From the Desk of Alfonso Depablos @Alfcharts

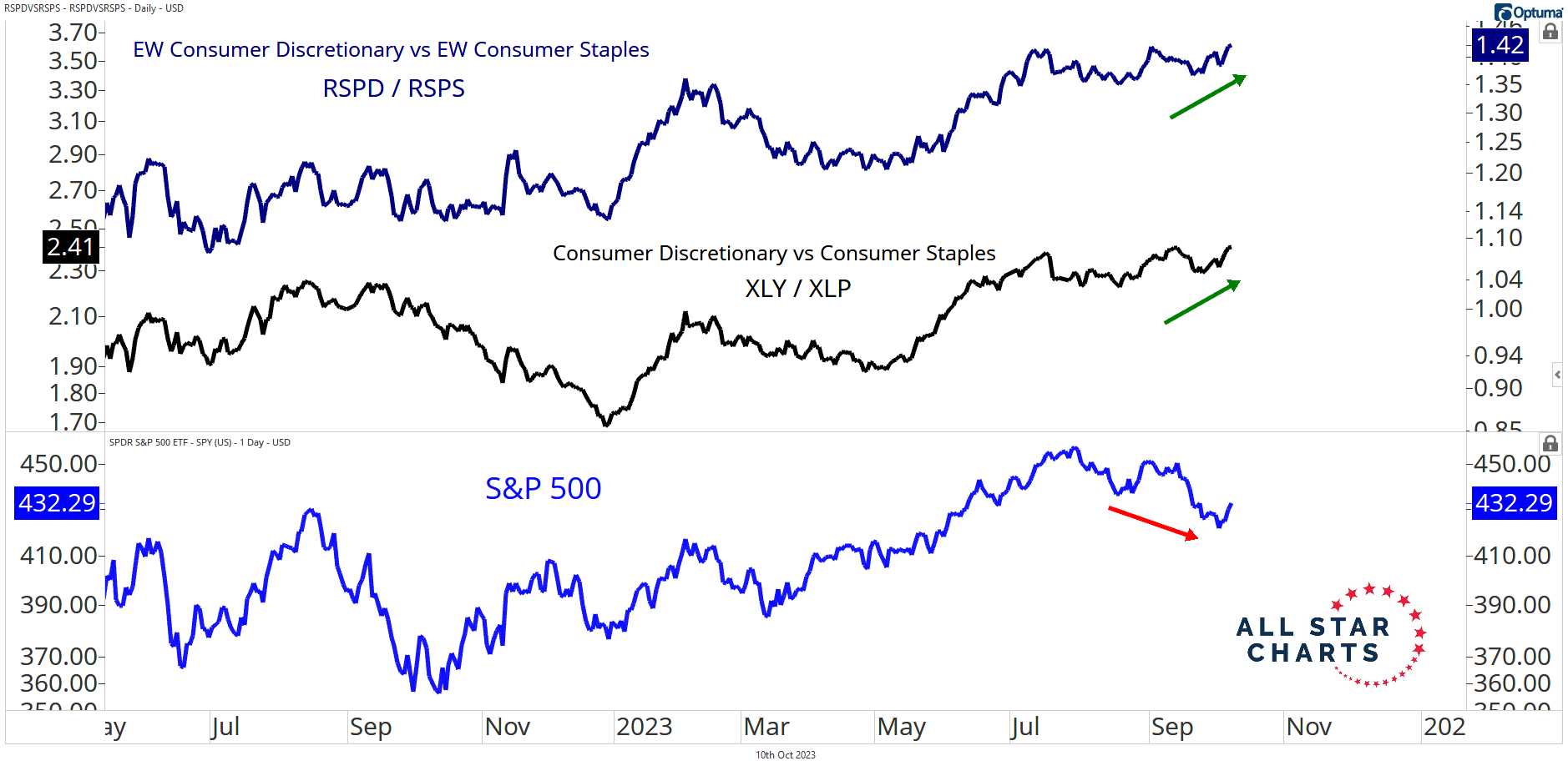

As the market has been sending mixed signals since July, we’re seeking information from our risk appetite indicators to try to gauge the next move.

One of our favorite ways to measure risk appetite is to compare the consumer discretionary sector with consumer staples. This tells us whether market participants are positioning themselves defensively, or embracing risk.

Discretionary stocks include automobiles, retailers, and homebuilders, among other things. Theoretically, we’re talking about products and services consumers buy with their discretionary incomes.

Meanwhile, staples are what “consumers” will buy regardless of how bad economic conditions get… things like food, toothpaste, cigarettes, etc.

When this ratio points higher, it illustrates a healthy degree of risk-seeking behavior among investors. Alternatively, when it points downwards, it speaks to a defensive tone and typically occurs during bear markets.

Despite lower lows for the S&P 500 in the last two months, we’re seeing higher highs from discretionary vs staples ratios.

This is true on both an equal-weight and cap-weighted basis.

Seeing these ratios make new 52-week highs indicates offensive positioning by investors and supports higher prices for risk assets.

We don’t foresee the stock market coming under increased pressure as long as these ratios remain strong.

As always, we love to hear from you, so shoot us a note and let us know what you think.

Alfonso

Be the first to comment