Microsoft $MSFT announced earnings last night, and while the stock gapped higher at the open, it has spent most of the morning giving back much of those gains.

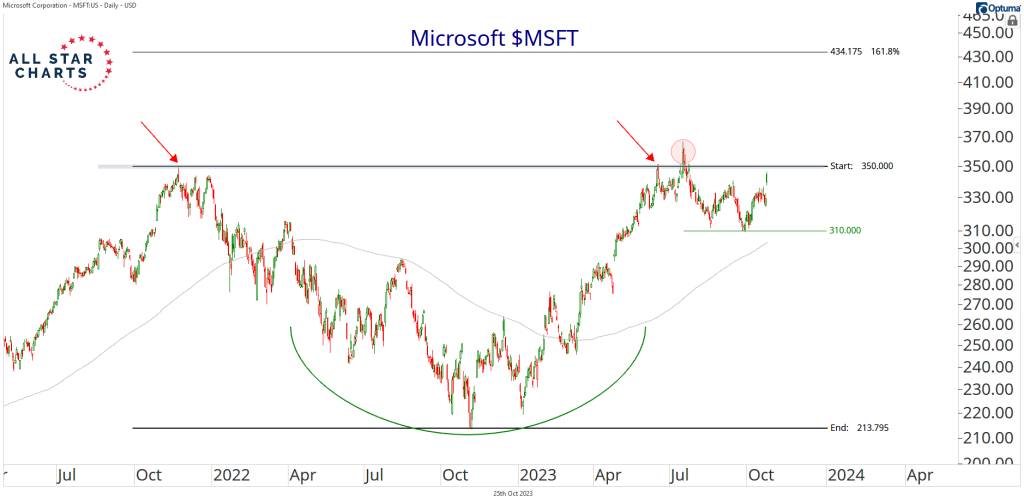

It looks to me that the prior trading range for $MSFT is acting as a powerful magnet. And the broader market weakness sure is helping things along in that regard.

At the end of the day, the market is telling us that the latest earnings report hasn’t really changed any minds of Microsoft bulls or bears, and therefore, we’re likely to remain stuck in this range until some new information reveals itself:

We options traders can benefit from this scenario.

There are still good options premiums available in out-of-the-money strikes, which makes it worthwhile to sell premium.

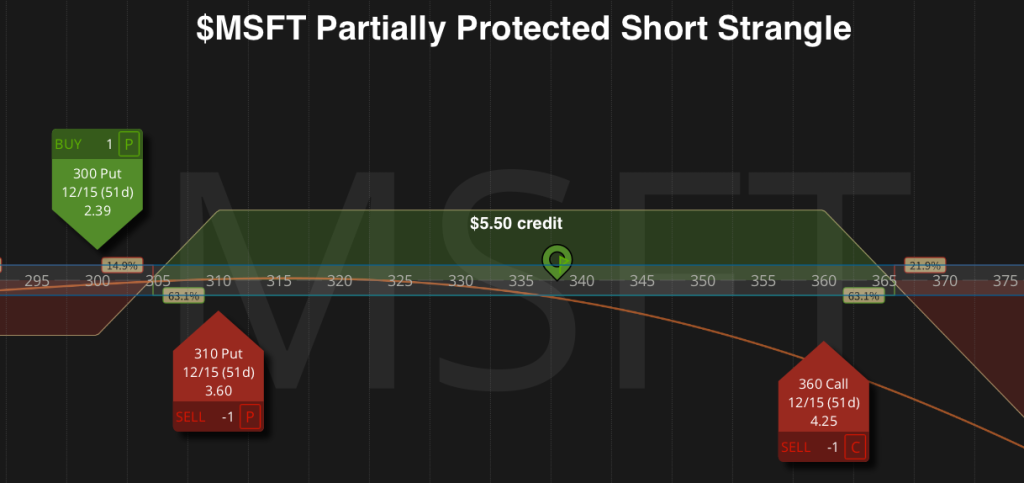

Under normal market conditions, I’d probably lean towards selling a strangle. This would involve both naked puts and naked calls. But given the dicey market backdrop, I’m concerned about downside risk, and less concerned about $MSFT printing new all-time highs before December options expiration.

So we’re going to sell a strangle and protect the downside.

Here’s the Play:

I like selling a $MSFT December “protected” strangle. I’m selling equal amounts of the 310 puts and 360 calls, and I’m also purchasing an equal amount of 300 puts. All in, I can get a net credit of around $5.50:

I’ll be looking to take the entire position off when I can close it all for about a $2.75 debit. This will represent a capture of 50% of the premiums I collect today. I’m looking to take the cream off the top and then move on to the next best opportunity. I won’t want to hold this all the way to expiration, as the longer I keep this position on, the more likely $MSFT will have a chance to break out of its range.

Meanwhile, if $MSFT loses the $310 support level, I’ll be looking to exit the trade, win or lose, because that is my signal that my rangebound thesis is broken. Similarly, if $MSFT makes a run back at all-time highs and closes above $360 per share, I’m out.

If you have any questions on this trade, please send them here.

If you missed last week’s video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7991.

Be the first to comment