Last night was one of the most important LIVE Conference Calls that we’ve had in a long time.

The beginning of the year shenanigans are behind us, the market has settled into 2024, and this all allows us to focus on the most important trends.

Check out the replay here and download all the charts.

If you’re not already a Premium Members of ASC, just contact Mary here and she’ll set you up.

In the meantime, I think it’s important to reiterate that if the most important sectors are holding their key breakouts, it’s hard to be too bearish on the overall market.

First is Technology – the largest weighting in the S&P500 representing almost 30% of the entire Index. Tech is also 50% of the Nasdaq.

You’re seeing similar behavior from Industrials. This sector historically has the highest correlation with the S&P500 among all S&P sectors.

There is no single stock that represents more than 4% of this entire index. So it’s a very diversified group:

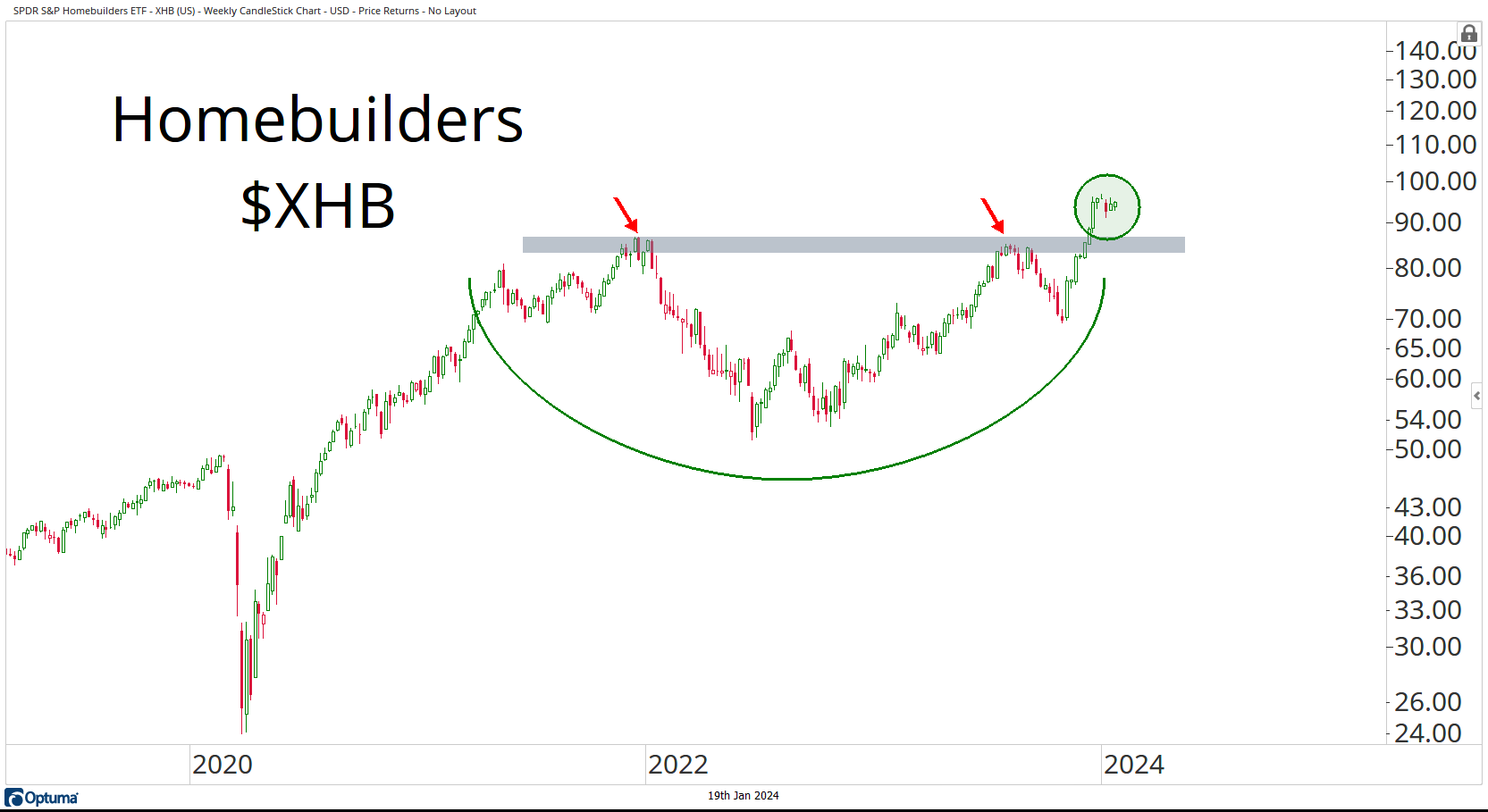

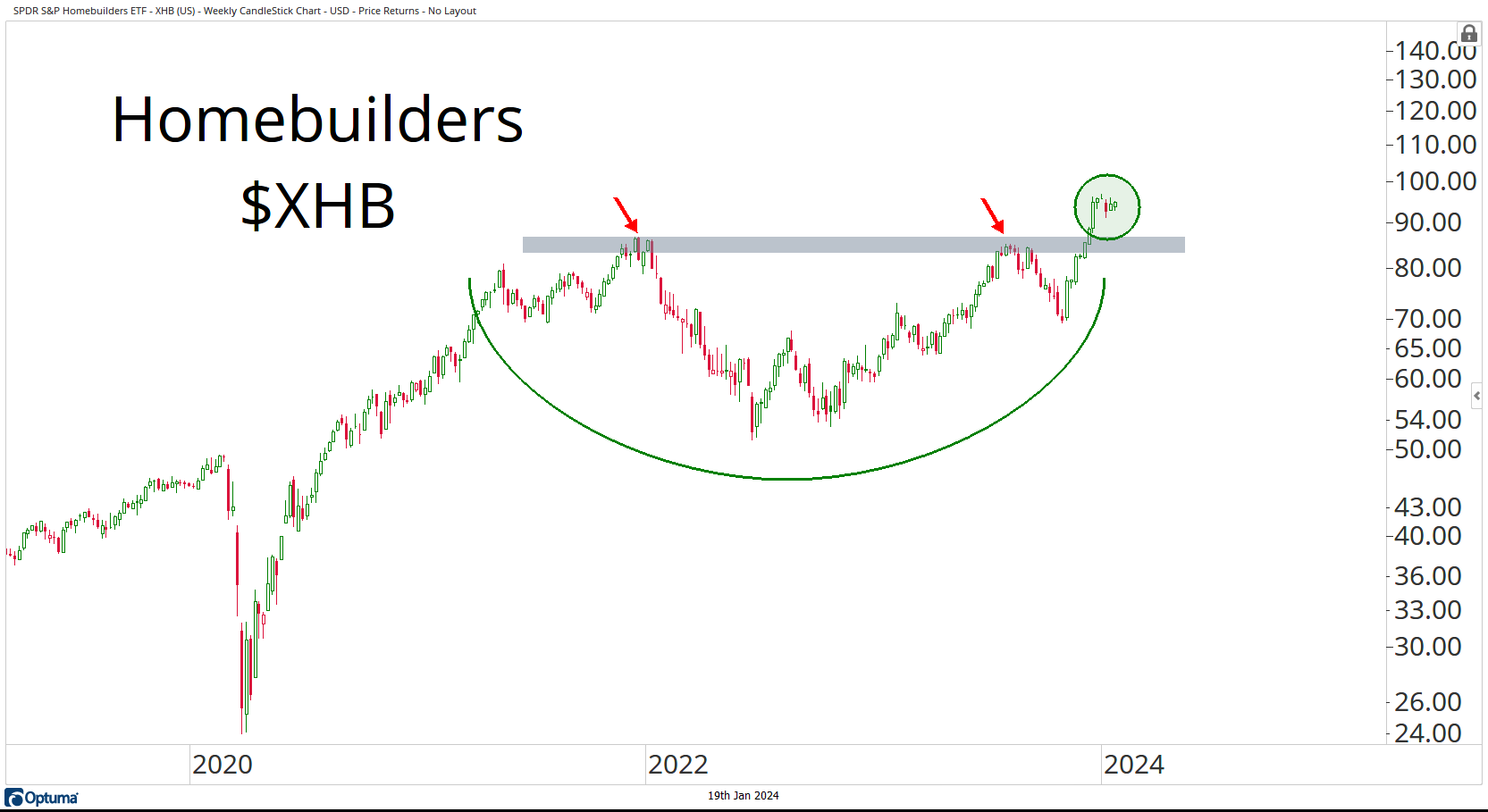

The importance of Homebuilders needs little introduction. But also keep in mind that this is one of the key groups within the Consumer Discretionary sector:

We don’t have bull markets around here without Financials. So if the NYSE Broker Dealers Index is above those former cycle highs, like all of these others, it’s hard to be too bearish on equities:

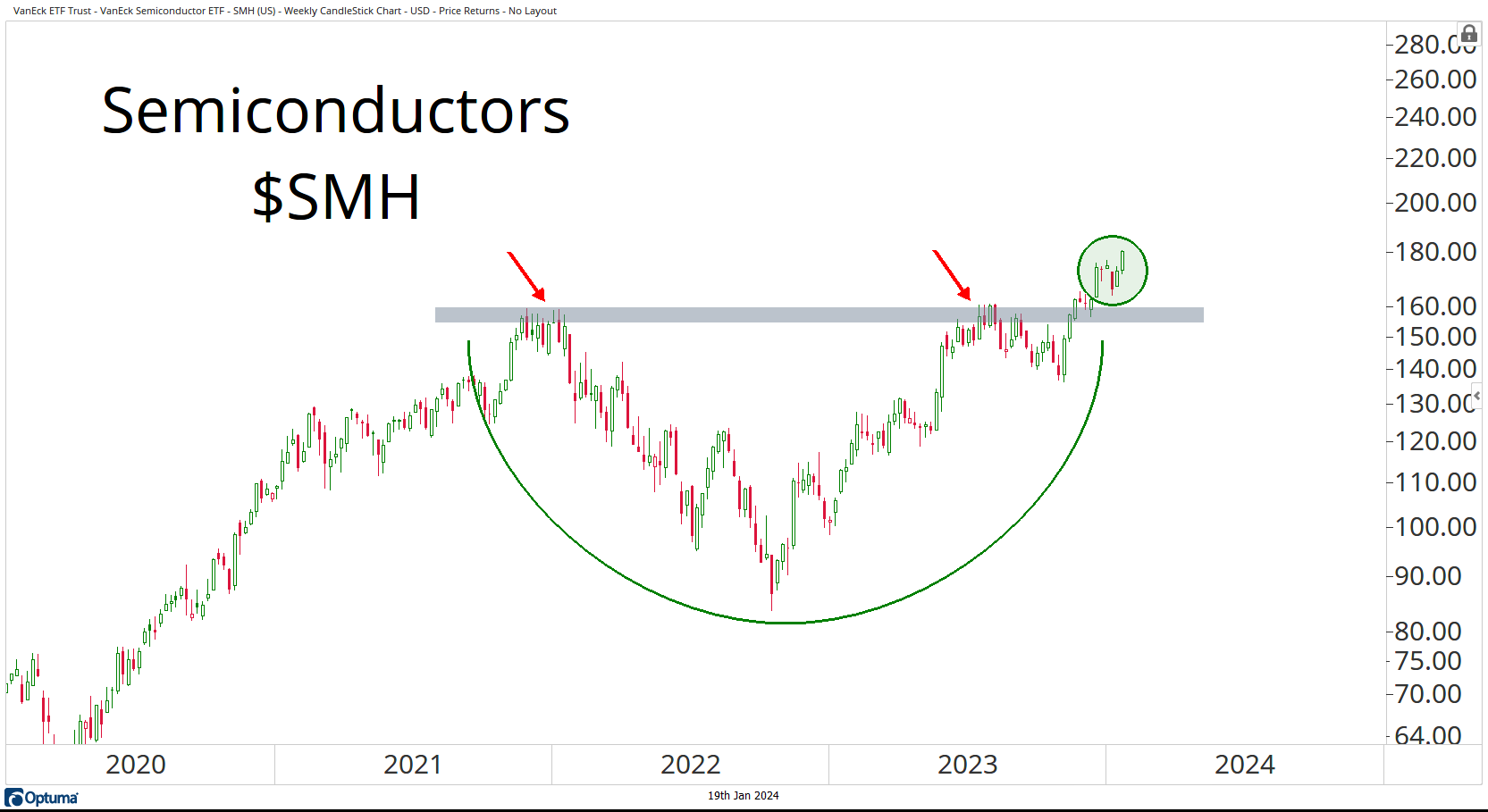

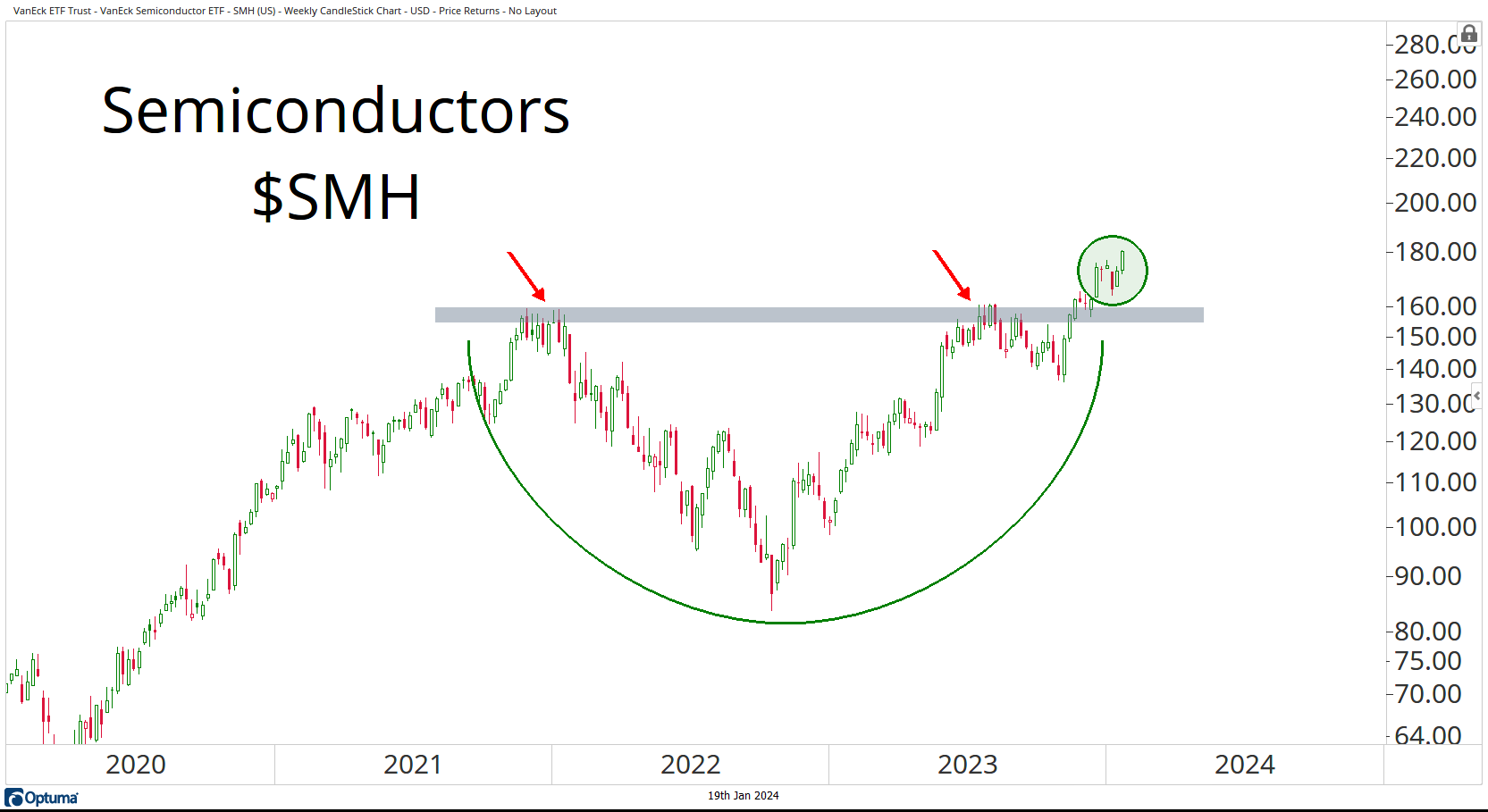

And finally, the strength out of Semiconductors cannot be overstated.

How can we be bearish Tech, or the market in general, if this group is breaking out and making new all-time highs?

The problems for this market start with these groups back below their prior cycle highs.

The recent strength out of the Dollar is warning sign number 1.

But the lack of rotation into the defensive sectors like Consumer Staples and Low Volatility are pointing to overall positive rotation.

So we’ll keep on eye on these defensive groups for sure.

But these “Fab 5” Offensive groups listed above are the key to this bull market.

If these 5 are doing what they’re doing, what’s there to be bearish about?

Chime in here and let me know what you think.

We love the feedback. Where do we have it wrong?

Make sure to catch the replay from last night’s LIVE Conference Call.

The Trade Ideas can be found in the App as well.

Give it a watch and then tell me what you think.

JC

Be the first to comment