My favorite setups are stocks making new all-time highs after emerging from a consolidation.

My second favorite setup is a 52-week breakout.

We’re on the cusp of getting one in Autodesk $ADSK.

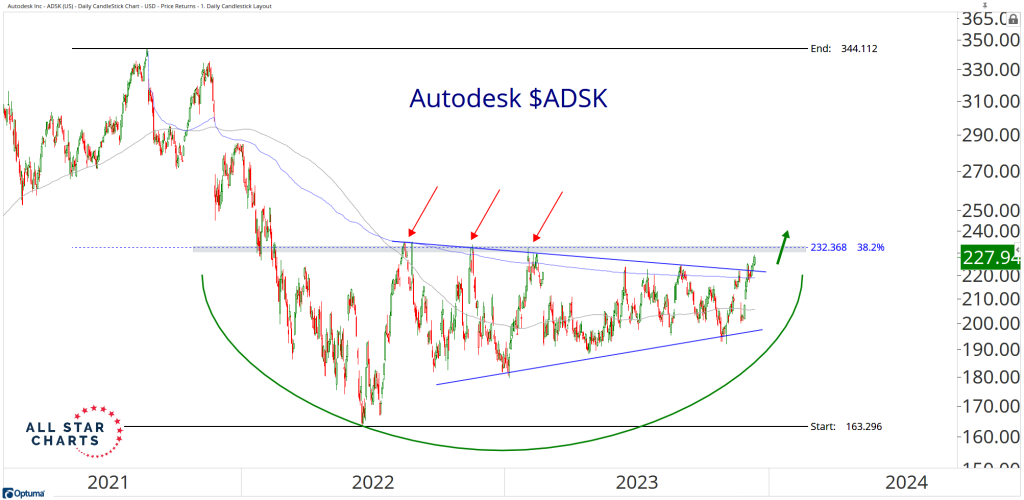

Check out this chart:

What we have here is a base that began forming in late 2021 and a nearly two-year-long tightening coil that appears to be concluding with a fresh break to the highest prices since February of this year.

Meanwhile, my analyst Steve Strazza commented to me that these less large but still large-cap tech stocks are catching nice volume flows.

I like it and I’m going to play it for a run back towards early 2022 highs in the $280 range.

Here’s the Play:

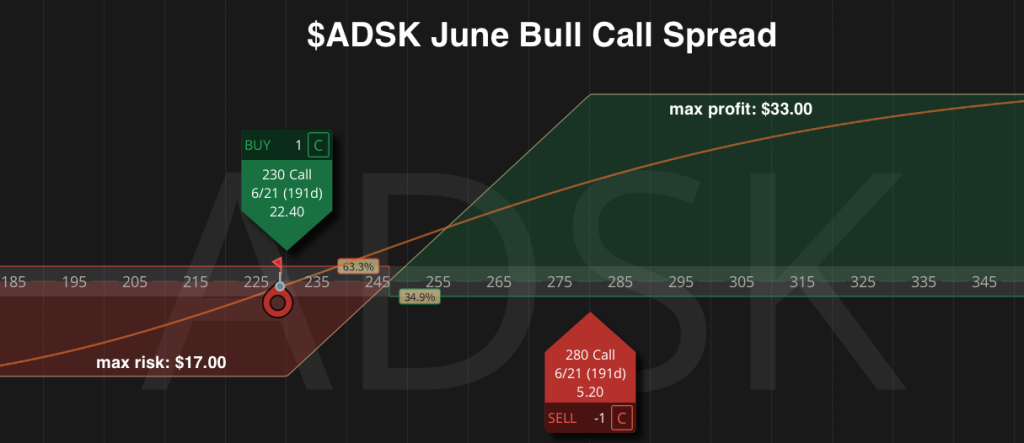

I like buying an $ADSK June 230/280 Bull Call Spread for an approximately $17.00 debit. This means I’ll be long the 230 calls and short an equal amount of 280 calls and the debit I pay today is the most I can lose:

But I’ll look to exit this spread to minimize any further losses under either of these two conditions:

- $ADSK sees a closing price below $220 per share. Or,

- The value of our spread losses 50%.

If either scenario materializes, I’ll exit this spread to protect my remaining investment in this trade.

Meanwhile, if/when $ADSK trades to/through $280 per share, I’ll look to take my profits on the trade. The most I can make is $33.00 on this spread, and the closer we are to the expiration day, the bigger my profit will be.

If you have any questions on this trade, please send them here.

If you missed last week’s video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7910.

Be the first to comment