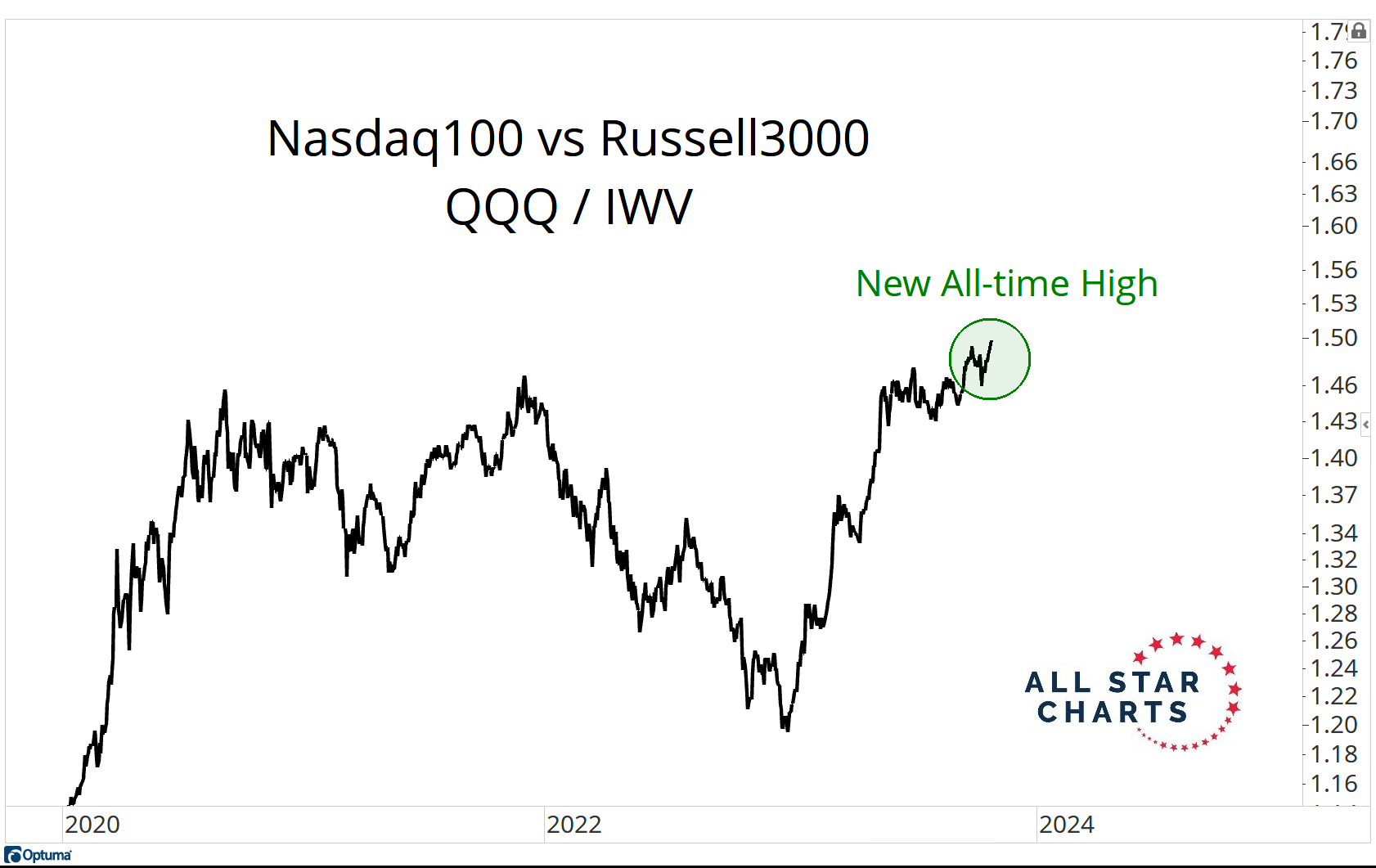

The Nasdaq100 index just went out at the highest levels in history relative to the much broader Russell3000 Index.

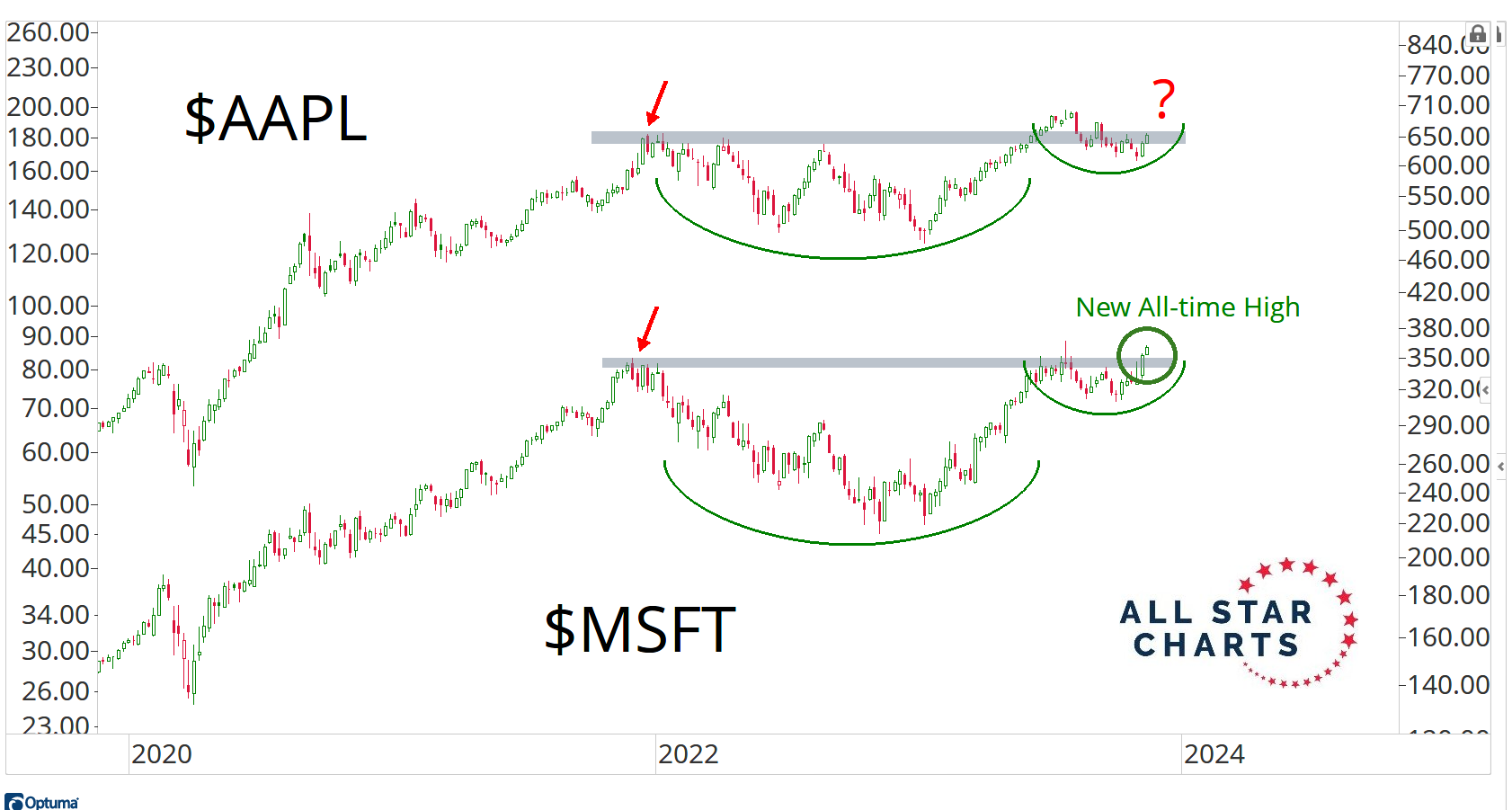

Technology represents about 50% of the Nasdaq100, with Apple’s weighting coming in at 11% of the index and Microsoft currently at just over 10%.

But the Nasdaq100 is a good representation of these mega-cap names, because Amazon, Google, Meta and Tesla all carry huge weightings. Remember, none of these stocks are in the Tech Index.

So the Nasdaq100 broadens it out to what most people consider “Tech”.

Here’s the QQQ hitting new all-time highs relative to Russell3000:

What’s funny is that I’m told this is, “Because of higher interest rates”.

But is it though?

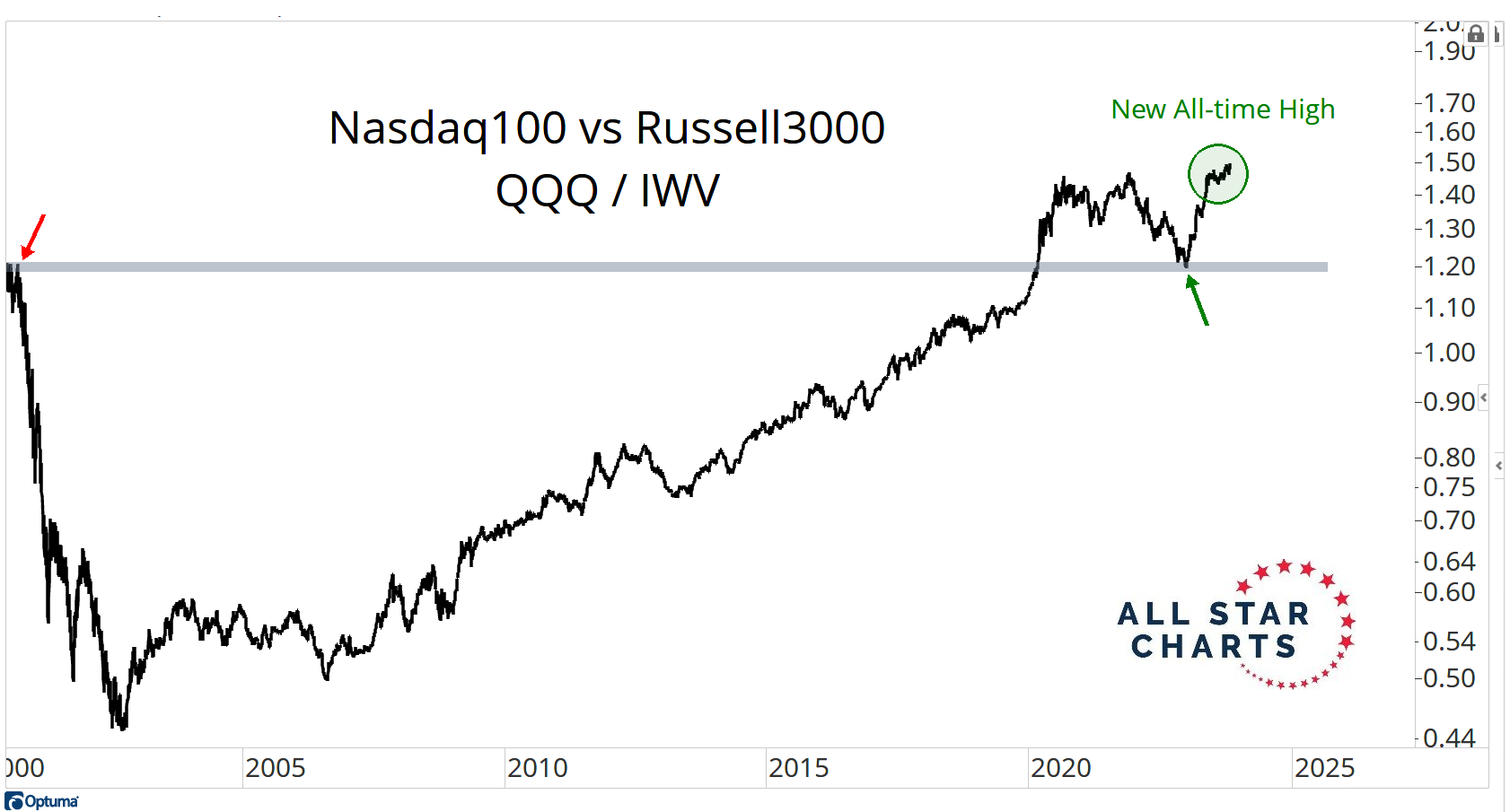

This line has been going up for over 20 years:

Seems to me like this trend is NOT because of higher interest rates because that doesn’t make any sense at all.

This line has been going up during a time of unpresented levels of low interest rates. And now it’s still going up despite the recent changes in rates.

To me, this line is going up because the big stocks keep getting bigger.

That’s the trend.

Some people don’t like that, for whatever reason.

But that’s their problem.

It’s not up to us to “like” a trend or not.

The real question is whether we’re making any money from the trend. That’s what I’m interested in.

And so that’s what we’re doing.

Last week we detailed a long Microsoft position. This week it’s making new all-time highs and breaking out of a multi-year base:

Is Apple next?

I think it probably is.

When you go back and study all the bull markets over the past 100 years, you’ll quickly notice how often Technology is a leading sector.

In fact, Tech is a leader during bull markets more consistently than any other sector.

So why should this bull market be any different?

Tech leading is perfectly normal.

Tech NOT leading would actually be strange.

Catch the replay for last week’s LIVE Call here and get all the details.

Let me know what you think!

JC

Be the first to comment