From the Desk of Ian Culley @IanCulley

The US Dollar Index $DXY is still dealing like an old-school ace on the mound.

I don’t care what stock market bulls or technology investors want to believe.

The buck has been lights out since July.

And just because it found itself in a bit of trouble last week doesn’t mean it can’t retire the side…

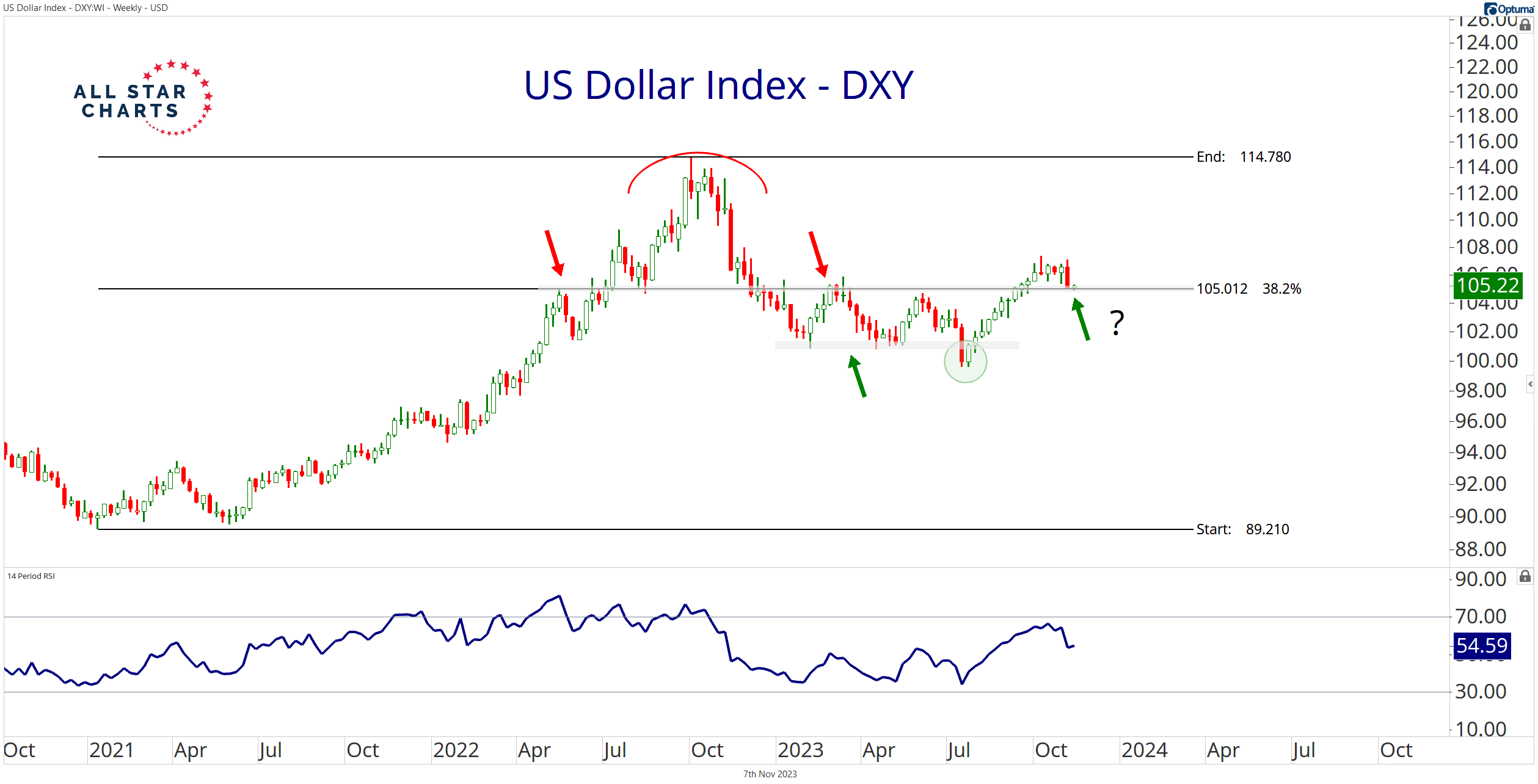

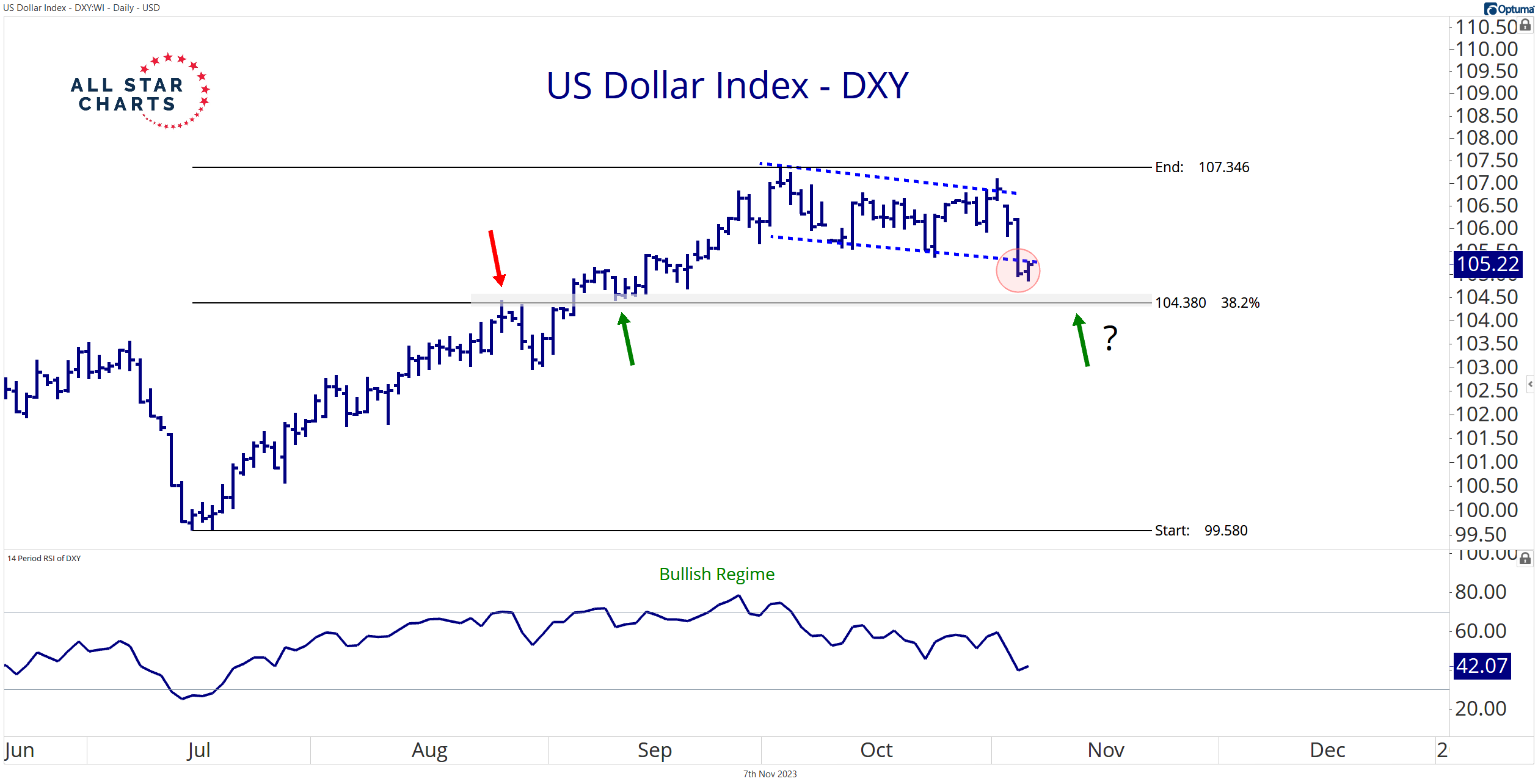

The index pulled back to a key retracement level at approximately 105 on Friday:

Unsurprisingly, the dollar bore down at this critical area as it coincides with a logical support zone.

But, when we take a closer look…

Sellers are digging in, seeing the spin on the ball, with runners in scoring position.

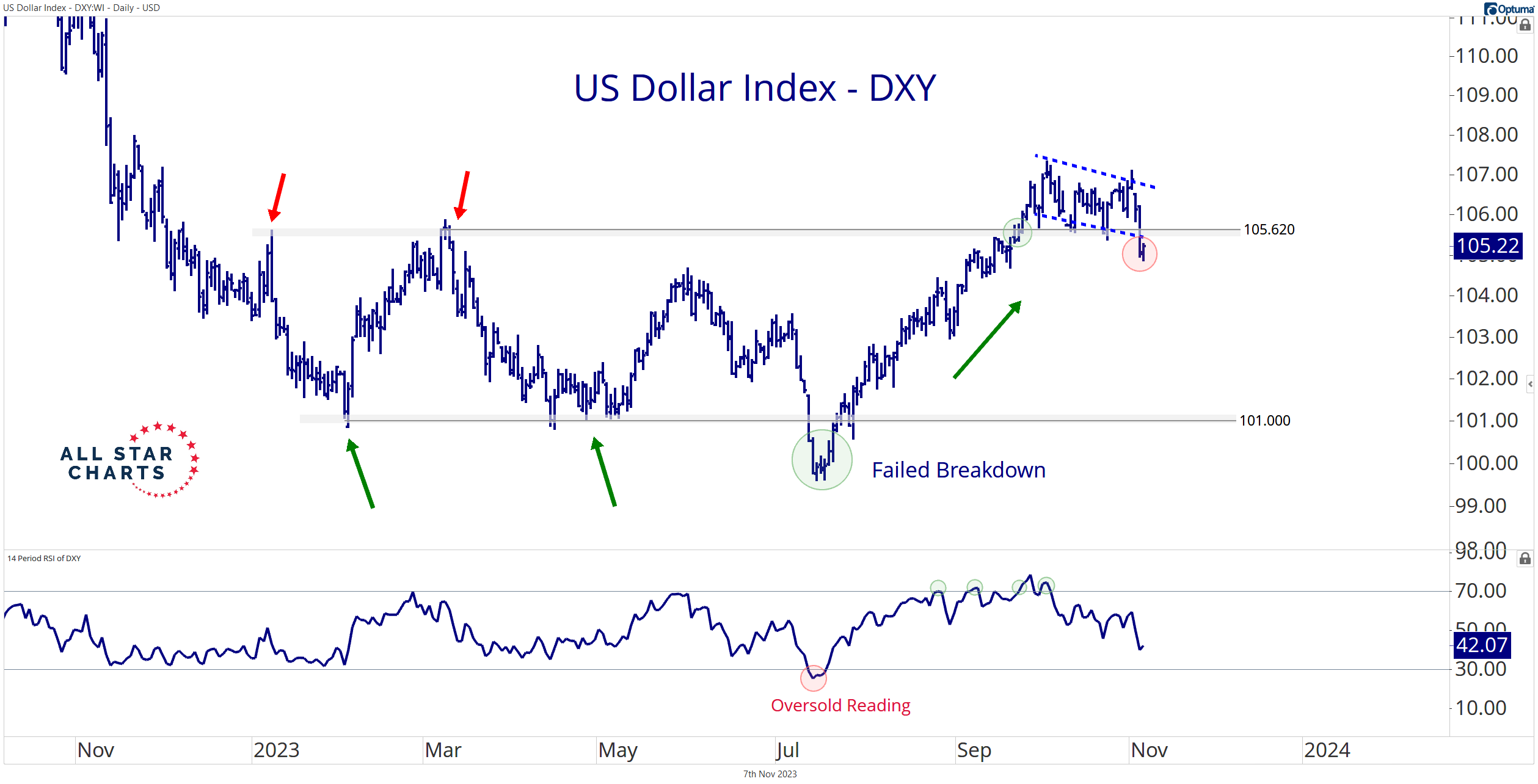

Check out last week’s breakdown:

The DXY undercut the January and March pivot highs from earlier this year.

Has it fallen behind in the count? Perhaps.

But, hey, we’re talking about the US dollar!

It’s been here before. In fact, it wasn’t that long ago that the dollar index found itself in a similar situation.

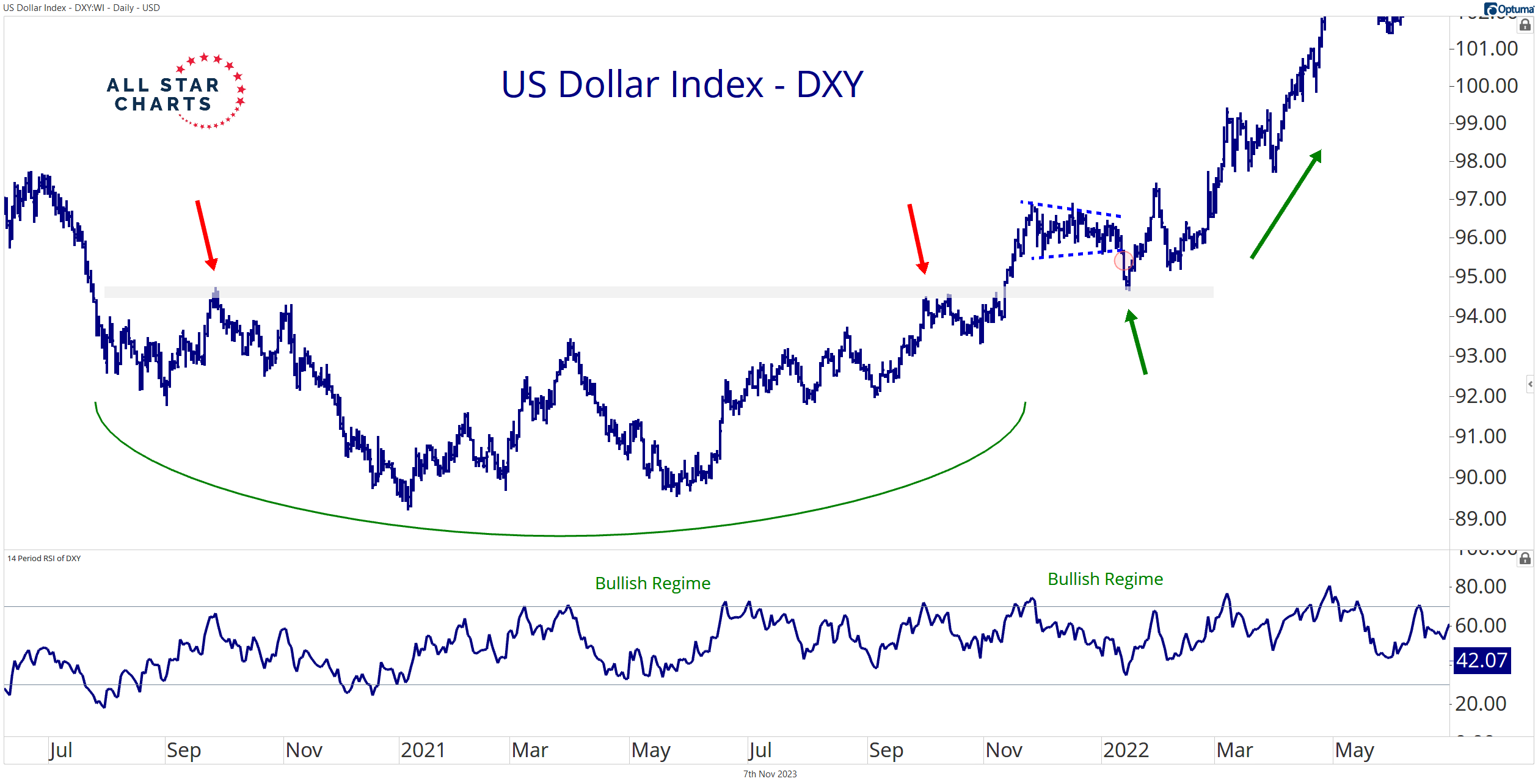

Recall January 2022, when the buck got itself in a jam, ultimately resolving lower from a short-duration bullish pattern:

The dollar dug deep with the principle of polarity as an aid – former resistance turned support.

(Feel free to check the DXY’s ball cap, it’s clean.)

The dollar index was untouchable over the following 10 months.

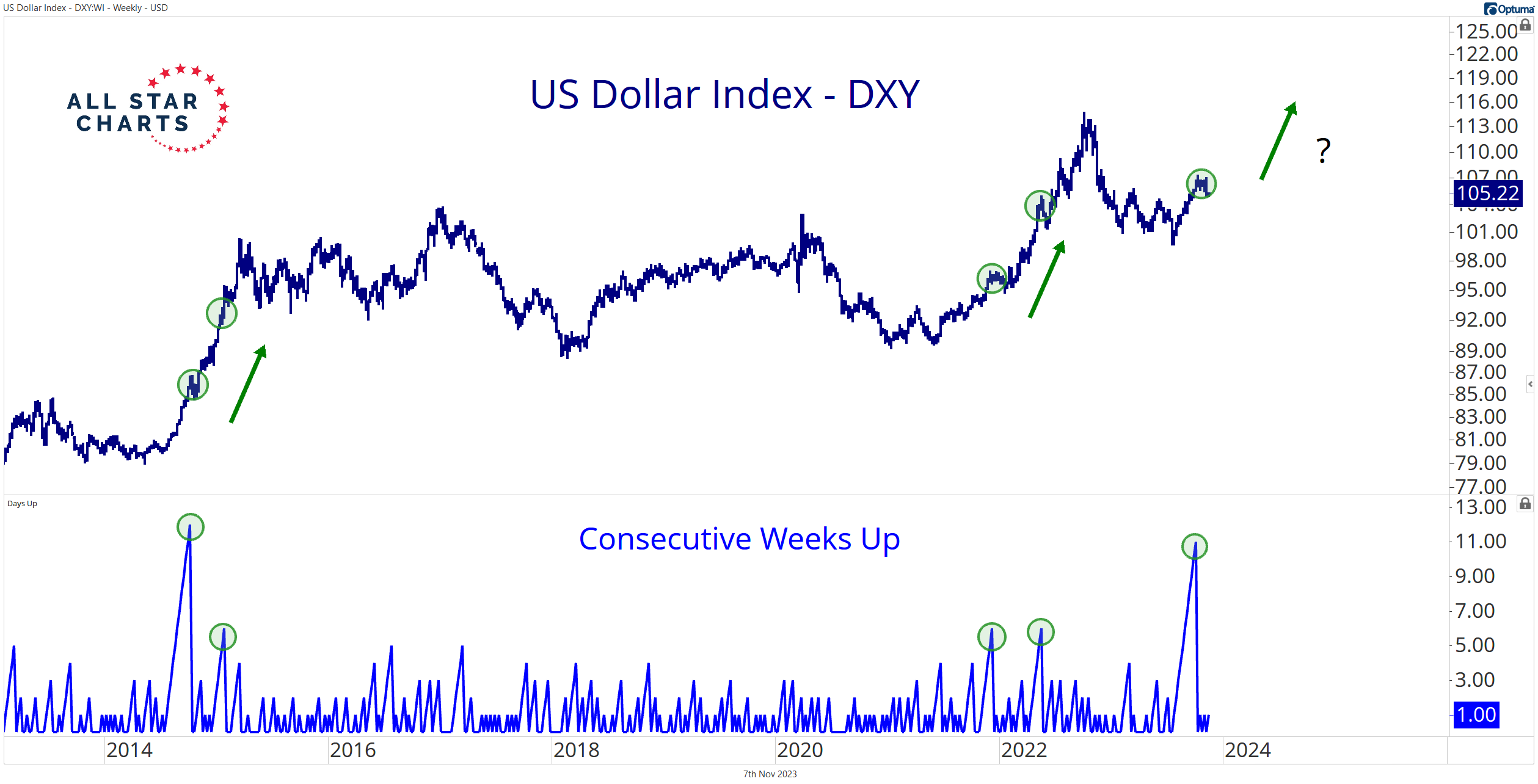

And, considering its recent winning streak, I have to give King Dollar the benefit of the doubt.

I understand past performance doesn’t indicate future returns…yada, yada, yada.

But 11 weeks of positive returns?

The DXY is a winner I don’t want to bet against – at least not yet.

If and when it falls below approximately 104.25, it’s time to consider making a change.

I imagine equities are warmed up and ready to go in that environment, as a weakening dollar has proven a strong tailwind for risk assets.

I’ll be ready when the time comes, but so far it hasn’t.

Stay tuned!

Thanks for reading.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment