If a new leg of the bull market is just getting started, positioning in the leaders should pay off well. With this in mind, we’re going to get involved in a name everyone knows and uses — Amazon. The odds are good that Amazon will deliver profits to those well-positioned for a run.

Implied volatility in the options affords us the luxury to go further out in time for our thesis to play out, but we’re going to cap our upside both because we think there will be some upside resistance that comes into play and also to increase our odds of success.

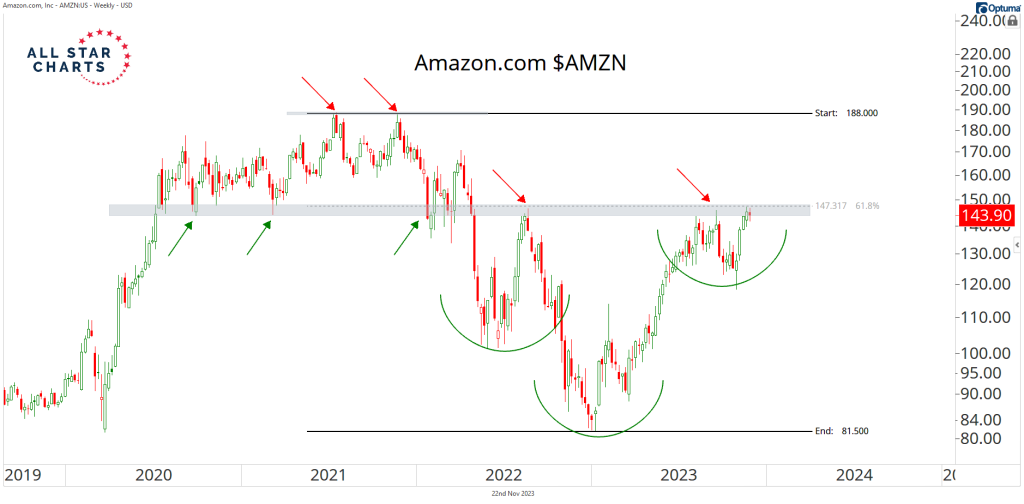

In a recent Hall of Famers report, Steve Strazza had this to say:

Amazon is in the process of reclaiming a critical level of interest as it looks to emerge higher from a bearish-to-bullish reversal pattern. If it’s above last August’s highs around 146, we’re buyers and looking for a run back to the old all-time highs.

On a relative basis, the stock is working its way higher after violating a three-year downtrend line versus the broader market. This kind of leadership reversal supports a move higher on absolute terms.

We want to own AMZN if it’s above 146, targeting 189 over the next 2-4 months.

$AMZN had a strong open today and it trading north of $147 at the moment. This is the signal that it’s time to get to work:

Here’s the Play:

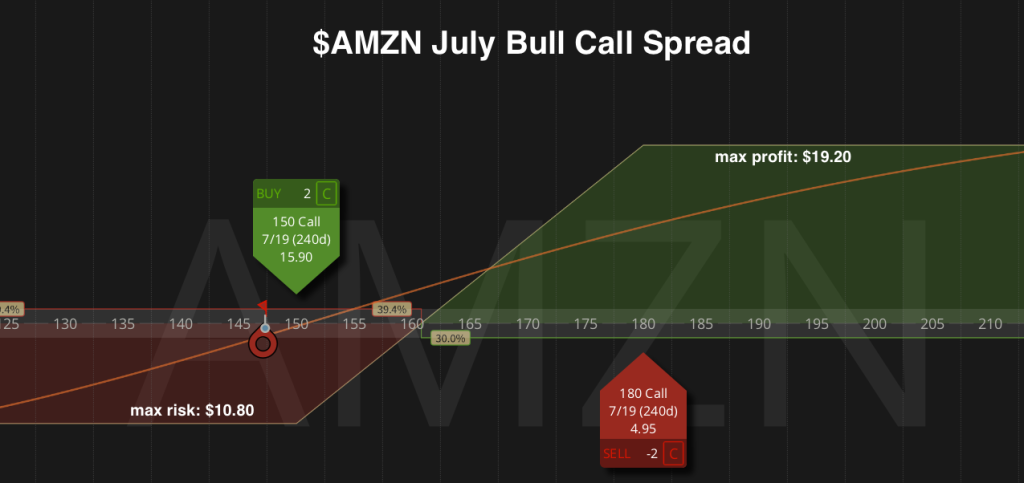

I like buying an $AMZN July 150/180 Bull Call Spread for approximately $10.80 net debit. This means I’ll be long the 150 calls and short an equal amount of 180 calls:

Our risk is defined to the premium we pay today. But our upside is capped as well. Considering my analysts think AMZN is likely to run into resistance around 189, I’m cool capping my gains.

As long as AMZN can hold above $140 per share, I’ll stick with the trade. But any close below $140 is my signal to close the trade and salvage whatever is left of the premium in the trade.

Meanwhile, I’ll continue holding this position for a run to the 189 price target. If/when AMZN gets there, that’s when I’ll close the trade and book the profit.

If we’re still in the trade on July 1st and the long 150 calls are in-the-money, then I’ll then begin trailing an aggressive stop at a 3-5 day low. But we’ll worry about that when we get there.

If you have any questions on this trade, please send them here.

If you missed last week’s video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7910.

Be the first to comment