The bull market continues as stocks keep making making new highs.

This is what happens in bull markets, stocks regularly go up.

The Dow Jones Industrial Average is making new all-time highs every day. The S&P500 and Nasdaq are right there too.

And the list of stocks on the NYSE hitting new highs is the longest its been in over 30 months.

But what’s driving these stock prices?

It’s not earnings. It’s not the Fed. It’s not the biden.

It’s the Dollar. It was always the Dollar.

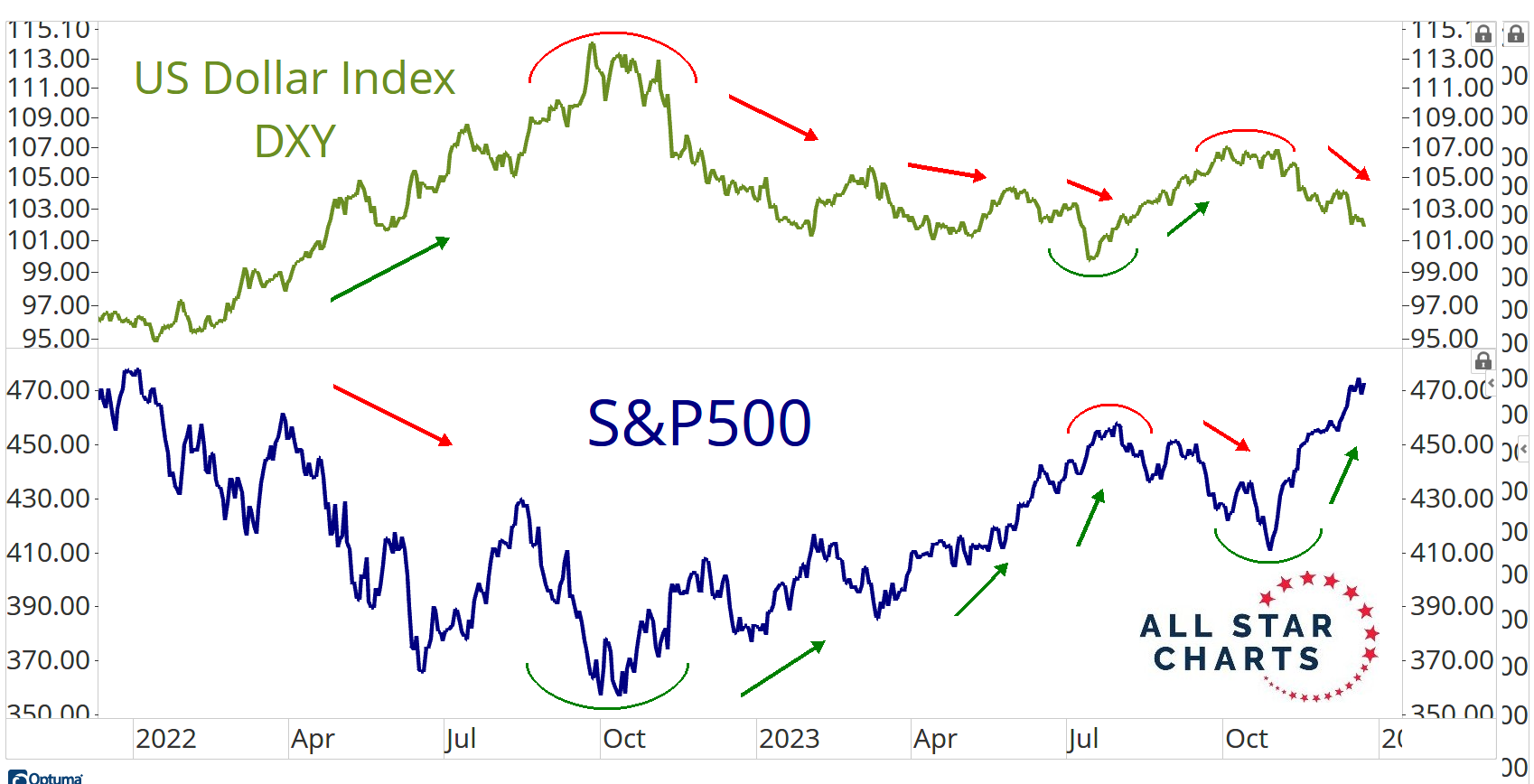

When the Dollar is weak, stocks go up. It’s that simple. And when the Dollar is strong, stocks have a hard time making any progress:

The day the Dollar peaked on October 3rd is the day the new lows list peaked on the NYSE. It’s been straight up from there for stocks, and straight down for the Dollar.

These trends certainly accelerated in November and December, but they got going in October.

As long as the Dollar is falling, expect the bid to remain in equities. And the Dollar sure looks like it has a lot more to fall. So get comfortable.

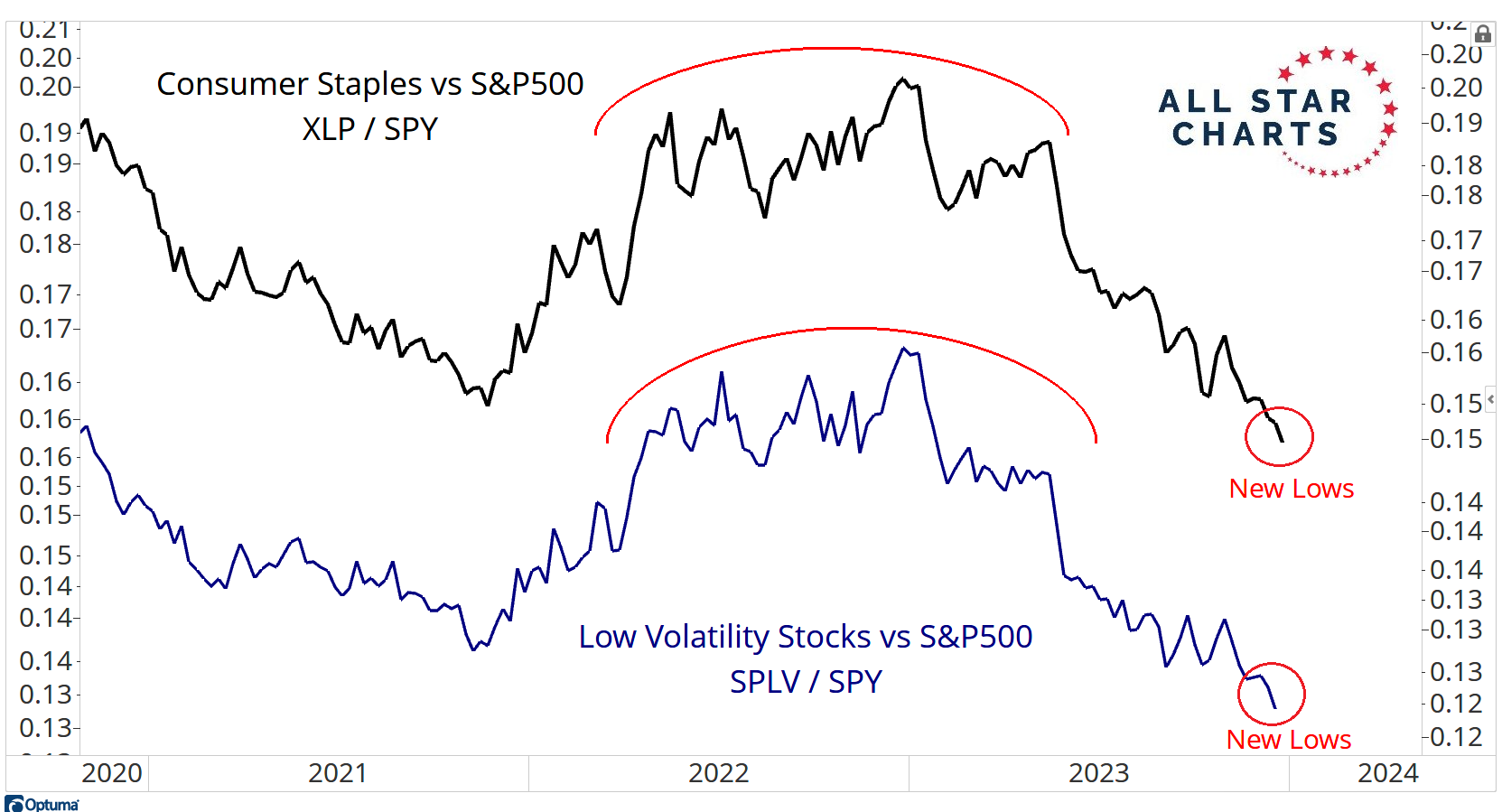

Another thing you see in bear markets is rotation into the more defensive stocks like Consumer Staples and Low Volatility in general.

We’ve only been seeing the exact opposite. Money continues to flow out of Staples and Low volatility stocks.

As you can see here, they’re making new multi-year lows relative to the rest of the market.

This is what you see in bull markets. And we’re seeing it this time too:

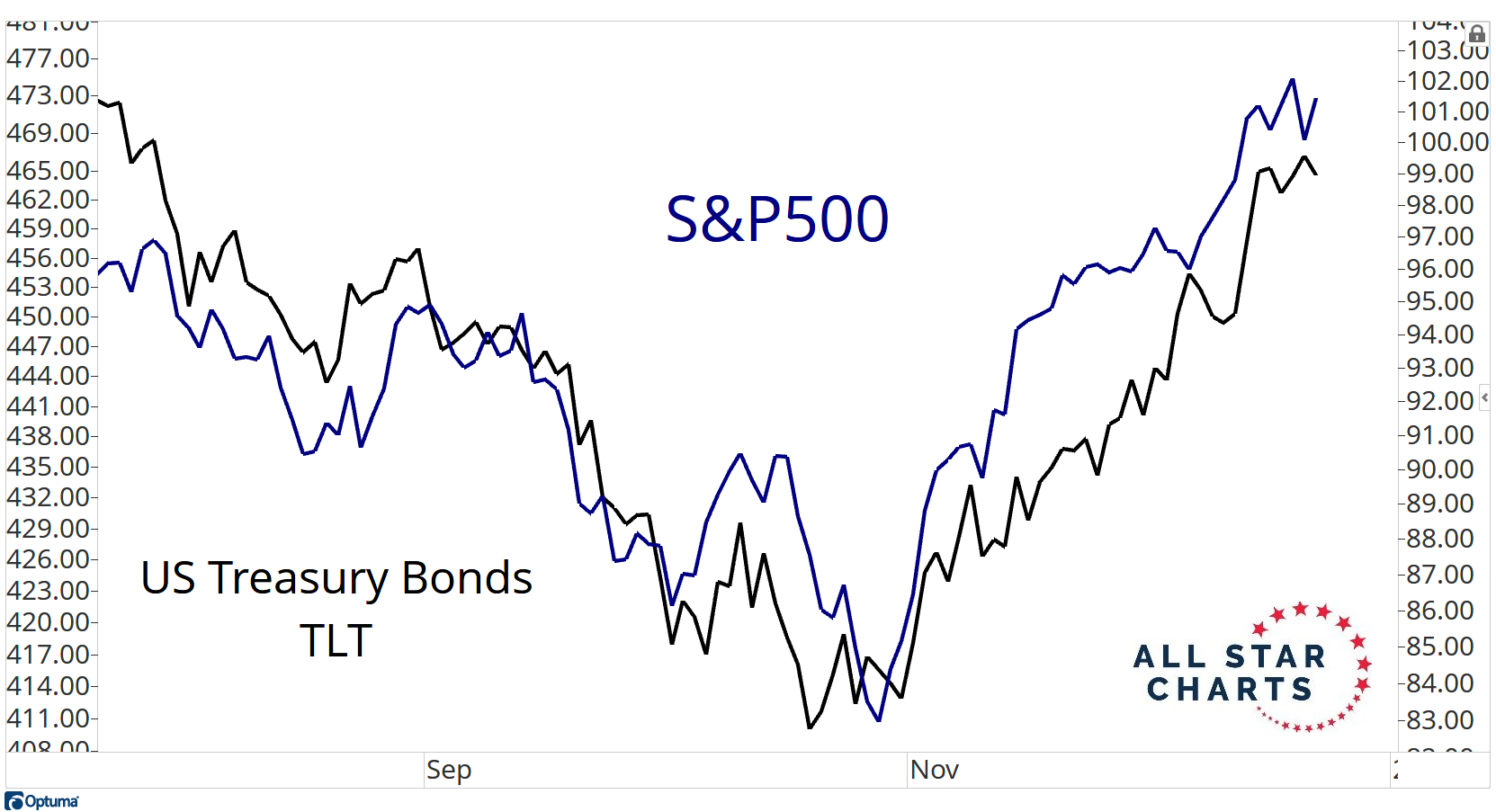

The US Treasury Bond market is NOT the safe haven.

It used to be.

It once was.

But it isn’t today.

The Dollar is the safe haven.

Stocks and Bonds are moving together:

Investors are having a hard time wrapping their heads around this relationship.

Some people even built models depending on Treasuries to act as a safe haven. But those models already blew up, and they’re not coming back.

If you’re telling investors that bonds are a safe haven, then you’re either lying to them maliciously, or you’re just looking at the data blind-folded.

Neither are acceptable.

Stocks and bonds are moving together.

You’re welcome to bet that this relationship is all of a sudden about to change completely and reverse.

Or you can continue to bet with us, that this positive correlation remains in place.

This is a free country. You’re welcome to lose money if you’d like. It’s perfectly allowed.

Our goal is to do the opposite.

We’re here to win.

Check out this week’s LIVE Conference Call and list of new trade ideas here. It’s everything you need to know as we close out 2023 and prepare for the new year.

Don’t miss it!

Check out the video and then let me know what you think!

JC

Be the first to comment