From the Desk of Ian Culley @IanCulley

No Santa Claus rally, no worries.

So Santa was a no-show this season. The Nasdaq 100, the S&P 500, and Papa Dow are still managing to post positive monthly returns heading into January’s close.

That’s an auspicious data point for the rest of the year.

Beneath the surface, last quarter’s laggards are also playing catch up to the leadership groups…

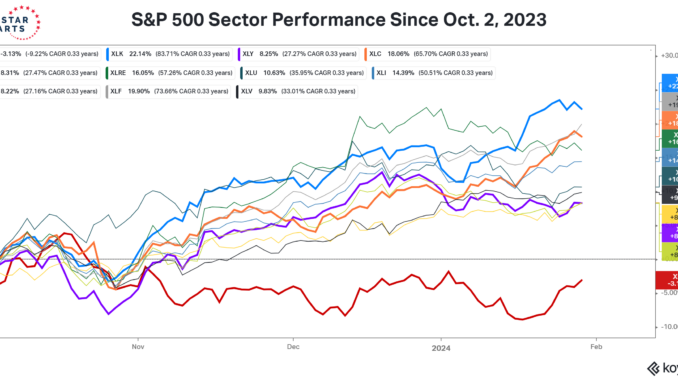

Check out the S&P 500 sector performance since the beginning of Q4:

The Energy Sector ETF $XLE is the biggest loser, the only sector to print negative returns over the trailing four months.

But it’s a bull market, ya know! And in bull markets, a rising tide lifts all boats.

Plus, stocks are heading into a seasonally weak period, a logical time of the year for the broader market to digest its gains and buyers to rotate into the laggards.

Here are three names to track in the coming weeks.

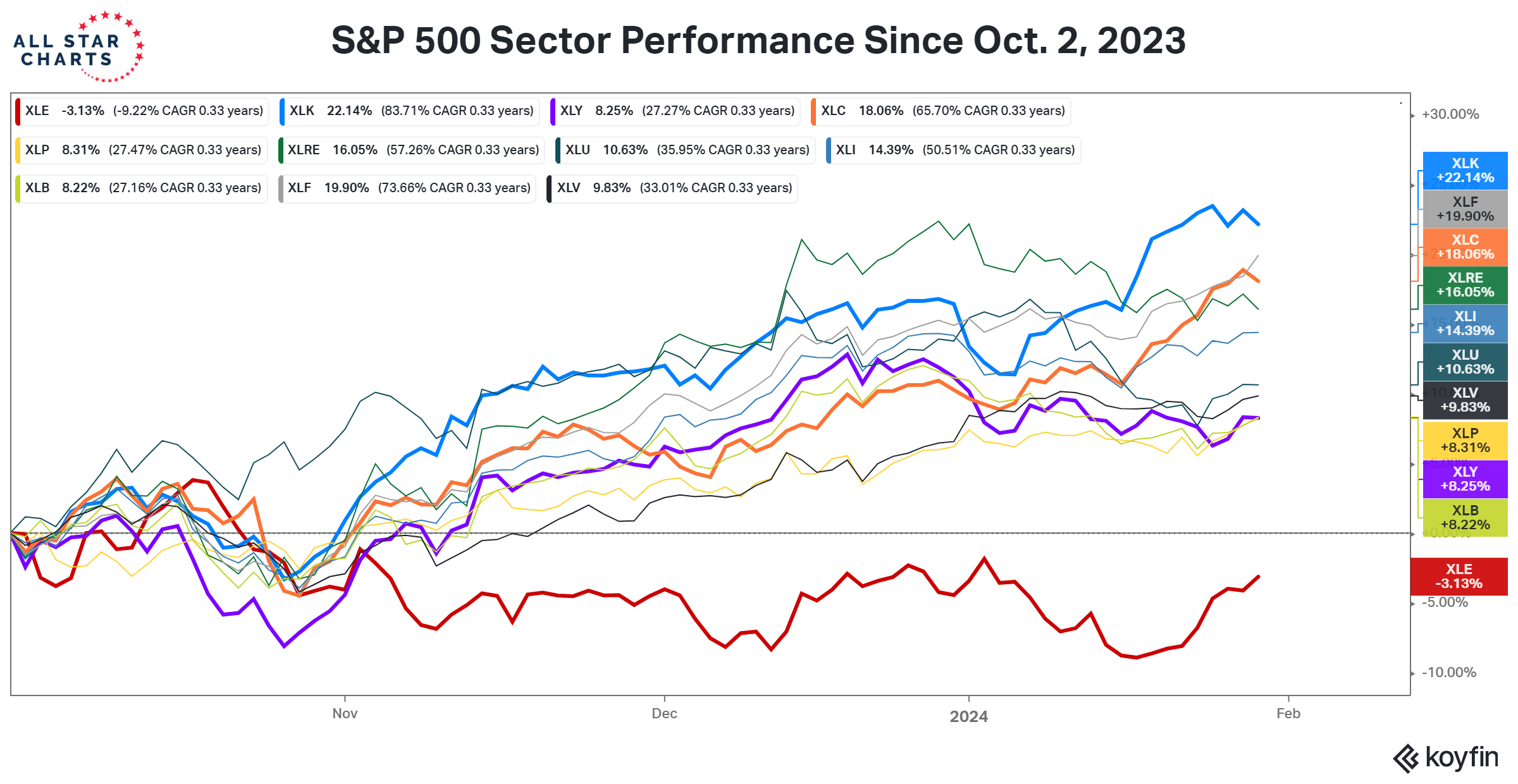

First up is Vista Energy S.A.B. $VIST, a $2B explorer & producer based in Mexico:

VIST is marching higher within a steady uptrend, respecting our extension levels every step of the way.

The 34.50 level marks a multi-month resistance zone and our line in the sand.

I like VIST long above 34.50, targeting 52.

To be clear, we can’t own Vista Energy until a decisive breakout above our risk level.

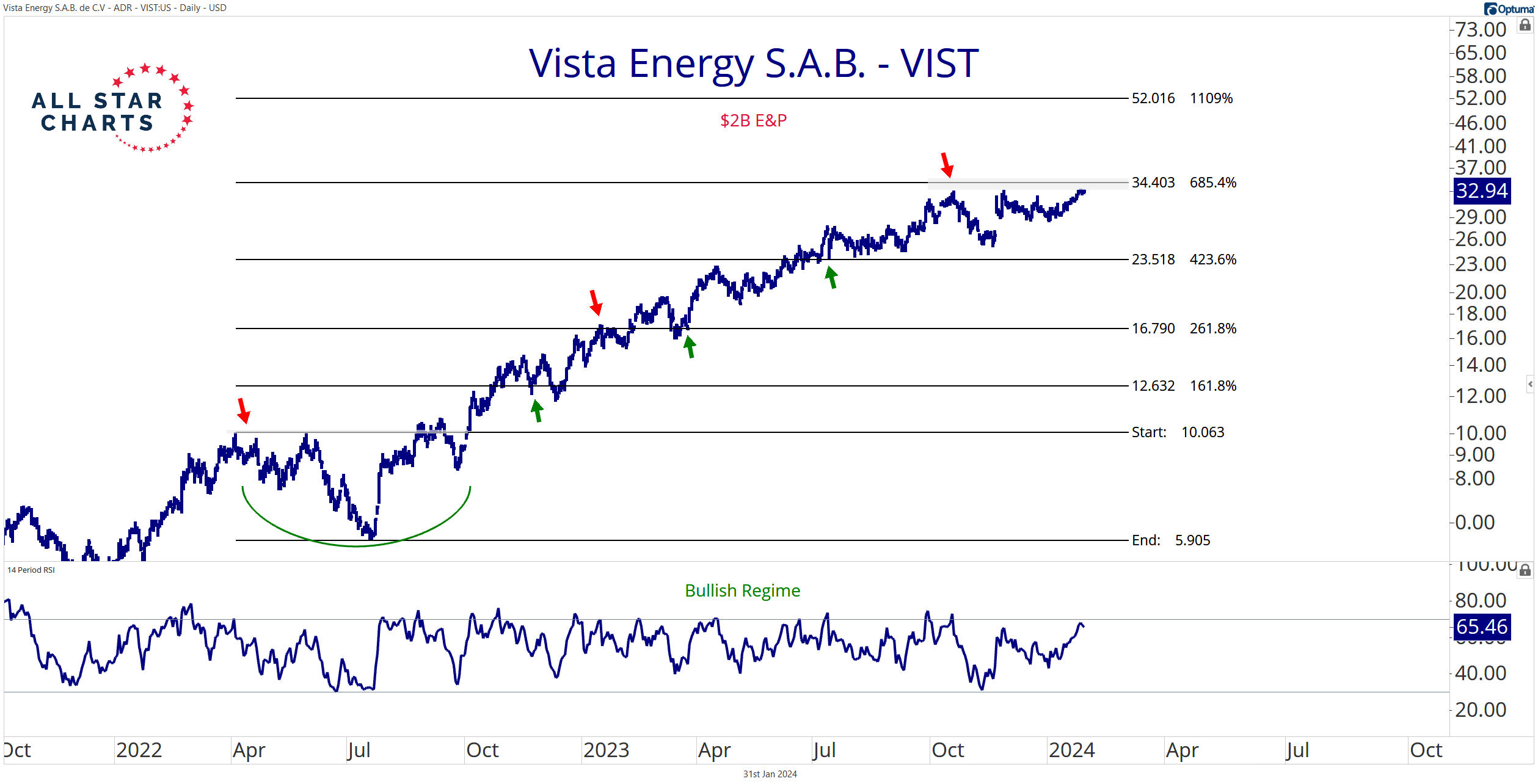

Next is Archrock Inc. (AROC), a $2.6B oil services name providing a juicy 4% dividend:

AROC is carving out a seven-year base and attempting to reclaim its former 2017 highs at approximately 16.50.

I want to buy the completion of this bullish reversal pattern within an upside objective of 28.50 (September 2014 high).

But breakouts from multi-year patterns can be messy. I refuse to hold AROC below 16.00. I’ll leave it for someone else if it slips back below that level.

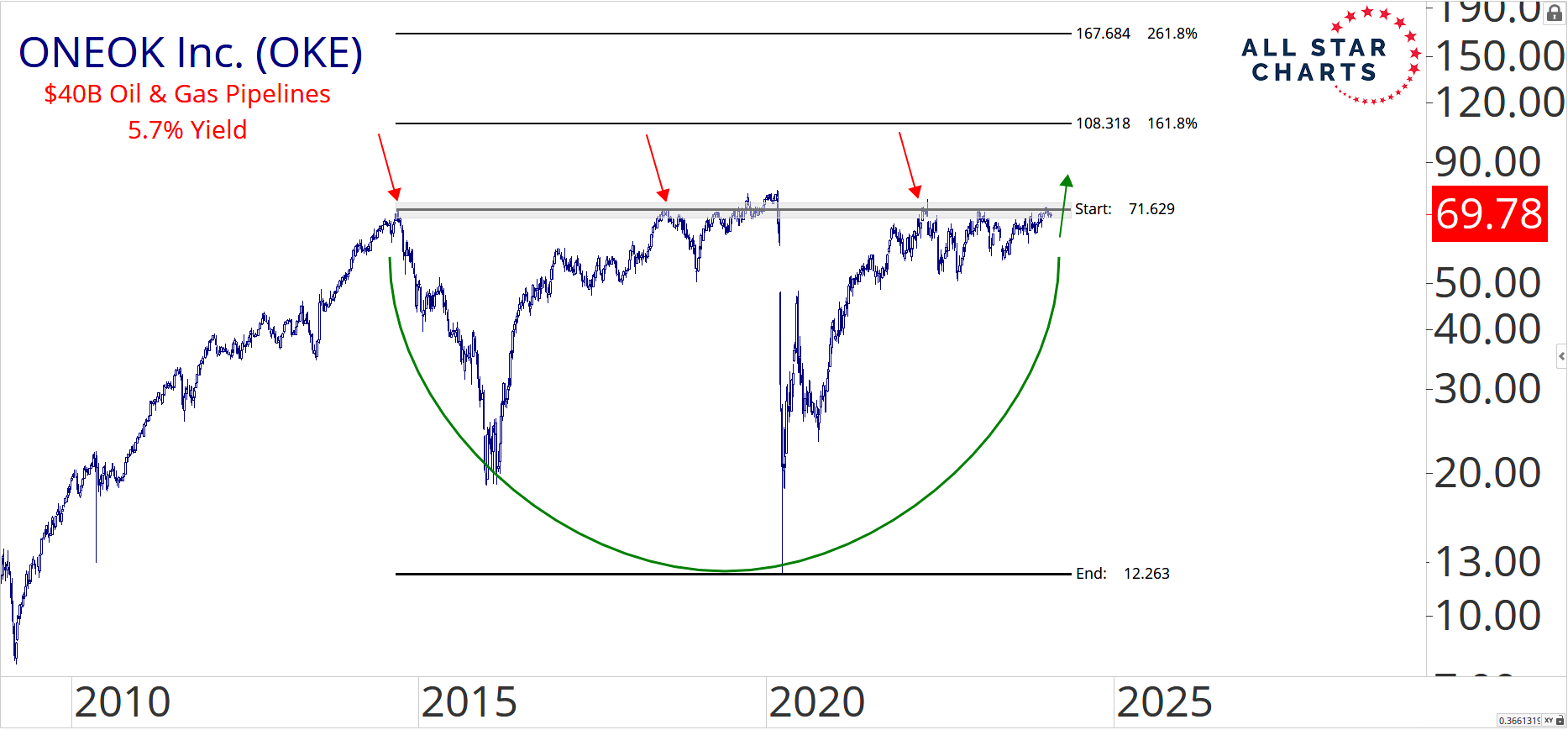

Last but not least, here’s ONEOK Inc. $OKE, a $40B oil and gas pipeline company with a 5.7% dividend:

OKE is challenging a shelf of former highs dating back to late 2014.

The game plan: Buy strength on a break above 72, targeting that one-hundred-dollar roll of 110 just beyond a key extension level. Simple!

But this is another multi-year base. The breakout will likely challenge our resolve. I won’t get caught holding this thing below 72.

Am I crazy for buying energy?

Should I give energy stocks a rest and move on to greener pastures?

– Ian

Be the first to comment