From the Desk of Ian Culley @IanCulley

Searching for trending markets?

Look no further than US treasury bonds!

Bonds across the curve are skidding to fresh contract lows as interest rates have a one-track mind…

Higher!

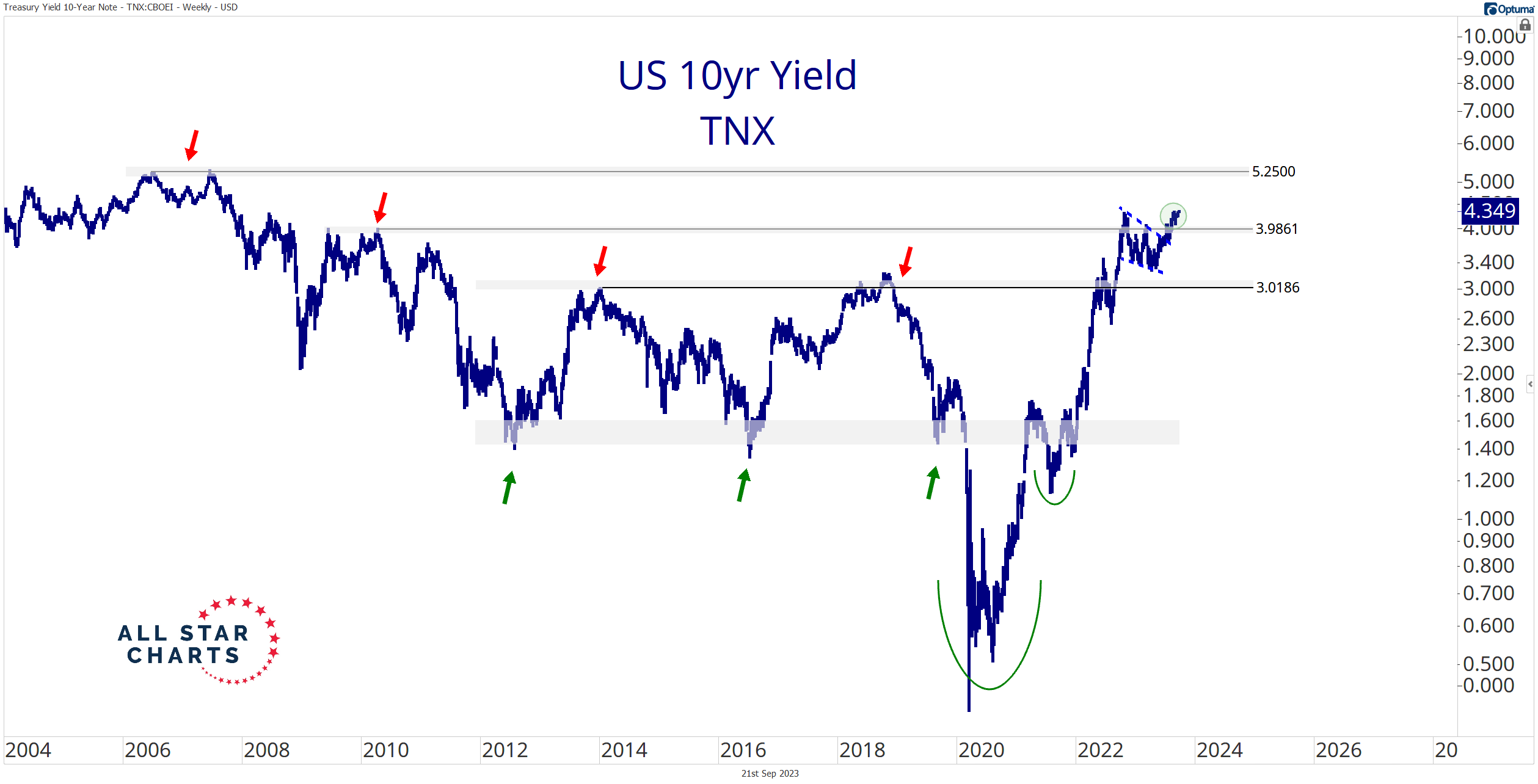

Check out the US 10-year yield posting fresh sixteen-year highs:

Not to be outdone, the 2-year yield just registered its highest level in seventeen years.

Interest rates across the curve are breaking to decade-plus highs in what has become a foot race.

It’s clear that the rising rate environment remains alive and well. An inverted yield curve keeps score, reminding us that shorter-duration yields are winning.

But I honestly don’t care what area of the curve is leading.

I simply want to catch and ride trending markets rather than fight a sideways mess.

Bonds, currencies, and commodities all provide excellent trading opportunities and will continue to do so as long as rates rise. Luckily, I focus on those market areas every day.

Spencer and I will be joined by Tracy Shuchart @Chigirl, Chief Market Strategist at Hilltower Resources Advisors, on tomorrow’s episode of “What the FICC?.” Be sure to tune in as we dive into commodities and energy.

If these markets aren’t in your wheelhouse, have no fear.

There are plenty of stocks enjoying a solid bid. I hate to beat a dead horse, but energy is your best bet during a rising-rate environment. Or at least in today’s environment.

Perhaps a 5.25 print on the 10-year by Christmas is a bit aggressive. Regardless, it’s on the table in the coming months and quarters.

More importantly for US stock indexes, it’s not if but how the 10-year arrives at those former highs that will impact the averages most. (A slow and steady yield increase is the best scenario for the broader equity market.)

Meanwhile, avoid the mess at the index level and trade what’s trending.

That means shorting bonds and global currencies against the US dollar while buying energy.

Stay tuned!

Countdown to FOMC

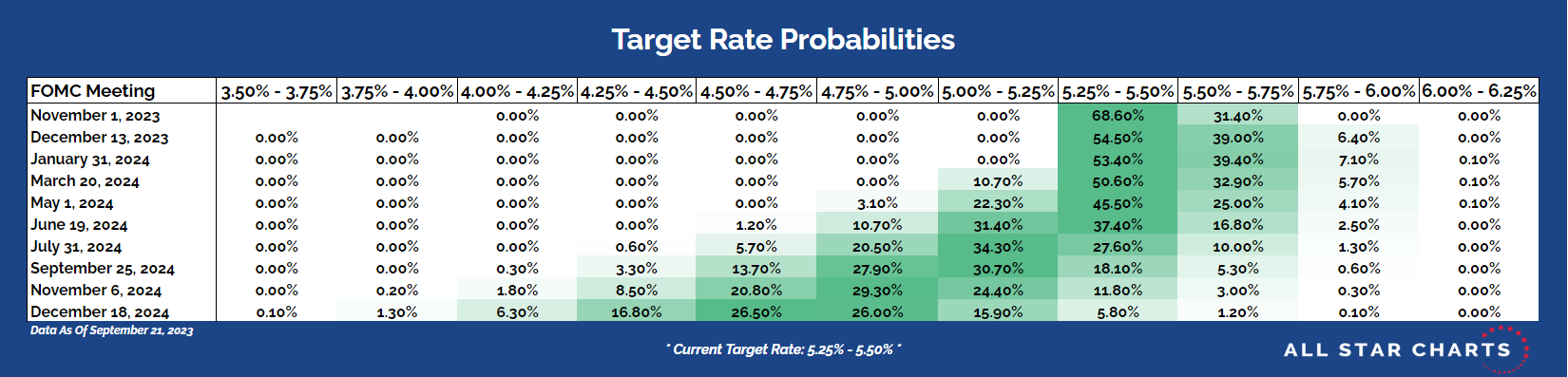

The market is pricing in a pause in the hiking cycle through Q2 of next year.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of September 21, 2023.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment