From the Desk of Ian Culley @IanCulley

JC asked me how far I thought interest rates would pull back during a recent internal meeting.

The question caught me off guard since I trade bonds, not interest rates. I know my bond trade targets off the top of my head, but not the corresponding rate levels.

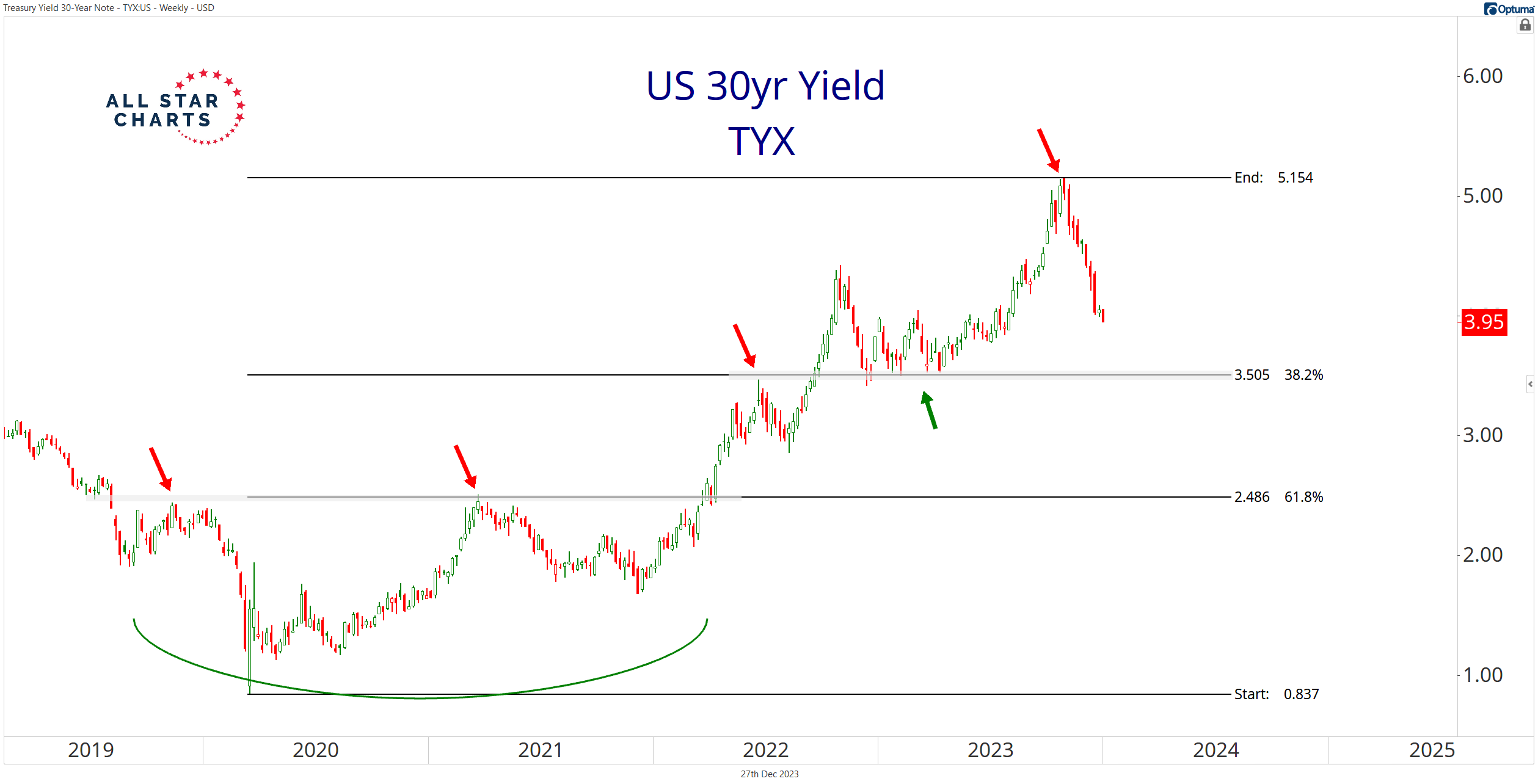

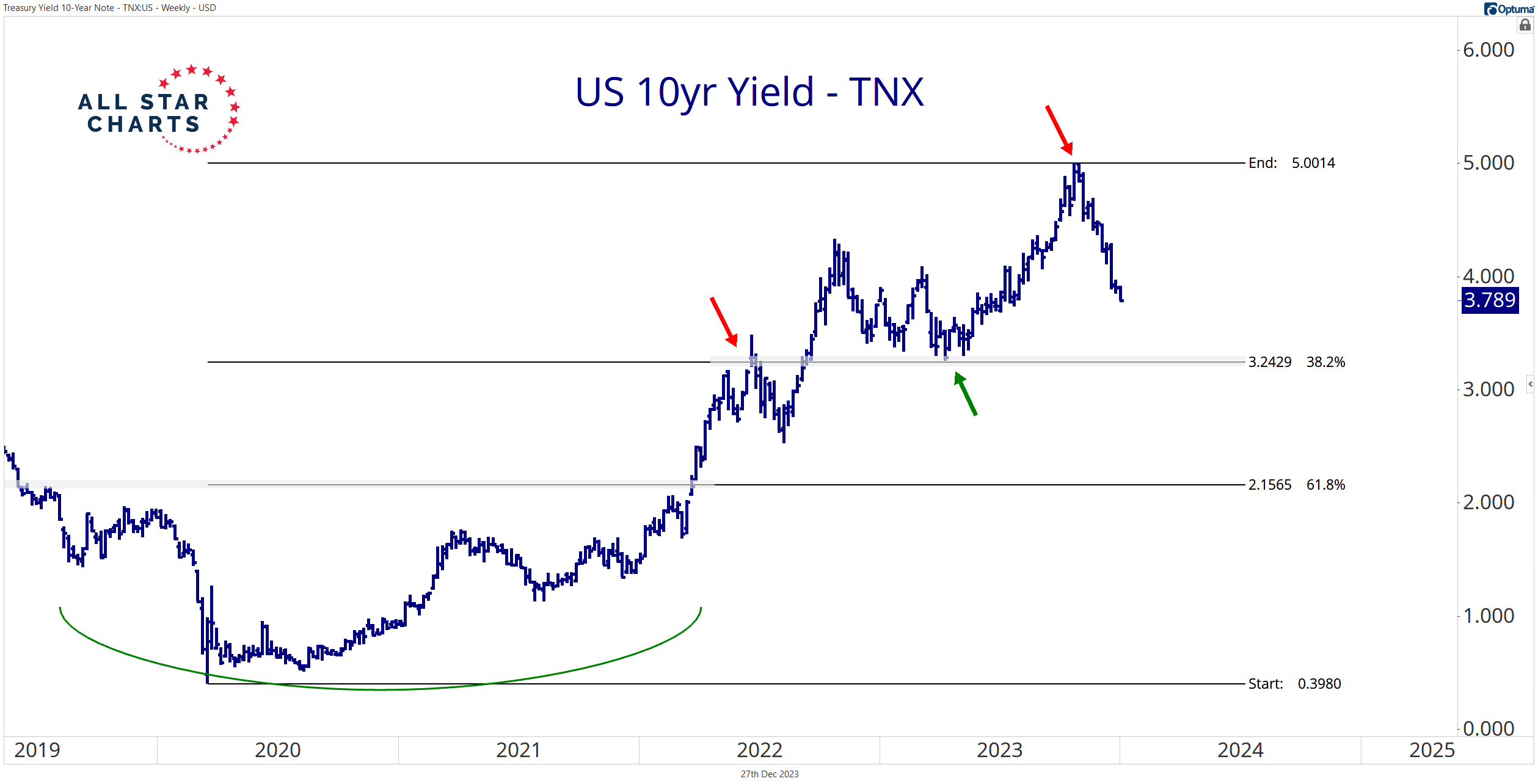

As soon as the call ended, I applied Fibonacci analysis to the 30- and 10-year yields…

The 3.50 level marks a logical area for the 30-year yield to stop falling.

That level coincides with a shelf of former lows and a critical retracement level covering the rally off the 2020 low.

The similar level for the 10-year yield stands at 3.25:

Whether rates pull back to these retracement levels is anyone’s guess.

One thing is for certain: interest rates have plenty of room to fall. I wouldn’t be surprised if they slice through these areas if and when the Fed begins to cut rates.

Nevertheless, I still believe we witnessed a generational bottom in yields in 2020 – not a generational low in bonds in 2023.

But we have to trade what’s in front of us.

Rates are coming off a historic rally as bonds and stocks catch higher.

And from the looks of it, the coming year is shaping up to be a doozie for stock and bond market bulls.

Let the good times roll!

Countdown to FOMC

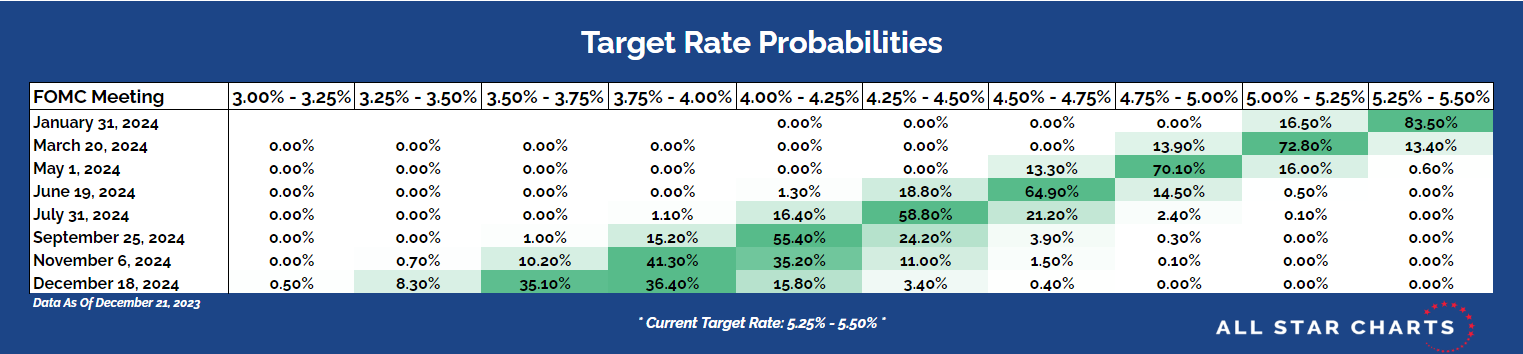

The market is pricing in a pause in the hiking cycle until March 2024 and two cuts before next summer.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of December 28, 2023.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

Be the first to comment