal 5% is hilarious. After you adjust that for inflation and pay taxes, you’re actually earning a negative return.

So you’re now looking at almost $6 Trillion in Money Market Funds, a new record.

And if you’re one of these people who think that Grandma getting 5% is a good decision, then fine.

Let’s assume 100% of the retail cash in Money Market Funds are grandmas locking in 5% (which we know isn’t true).

Well then what about the near $4 Trillion in Institutional assets in Money Market Funds?

These are professionals with career risk caught on the complete wrong side of this raging bull market.

Wall Street strategists predicted a down year for stocks in 2023.

These institutions are their clients.

It’s the blind leading the blind out there.

And my bet is that these humans will continue to make poor choices.

It’s our job to take their money.

Happy New Year!

JC

Our first LIVE video Strategy Session of the New Year is happening Tuesday, January 2, at 6:00 p.m. ET.

ASC Premium Members, click here to register.

During this LIVE Conference Call we will be discussing our favorite stocks to be buying this month, which stocks we want to be selling, and how the intermarket relationships will impact Energy, Gold and Interest Rates.

Be the first to comment