From the Desk of Ian Culley @IanCulley

Y’all know the drill…

That dominant inverse relationship remains firm as stocks rip and the dollar dips.

The market’s message is clear: Buy stocks, sell dollars.

If you trade the FX markets, I have two new setups to ride the falling dollar…

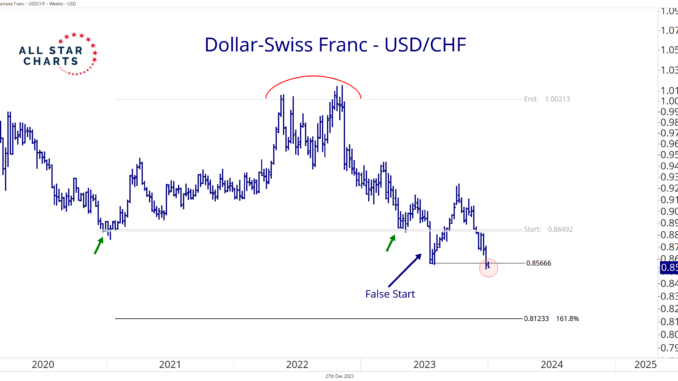

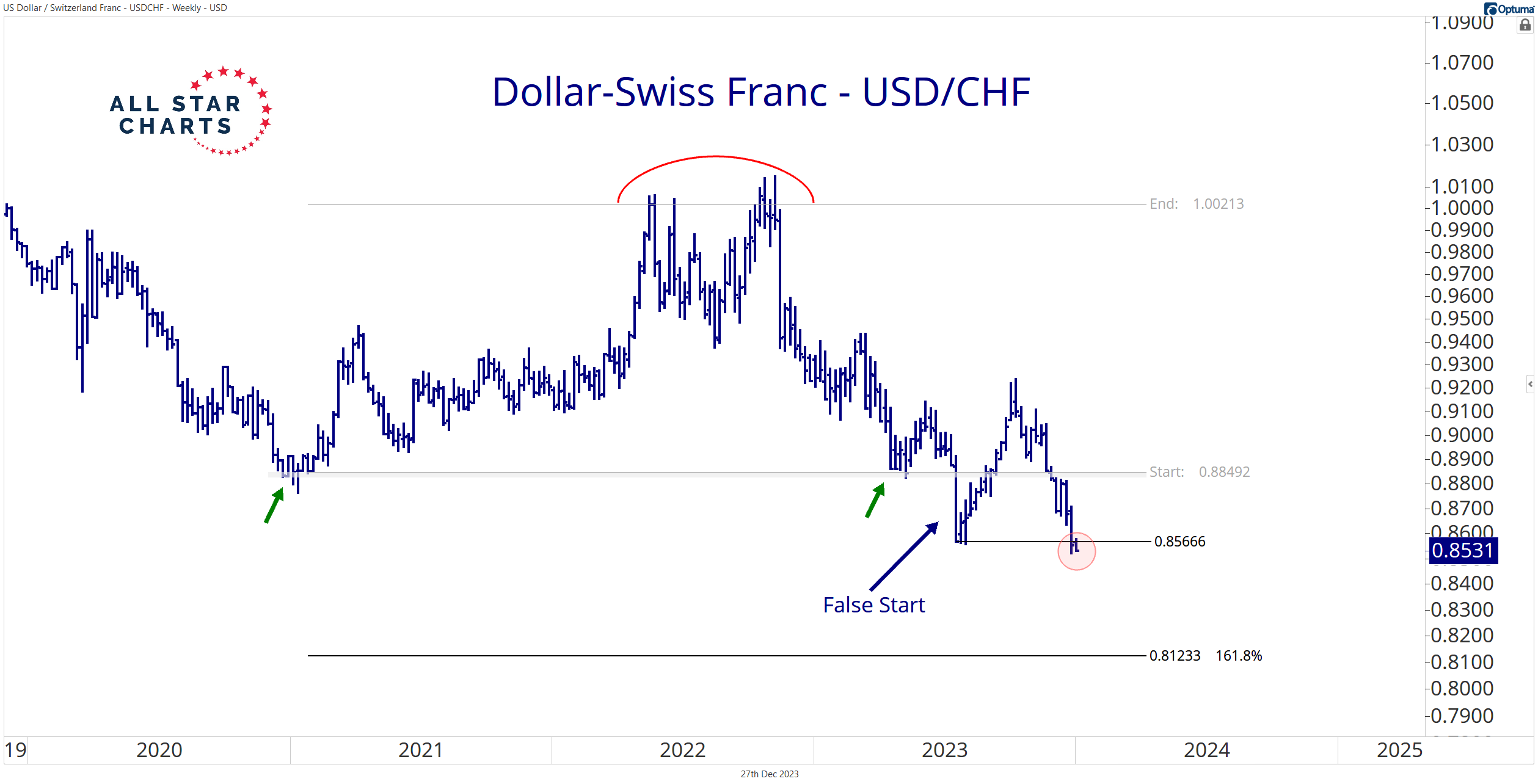

First up, the US dollar-Swiss franc pair USD/CHF:

I’ve been tracking a generational topping formation in the USD/CHF (bottoming formation in the Swiss franc futures) for most of this year.

It wanted to break down in July but lacked follow-through.

Today, the USD/CHF is printing fresh 8-year lows, flashing another sell signal.

I’m short the USD/CHF below .8575 with an initial objective of .8125.

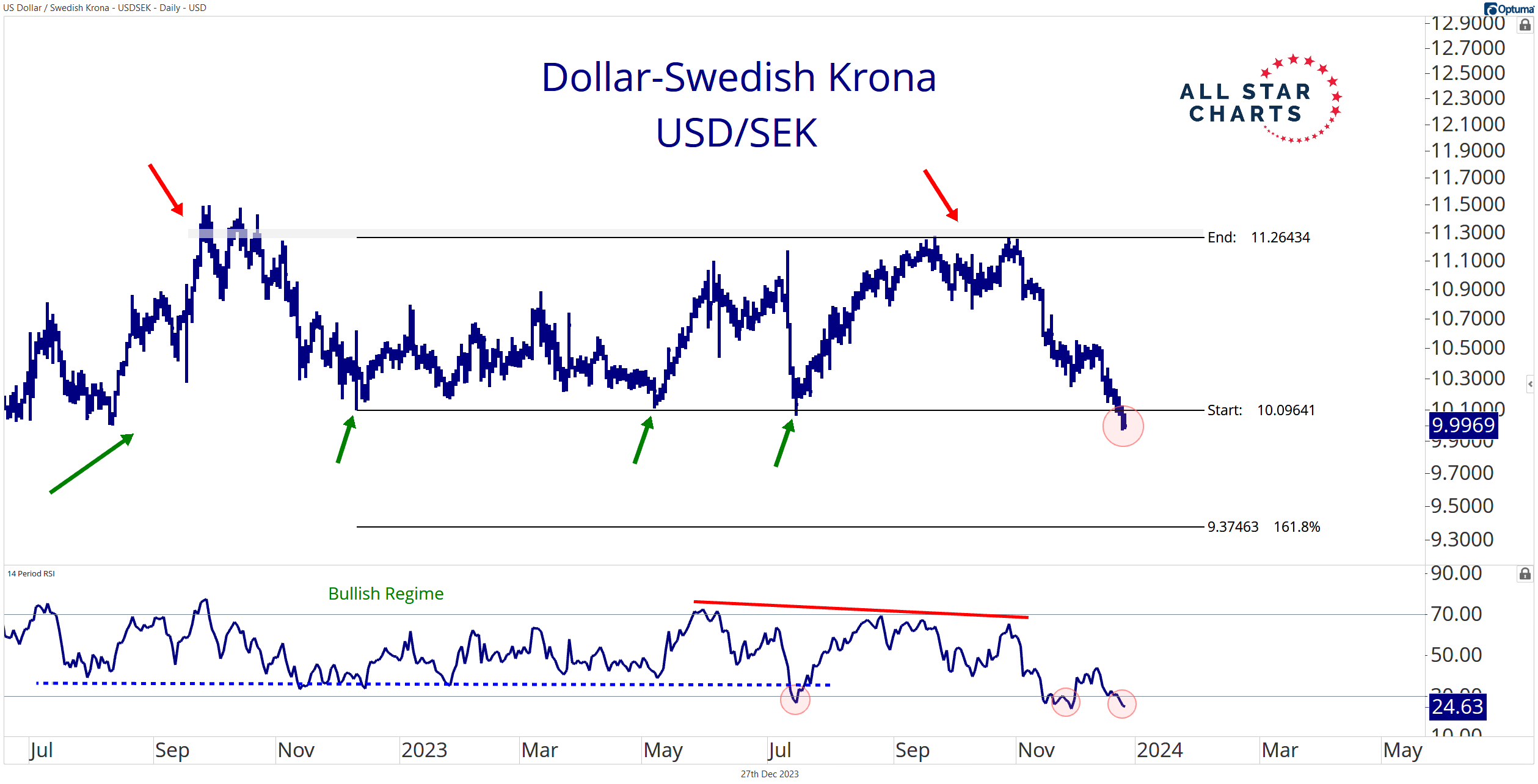

Next, the US dollar-Swedish krona pair USD/SEK:

The USD/SEK is undercutting a shelf of former lows.

Meanwhile, the 14-day RSI is posting its third oversold reading since July. This is the definition of a bearish momentum regime, as the bears are in full control of this FX pair.

I like the USD/SEK short below 10.10, targeting 9.38.

That’s it for today: two fresh USD shorts.

You won’t hear much about these pairs in the headlines. But they’re both US Dollar Index $DXY components, and they’re both printing fresh lows.

That’s critical information for every investor.

Stay tuned.

Let me know what you think. I love hearing from you!

And be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment