Stocks move first, and then the indexes follow.

It’s a market of stocks, remember?

And while the S&P500 may have just had its 4th consecutive weekly gain of at least 1%, the stocks themselves are NOT doing that.

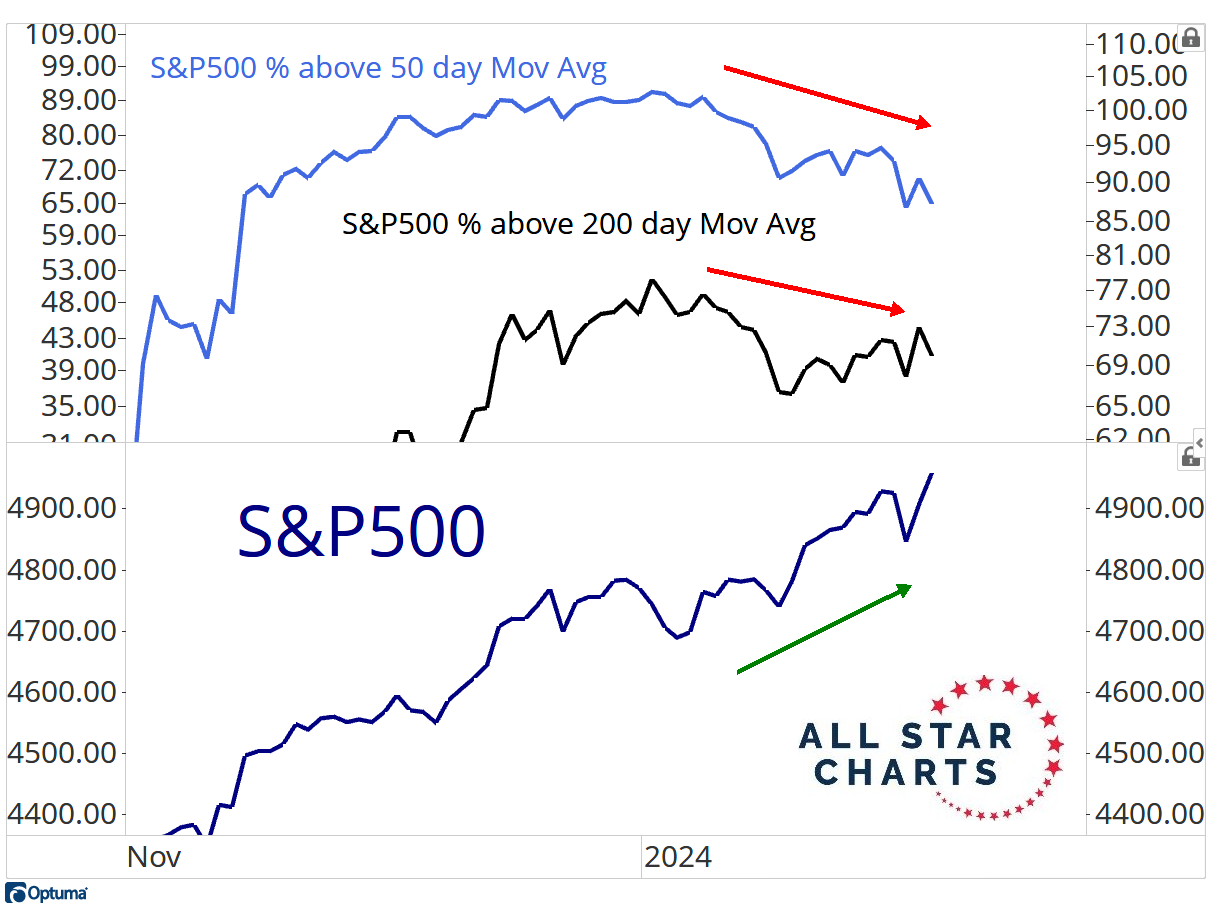

Look at the percentage of stocks in short-term uptrends, as seen here by the % above their 50 day moving average.

Also take a look at the percentage of stocks in longer-term uptrends, as seen here by the % above their 200 day moving average.

The numbers 50 or 200 aren’t perfect. It’s not an exact science.

You can use new 52-week highs, and you’ll see the same deterioration.

You can also look at the 3-month highs, and again, you’ll see the same lack of confirmation by the stocks themselves.

Then of course, there’s the intermarket analysis.

Those of you following along for years, you already know how helpful the US Dollar has been at identifying turning points in the market.

A weaker Dollar has come with stronger stocks, like October-December. And before that when the Dollar was strong from July through September, stocks were under pressure.

But since the end of December, when the Dollar bottomed, it’s been nothing but deterioration for stocks.

You can see it in the market internals.

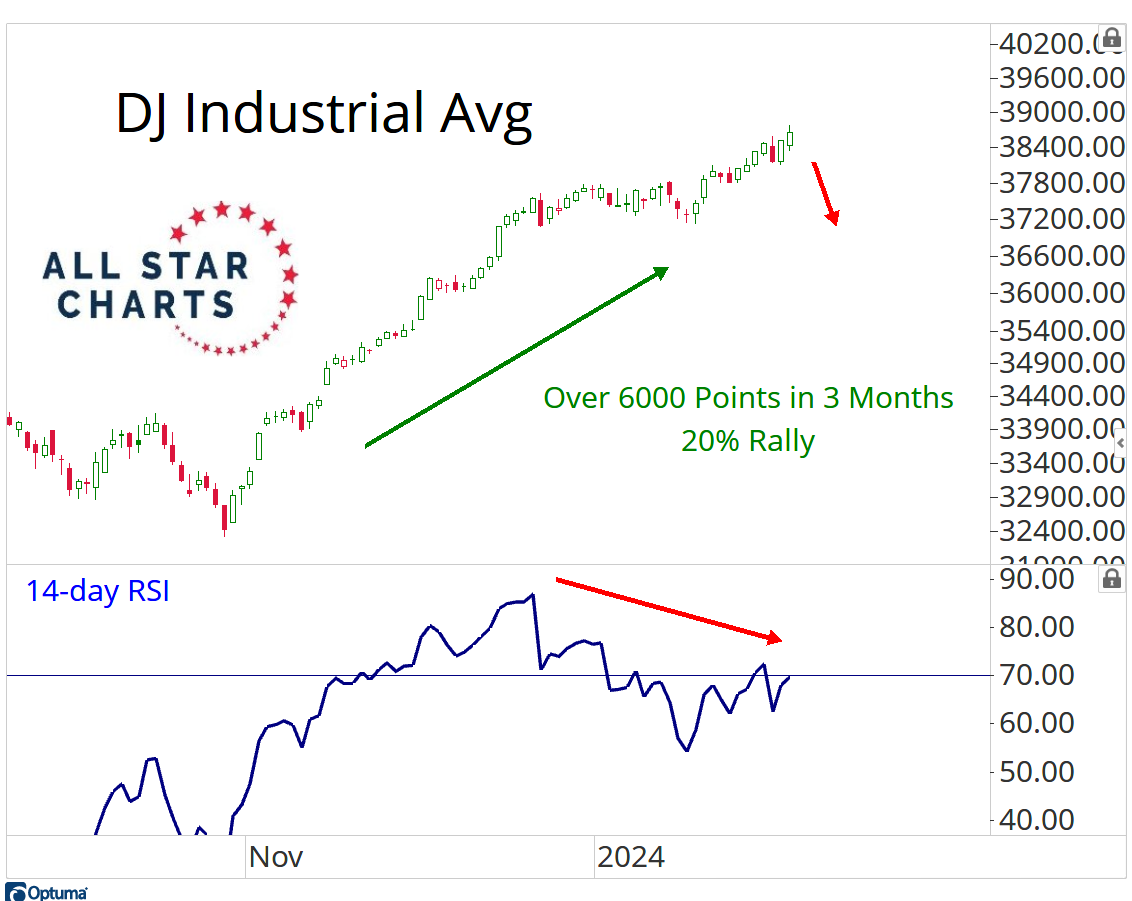

And you can also see it in momentum. These are the types of divergences we love to see before a good rug pull:

You can see the new highs in the Dow this week after a 6000 points rally in just 3 months. But with those new highs in prices, came a strong rollover in momentum.

It makes perfect sense with the divergences we’re seeing High Beta vs Low Volatility. You can also see it in the rotation into defensive stocks.

If it was just one data point, or just one chart pointing to a dramatic increase in vulnerability for stocks, then that would be one thing.

But it’s not just one of them. It’s most of them.

And that’s why we got so short this week.

All the things we were waiting for to get short, started to come to fruition. So why wouldn’t we get short?

We’ll be discussing this all on Monday night during our LIVE Monthly Strategy Session.

Premium Members make sure to REGISTER HERE.

We’ll get going LIVE @ 6PM ET Monday Feb 5th.

I you have any trouble getting in, just email Mary directly and she’ll set you up.

JC

Be the first to comment