This has to be one of the world’s most important trends right now. How could it not be?

You hear all this nonsense about the S&P493 and how it’s only 7 stocks going up.

But those are just lies. That’s not how the market works, and that is certainly not what’s been happening this year.

The real trend here is in the outperformance of the largest companies, particularly mega-cap growth, relative to other indexes with more diversified sector exposure and market-caps.

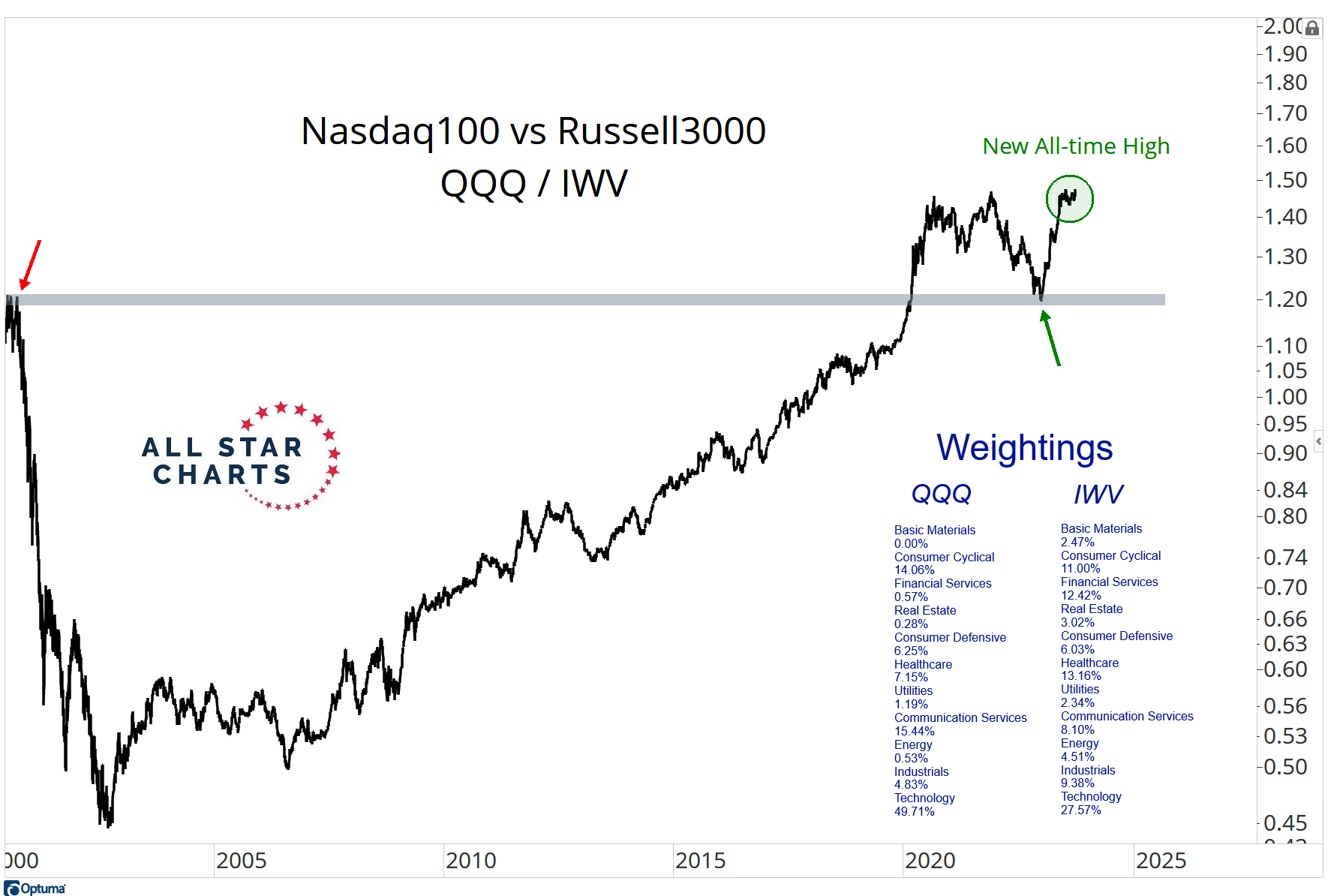

This is the Nasdaq100 making new all-time highs relative to the much broader Russell3000 Index:

Let’s remember that the Russell3000 includes all Russell2000 Small-caps + the Russell1000 Large-caps.

The Russell3000 has half the exposure to Technology that the Nasdaq100 has, half the exposure to Communications and 2x the weighting for Industrials.

Meanwhile, the Nasdaq100 has no Energy, no Financials, no Real Estate and no Materials.

These two indexes are very different.

I think it’s important to identify those differences, and recognize these ongoing trends that look far from over.

The Nasdaq100 is NOT the “stock market”. It is one index made up of a very specific group of stocks, both sector wise and market-cap wise.

The big keep getting bigger. And the small, by definition, will remain small. Remember, the Russell2000 small-caps regularly kick out their best players.

And once they get to Nasdaq100 status, the sky is the limit. There is no ceiling.

Plus, let’s remember that these massive companies – Apple, Google, Amazon, etc are really a bunch of different large businesses all in one. So keep that in mind too.

This week we had our LIVE Monthly Charts Strategy Session where we discussed all of this and what we want to do about it this quarter.

Premium Members can access the replay here and also download all the slides.

Contact me here if you’re in the Chicago area and would like to join us next Wednesday 10/11 at the CBOT.

See you there!

JC

Be the first to comment