The billionaire hedge fund manager, Ray Dalio, famously stated that the key to his success was diversification. However, not in the classical sense. Instead, he meant diversification across investment strategies.

This means, if you strive for above average returns, you do not just diversify across asset classes (stocks, bonds, commodities, etc.) and regions, but you try to find investment strategies which are not highly correlated with each other and produce a positive return.

Then, your portfolio would look like if you have 10 different sources of income. These incomes do not depend on each other, hence they are not correlated. Just think about if you would earn $1k per month by selling digital products as well as receive $1k in dividends. Both incomes have nothing to do with each other. If the stock market tanks and dividends are cut to zero, you still have your other income. Now, let’s scale it up to 10 and you get the picture.

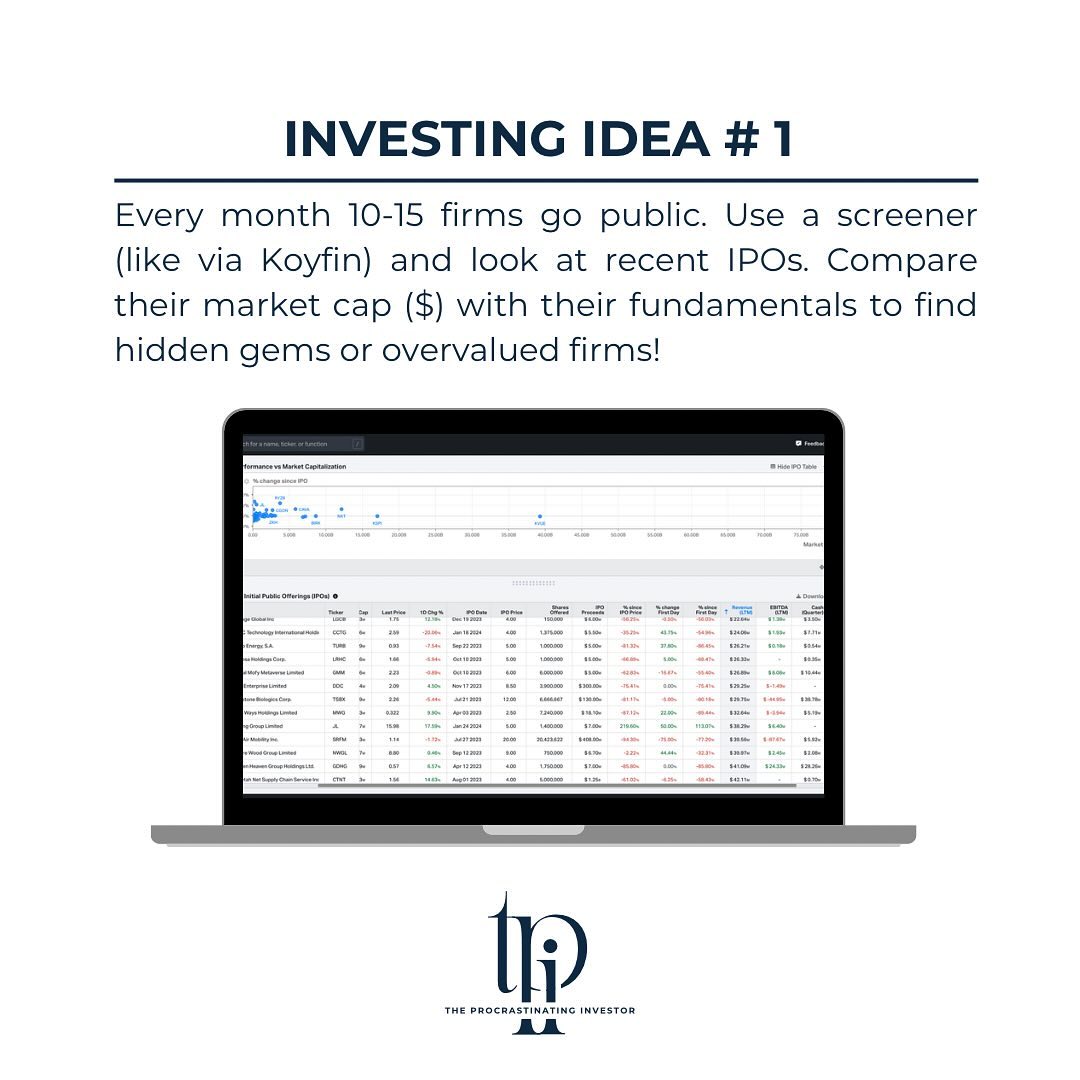

Right now, I try to research investment strategies. I try to find them, test them and if I found something interesting, I share my findings with you. The first one is about looking for brand new stocks – hence IPOs.

Investment Strategy #1 – IPO Basket

Idea: Screen for recent IPOs – Compare Market Cap with Revenues, Debt and some Multiples (P/E, PEG, EV/EBIDTA): Research hidden gems (Market Cap = Revenues or P/E < 10 with steady growing earnings) and invest. If you spot highly overvalued companies (Market Cap = 100x Revenues or more) look for more red flags. It might be a good short. Create a basket of 10 companies (small investments, e.g. 1% of your portfolio size) over time and see how they perform. On average, there are 10-15 IPOs per month! Research shows, that most investors overpay at IPOs. Two thirds underperform the market in a period of three years. So be careful and selective! #ipo #marketscreener #investingstrategy #trading #stockmarket #shorting #value #financialliteracy #koyfin

Be the first to comment