We’re shorting bank stocks now too.

More details on that below.

But first…

Breaking News: “Dow Futures fell 100 points and the VIX rose this Friday on news of new all-time highs for the stock market”

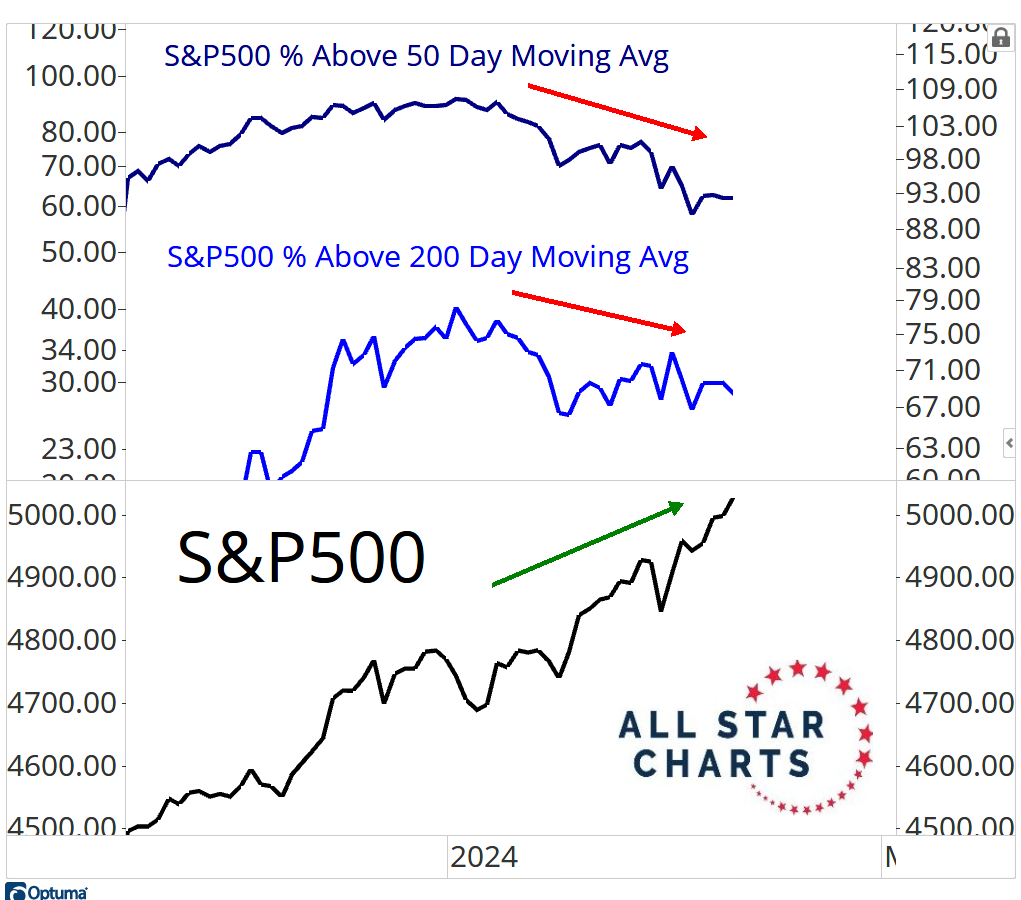

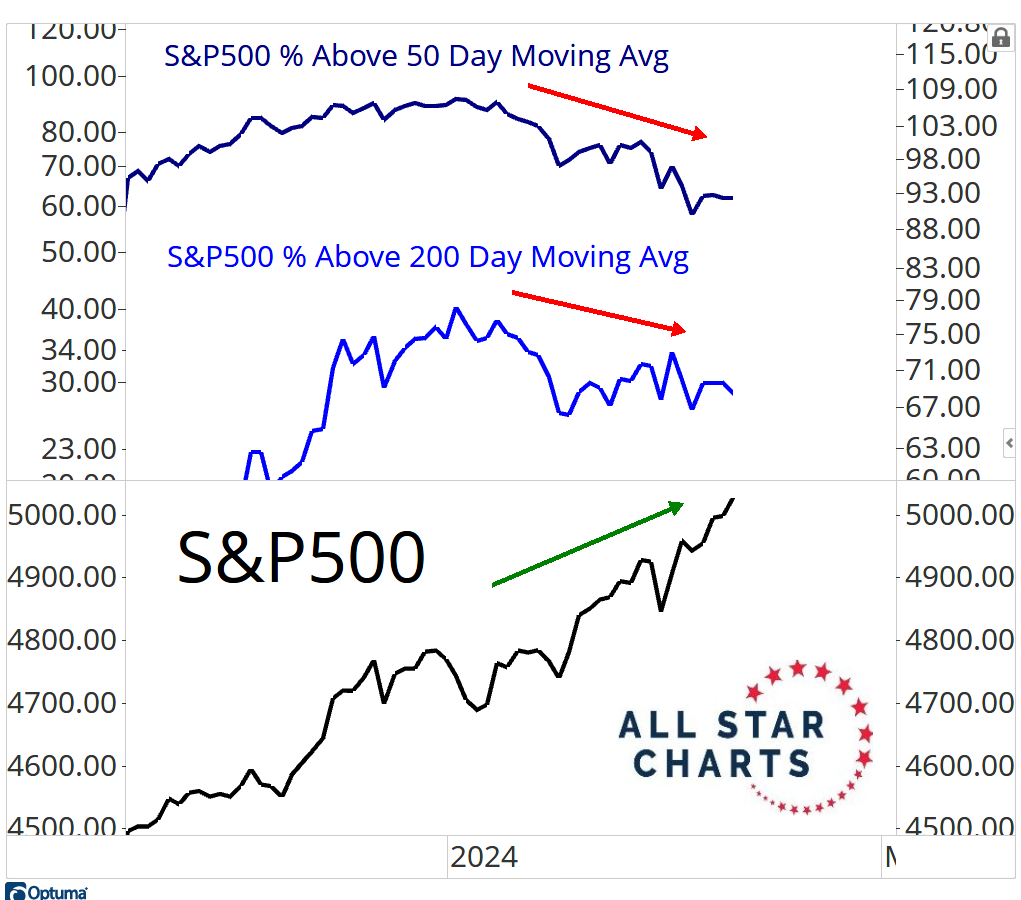

The breadth continues to deteriorate with every week that goes by.

You notice?

You can see it in our trades as well. While the puts on our $SPY and $QQQ haven’t started to work yet, the bearish trades on individual stocks are all either working or flat.

It’s interesting. What you see in happening in the portfolio, you can also see happening in the market itself.

We saw new all-time highs this week for the S&P500. But we had the fewest stocks in the S&P500 above their 200 day moving average since December. And the fewest above their 50 day moving average since November.

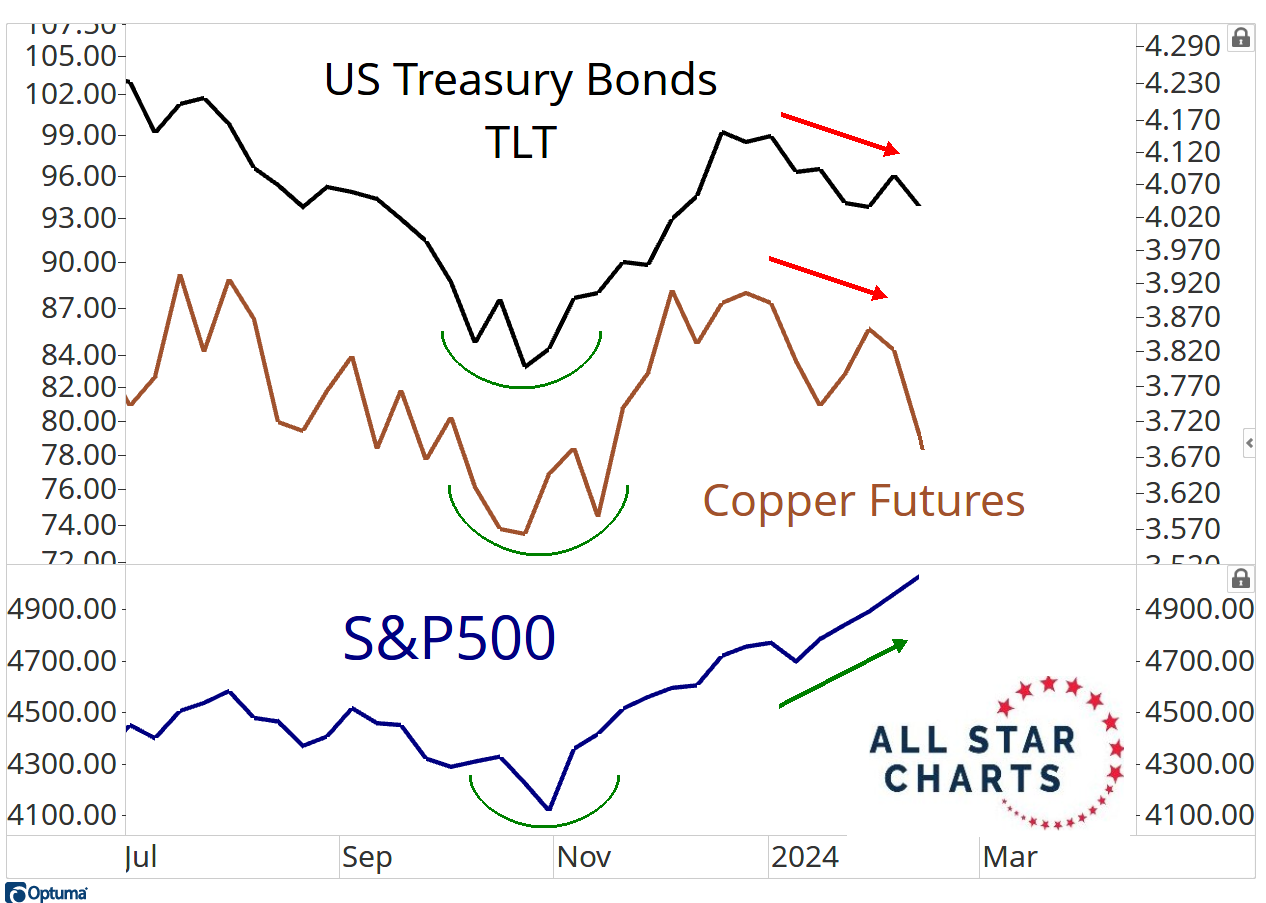

You can also see it across the intermarket complex.

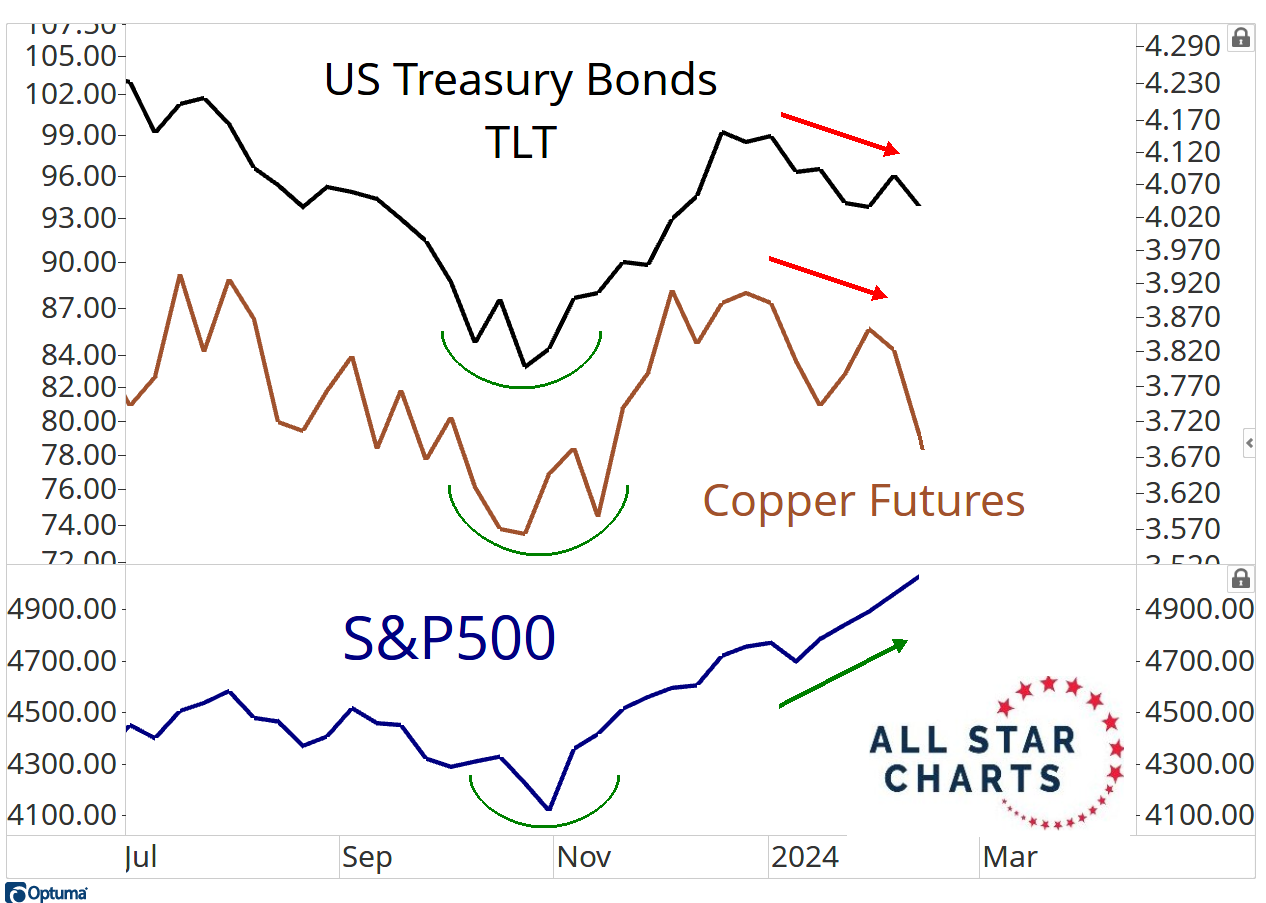

With Copper and Bonds ripping in the 4th quarter with stocks, both of them stopped going up in late December, the day the US Dollar bottomed.

Since then it’s been lower lows and lower highs, despite the S&P500 roaring higher.

The new highs list continues to deteriorate. Copper and Bonds are falling off a cliff.

Is the bet you want to make that the indexes won’t follow?

That’s a tough bet and one I’m not making.

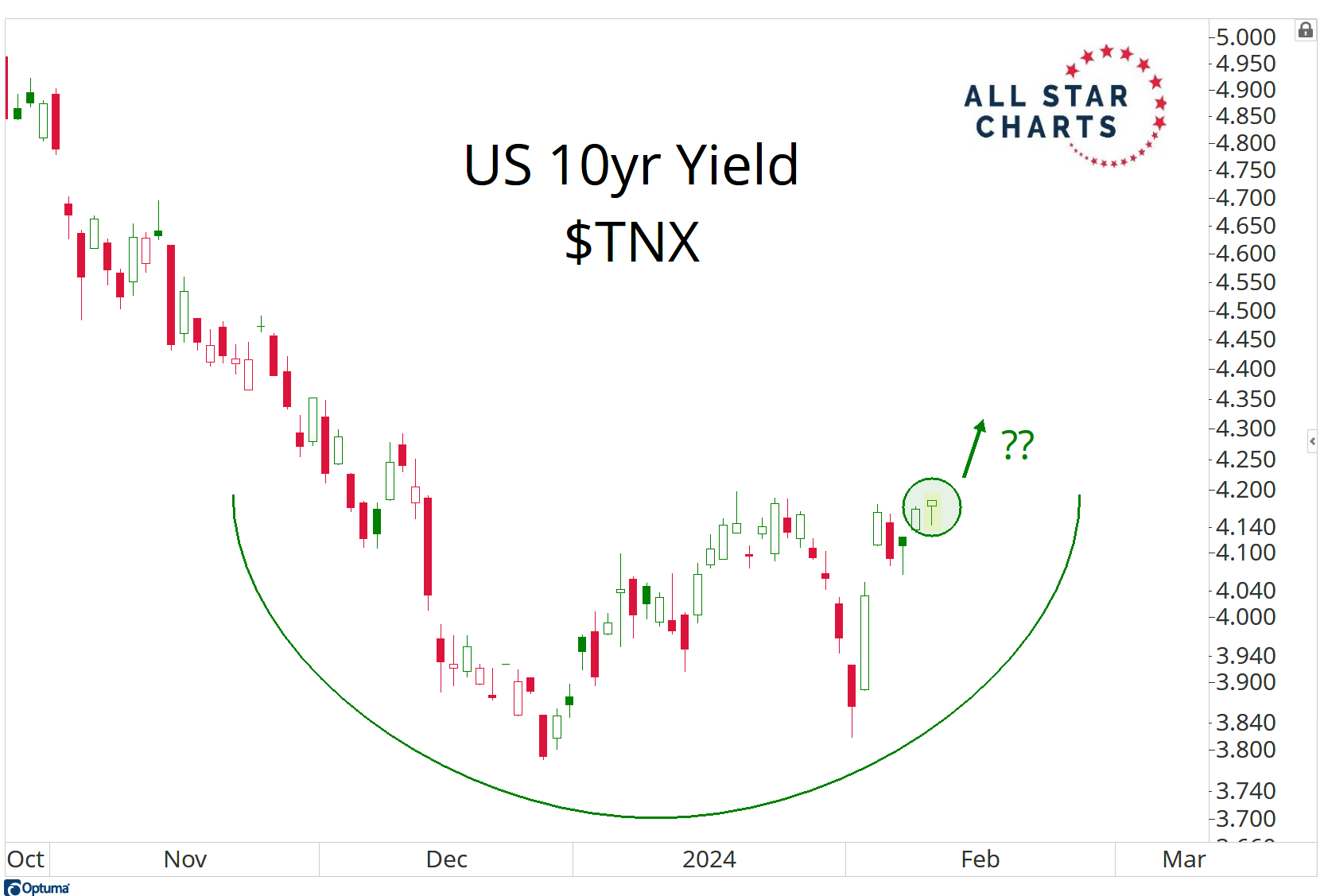

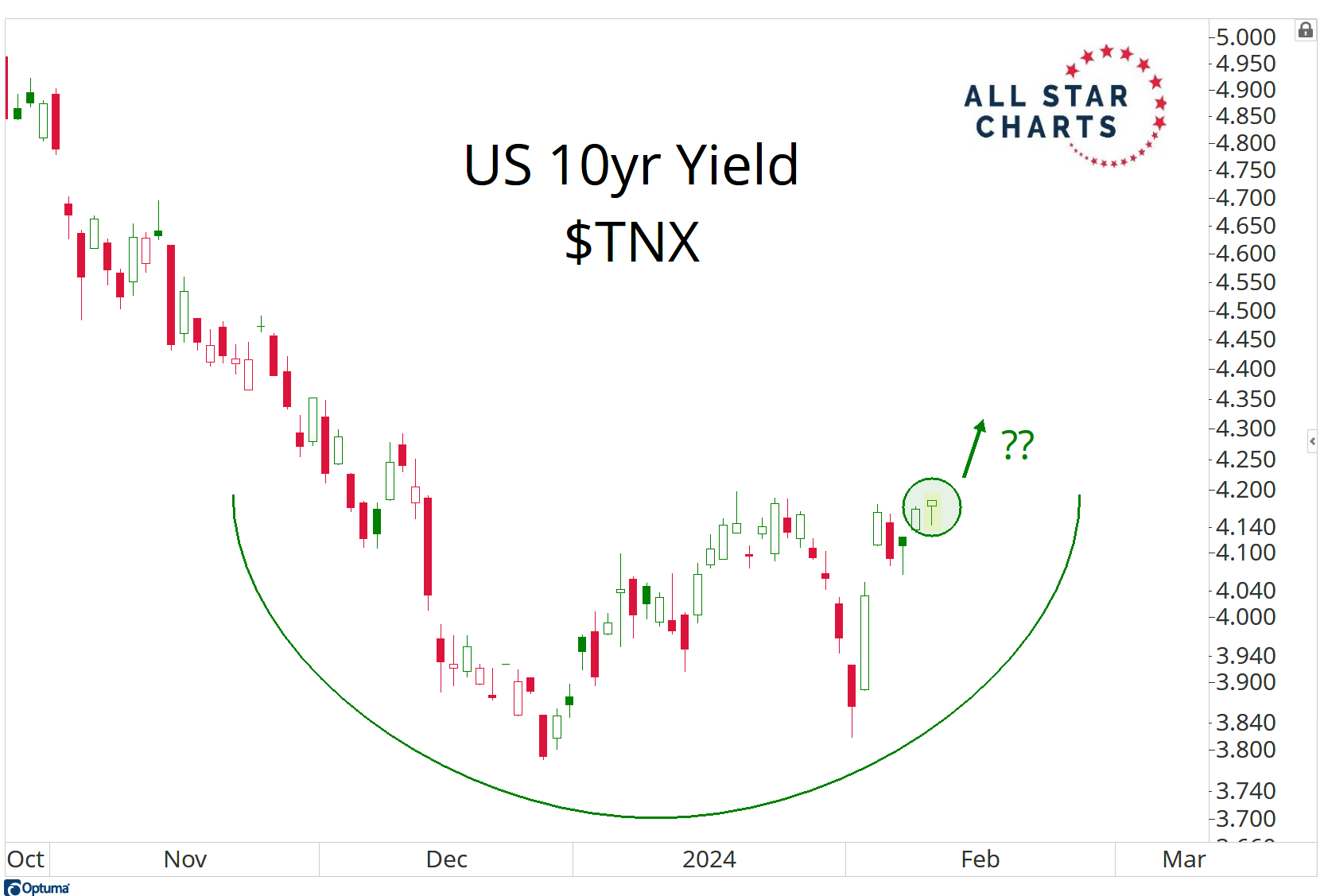

Look at the US 10-year, going out this week at new 2-month highs.

If stocks are going higher from here this quarter, then why are interest rates creeping up?

Stocks and bonds have been moving together.

And it’s not like that is changing. The market only continues to prove that this correlation is still in place.

So looking at the charts above, if rates are going up, bonds are falling, copper is falling, fewer and fewer stocks are going up, what does all this add up to?

We’re shorting bank stocks now too.

Here is an update on all the short positions we’ve put on over the past 8 days.

To get the details on our Bearish Positions, you must be a premium member of All Star Charts. Please login below or start your risk-free 30 day trial today.

Lost Password?

If you have any questions on any of these trades we like, please shoot us a note.

Remember, everyone has different time horizons, risk tolerance and overall objectives.

Even within our own team, even if we agree, we’ll usually all execute in different ways. Steve tends to be more short-term aggressive. Sean tends to be more conservative. And I’m usually somewhere in between. But even that changes sometimes too.

So remember that what someone else might be doing because it’s best for them, doesn’t necessarily mean it’s what’s best for you.

Hope that helps!

JC

Be the first to comment